English ic33 chapter 1 to 5 mock test

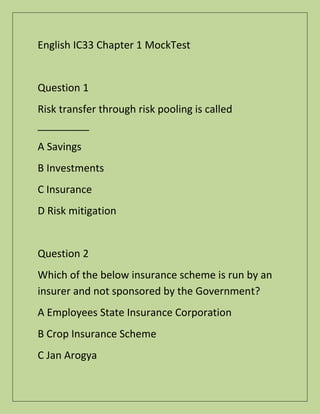

- 1. English IC33 Chapter 1 MockTest Question 1 Risk transfer through risk pooling is called _________ A Savings B Investments C Insurance D Risk mitigation Question 2 Which of the below insurance scheme is run by an insurer and not sponsored by the Government? A Employees State Insurance Corporation B Crop Insurance Scheme C Jan Arogya

- 2. D All of the above Question 3 Origins of modern insurance business can be traced to _________ A Botta mry B Lloyds C Rhodes D Malhotra Committee Question 4 When was Lic formed? A 1956 B 1999 C 1976 D 2000

- 3. Question 5 Which of the following statements is true? A Insurance is a method of sharing the losses of a 'few' by 'many' B Insurance is a method of transferring the risk of an individual to another individual C Insurance is a method of sharing the losses of a 'many' by a few D Insurance is a method of transferring the gains of a few to the many Question 6 Which of the below is not an advantage of cash value insurance contracts? A Safe and secure investment B Inculcates saving discipline

- 4. C Lower yields D Income tax advantages Question 7 How many life insurance companies are operating in India currently ? A 26 B 23 C 20 D 24 Question 8 Which among the following is a secondary burden of risk? A Business interruption cost B Goods damaged cost

- 5. C Setting aside reserves as a provision for meeting potential losses in the future D Hospitalisation costs as a result of heart attack Question 9 Which is the first life insurance company in the world? A Lloyds Coffee House B Bombay Mutual Assurance Society Ltd C Amicable Society for a perpetual Assurance D National Insurance Company Limited Question 10 Two types of risk burdens that one carries are _________ A Primary Burden of risk and Secondry Burden of risk

- 6. B Conditional Burden of Risk and Unconditional Burden of Risk C Positive Burden of Risk and Negative Burden of Risk D All the Above Question 11 Who devised the concept of HLV? A Dr. Martin Luther King B Warren Buffet C Prof hlubener D George Soros Question 12 Which of the below is not an element of the life insurance business?

- 7. A Asset B Risk C Principle of mutuality D Subsidy Question 13 Nationionalisation of Insurance was on _______________ A 1st September 1956 B 1st December 1956 C 1 st October 1956 D 10th Sept 1956 Question 14 The Asset May Be A Physical

- 8. B Non Physical C Personal D All the Above Question 15 The measures to reduce chances of occurrence of risk are known as ________ A Risk retention B Loss prevention C Risk transfer D Risk avoidance Question 16 When an insurer enters into an Insurance Contract with each person who seeks to participate in the Scheme. Such a participant is known as _____________

- 9. A Insurer B Insured C Both a and b D None of the Above Question 17 The first indian inurance company is ____________ A The Oriental life Insurance Co.ltd B Bombay Mutual Assurance Society Ltd C National Insurance Company Ltd D Triton Insurance o. Ltd Question 18 Out of 400 houses, each valued at Rs. 20,000, on an average 4 houses get burnt every year resulting in a combined loss of Rs. 80,000. What should be the

- 10. annual contribution of each house owner to make good this loss? A Rs.1 00/- B Rs.200/- C Rs80/- D Rs.4001- Question 19 How does diversification reduce risks in financial markets? A Collecting funds from multiple sources and investing them in one place B Investing funds across various asset classes C Maintaining time difference between investments D Investing in safe assets

- 11. Question 20 Collecting numerous individual contributions From various People. These people have similar assets which are exposed to similar risks. This process is known as _____________ A Peril B Pooling C Risk D Asset Question 21 ____________ Refers to protection against an event that will happen A Insurance B Assurance C Micro fnsurance D Bancassurance

