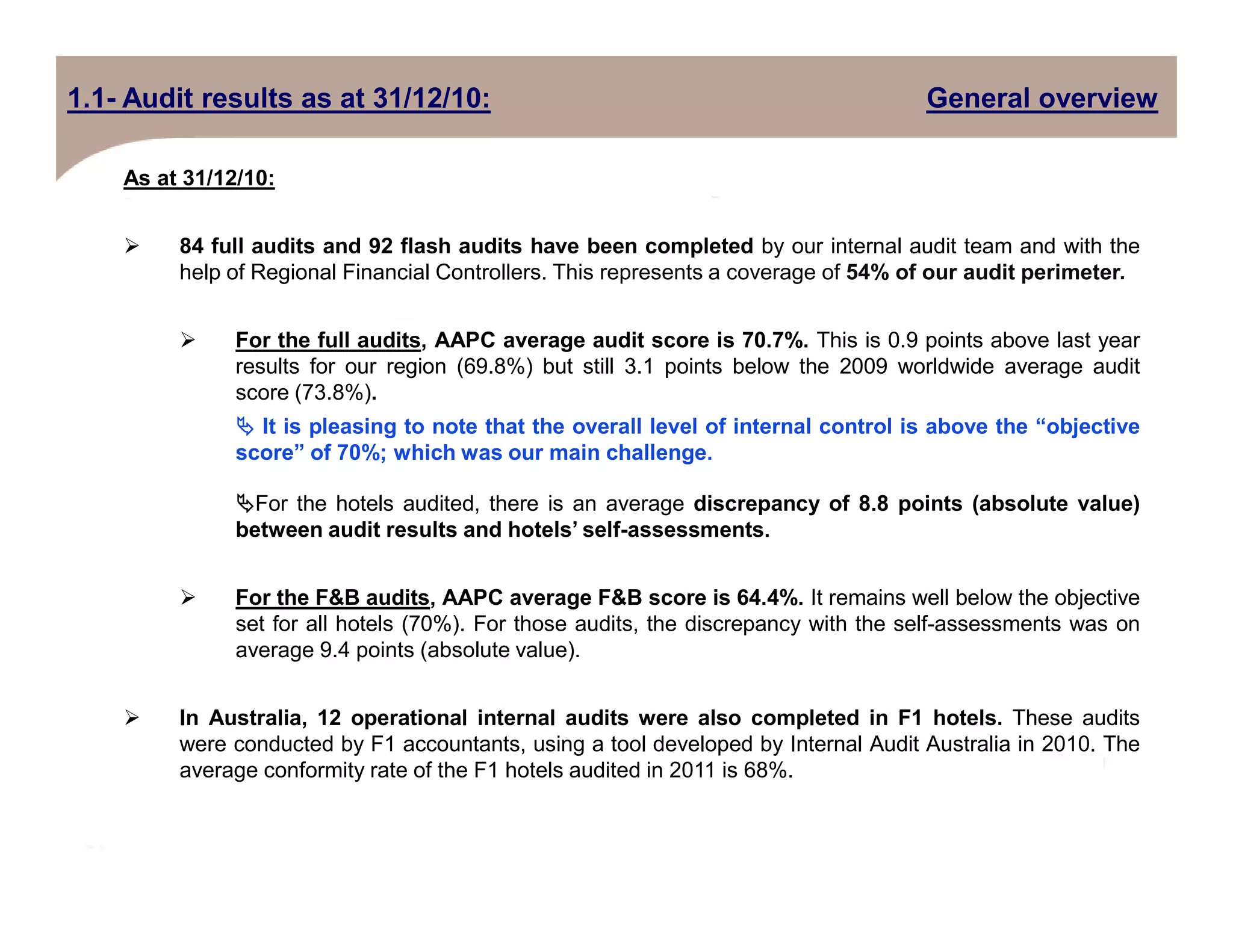

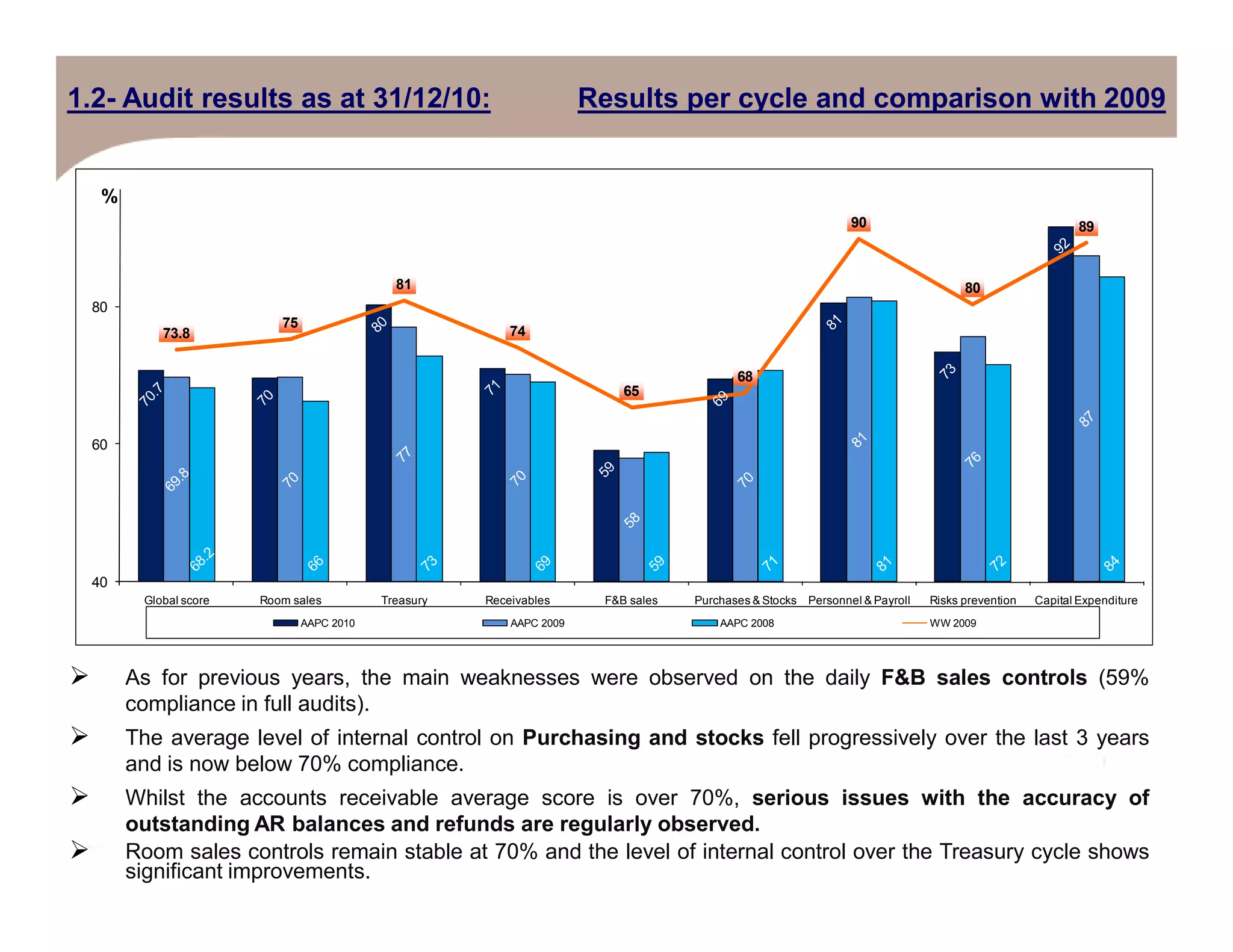

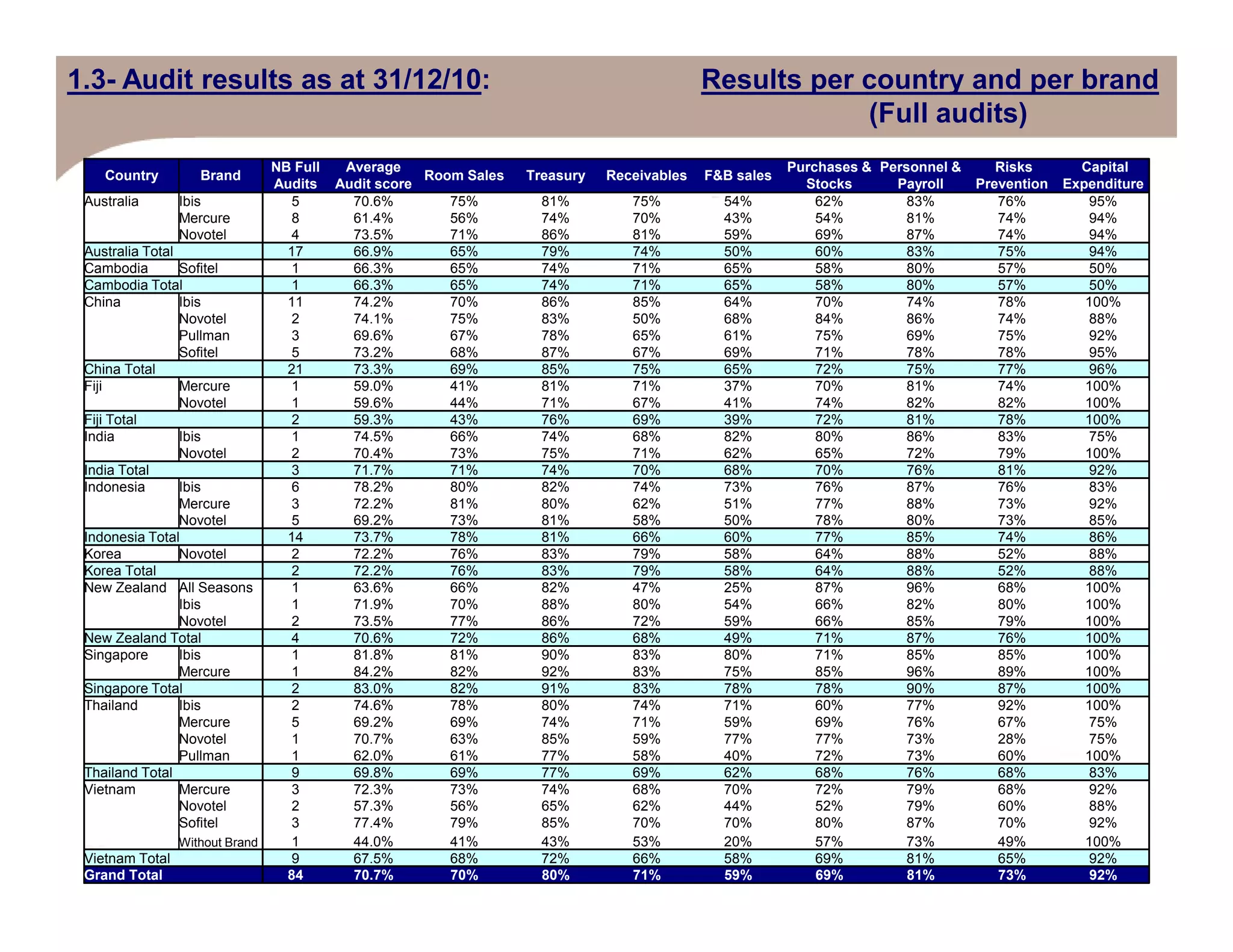

