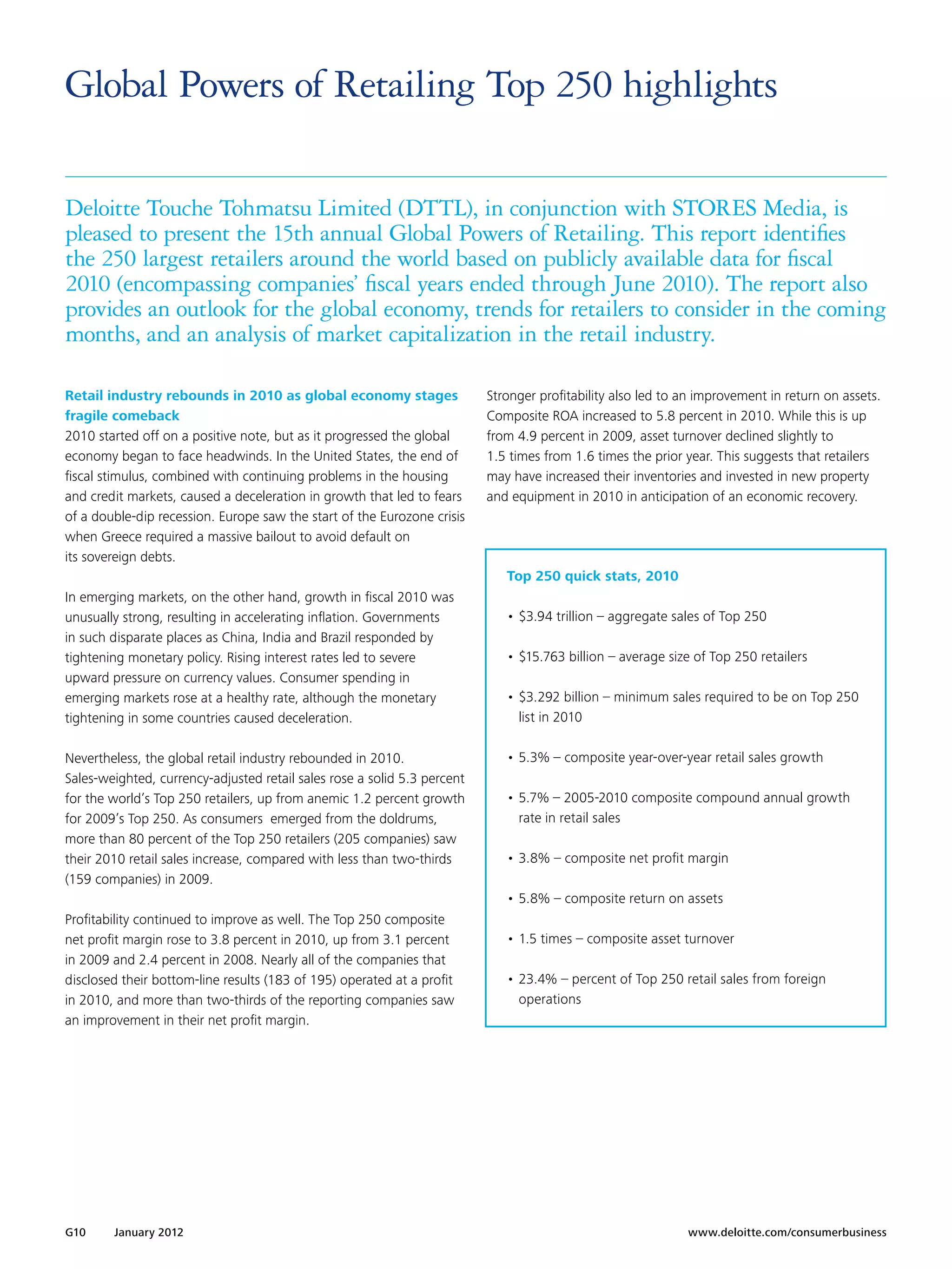

This document provides a summary of the global economic outlook and trends for retailers to consider. It discusses slowing economic growth in many leading markets in 2012. In Europe, government spending cuts and debt issues are weakening economies and confidence. In the US, uncertainty around fiscal policy is hurting markets. China is also slowing after monetary tightening. Some positives for retailers include potential margin improvements from lower commodity prices and inflation in some countries. Long term global growth prospects remain strong, especially in emerging markets.