- 12. Question 22 The GIONA was Passed in A 1999 B 1956 C 1972 D 1993 Question 23 Which of the below is an advantage of cash value insurance contracts? A Returns subject to corroding effect of inflation B Low accumulation in earlier years C Lower yields D Secure investment

- 13. Question 24 Which is one of the major forms of Risk Transfer A Assurance B Fixed deposit C Insurance D Mutual Fund Question 25 Which among the following is a method of risk transfer? A Bank ED B Insurance C Equity shares D Real estate Question 26

- 14. Which of the following statement is true? A Insurance protects the asset B Insurance prevents its loss C Insurance reduces possibilities of loss D Insurance pays when there is loss of asset Question 27 Which of the below statement is true? A Life insurance policies are contracts of indemnity while general insurance policies are contracts of assurance B Life insurance policies are contracts of assurance while general insurance policies are contracts of indemnity C In case of general insurance the risk event protected against is certain

- 15. D The certainty of risk event in case of general insurance increases with time Question 28 By transferring risk to insurer, it becomes possible ____________ A To become careless about our assets B To make money from insurance in the event of a loss C To ignore the potential risks facing our assets D To enjoy peace of mind and plan one's business more effectively Question 29 Which of the below option best describes the process of insurance? A Sharing the losses of many by a few

- 16. B Sharing the losses of few by many C One sharing the losses of few D Sharing of losses through subsidy Question 30 In insurance context 'risk retention' indicates a situation where ______ A Possibility of loss or damage is not there B Loss producing event has no value C Property is covered by insurance D One decides to bear the risk and its effects Question 31 Which of the below cannot be categorised under risks? A Dying too young

- 17. B Dying too early C Natural wear and tear D Living with disability Question 32 Which among the following cannot be termed as an asset? A Car B Human Life C Air D House Question 33 Why do insurers arrange for survey and inspection of the property before acceptance of a risk? A To assess the risk for rating purposes

- 18. B To find out how the insured purchased the property C To find out whether other insurers have also inspected the property D To find out whether neighbouring property also can be insured Question 34 Which of the below is the most appropriate explanation for the fact that young people are charged lesser life insurance premium as compared to old people? A Young people are mostly dependant B Old people can afford to pay more C Mortality is related to age D Mortality is inversely related to age

- 19. Question 35 Which among the following is the regulator for the insurance industry in India? A Insurance Authority of India B Insurance Regulatory and Development Authority C Life Insurance Corporation of India D General Insurance Corporation of India Question 36 Which among the following scenarios warrants insurance? A The sale bread winner of a family might die untimely B A person may lose his wallet C Stock prices may fall drastically D A house may lose value due to natural wear and tear

- 20. Question 37 Which among the following methods is a traditional method that can help determine the insurance needed by an individual? A Separation B Risk Avoidance C Risk financing D Risk Retension Question 38 ___________________ was the first legislation enacted to regulate the conduct of insurance companies in India A The Insurance Act 1938 B The Life lnsurnce companies Act 1938 C Provident Fund Act 1912

- 21. D The Insurance Act 2000 Question 39 Which of the below mentioned insurance plans has the least or no amount of savings element? A Term insurance plan B Endowment plan C Whole life plan D Money back plan Question 40 What Should one consider before opting for Insurance? A Don't risk a lot for little B Don't risk more than what you can afford to loose C Consider the likely outcomes of the risk carefully

- 22. D All the Above ========================================== ======================== English IC33 Chapter 2 MockTest Question 1 Premium collected in the early years of the insurance contract are held in trust by the insurance company, this amount is known as A Reserve B Corpus C Fund D Safe deposit Question 2 Which of the following are the components of level premium A Cash value element

- 23. B Term or protection component C Both of the above D Cash reserve ratio Question 3 Which type of premium does not increase with age but remains constant throughout the contract period? A Single premium B Level Premium C Flexible Premium D Risk Premium Question 4 Life Insurers are required to maintain_____________as a condition for writing the business

