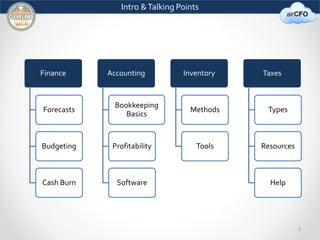

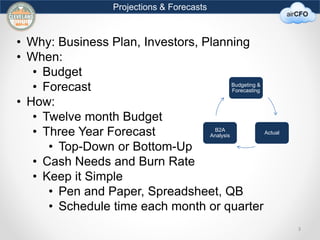

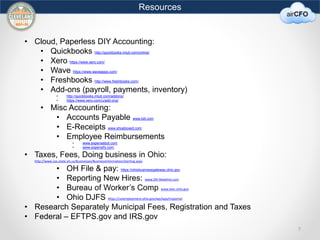

The document outlines essential accounting and finance practices for seed and startup companies, including budgeting, forecasting, accounting basics, inventory management, and tax obligations. It emphasizes the importance of compliance, financial projections, and software tools like QuickBooks, Xero, and Wave for managing finances. Additionally, it provides resources for startup accounting, tax filings, and employee reimbursements.