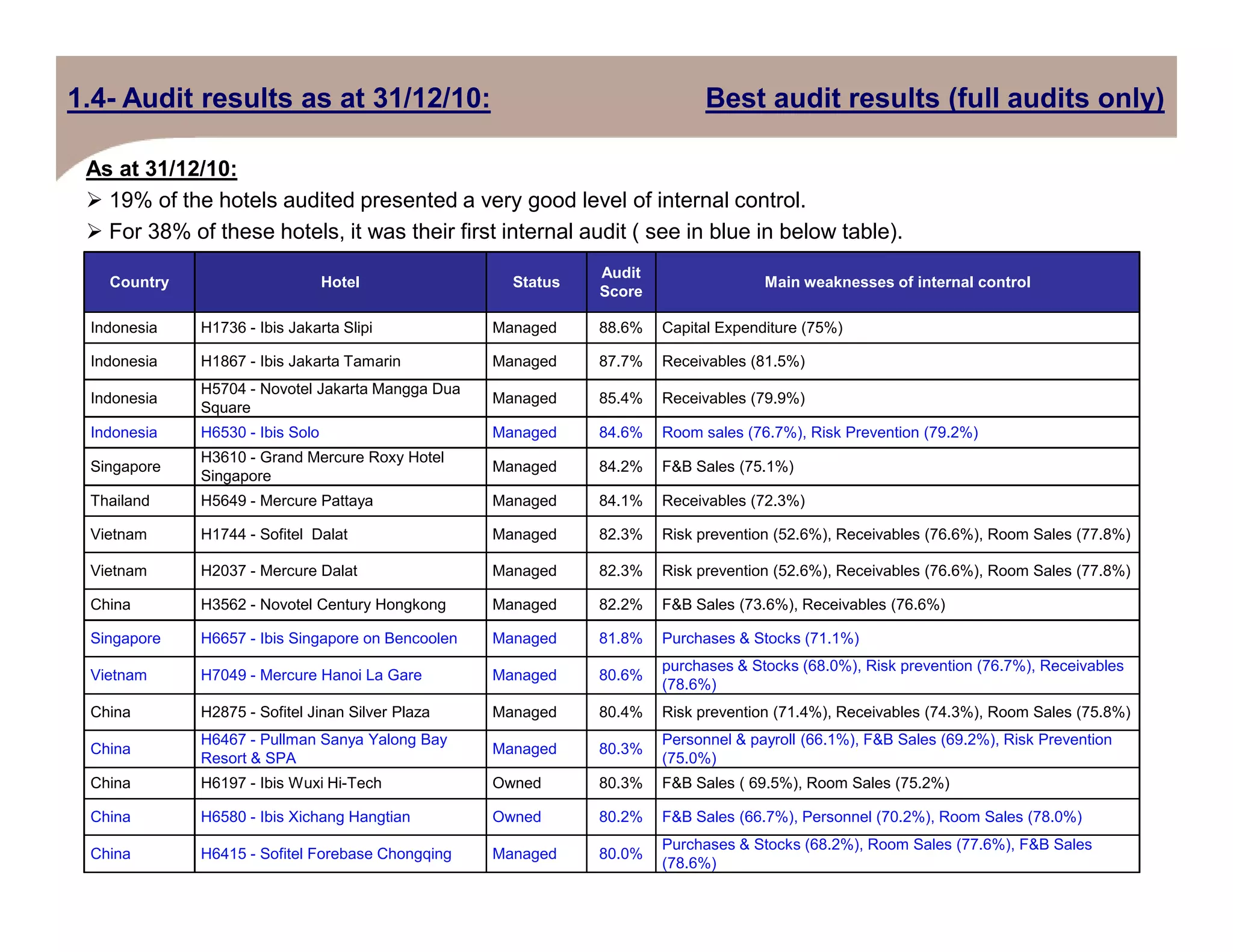

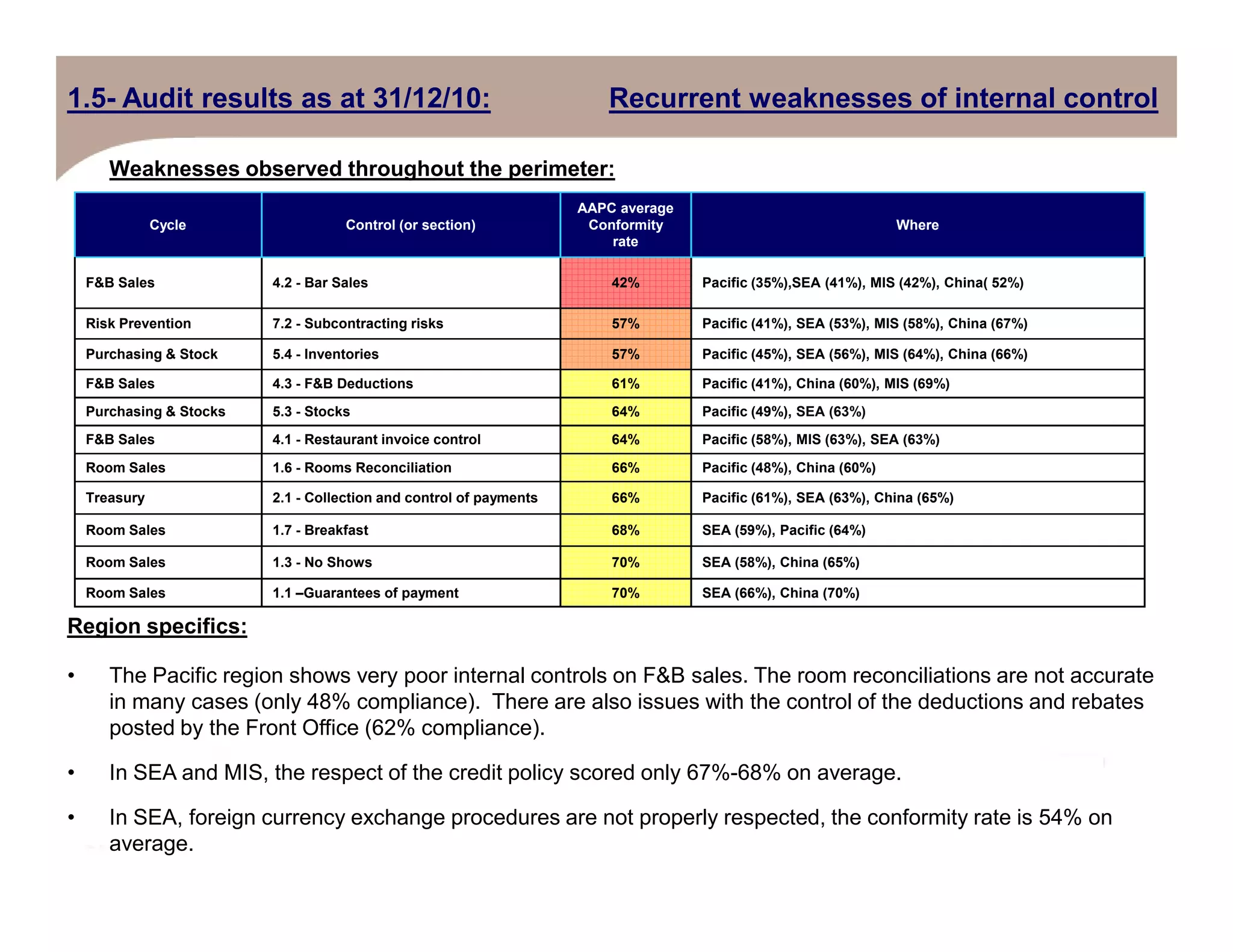

