CIV214702 Sulphur Mountain/Gaggero v Redmonds Relevant Case Record 7

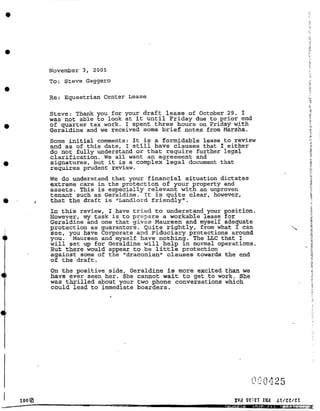

- 1. * To: Steve Gaggero could lead to immediate boarders. 0 0 0 4 25 TOO® poATajQHr On the positive side, Geraldine is more excited than we have ever seen her. She cannot wait to get to work. She was thrilled about your two phone conversations which C f •j. Steve: Thank you for your draft lease of October 29. I was not able to look at it until Friday due to prior end of quarter tax work. I spent three hours on Friday with Geraldine and we received some brief notes from Marsha. 5 J-ii ‘i =-■ j Ii i I I 1: Re: Equestrian Center Lease Some initial comments: It is a formidable lease to review and as of this date, I still have clauses that I either do not fully understand or that require further legal clarification. We all want an agreement and signatures, but it is a complex legal document that requires prudent review. We do understand that your financial situation dictates extreme care in the protection of your property and assets. This is especially relevant with an unproven tenant such as Geraldine. It is quite clear, however, that the draft is "Landlord friendly". In this review, I have tried to understand your position. However, my task is to prepare a workable lease for Geraldine and one that gives Maureen and myself adequate protection as guarantors. Quite rightly, from.what I can see, you have Corporate and Fiduciary protections around you. Maureen and myself have nothing. The LLC that I will set up for Geraldine will help in normal operations. But there would appear to be little protection against some of the "draconian" clauses towards the end of the draft. November 3, 2001 Yii SC:CT DU 1T/JZ/ZT

- 2. ACCEPTED I ZOO© 2 eBed r- 000426 Specific Comments 1(a) Paragraphs 1,2.6.10.11.14.15.16.18.20.21.22.23.24. on the Lease: 4 S I i! 5 1(b) P 3 We understood from our last conversation that there would be three three year options. 1(c). P.4. Minimum rent too harsh. Surely, there is a better way to handle expiration or termination. It should be faster (less than 180 days) . You should have the right to get Geraldine to terminate boarders and restore the center to its present condition. 1(d) . P.5. I think all of this clause needs simplifying. It seems to me that the only ones who understand it are yourself and Geraldine. She thinks that you need to work in some flexibility on stabling costs. The last paragraph is fine. 1(e) . P.7. We never did discuss the security deposit. I assume this was one of the "other issues" you mention in your introduction. $25,000 seems very high as a security deposit and the timing wrecks the cash flow analysis that Geraldine prepared for you. 1(f) . P.8. See note on P.4. This seems very one sided and too complicated. 1(g). P.9 & P 12. We understand your trespassing and hunting clauses. However, the penalty is harsh. In addition, with the increased flow of visitors, there may be non training visitors who trespass and Geraldine could be held responsible. It is obvious that Geraldine will seek to protect your rights under any situation. Signs and additional fencing may be needed to clearly establish the center boundary. 1(h). P.13. "Incurable Breach" is too harsh. It is an ugly phrase. This, is an operational situation. If Geraldine does not do her* part in keeping the facility in good condition, Paragraph 8 is the remedy. l(i) . P.17.25.26.27.28. through 34. These look like items that you took from standard leases. As I said earlier, some of these require legal review to protect Maureen and myself as guarantors. looie ibcjosoi jh <- I¥d SC:CT IHJ 1T/ZZ/ZT !liMdQa:e io/e /ll :paATe=aH

- 3. FINAL THOUGHTS: the risk is with you. confidence, Thank You 000427 COO0 e oBej dH <- :P0ATQO0H •? s6 JOOLS lepjeson I hope you feel that I have responded in a positive manner. Maureen and myself so want Geraldine to have this opportunity. She deserves it. We like you and feel you will be fair with her. When I first read the draft, my initial reaction was that the first year of the contract should be a one page short lease. This would give both of you a year to explore and experiment before settling down with a full long term lease. As I have done this analysis, I feel that this is the right way to go. I do understand that the majority of I have been mulling over the guarantor provision. I feel that three years as a guarantor is all that we feel comfortable with. In that time, in our view, you will have adecruate time to assess Geraldine' s ability and performance. I have just passed my 65th birthday and I am now at the stage where I want a settled personal environment and I do not want to be upset by events over which I have no direct control (P.19) . £ 0 | 0 £ I ! ft £ I % I IY.I 9e:ci IHi il/ZZ/ZT io/e /n , In the final analysis, if Geraldine loses your she would not want to stay and her sense of fair play would dictate that she would work with you to ensure an acceptable conclusion that would protect your interests.

