Recommended

PPT

sir-david-tweedies-p.pptfhffhhfhhgfgfgffgffg

PDF

Understanding IFRS vs GAAP: Key Differences

PPTX

The Future of Accounting Standards

PPTX

IFRS 11 Joint Arrangements

PDF

PDF

PPTX

IFRS Indian Standards of now

PDF

PPT

IFRS.. Full ahead or caution?

PPT

Utilizing HFM to Handle the Requirements of IFRS

PPT

Ifrs a global threat to cooperatives

PDF

PPTX

Chapter1Managment Accounting.pptx chapter 1 of management accounting

PDF

DOCX

PPT

PPT

Ifrs Ice Breaking Slide Deck

PDF

PDF

Grant Thornton - Accounting for joint arrangements

PDF

Accounting for joint arrangements IFRS 11

PPTX

PPTX

International business strategy

PPTX

New ifrs 11 joint arrangements & associates

PPT

Ifrs 11 joint arrangements

PDF

PDF

PDF

International Business Review - September 2013 - Israel Edition

PPTX

PDF

Where to Buy LinkedIn Accounts_ [12 Best Site.pdf

PDF

automatic-enrolment-review-2017-maintaining-the-momentum.PDF

More Related Content

PPT

sir-david-tweedies-p.pptfhffhhfhhgfgfgffgffg

PDF

Understanding IFRS vs GAAP: Key Differences

PPTX

The Future of Accounting Standards

PPTX

IFRS 11 Joint Arrangements

PDF

PDF

PPTX

IFRS Indian Standards of now

PDF

Similar to 20120911_Isern - Effect Analysis - IFRS 11 Joint Arrangements.ppt

PPT

IFRS.. Full ahead or caution?

PPT

Utilizing HFM to Handle the Requirements of IFRS

PPT

Ifrs a global threat to cooperatives

PDF

PPTX

Chapter1Managment Accounting.pptx chapter 1 of management accounting

PDF

DOCX

PPT

PPT

Ifrs Ice Breaking Slide Deck

PDF

PDF

Grant Thornton - Accounting for joint arrangements

PDF

Accounting for joint arrangements IFRS 11

PPTX

PPTX

International business strategy

PPTX

New ifrs 11 joint arrangements & associates

PPT

Ifrs 11 joint arrangements

PDF

PDF

PDF

International Business Review - September 2013 - Israel Edition

PPTX

Recently uploaded

PDF

Where to Buy LinkedIn Accounts_ [12 Best Site.pdf

PDF

automatic-enrolment-review-2017-maintaining-the-momentum.PDF

PDF

How to Buy Instagram accounts for professional brand ... (1).pdf

PDF

How to Buy Snapchat accounts for professional brand ....pdf

PDF

Juniper Research's Top 10 Trends for Fintech in 2026

PDF

How to Buy Facebook accounts for professional brand ....pdf

PDF

growth-approach-pm-letter-december-2025 (1).pdf

PDF

Comprehensive consulting casebook from FMS Delhi (2023–24), covering framewor...

PDF

Institute for Public Relations 2025 Year in Review

PDF

What You in 2026 Buy Twitter Accounts_.pdf

PDF

How to Buy a USA Facebook Accounts Safely.pdf

PDF

Where to Buy Verified Chime Accounts for Quick ....pdf

PDF

Top 5 Places to Buy Aged LinkedIn Accounts and Should ....pdf

PDF

The Easiest Way to Buy Snapchat Accounts (1).pdf

PDF

Top 10 Websites to Buy Facebook Accounts Tone.pdf

PDF

Step-by-Step Guide to Buying LinkedIn Accounts in 2026.pdf

PPTX

CMMI Consulting & Implementation Services.pptx

PDF

Best Platforms to Buy Verified Wise Accounts in the USA.pdf

DOCX

Premium Aged Gmail Accounts – Instant Delivery.docx

PDF

Buy Verified PayPal Accounts Search Intent Analysis for 2025–26.pdf

20120911_Isern - Effect Analysis - IFRS 11 Joint Arrangements.ppt 1. International Financial Reporting Standards

The views expressed in this presentation are those of the presenter,

not necessarily those of the IFRS Foundation or the IASB

Joint Arrangements and

Related Disclosures

© 2011 IFRS Foundation. 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org

Effect analysis 2011

2. Effect analysis – Aspects considered

Joint venture activity (slides 3-4)