- 24. A Goodwill B Marketshare C Statutory reserve D Credit notes Question 5 Which Insurance plan provides only Death Benefit? A Endowment plan B Money Back Plan C Term plan D Child Plan Question 6 Typical risks faced by people are A Dying to early B Living to long

- 25. C Living with disability D All of the above Question 7 Mutality or the pooling principle plays which specific role in life insurance A Provides protection against economic loss arising as a result of one"s untimely death B Ensures a certain part of the fund is diverted to social security C Provides guarantee of premiums paid to the investors D None of the above ========================================== ======================== English IC33 Chapter 3 MockTest

- 26. Question 1 In Fire Insurance if the proposer discloses the following information at the time of insurance contract -1) Construction of building & age, 2) nature of goods in building premises. Then as per the insurance contract which information is he disclosing______________ A Material Fact B Insurable Interest C Proximate Clause D Contract of Adhesion Question 2 _____________ relates to inaccurate statements, which are made without any fraudulent intention. A Misrepresentation B Contribution

- 27. C Offer D Representation Question 3 Deliberate concealment of facts or misrepresentation of facts falls under which category ____________ A Fraud B Consideration C Capacity of the party D Free Consent Question 4 Mr. Dsouza works in a factory. Unfortunately the factory catches fire and Mr Dsouza is critically injured and after spending few days in the hospital dies. What is the proximity cause in this situation.

- 28. A Death B Sickness C Fire in Factory D None of the above Question 5 Which among the following is an example of coercion? A Ramesh signs a contract without having knowledge of the fine print B Ramesh threatens to kill Mahesh if he does not sign the contract C Ramesh uses his professional standing to get Mahesh to sign a contract D Ramesh provides false information to get Mahesh to sign a contract

- 29. Question 6 Predominant cause which sets into motion the chain of events producing the loss is known as ___________ A Contract Adhesion B Proximate Cause C Leagality D Utmost Good Faith Question 7 The payment of money in an insurance contract is known as___________ A Offer and acceptance B Consideration C Legality D Capacity of the parties

- 30. Question 8 Which element of a valid contract deals with premium? A Offer and acceptance B Consideration C Free consent D Capacity of parties to contract Question 9 Which of the below is not a valid consideration for a contract? A Money B Property C Bribe D Jewellery

- 31. Question 10 In which of the following does Insurable interest exist A Husband & Wife B Employer & Employee C Business partners D All of the above Question 11 Free Consent containt Mistake, Fraud, Misrepresentation, __________ and ___________ A Undue Influence B Correction C Both option D None of the above

- 32. Question 12 Which of the below party is not eligible to enter into a life insurance contract? A Business owner B Minor C House wife D Government employee Question 13 Which of the below is not correct with regards to insurable interest? A Father taking out insurance policy on his son B Spouses taking out insurance on one another C Friends taking out insurance on one another D Employer taking out insurance on employees

- 33. Question 14 Which of the below action showcases the principle of "Uberrima Fides"? A Lying about known medical conditions on an insurance proposal form B Not revealing known material facts on an insurance proposal form C Disclosing known material facts on an insurance proposal form D Paying premium on time Question 15 In a legal contract if pressure is applied on either of the parties through criminal needs, it is known as A Coercion B Fraud

- 34. C Undue Influence D Mistake Question 16 ______________ involves pressure applied through criminal means. A Fraud B Undue influence C Coercion D Mistake Question 17 When is it essential for insurable interest to be present in case of life insurance? A At the time of taking out insurance B At the time of claim

- 35. C Insurable interest is not required in case of life insurance D Either at time of policy purchase or at the time of claim Question 18 Which among the following options cannot be insured by Ramesh? A Ramesh's house B Ramesh's spouse C Ramesh's friend D Ramesh's parents Question 19 In which of the following insurable interest will not exist

