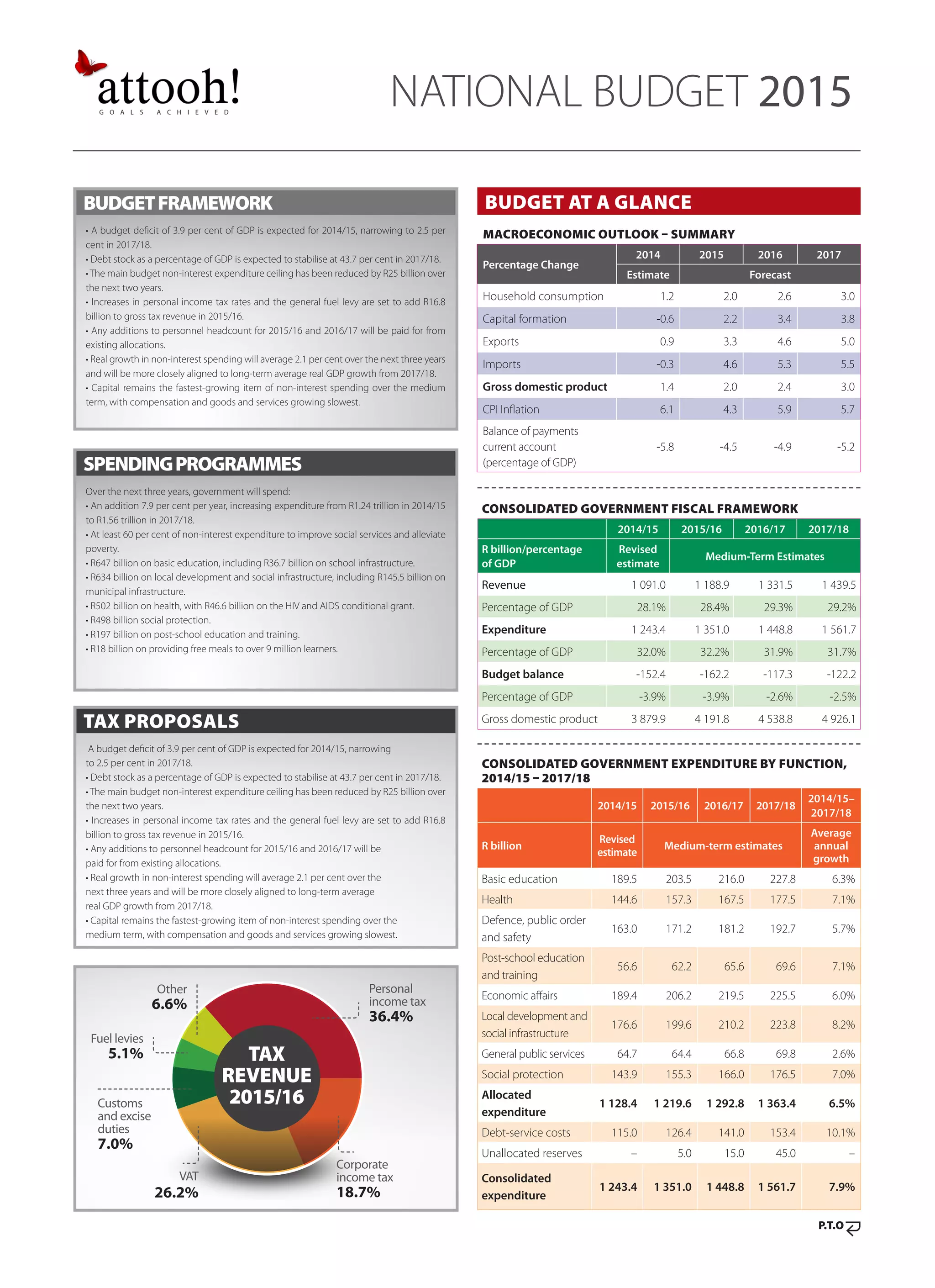

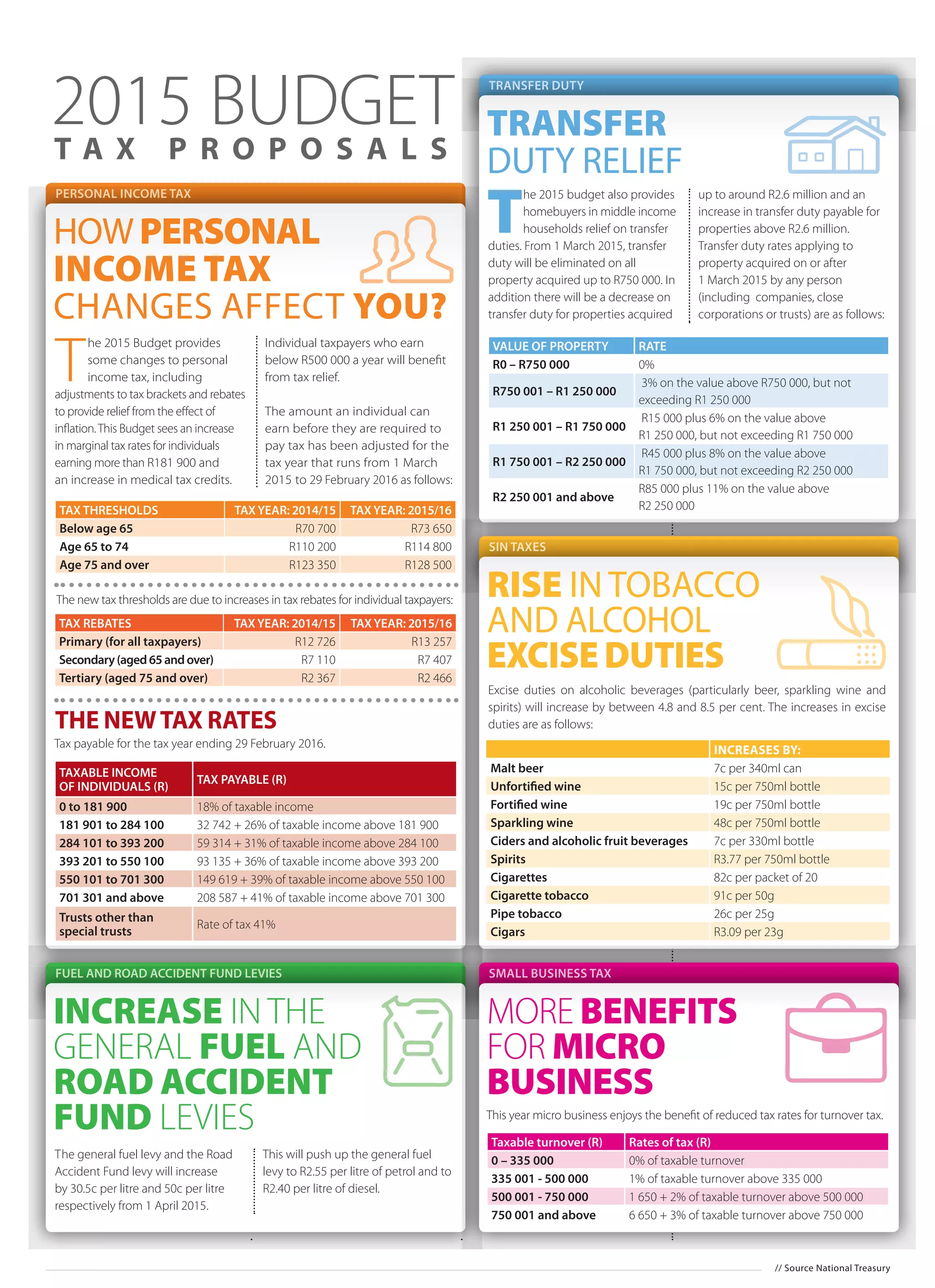

The 2015 budget proposal from South Africa's National Treasury outlines a budget deficit of 3.9% of GDP for 2014/15, expected to narrow to 2.5% by 2017/18, alongside a stabilization of debt stock at 43.7% of GDP. Key tax changes include increases in personal income tax rates for high earners and adjustments in transfer duties aimed at providing relief to middle-income homebuyers. The government plans to increase expenditure significantly on social services, educational infrastructure, and health, while ensuring that real growth in non-interest spending aligns with long-term GDP growth.