2

© 2011 IFRS Foundation. 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org

Financial statement effects (slides 5-7)

Cost-benefit analysis (CBA) (slide 8)

Convergence with US GAAP (slide 9)

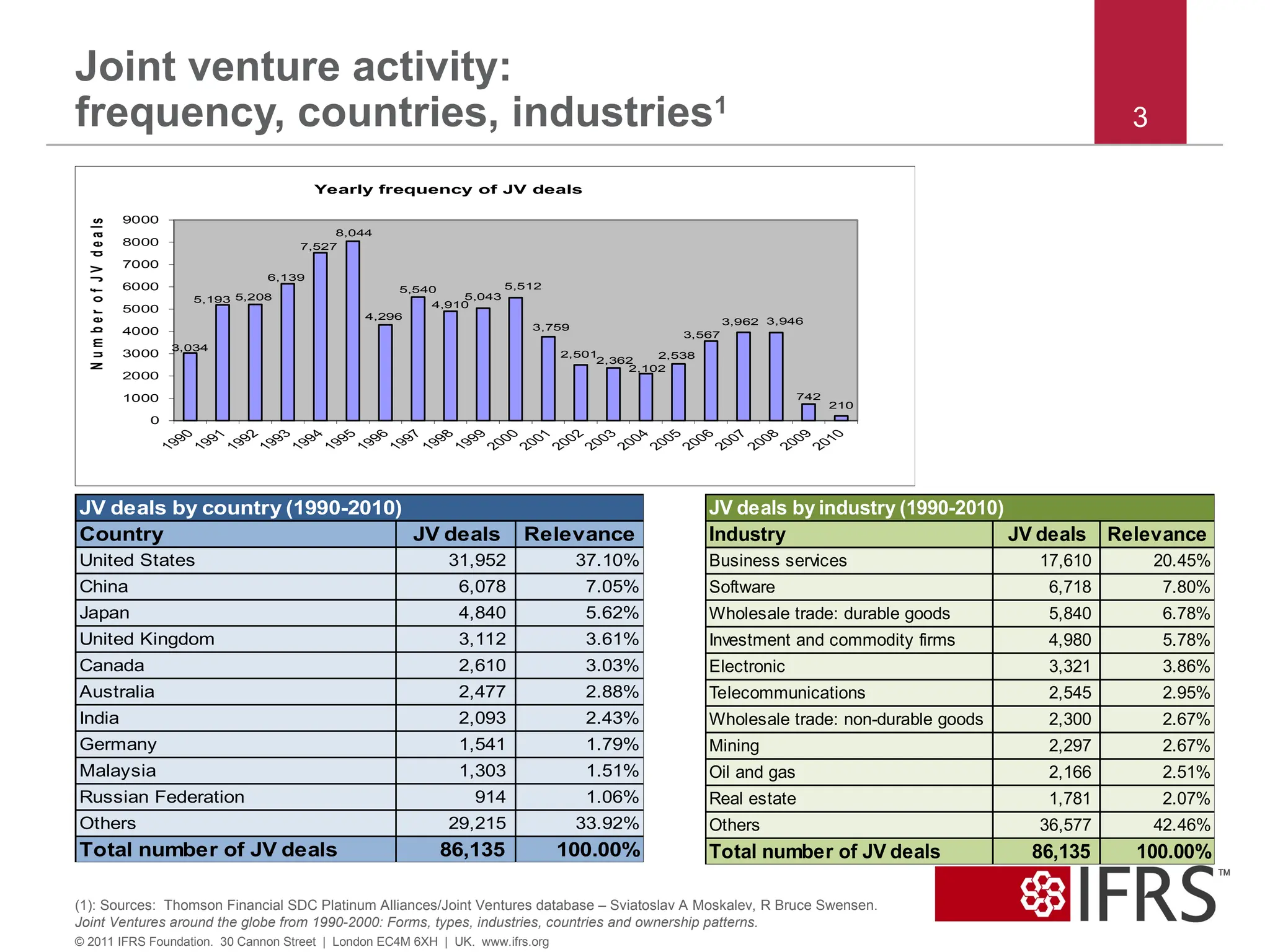

3. Joint venture activity:

frequency, countries, industries1

3

© 2011 IFRS Foundation. 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org

3,034

5,193 5,208

6,139

7,527

8,044

4,296

5,540

4,910

5,043

5,512

3,759

2,501

2,362

2,102

2,538

3,567

3,962 3,946

742

210

0

1000

2000

3000

4000

5000

6000

7000

8000

9000

N

u

m

b

e

r

o

f

J

V

d

e

a

ls

Yearly frequency of JV deals

Country JV deals Relevance

United States 31,952 37.10%

China 6,078 7.05%

Japan 4,840 5.62%

United Kingdom 3,112 3.61%

Canada 2,610 3.03%

Australia 2,477 2.88%

India 2,093 2.43%

Germany 1,541 1.79%

Malaysia 1,303 1.51%

Russian Federation 914 1.06%

Others 29,215 33.92%

Total number of JV deals 86,135 100.00%

JV deals by country (1990-2010)

(1): Sources: Thomson Financial SDC Platinum Alliances/Joint Ventures database – Sviatoslav A Moskalev, R Bruce Swensen.

Joint Ventures around the globe from 1990-2000: Forms, types, industries, countries and ownership patterns.

Industry JV deals Relevance

Business services 17,610 20.45%

Software 6,718 7.80%

Wholesale trade: durable goods 5,840 6.78%

Investment and commodity firms 4,980 5.78%

Electronic 3,321 3.86%

Telecommunications 2,545 2.95%

Wholesale trade: non-durable goods 2,300 2.67%

Mining 2,297 2.67%

Oil and gas 2,166 2.51%

Real estate 1,781 2.07%

Others 36,577 42.46%

Total number of JV deals 86,135 100.00%

JV deals by industry (1990-2010)