- 4. Equestrian Facility Lease 5. Rent This Equestrian facility Lease ("Lease") is entered into this 23 day of November, 2001, by and between Sulphur Mountain Land and Livestock Co., LLC (Landlord) and Somerset, LLC (Tenant), and John A. Redmond, Maureen C. Redmond and Geraldine Redmond (Guarantors) on the following terms and conditions: 4. Holding Over Tenant shall vacate the Facility upon the expiration or earlier termination of this Lease. If Tenant fails to vacate the Facility within thirty (30) days after notice from Landlord of the expiration or earlier termination of this Lease, Tenant shall reimburse Landlord for and indemnify Landlord against all damages which Landlord incurs from Tenant's delay in vacating the Property. If Tenant does not vacate the Facility upon the expiration or earlier termination of this Lease and Landlord thereafter accepts rents from Tenant, Tenant's occupancy of the Facility shall be a "month-to-month" tenancy, subject to all of the terms of this Lease applicable to a month-to-month tenancy, except that the Minimum Rent then in effect shall be increased by fifty percent (50%). 2. Housing Included in this lease shall be a two bedroom dwelling unit for Geraldine Redmond and her immediate family (“Dwelling”). The Dwelling shall initially be located within the duplex known as the Bunkhouse approximately one mile west of the facility. Landlord reserves the right to provide a different Dwelling, in a different location, from time to time at landlord's discretion. Tenant shall have the right at Tenants expense, to install a prefabricated housing unit within the Facility for Geraldine’s use, provided the location is mutually agreed upon between tenant and landlord. Tenant shall be responsible for the cost of all utilities, maintenance, repair, replacements etc. within and surrounding the Dwelling. Tenant shall be billed for Tenants proportionate share of electricity used in the Bunkhouse Dwelling. The amount per hour or kilowatt charged to tenant shall be the same amount charged to any other user and may vary from time to time depending on the cost of fuel, service, maintenance and repair of the generator. If Tenant’s Dwelling is changed by Landlord or by Tenant, and the new Dwelling has a dedicated generator or uses the generator at the equestrian facility, Tenant shall be responsible for all generator costs, including fuel, oil, regular maintenance, repair and replacement. 3. Term Unless extended pursuant to the terms and conditions in this Article 3, the term of this agreement (“Lease Term") shall be twelve months, commencing January 1, 2002 (“Commencement Date”), and terminating December 31, 2002 (“Termination Date”). Tenant shall have three, three-year options (“Option Period(s)") to extend the Lease Term, subject to mutually agreed upon modifications to the terms and conditions contained in this Lease, as may be determined to be necessary from time to time during the Lease Term by Landlord. Between sixty and ninety days prior to the Termination Date, Landlord shall provide Tenant with any new or modified Lease terms and conditions. Tenant shall have thirty days to accept the new or modified Lease terms and conditions and extend the Lease Term for three years, or elect to terminate the Lease on the Termination Date. Upon execution of this Lease and payment of the security deposit, Tenant shall have use of the equestrian facility at no charge until the Commencement Date. 090367 k’ 1. Use Landlord hereby leases to Tenant and Tenant hereby leases from Landlord the approximately 30 acre equestrian facility located in Ventura County, on Canada Larga Road, a dwelling unit more fully described herein below, the use from time to time of portions of the ranch within which the equestrian facility exists as more fully described and conditioned herein below as designated areas and restricted areas, all collectively referred to herein as the facility ("Facility"). Tenant shall utilize the Facility exclusively for the purpose of boarding and training horses, and related purposes.