- 36. A Mr Singh wants to take an insurance policy for his child B Anita wants to take insurance policy for her friend C Anuj wants to take an insurance policy for her wife D All of the above Question 20 Find out the proximate cause for death in the following scenario? Ajay falls off a horse and breaks his back. He lies there in a pool of water and contracts pneumonia. He is admitted to the hospital and dies because of pneumonia. A Pneumonia B Broken back C Falling off a horse D Surgen

- 37. Question 21 Which among the following is true regarding life insurance contracts? A They are verbal contracts not legally enforceable B They are verbal which are legally enforceable C They are contracts between two parties (insurer and insured) as per requirements of Indian Contract Act, 1872 D They are similar to wager contracts Question 22 Caveat Emptor relates to A Uberrima Fides B Insurable Interest C Free Consent

- 38. D Capacity of the parties Question 23 Rajesh had taken life insurance policy for Sum Assured of 50L for 20 yrs while returning home he met with a road accident and died. His death claim was not settled as he did not disclose his age correctly. This is known as breach of ____________ A Consideration B Insurable Interest C Offer and acceptance D Utmost Good Faith Question 24 Anthony has taken a new car and immediately gets his car insured too. He is paying a premium of Rs.4000 premium for car insurance. Unfortunately

- 39. his car meets with an accident and most of the parts are broken.So that Anthony receives the insurance when should the insurable interest exist A At time of Purchasing Ne.,n) Car B AT time of Paying Premium C At the time of claim D None of the above ========================================== ======================== English IC33 Chapter 4 MockTest Question 1 MR. Shelly wants to purchase a new house. This is which category of goal? A Short Term Gaol B Log term Goal C Medium Term Goal D Option 2& 3

- 40. Question 2 Which of the following is not a wealth accumulation product ____________ A Real Estate B Fixed Deposit C Share D High Yield Bond Question 3 Which among the following would you recommend in order to seek protection against unforeseen events? A Insurance B Transactional products like bank. FD's C Shares

- 41. D Debentures Question 4 An individual with an aggressive risk profile is likely to follow wealth __________ investment style A Consolidation B Gifting C Accumulation D Spending Question 5 During which stage of life will an individual appreciate past savings the most? A Post retirement B Earner C Learner

- 42. D Just married Question 6 Which among the following can be categorised under contingency products? A Bank deposits B Life insurance C Shares D Bonds Question 7 Phases of retirement planning are __________ A Distribution, Accumulation B Conversation, Accumulation C Conversation, Distribution D Accumula.tion, Conservation, Distribution

- 43. Question 8 Which of the below can be categorised under wealth accumulation products? A Bank deposits B Life insurance C General insurance D Shares Question 9 ____________ are unforeseen life events that may call for a large commitment of funds A U'LI P B Wealth Acc.umulation C Diversification D Contingencies

- 44. Question 10 ____________ is a rise in the general level of prices of goods and services in an economy over a period of time. A Deflation B Inflation C Stagflation D Hyperinflation Question 11 Optimal method of converting principal (which we may call the corpus )into annuity payments for meeting income needs post retirement is known as ___________ A Distribution B Accumulation

- 45. C Conversation D Estate Question 12 Which of the following is not a part of investment parameters A Diversification B Time Horizon C Retirement Planning D Risk Tolerance Question 13 ____________ includes preparing of budget, analysing of expenses and income flow and predicting the future monthly income & expenses A Estate Planning

- 46. B Investment Planning C Retirement Planning D Cash Planning Question 14 In progressive risk profile Investment style is _____________ A Accumulation B Wealth Accumulation C Estate Planning D Consolidation Question 15 _________________ planning includes current need, future need, individual risk profile and income to roadmap anticipated need

- 47. A Risk Tolerance B Estate Planning C Financial Planning D Time Horizon Question 16 If a customer"s investment style falls into spending then in which risk profile will he fall? A Conservative B Secured C Progressive D Aggressive Question 17 Which of the following are the elements of Financial Planning ____________

- 48. A Investment & Risk Management B Tax & Estate Planning C Financial Cries need & Retirement Planning D All of the above Question 18 A complete insurance planning includes _________________ A Life Insurance B Health Insurance C Asset Insurance D All of the above Question 19 Which is the prime cause of financial distress in financial planning?