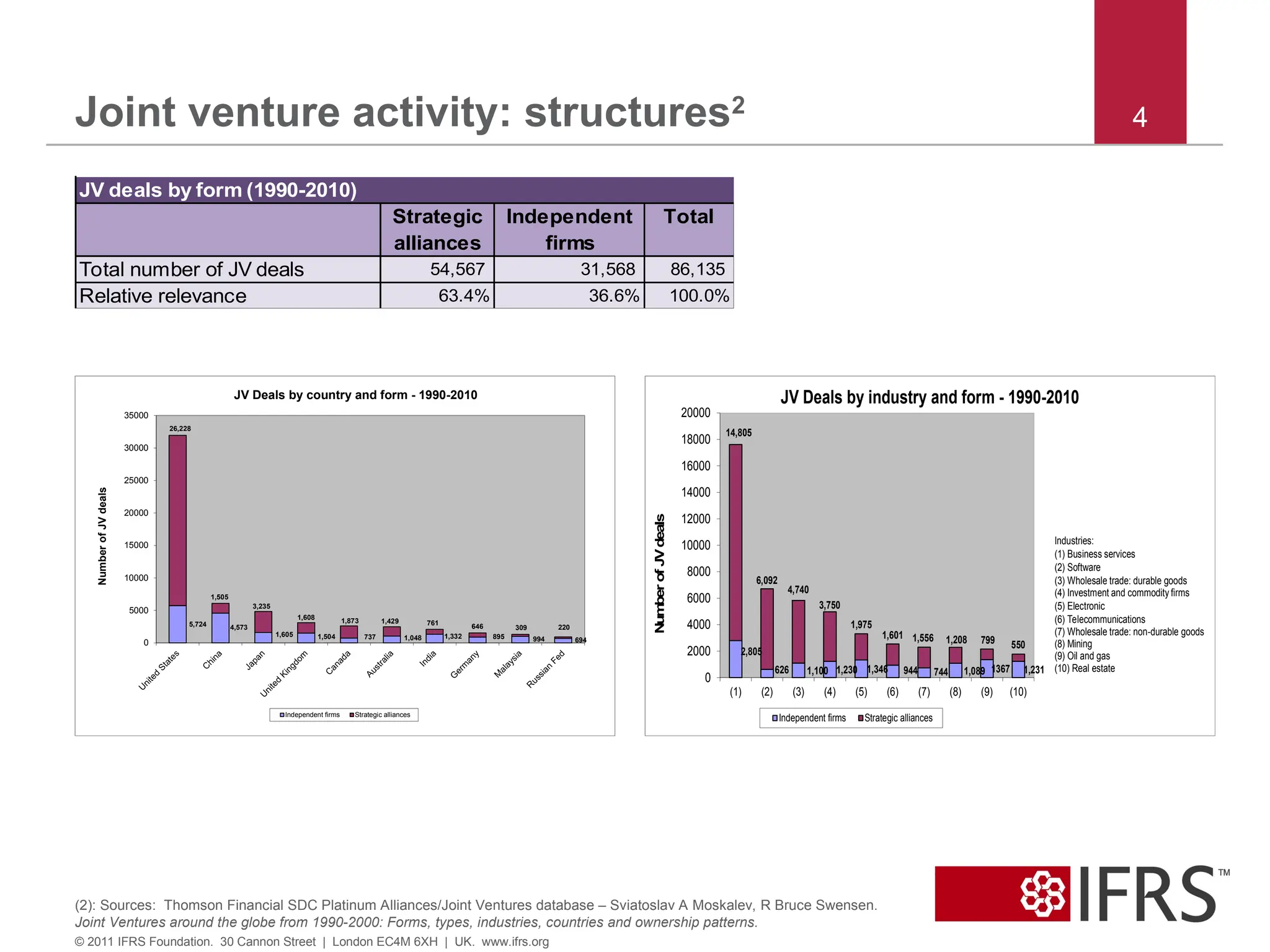

4. Joint venture activity: structures2

4

© 2011 IFRS Foundation. 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org

(2): Sources: Thomson Financial SDC Platinum Alliances/Joint Ventures database – Sviatoslav A Moskalev, R Bruce Swensen.

Joint Ventures around the globe from 1990-2000: Forms, types, industries, countries and ownership patterns.

5,724 4,573

1,605 1,504 737 1,048 1,332 895 994 694

26,228

1,505

3,235

1,608 1,873 1,429 761 646 309 220

0

5000

10000

15000

20000

25000

30000

35000

Number

of

JV

deals

JV Deals by country and form - 1990-2010

Independent firms Strategic alliances

2,805

626 1,100 1,230 1,346 944 744 1,089 1367 1,231

14,805

6,092

4,740

3,750

1,975

1,601 1,556 1,208 799 550

0

2000

4000

6000

8000

10000

12000

14000

16000

18000

20000

(1) (2) (3) (4) (5) (6) (7) (8) (9) (10)

Num

ber

of

JV

deals

JV Deals by industry and form - 1990-2010

Independent firms Strategic alliances

Industries:

(1) Business services

(2) Software

(3) Wholesale trade: durable goods

(4) Investment and commodity firms

(5) Electronic

(6) Telecommunications

(7) Wholesale trade: non-durable goods

(8) Mining

(9) Oil and gas

(10) Real estate

Strategic

alliances

Independent

firms

Total

Total number of JV deals 54,567 31,568 86,135

Relative relevance 63.4% 36.6% 100.0%

JV deals by form (1990-2010)

