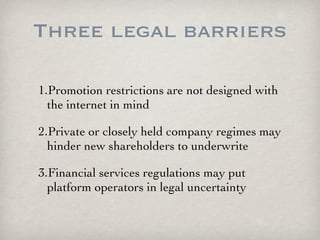

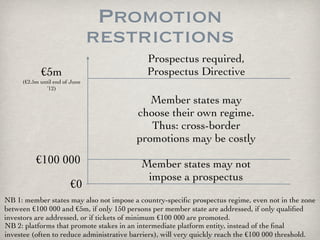

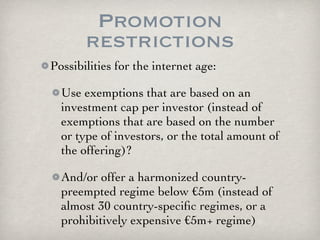

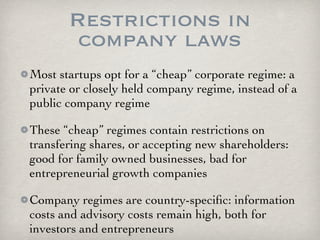

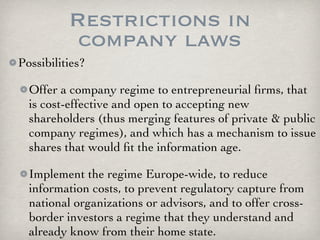

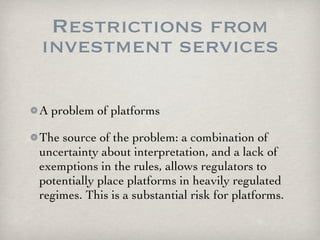

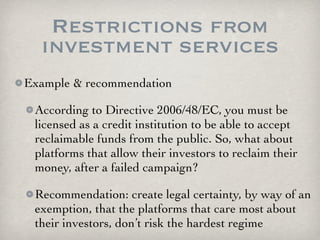

The document highlights legal barriers hindering crowdfunding in Europe, including promotion restrictions, company law limitations, and uncertainties in investment services regulations. It suggests creating harmonized regulations and legal exemptions to enhance cross-border crowdfunding activities, while promoting a cost-effective company regime that accommodates new shareholders. The need for clearer legal frameworks and exemptions is emphasized to reduce regulatory burdens on platforms and make them more appealing to investors.