- 49. A Risk Tolerance B Unplanned C Time Horizon D Planned Question 20 In which of the following option can the investor spread the investment and reduce the risk A Time Horizon B Marketability C Risk Tolerance D Diversification Question 21

- 50. Mr Kumar wants to transfer his property in the name of his Son Vijay, this is known as _________ planning A Investment Planning B Retirement Planning C Estate Planning D All of the above Question 22 Which among the following is a wealth accumulation product? A Bank Loans B Shares C Term Insurance Policy D Savings Bank Account

- 51. Question 23 Savings can be considered as a composite of two decisions. Choose them from the list below. A Risk retention and reduced consumption B Gifting and accumulation C Spending and accumulation D Postponement of consumption and parting with liquidity Question 24 When is the best time to start financial planning? A Post retirement B As soon as one gets his first salary C After marriage D Only after one gets rich

- 52. Question 25 Which among the following can be categorised under transactional products? A Bank deposits B Life insurance C Shares D Bonds Question 26 Which among the following is not an objective of tax planning? A Maximum tax benefit B Reduced tax burden as a result of prudent investments C Tax evasion D Full advantage of tax breaks

- 53. Question 27 Which of the below is not a strategy to maximise discretionary income? A Debt restructuring B Loan transfer C Investment restructuring D Insurance purchase Question 28 What is the relation between investment horizon and returns? A Both are not related at all B Greater the investment horizon the larger the returns C Greater the investment horizon the smaller the returns

- 54. D Greater the investment horizon more tax on the returns ========================================== ======================== English IC33 Chapter 5 MockTest Question 1 Which of the below statement is correct with regards to endowment assurance plan? A It has a death benefit component only B It has a survival benefit component only C It has both a death benefit as well as a survival component D It is similar to a term plan Question 2 Life insurance is a product that is ___________

- 55. A Tangible B Expensive C Intangible D Productive Question 3 What is the primary purpose of a life insurance product? A Tax rebates B Safe investment avenue C Protection against the loss of economic value of an individual's productive abilities D Wealth accumulation Question 4

- 56. Mrs. Shailaja wishes to buy a product which will provide her both a death and a survival benefit component. Which plan will you suggest for her? A Endowment Assurance Plan B Term Assurance Plan C Money Back Plan D Annuity Plan Question 5 Mr. Ankit Joshi is looking out for a plan which will provide him a high insurance coverage in low budget. Which plan would you suggest for him? A Endowment Plan B ULIP C Term Insurance Plan. D Pure Endowment Plan

- 57. Question 6 Which feature of term insurance allows a policyholder to change or convert a term insurance policy into a permanent plan without providing fresh evidence of insurablity? A Changeable Term Insurance Policy B Decreasing Term Assurance Policy C Increasing Term Assurance Policy D Convertability Question 7 Which insurance plan comes handy as an income replacement plan? A Pure Endowment Plan B Term Insurance Plan C Health Plan D Whole life plan

- 58. Question 8 ___________ is a plan of decreasing term insurance designed to provide a death amount that corresponds to the decreasing amount owned on a mortgage loan. A Loan Redemption Plan B Cash Redemption Plan C Mortgage Redemption Plan D Credit Redemption Plan Question 9 Policies which do not participate in the profits are called as _______________ A Dividend Plans B Non-Participating Plans C Non-Dividend Plans

- 59. D Non-Investment Plans Question 10 _____________ is a plan in which there is no fixed term of cover but the insurer offers to pay the agreed upon death benefit when the insured dies, no matter whenever the death might occur. A Term Assurance Plan B Pure Endowment Plan C Whole Life Insurance D Endowment Assurance Question 11 The Bonus which is paid in case of death of the policyholder or maturity benefit is called as ___________ A Terminal Bonus

- 60. B Guaranteed Bonus C Reversionary Bonus D Profit gain Bonus Question 12 Which among the following is an intangible product? A Car B House C Life insurance D Soap Question 13 Policies which have a provision for participating in profits are called as _____________ A Participating Plans