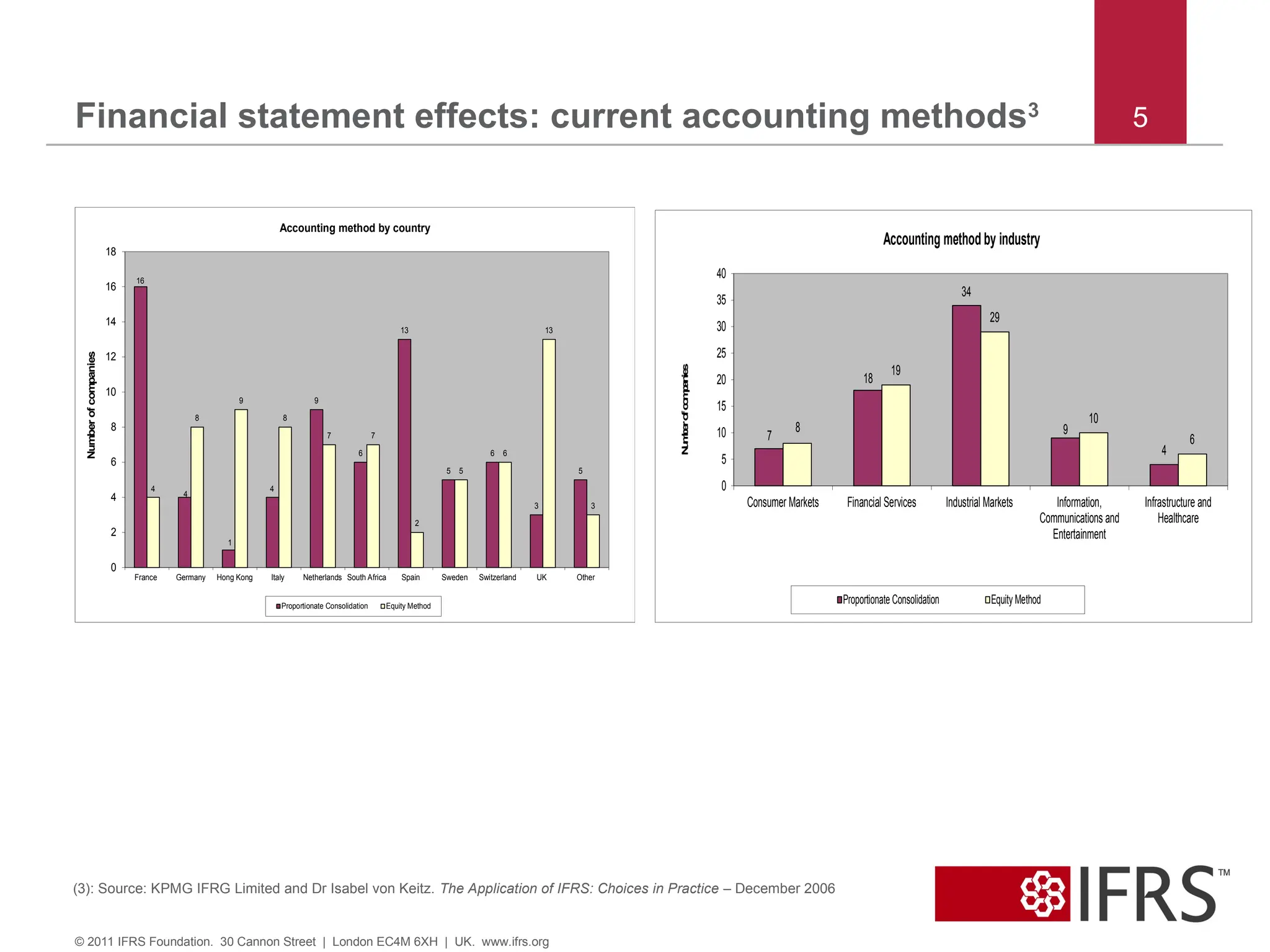

5. Financial statement effects: current accounting methods3 5

© 2011 IFRS Foundation. 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org

(3): Source: KPMG IFRG Limited and Dr Isabel von Keitz. The Application of IFRS: Choices in Practice – December 2006

16

4

1

4

9

6

13

5

6

3

5

4

8

9

8

7 7

2

5

6

13

3

0

2

4

6

8

10

12

14

16

18

France Germany Hong Kong Italy Netherlands South Africa Spain Sweden Switzerland UK Other