- 5. (6^-. 000368 Geraldine Redmond, a member of Tenant, shall train certain horses that will be boarded at the Facility from time to time. Any training income paid to tenant or Geraldine for Geraldine’s direct training shall be divided ninety percent Tenant, ten percent Landlord. Landlords portion shall be paid to Landlord monthly, along with other RGA and shall be included in the GP calculation at the end of the lease term. Tenants portion of Geraldine’s training income shall not be included in the GP calculation. When determining the net revenue from any RGA, other than stabling and pasturing, only the actual costs (“Cost") for outside services and materials, which were specifically incurred for the specific RGA shall be deducted from the gross revenue, there shall be no deduction for general expenses, salaries or compensation of any nature to Tenant or Tenant’s members or employees. When determining net revenue for stabling, Tenants Cost shall be $150.00 (“Stabling Cost"), per stall, which amount shall include all labor, feed, shavings and any other cost associated with stabling and board. Notwithstanding the foregoing, ninety days after the Commencement Date, Landlord and Tenant shall meet and review the books and records of the operation, if it is determined that the actual cost of stabling is materially different than $150.00 per stall, Tenant and Landlord shall adjust the Stabling Cost up or down accordingly. The revised Stabling Cost shall then be in effect until the end of the LeaseTerm. Tenant shall only deduct Stabling Cost from the gross stabling revenue, for each stall that is occupied with a paying clients horse. When determining the net revenue for pasturing, Tenant shall deduct only the Cost of any supplemental feed from any pastured horse of any paying client. There shall be no Stabling Cost or Cost deductions for any stall or horse in pasture that is not generating revenue in excess of Cost. When determining short-term rentals net income, it will be on revenue less Cost basis. 6. Utilities Tenant shall be responsible for all utilities at the Facility. Propane and diesel service shall be put in Tenants name at the Facility and Propane service shall be put in Tenants name for the tank that services the Dwelling. Tenant acknowledges the propane tank and diesel tank at the Facility are full and in perfect working order, free of leaks and spills, as of the execution of this Lease, and the propane servicing the Dwelling is in perfect working order, free of leaks and spills and will be full at the time Tenant takes occupancy. Tenant agrees to deliver all tanks full at the end of the Lease Term or any extension thereof. Tenant further agrees to maintain the tanks and abide by any and all regulations effecting the use or storage of propane and diesel fuel. Tenant shall be solely responsible for any requirements from any government agency regarding the tanks and use of the propane and diesel. Tenant shall indemnify and hold Landlord harmless for any contamination or hazardous material cleanup resulting from the storage or use of propane and diesel fuel. Tenant is hereby advised that the water to the Dwelling and the During the Lease Term, or any extension thereof (subject to any modified Lease terms and conditions pursuant to Article 3 herein above for any Option Periods, including modified rent terms and conditions) Tenant shall pay to Landlord the greater of $83,500 (“Minimum Rent") or $100,000 plus fifty percent of all net income from any revenue generating activities (“RGA”) over $100,000. RGA shall include but not be limited to, equestrian events, clinics, group activities, trainer fees, blanketing, hot walking, turnouts, pasturing, board, stabling, feed, supplies, etc. Minimum Rent shall be paid monthly, on the first of every month, commencing January 1, 2002, according to the monthly minimum rent schedule attached hereto as exhibit “A”, plus ninety percent of any and all net revenue received from any RGA. Within thirty days following the Termination Date of this Lease, or, if extended, no later than January 31st, of each year, Tenant shall provide an accounting to Landlord showing the total amount of funds paid to Landlord and the total amount retained by Tenant during the prior twelve month period ending December 31s1 (“TMP"). In the event the total amount paid to Landlord exceeds $100,000 for the TMP, the remaining balance after deducting $100,000 shall be added to the amount retained by Tenant during the TMP and that amount shall be the gross profit (“GP”) and shall be divided fifty-fifty between Tenant and Landlord. Landlord shall pay Tenant the difference between the amount retained by Tenant during the TMP and fifty percent of the GP within 10 days of receiving the accounting from Tenant and Landlords approval of same. In the event the combined total of the Minimum Rent and the RGA paid to Landlord at any time during the TMP exceeds $100,000, Tenant shall be entitled to receive fifty percent of the GP pursuant to the formula herein above. Thereafter, Tenant shall retain fifty percent of the RGA and pay landlord fifty percent of the RGA, monthly, in lieu of the Minimum Rent and the ninety percent of the RGA, until the end of the TMP. In the event Minimum Rent is not received by Landlord on or before the 10lh of any month, a late fee of five percent shall become due and payable and added to the rent then due. Tenant shall provide Landlord with detailed income and expense reports, deposit receipts and check registers on a monthly basis, showing in detail, all income and expense for the operation of the Facility. Tenant shall also provide Landlord on a monthly basis income and expense reports, deposit receipts and check registers for Geraldine's training and personal-equine and other animal related expenses. Landlord shall have the right to request additional reports, different formats and backup documentation form time to time, at Landlords discretion.