- 61. B Profit Making Plans C Dividend Plans D Investment Plans Question 14 Mrs. Anita has opted for an life insurance plan with a tenure of 10 yrs. According to the plan she will have to pay premiums regularly and will get an insurance coverage of Rs 10 lass for the entire tenure. However the plan doesn't provide any maturity benefit. Which plan has Anita opted for? A Term Assurance Plan B Endowment Plan C Annuity Plan D Money back Plan Question 15

- 62. Which of the below statement is incorrect with regards to decreasing term assurance? A Death benefit amount decreases with the term of coverage B Premium amount decreases with the term of coverage C Premium remains level throughout the term D Mortgage redemption plans are an example of decreasing term assurance plans Question 16 The premium paid for whole life insurance is ____________ than the premium paid for term assurance. A Higher B Lower C Equal

- 63. D Substantially higher Question 17 Products that can only be perceived indirectly are called _____________ A Intangible B Consuming C Expensive D Tangible Question 18 ______________ life insurance pays off a policyholders mortgage in the event of the person"s death. A Term B Mortgage

- 64. C Whole D Endowment Question 19 Who among the following is best advised to purchase a term plan? A An indhidual who needs money at the end of insurance term B An individual who needs insurance and has a high budget C An individual who needs insurance but has a low budget D An individual who needs an insurance product that gives high returns Question 20

- 65. An immensely valuable asset possesed by an human being which is also the source of his productive earning capacity is called ____________ A Human Income B Human Life Value C Human Capital D Human Asset Question 21 Which of the below option is correct with regards to a term insurance plan? A Term insurance plans came with life-long renewability option B All term insurance plans come with a built-in disability rider C Term insurance can be bought as a stand-alone policy as well as a rider with another policy

- 66. D There is no provision in a term insurance plans to convert it into a .,.vhcile life insurance plan Question 22 Which of the below is an example of an endowment assurance plan? A Mortgage Redemption Plan B Credit Life Insurance Plan C Money Back Plan D Whole Life Plan Question 23 Physical objects that can be directly perceived by touch are known as ___________ objects A Intangible B Physical

- 67. C Tangible D Consuming Question 24 According to the new guidelines for regular premium policies, the cover will be __________ times the annualised premium paid for those below 45 and times for others. A 10 and 5 B 10 and 7 C 7 and 10 D 5 and 10 Question 25 In decreasing-term insurance, the premiums paid ___________ over time. A Increase

- 68. B Decrease C Remain constant D Are returned Question 26 Which type of term insurance plan is designed to pay the balance due on a loan? A Increasing Life Insurance B Mortgage Life Insurance C Credit Life Insurance D Convertible Life Insurance Question 27 Which plan leaves the policyholder with the satisfaction that he/she has not lost anything incase he/she survives the term.

- 69. A Term insurance with return of premiums. B Cash return insurance plan. C Pure Endowment Plan. D Pure Endowment with return of premiums. Question 28 An endowment assurance is an combination of _________ _________ A Health Plan + Term Assurance Plan B Term assurance plan + Pure endowment plan C Pure endowment + Pension plan D Term assurance + Pension plan Question 29 Mr Suresh Patil is the main income earner of the family and wants to save in an insurance plan which

- 70. gives him life cover till he is alive Which plan will you suggest for his needs? A Decreasing Term Assurance B Pure Endowment Plan C Pension Plan D Whole life Insurance Plan Question 30 Using the conversion option present in a term policy you can convert the same to ___________ A Whole life policy B Mortgage policy C Bank FD D Decreasing term policy Question 31

- 71. The _________ the premium paid by you towards your life insurance, the __________ will be the compensation paid to the beneficiary in the event of your death. A Higher: Higher B Lower, Higher C Higher: Lower D Faster: Slower Question 32 _______________ is a plan with the provision for return of a part of the sum assured in periodic installments during the term and balanced of sum assured at the end of the term. A Pure Endowment Plan B Money back plan C Whole Life Insurance

- 72. D Cash back. plan