Number

of

companies

Accounting method by country

Proportionate Consolidation Equity Method

7

18

34

9

4

8

19

29

10

6

0

5

10

15

20

25

30

35

40

Consumer Markets Financial Services Industrial Markets Information,

Communications and

Entertainment

Infrastructure and

Healthcare

N

u

m

b

e

r

o

f

c

o

m

p

a

n

ie

s

Accounting method by industry

Proportionate Consolidation Equity Method

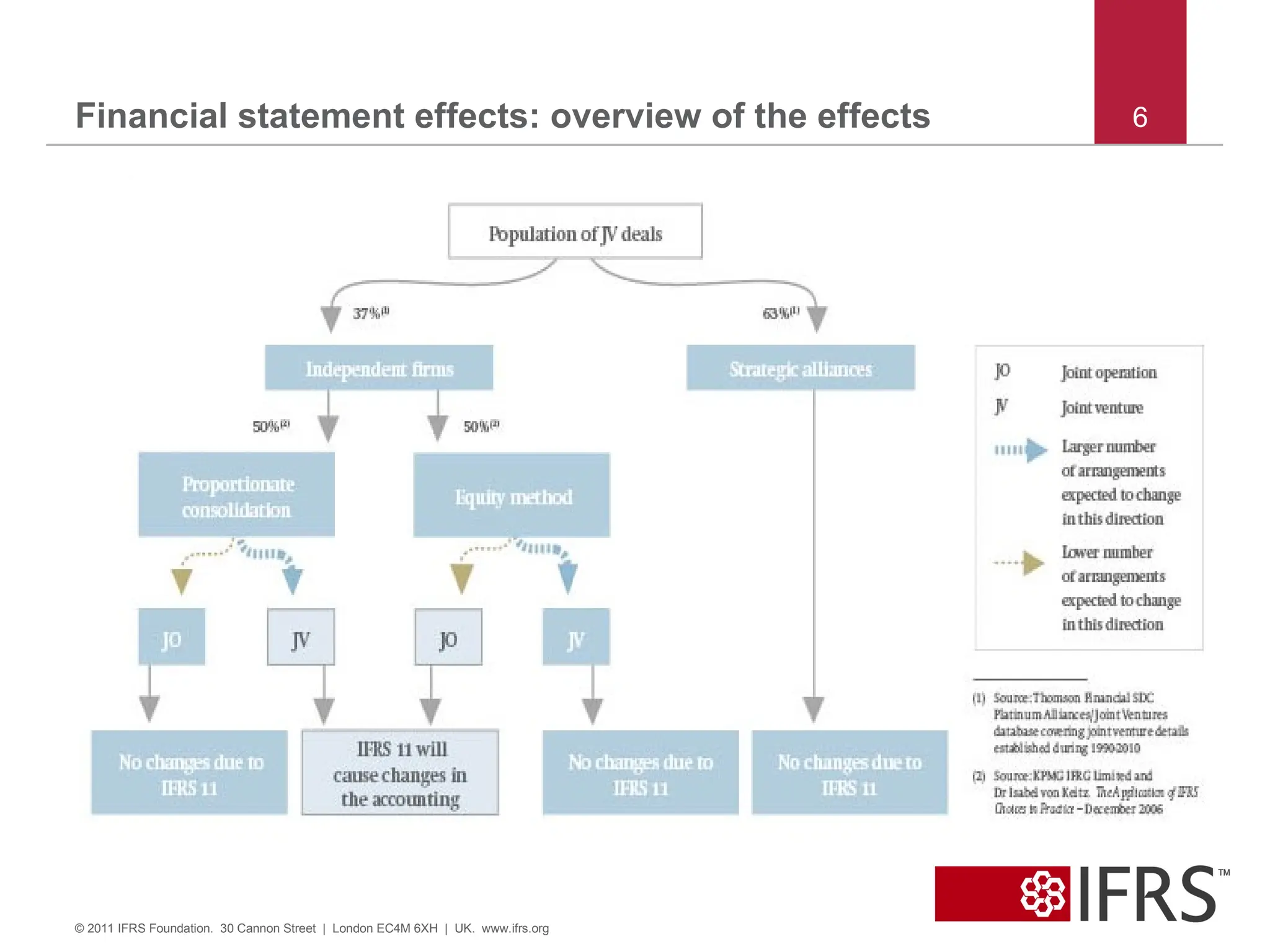

6. 7. Financial statement effects: other effects analysed 7

© 2011 IFRS Foundation. 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org

The Effect analysis document also considers:

•Effects on the entities’ financial statements (ie statement of financial

position, statement of comprehensive income, statement of changes in

equity, statement of cash flows).

•Effect of the accounting change on return on capital and its

components (ie profitability, assets turnover and financial leverage).

•Effects expected on the arrangements analysed during the outreach

which covered different industries.

8. Cost-benefit analysis (CBA) 8

© 2011 IFRS Foundation. 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org

The areas identified as the areas that will represent the highest costs

and benefits for those entities affected by the implementation of

IFRS 11 are as follows:

•Classification of the types of joint arrangement

•Transition provisions

•Additional disclosures

Overall assessment is that the benefits brought by IFRS 11 will

outweigh its related costs.