- 6. Facility may not be potable from time to time, and Tenant agrees to use the water at Tenants own risk, or purchase bottled water. 9. Designated Areas Tenant and all of Tenants members, clients, boarders, employees, agents, affiliates etc. fTC”) shall only use the designated areas (“DA”) as set forth on Exhibit “B" attached hereto. Tenant and TC shall not be permitted to use, ride, walk, drive or enter upon any other area not specifically identified on Exhibit B, for any reason whatsoever. Any area not designated on Exhibit B shall be considered a restricted area (“RA”). At Tenants sole expense, Tenant shall place signage in appropriate locations, prepare and pass out rules, regulations and maps as necessary to insure there is no trespassing on any RA. Any trespassing by any TC without express written permission from Landlord shall be considered a material breach of this lease. In the event any TC is found trespassing on any restricted area, Landlord shall send a written trespass notice to Tenant (“Trespass Notice”) specifying the date, approximate time and location of the trespass event, along with the trespassers general description and name (if obtainable from trespasser). Immediately upon receipt of a Trespass Notice, Tenant shall investigate the trespassing event and interview the trespasser if he or she is known to Tenant, or interview the person who was responsible for inviting the trespasser, if the trespasser is not known to Tenant. After the investigation and interview, Tenant shall make a determination whether to evict the trespasser, or person responsible for the trespass event or implement some other action, which will preclude future trespass events. Tenant shall furnish Landlord with a written report on the investigation and mitigation action taken within three days of the Trespass Notice. If more than four Trespass Notices are given to Tenant in any three-month period, Landlord may deem it an Incurable Breach, at Landlords sole discretion. If Tenant desires to use portions of the RA for an RGA, express written permission must be obtained from Landlord prior to any use. 7. Security Deposit Upon execution of the Lease Tenant shall pay Landlord the sum of $16,000 as a security deposit, to insure Tenants performance under the Lease. At any time during the Lease Term, or any extention thereof, Landlord may deduct amounts from the security deposit if Tenant fails to perform any requirement of the Lease. Thereafter, Tenant shall replenish the security deposit, or any portion thereof, upon written demand by Landlord. Provided the Facility and all associated equipment is in good condition and working order, and that there are no sums outstanding or due to Landlord, within thirty days after the termination date or any extension thereof. Landlord shall refund the security deposit to Tenant. In the event the Facility, Dwelling, or any portion thereof, or any associated equipment is not in good condition or needs repair (reasonable wear and tear excepted) at the end of the Lease Term or any extension thereof, Landlord shall keep the security deposit, repair or replace portions of the Facility, Dwelling, or equipment as necessary, deduct the cost for the repair and replacement from the security deposit, and return any unused portion to Tenant thereafter along with the bills for the repair or replacement. In the event the cost of any repair or replacement exceeds the amount of the security deposit, Tenant shall promptly pay Landlord the difference, upon presentation of the bills by Landlord to tenant. 8. Cancellation At any time during the Lease Term, or any extension thereof. Landlord may, at Landlords sole discretion, terminate this Lease by giving a minimum of one hundred eighty (180) days written notice to Tenant of Landlords election to terminate. Provided the Facility is left in good condition and there are no amounts due Landlord, within ten days of Tenant vacating the facility, Landlord shall refund any and all deposits being held by Landlord and Landlord shall pay to Tenant a cancellation fee calculated as follows: The GP for the prior TMP, divided by two, divided by twelve, times the months remaining on the Lease Term then in effect (not including any unexercised Option Periods), times .25, plus a percentage of the total cost for any capital improvements paid for by Tenant out of Tenants funds, which percentage shall be calculated by using the following formula: The capital expenditure amount, divided by the number of months remaining on the Lease Term then in effect (not including any unexercised Option Periods) as of the date of the capital expenditure, times the remaining months of the Lease Term then in effect ( not including any unexercised Option Periods)as of the move out date. 10. Rules and Regulations Tenant shall prepare, for Landlords approval, posting, and for distribution to all TC's, rules and regulations (“R&R”), for the use of, and proper conduct at the Facility, including hours of operation. Landlord shall have the unilateral right to reasonably modify, or supplement the R&R at any time, for any reason at Landlords sole discretion. Tenant shall insure that all TC's obey the R&R or Tenant shall promptly evict them from the Facility with no ability to re-enter for any reason. Landlord shall have the right to require Tenant to evict any TC for any reason at Landlords sole discretion. Tenant shall include in the rules and regulations a warning and instructions 0003 6

- 7. 090370 not to drink the water from any tap or hose as the water may not be potable from time to time, and Tenant shall place signs at all faucet locations in Spanish and English explaining the water may not be potable and warning TC's not to drink it. 11. Cattle Lease Tenant acknowledges the pasture lease on the surrounding ranch land, and the fact that the pasture lessee has access to the cattle corrals, working chute, loading chute and scales within the Facility (“Cattle Area"), and that use of the Cattle Area by the pasture lessee may inconvenience or effect the quiet enjoyment of Tenant and TC's from time to time. 12. Hunting Under no circumstances shall Tenant or any TC enter upon the DA or the RA with any firearm, bow, crossbow, trap, or any other device, which could be used for hunting. Hunting is strictly prohibited! In the event Tenant or any TC is found with a firearm, bow, crossbow, trap, or any other device, which could be used for hunting, other than a handgun duly licensed by a government authority, it shall be considered an incurable breach of this lease. Tenant further acknowledges Landlords right to hunt and conduct private hunts from time to time, and that hunting by Landlord or Landlords invitees shall not be construed as a negative impact or an infringement of any kind upon Tenants use and quiet enjoyment of the Facility. Tenant hereby leases the Facility knowing some TC's may be opposed to, and offended by hunting, and that Landlords hunting activities