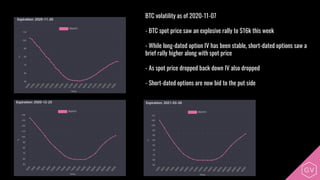

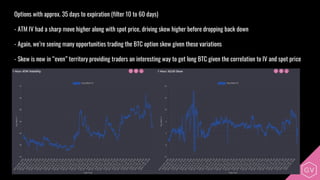

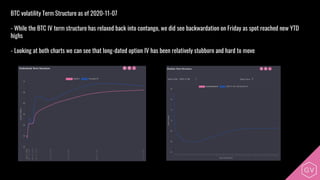

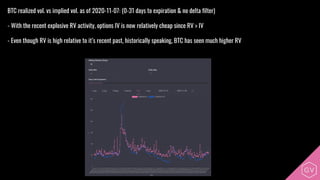

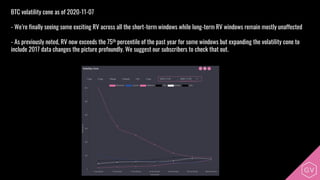

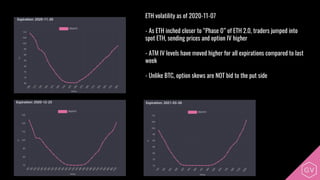

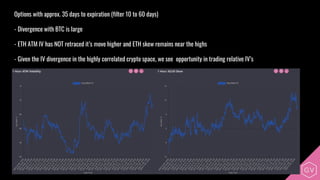

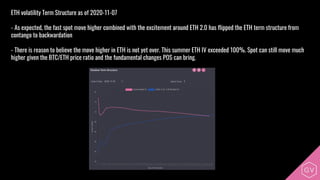

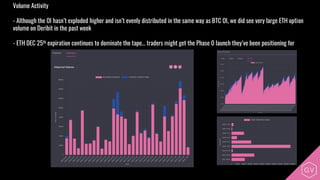

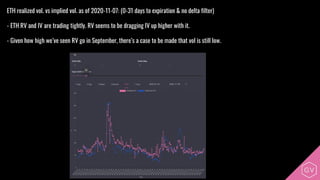

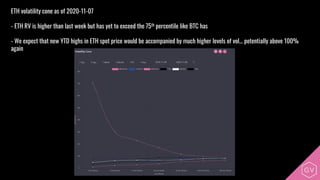

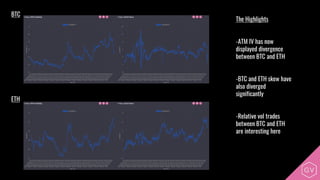

This newsletter summarizes the latest volatility statistics and analytics for Bitcoin and Ethereum options. BTC volatility increased as the spot price rallied to $16k but has since decreased as the spot price fell back down. ETH volatility also increased as its spot price moved closer to the launch of ETH 2.0. The newsletter provides analysis of implied volatility, realized volatility, volume activity, and term structures for both BTC and ETH options. It also announces new data integration from OKEX and includes the standard disclaimer.