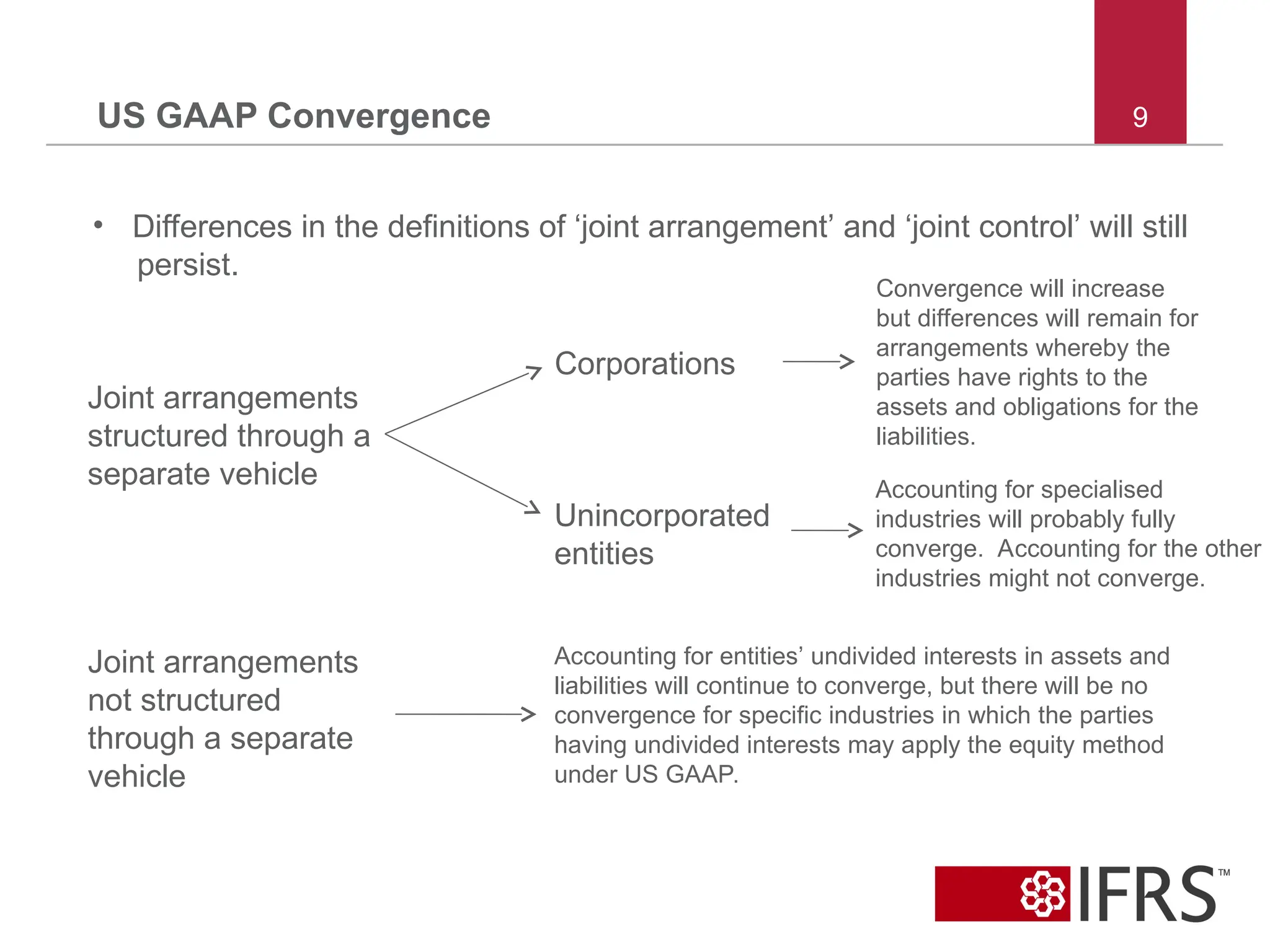

9. US GAAP Convergence

Joint arrangements

structured through a

separate vehicle

Joint arrangements

not structured

through a separate

vehicle

• Differences in the definitions of ‘joint arrangement’ and ‘joint control’ will still

persist.

Corporations

Unincorporated

entities

Convergence will increase

but differences will remain for

arrangements whereby the

parties have rights to the

assets and obligations for the

liabilities.

Accounting for specialised

industries will probably fully

converge. Accounting for the other

industries might not converge.

Accounting for entities’ undivided interests in assets and

liabilities will continue to converge, but there will be no

convergence for specific industries in which the parties

having undivided interests may apply the equity method

under US GAAP.

9

10. Questions or comments?

Expressions of individual

views by members of the

IASB and

its staff are encouraged.

The views expressed in this

presentation are those of the

presenter. Official positions

of the IASB on accounting

matters are determined only

after extensive due process

and deliberation.

10

© 2011 IFRS Foundation. 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org