may have a negative effect on Tenants income and use of the Facility from time to time. 13. Maintenance and Repair It is understood and agreed that Landlord is providing the Facility and dwelling unit in good condition, having recently completed extensive remodeling on the dwelling unit, and recently completed extensive repairs and refurbishing on all the barns, roads, staff house, arenas, footing, landscaping, equipment, etc. At all times during the Term, Tenant shall maintain, at Tenants sole cost and expense, the Facility and all equipment and machinery associated or used in conjunction with the Facility, including but not limited to interior and exterior painting, barns, stalls, mats, barn, stall, and walkway footing, arena's and arena footing, roads, landscaping, trees, housing (including all appliances, plumbing fixtures, flooring, roofing, cabinets, finishes, heating, etc.), bathrooms, water system, Water distribution manifold, electrical system, phone lines, generator, fuel and propane tanks, Facility tractor (old gray Ford), drags, harrows, lighting, fencing, gates, pastures, troughs, weed abatement, gopher abatement, bridges, crossings, drainage devices, downspouts, sprinklers, signage, locks, trails, etc. in the same or better condition as received by Tenant as of the execution of this Lease. On or before January 1, 2002 Tenant shall videotape and deliver to Landlord along with a copy of the video tape, a list of all items that are not in proper working order or that are damaged or worn to such a degree that they should be exceptions from Tenants responsibility to return everything in good condition and repair (“Exception List”). Anything not on the Exception List shall be conclusively deemed as Tenants responsibility to maintain and return in good condition. Landlord shall be responsible to maintain the main water system and to insure water up to the water distribution manifold located at the Facility next to the hay bam. Landlord shall not be responsible for any fencing (whether fences are ineffective, damaged by cattle or any other cause), roads, maintenance or repair of any kind, in or around the Facility and DA. Landlord may inspect the Facility, DA, and Dwelling from time to time to insure proper maintenance and repair. If in Landlords opinion any portion of the Facility, associated equipment or the Dwelling are not being properly maintained, Landlord may give written notice to Tenant of the items found to be in need of proper maintenance, repair or replacement. Tenant shall have ten days from the date of the notice to correct the required maintenance, or complete the repairs or replacement If Tenant fails to correct the maintenance, or complete the repairs or replacement within the ten day period, Landlord shall have the right but not the obligation to facilitate the maintenance, repairs, or replacement and bill Tenant for the cost of same, which amount Tenant shall pay within 10 days of receiving the bill from Landlord. Failure to pay Landlord for any maintenance, repairs or replacements within thirty days from the date of the bill shall be a material breach of this lease. 14. Alterations, Additions, and Improvements (a) Tenant shall not make any alterations, additions, or improvements to the Facility without Landlord's prior written consent. Tenant shall promptly remove any alterations, additions or improvements constructed in violation of this paragraph upon Landlord's written request All alterations, additions, and improvements shall be done in a good and workmanlike manner, in conformity with all applicable laws and regulations, and by a contractor approved by Landlord. Upon completion of any such work, Tenant shall provide Landlord with "as built" plans, copies of all construction contracts, and proof of payment for all labor and materials.

- 8. (b) 00037 V-—" 15. Landlord's Access Landlord or its agents may enter the Facility at all reasonable times to shov/ the Facility to any person or party, to do any other act or to inspect and conduct tests in order to monitor Tenant’s compliance with all terms of this Lease, applicable environmental laws, the presence and use of Hazardous Materials, or for any other purpose Landlord deems necessary. Landlord shall not be required to give Tenant prior notice of such entry unless entry to the Dwelling is required, at which time Landlord shall give Tenant 24 hours notice. 17. Indemnity Tenant shall indemnify Landlord and Landlords agents, employees, managers, associates, and affiliates, etc. against and hold Landlord and Landlords agents, employees, managers, associates, and affiliates, etc. harmless from any and al! costs, claims or liability arising from: (a) Tenant’s use of the Facility; (b) the conduct of Tenant’s business or anything else done or permitted by Tenant to be done in or about the Facility, including any contamination of the Facility or any other property resulting from the presence or use of Hazardous Materials caused or permitted by Tenant; (c) any breach or default in the performance of Tenant's obligations under this Lease; (d) any misrepresentation or breach of warranty by Tenant under this Lease; or (e) other acts or omissions of Tenant. Tenant shall defend Landlord against any such cost, claim or liability at Tenant's expense with counsel reasonably acceptable to Landlord or, at Landlord’s election, Tenant shall reimburse Landlord for any legal fees or costs incurred by Landlord in connection with any such claim. As a material part of the consideration to Landlord, Tenant assumes all risk of damage to property or injury to persons in or about the Facility arising from any cause, and Tenant hereby waives all claims in respect thereof against Landlord, except for any claim arising out of Landlord's gross negligence or willful misconduct. Tenant shall be responsible for all safety issues at the facility, and all permits or other requirements from any governmental body or agency. Tenant shall obtain releases from any person engaging in any activity at the facility, whether actually riding a horse or not As used in this Section, the term "Tenant" shall include Tenant’s employees, agents, contractors, sub tenants, boarders, trainers, customers and invitees, if applicable. 