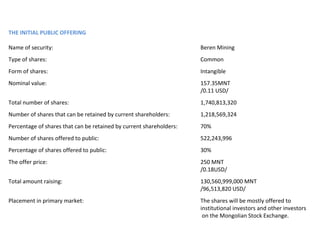

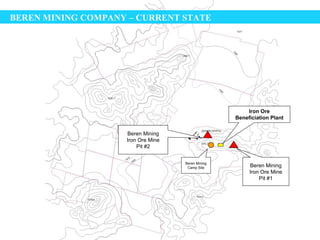

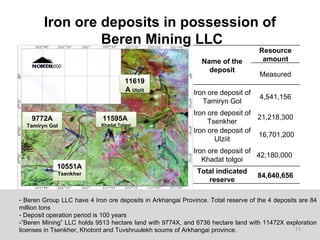

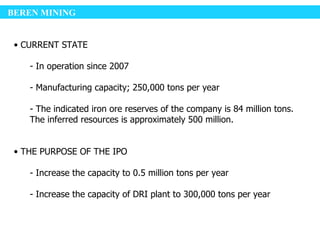

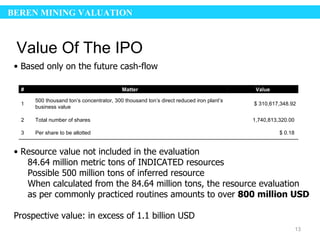

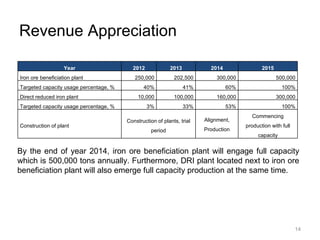

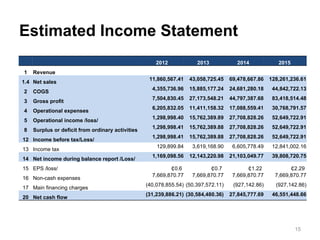

Beren Mining Company is conducting the largest initial public offering to date on the Mongolian Stock Exchange. The IPO involves the sale of 522 million common shares, representing 30% of the company, at a price of 250 MNT per share, raising a total of over 96 million USD. Beren Mining is the sole producer of iron ore fines with 65% iron content in Mongolia and owns several large iron ore deposits with over 84 million metric tons of indicated resources. Proceeds from the IPO will be used to increase the company's production capacity to 500,000 tons of iron ore and 300,000 tons of direct reduced iron annually.