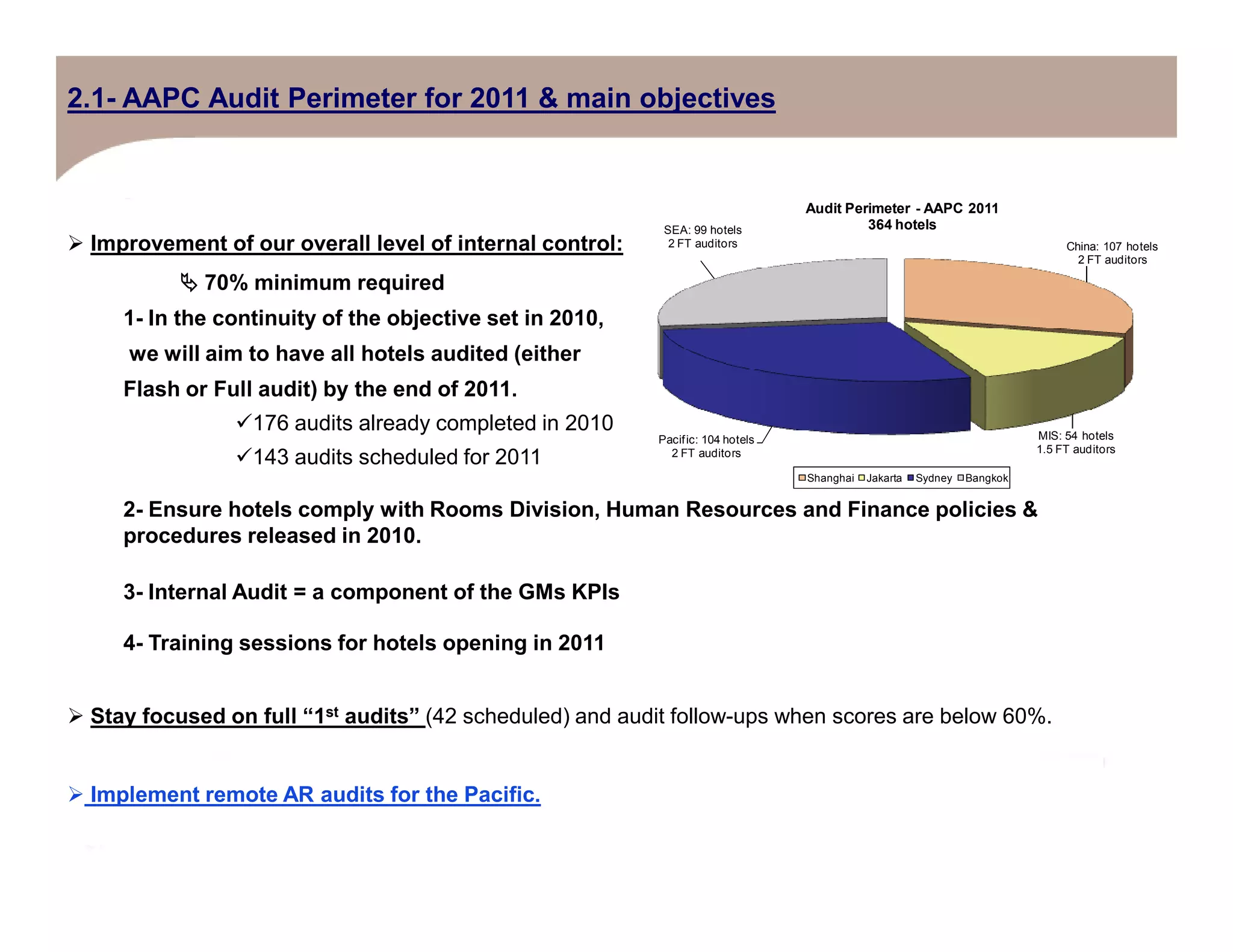

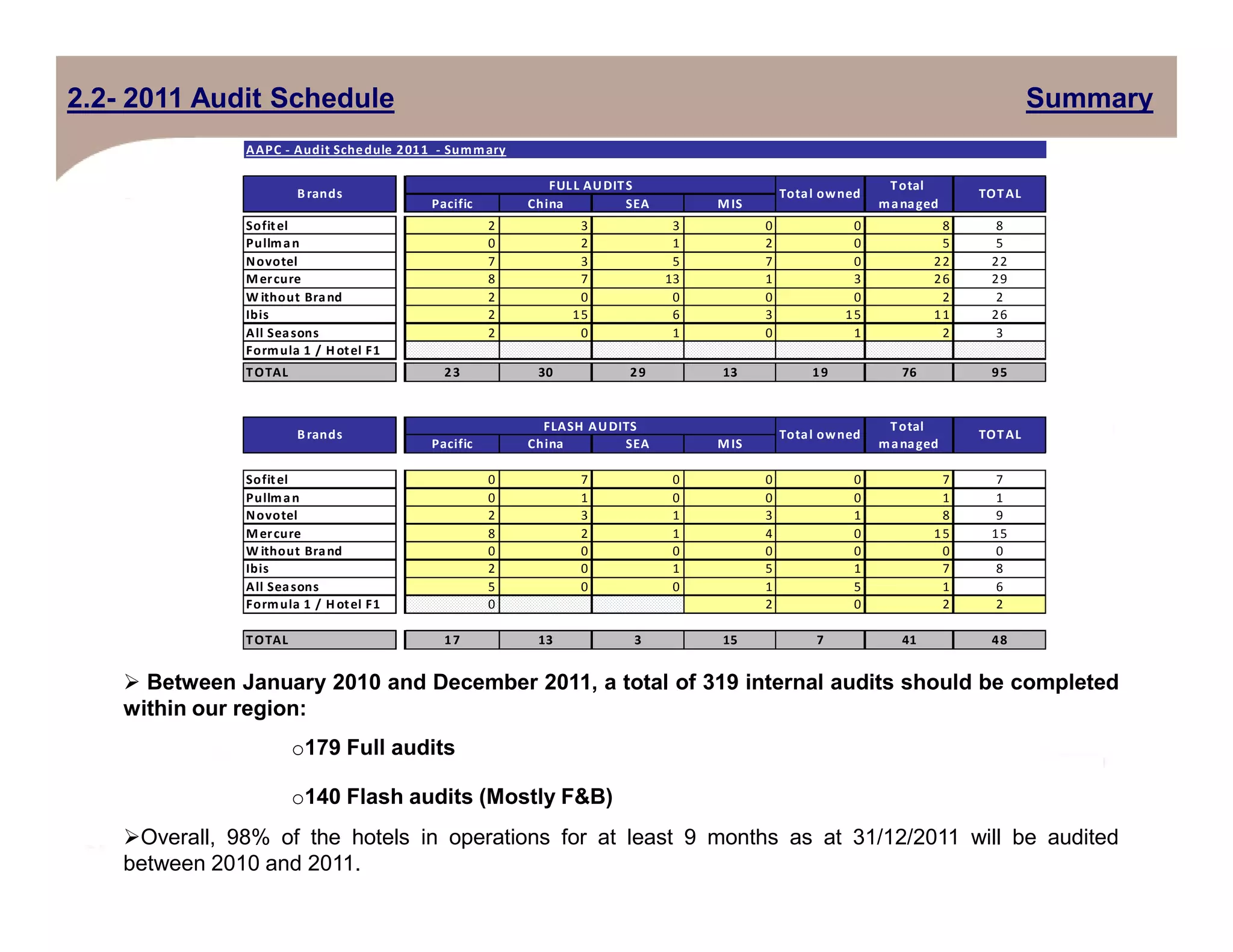

The document summarizes internal audit results for 2010 and outlines audit objectives for 2011 for AAPC. In 2010, 84 full audits and 92 flash audits were conducted, with an average score of 70.7%. Recurrent weaknesses were in F&B sales, risk prevention, and purchasing/stocks. In 2011, the objectives are to audit all hotels, ensure compliance with new policies, and focus on first audits and scores below 60%. A total of 319 audits are planned for 2010-2011, with 98% of eligible hotels being audited.