18. Insurance Prior to moving any animals or property on to the Facility, Tenant shall provide Landlord with a certificate of workers compensation insurance and general liability and property damage insurance in a form and with coverage terms acceptable to Landlord, with minimum coverage for general liability and property damage, including fire liability, in an amount not less than $2,000,000 per claim, naming Landlord, the Giganin Trust, Joseph J. Praske, Trustee, Pacific Coast Management and Stephen Gaggero as additional insured's. Such insurance must be maintained at all times during the term of this lease. Said certificate shall specify on its face that Landlord shall be notified by certified mail at least 60 days prior to any cancellation. Landlord reserves the right to change the insurance requirements of this Lease from time to time as determined necessary in Landlords sole discretion. In the event Tenants insurance is cancelled, not renewed, or there is a lapse in coverage, for any reason, Landlord may purchase any insurance at Landlords sole discretion, necessary to protect Landlord and the Facility and thereafter bill Tenant for the cost of same, which amount Tenant shall pay within 10 days of receiving (b) Tenant shall pay when due all claims for labor and materials furnished to the Facility. Tenant shall give Landlord at least ten days’ prior written notice of the commencement of any work on the Facility, regardless of whether Landlord's consent to such work is required. Landlord may elect to record and post notices of non responsibility on the Property. 16. Reserved Rights All rights other than those specifically conveyed in this agreement by Landlord to Tenant are reserved to Landlord. Landlord shall not be required to provide or pay any expenses related to the Facility other than property tax and Landlords insurance. Except for the Dwelling, Landlord and Landlord’s invitees shall have the right to use the Facility at any time, for any reason. Provided stalls are available (not rented to paying clients for standard boarding rates), and provided Landlord supplies the feed and shavings for Landlords horses, Landlord may keep up to eight horses at the Facility and Tenant shall feed landlords horses twice a day, and clean the stalls twice a day at no charge to Landlord. If at anytime Landlords horses are preventing a paying client from boarding their horse at the Facility, Landlord must either (a) remove the number of horses necessary to accommodate the paying client, or (b) pay Tenant the amount the paying client would otherwise pay, or (c) immediately construct additional stalls for Landlords horses at the Facility and move Landlords horses before the paying client needs or wants occupancy.

- 9. Signing of Documents. Tenant shall sign and deliver any instrument or documents necessary or appropriate to evidence any such attornment or subordination or agreement to do so. 19. Guarantors All parties signing this Lease as Tenant or as Guarantors shall be jointly and severally liable for all obligations of Tenant. John Redmond and Maureen C. Redmond may be released from being Guarantors at any time during the second three-year option period (years 5 through 7) by depositing with Landlord, an additional Fifty Thousand Dollars as a cash guarantee and security deposit. However, in the event Tenant or any of Tenants members files for, or is placed involuntarily into bankruptcy proceedings, John Redmond and Maureen C. Redmond shall automatically be reinstated as Guarantors and Landlord shall be under no obligation to return any of the security deposit as a result of the reinstatement. Attornment. If Landlord's interest in the Facility is acquired by any ground Landlord, beneficiary under a deed of trust, mortgagee, or purchaser at a foreclosure sale, then at such person's or entity's election, Tenant shall attorn to the transferee of or successor to Landlord's interest in the Facility and recognize such transferee or successor as Landlord under this Lease. Tenant waives the protection of any statute or rule of law, which gives or purports to give Tenant any right to terminate this Lease or surrender possession of the Facility upon the transfer of Landlord's interest. 20. Protection of Lenders Subordination. This Lease shall be subordinate to any existing ground lease, deed of trust or mortgage, and Landlord shall have the right to subordinate this Lease to any ground lease, deed of trust or mortgage hereafter encumbering the Facility, any advances made on the security thereof and any renewals, modifications, consolidations, replacements or extensions thereof, whenever made or recorded. Tenant shall cooperate with Landlord and any lender, which is acquiring a security interest in the Facility or this Lease. Tenant shall execute such further documents and assurances as such lender may require, provided that Tenant’s obligations under this Lease shall not be increased in any material way (the performance of ministerial acts shall not be deemed material), and Tenant shall not be deprived of its rights under this Lease. Tenant's right to quiet possession of the Facility during the Lease Term shall not be disturbed by any future beneficiary under a deed of trust or mortgagee under a mortgage if Tenant pays the rent and performs all of Tenant's obligations under this Lease and is not otherwise in default. If any ground Landlord, beneficiary or mortgagee elects to have this Lease prior to the lien of its ground lease, deed of trust or mortgage and gives written notice thereof to Tenant, this Lease shall be deerhed prior to such ground lease, deed of trust or mortgage whether this Lease is dated prior or subsequent to the date of said ground lease, deed of trust or mortgage or the date of recording thereof. the bill from Landlord. Failure to pay Landlord for any insurance advance within thirty days from the date of the bill from Landlord, shall be an incurable breach of this lease. Estoppel Certificates. (a) Upon Landlord’s written request, Tenant shall execute, acknowledge and deliver to Landlord a written statement certifying: (i) that none of the terms or provisions of this Lease have been changed (or if they have been changed, stating how they have been changed); (ii) that this Lease has not been cancelled or terminated; (iii) the last date of payment of the Minimum Rent and other charges and the time period covered by such payment; (iv) that Landlord is not in default under this Lease (or, if Landlord is claimed to be in default, stating why); and (v) such other representations or information with respect to Tenant or this Lease as Landlord may reasonably request or which any prospective purchaser or encumbrancer of the Facility may require. Tenant shall deliver such statement to Landlord within ten (10) days after Landlord's request. Landlord may give any such statement by Tenant to any prospective purchaser or encumbrancer of the Property. Such purchaser or encumbrancer may rely conclusively upon such statement as true and correcL (b) If Tenant does not deliver such statement to Landlord within such ten (10) day period, Landlord, and any prospective purchaser or encumbrancer, may conclusively presume and rely upon the following facts: (i) that the terms and provisions of this Lease have not been changed except as otherwise represented by Landlord; (ii) that this Lease has not been cancelled or terminated except as otherwise represented by Landlord; (iii) that not more than one month's Minimum Rent or other charges have been paid in advance; and (iv) that Landlord is not in default under this Lease. In such event, Tenant shall be estopped from denying the truth of such facts.

