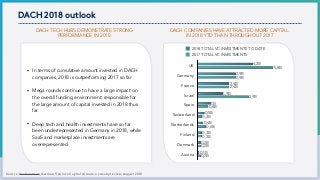

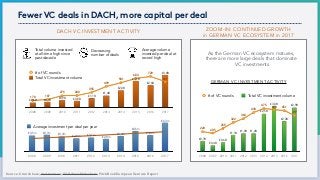

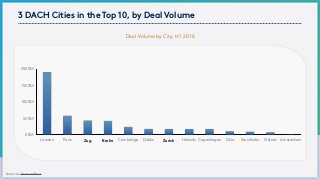

Corrected version see: https://www.slideshare.net/mathiasockenfels/state-of-the-startup-venture-capital-landscape-in-dach-2018edition-corrected - Our annual update of the State of the Startup & Venture Capital Landscape in Germany, Austria and Switzerland (DACH) - 2018 Edition by Speedinvest x (www.speedinvest.com/x) and Frontline Ventures (www.frontline.vc) - more on www.ockenrock.com - read more about this here: https://medium.com/speedinvest/state-of-the-startup-venture-capital-landscape-in-dach-2018-edition-e0193abe26bd

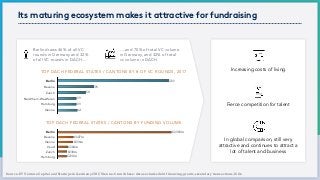

![Firms keep raising bigger funds - more capital available

Source: Selected funds with German operation; not including special/side vehicles; data from Crunchbase & interviews

FundSize

€0M

€50M

€100M

€150M

€200M

€250M

€300M

€350M

€400M

1st Generation 2nd 3rd 4th 5th 6th 7th

Earlybird

Holtzbrinck Ventures 2018

2015

20132011

Acton

Project A

Creathor

Point Nine

Speedinvest

2015

2008

2004

2017

2013

2018

2011

2007

2015

2013 2015

2017btov

2015

2007

2008

2011

[Vintage]

Capnamic

2017

Lakestar

2012

2015](https://image.slidesharecdn.com/dachlandscape2018final-180910174512/85/State-of-the-Startup-Venture-Capital-Landscape-in-DACH-2018-Edition-28-320.jpg?cb=1537736497)