- 10. Damage or Destruction 21. If the damage to the Facility occurs during the last three (3) months of this Term and such Tenant. (c) If the damage to the Facility occurs during the last three (3) months of this Term and such damage will require more than thirty (30) days to repair, either Landlord or Tenant may elect to terminate this Lease as of the date the damage occurred, regardless of the sufficiency of any insurance proceeds. The party electing to terminate this Lease shall give written notification to the other party of such election within thirty (30) days after Tenanfs notice to Landlord of the occurrence of the damage. Substantial or Total Destruction. If the Facility is substantially or totally destroyed by any cause whatsoever (i.e., the damage to the Facility is greater than partial damage), and regardless of whether Landlord receives any insurance proceeds, this Lease shall terminate as of the date the destruction occurred. Notwithstanding the preceding sentence, if the Facility can be rebuilt within nine (9) months after the date of destruction, Landlord may elect to rebuild the Facility at Landlord's own expense, in which case this Lease shall remain in full force and effect Landlord shall notify Tenant of such election within thirty (30) days after Tenant's notice of the occurrence of total or substantial destruction. If Landlord so elects, Landlord shall rebuild the Facility at Landlord's sole expense, except that if the destruction was caused by an act or omission of Tenant, Tenant shall pay Landlord the difference between the actual cost of rebuilding and any insurance proceeds received by Landlord, including the "deductible" amount (if any) under Landlord's insurance policies. Tenant shall not be obligated to pay rent until the Facility is rebuilt, unless Tenant uses a portion of the Facility, or pasture area, or uses portions of the Facility as they are rebuilt, at which time Landlord and Tenant shall agree on a rental amount proportionate to the portions of the Facility and or pasture area being used. 23. Notices Any notices to be given hereunder by either party to the other may be effected either by personal delivery in writing or by mail, registered or certified, postage prepaid with return receipt requested. Mailed notices shall be addressed to the parties at the address provided at the end of this agreement, but each party may change his 22. Relationship It is agreed and understood that Tenant is not an agent or employee of Landlord, and that this agreement does not establish a partnership or joint venture between Landlord and 000373 Partial Damage to Facility (a) Tenant shall notify Landlord in writing immediately upon the occurrence of any damage to the Facility. If the Facility is only partially damaged (i.e., less than fifty percent (50%) of the Facility is untenantable as a result of such damage or less than fifty percent (50%) of Tenant's operations are materially impaired) and if the proceeds received by Landlord from the insurance policies are sufficient to pay for the necessary repairs, this Lease shall remain in effect and Landlord shall repair the damage as soon as reasonably possible. Landlord may elect (but is not required) to repair any damage to Tenant’s fixtures, equipment, or improvements (unless Landlord obtained insurance for such improvements and sufficient proceeds are available therefrom for such repair), and Tenant shall pay Landlord the "deductible" amount under Landlord's insurance policies. (b) If the insurance proceeds received by Landlord are not sufficient to pay the entire cost of repair, or if the cause of the damage is not covered by the insurance policies which Landlord maintains, Landlord may elect either to (i) repair the damage as soon as reasonably possible, in which case this Lease shall remain in full force and effect, or (ii) terminate this Lease as of the date the damage occurred. Landlord shall notify Tenant within thirty (30) days after receipt of notice of the occurrence of the damage whether Landlord elects to repair the damage or terminate this Lease. If Landlord elects to repair the damage, Tenant shall pay Landlord the "deductible amount" (if any) under Landlord's insurance policies and, if the damage was due to an act or omission of Tenant, or Tenant's employees, agents, contractors, clients, or invitees, the difference between the actual cost of repair and any insurance proceeds received by Landlord. If Landlord elects to terminate this Lease, Tenant may elect to continue this Lease in full force and effect, in which case Tenant shall repair any damage to the Facility. Tenant shall pay the cost of such repairs, except that, subject to the terms of any deed of trust encumbering the Facility, upon satisfactory completion of such repairs, Landlord shall deliver to Tenant any insurance proceeds received by Landlord for the damage repaired by Tenant. Tenant shall give Landlord written notice of such election within ten (10) days after receiving Landlord's termination notice. (c) Upon Tenant's request, Landlord shall execute, acknowledge and deliver to Tenant a written statement as to such matters relating to this Lease as are reasonably requested by Tenant and acceptable to Landlord.

- 11. 24. Tenant shall be in material default under this Lease: If Tenant abandons the Facility and fails to pay rent or any other charge when due or if Tenant's If Tenant fails to pay rent or any other charge when due. (b) (d) 0303 (c) I of ten (10) days after written notice from Landlord; provided that if more than ten (10) days are required (a) I vacation of the Facility results in the cancellation of any insurance. If Tenant fails to perform any of Tenant's non-monetary obligations under this Lease for a period »— .—-----------s-i-j ---------------------------------------------------- -------------------------------:—j t0 complete such performance, Tenant shall not be in default if Tenant commences such performance within the ten (10) day period and thereafter diligently pursues its completion. However, Landlord shall not be required to give such notice if Tenant's failure to perform constitutes a non-curable breach of this Lease. The notice required by this Paragraph is intended to satisfy any and all notice requirements imposed by law on Landlord and is not in addition to any such requirement. Defaults, Breach of Contract Tenant's performance of each of Tenant’s obligations under this Lease is a condition as well as a covenant. Tenant's right to continue in possession of the Property is conditioned upon such performance. Time is of the essence in the performance of all covenants and conditions. (i) If Tenant makes a general assignment or general arrangement for the benefit of creditors; (ii) if a petition for adjudication of bankruptcy or for reorganization or rearrangement is filed by or against Tenant and is not dismissed within thirty (30) days; (iii) if a trustee or receiver is appointed to take possession of substantially all of Tenant's assets located at the Facility or of Tenant’s interest in this Lease and possession is not restored to Tenant within thirty (30) days; or (iv) if substantially all of Tenant's assets located at the Facility or of Tenant’s interest in this Lease is subjected to attachment, execution or other judicial seizure which is not discharged within thirty (30) days. If a court of competent jurisdiction determines that any of the acts described in this subparagraph (d) is not a default under this Lease, and a trustee is appointed to take possession (or if Tenant remains a debtor in possession) and such trustee or Tenant transfers Tenant's interest hereunder, then Landlord shall receive, as Minimum Rent, the excess, if any, of the rent (or any other consideration) paid in connection with such assignment or sublease over the rent payable by Tenant under this Lease. (e) If any guarantor of this Lease revokes or otherwise terminates, or purports to revoke or otherwise terminate, any guarantee of all or any portion of Tenant’s obligations under this Lease. Unless otherwise expressly provided, no guaranty of this Lease is revocable. address by written notice in accordance with this paragraph. Notices delivered personally shall be deemed communicated as of the date of actual receipt; mailed notices shall be deemed communicated as of five (5) days after mailing. 25. Remedies On the occurrence of any material default by Tenant, Landlord may, at any time thereafter, with or without notice or demand and without limiting Landlord in the exercise of any right or remedy which Landlord may have; (a) Terminate Tenant's right to possession of the Property by any lawful means, in which case this Lease shall terminate and Tenant,shall immediately surrender possession of the Facility to Landlord. In such event, Landlord shall be entitled to recover from Tenant all damages incurred by Landlord by reason of Tenant's default, including (i) the worth at the time of the award of the unpaid Minimum Rent, and other charges which Landlord had earned at the time of the termination, (ii) the worth at the time of the award of the amount by which the unpaid Minimum Rent and other charges which Landlord would have earned after termination until the time of the award exceeds the amount of such rental loss that Tenant proves Landlord could have reasonably avoided; (iii) the worth at the time of the award of the amount by which the unpaid Minimum Rent and other charges which Tenant would have paid for the balance of the Lease Term after the time of award exceeds the amount of such rental loss that Tenant proves Landlord could have reasonably avoided; and (iv) any other amount necessary to compensate Landlord for all the detriment proximately caused by Tenant's failure to perform its obligations under this Lease or which in the ordinary course of things would be likely to result therefrom, including, but not limited to, any costs or expenses Landlord incurs in maintaining or preserving the Facility after such default, the cost of recovering possession of the Facility, expenses of reletting, including necessary renovation or alteration of the Facility. Landlord's reasonable attorneys' fees incurred in connection therewith, and any real estate commission paid or payable. As used in subparts (i) and (ii) above, the "worth at the time of the award" is computed by

- 12. (b) Pursue any other remedy now or hereafter available to Landlord under the laws or judicial Waivers. 33. In the event Tenant violates any of the terms of this agreement which constitute an incurable breach, Tenant and TC's shall immediately vacate the Facility, the lease shall terminate, and Landlord shall have no obligation to refund any amounts paid byTenant. 030375 (c) f decisions of the state in which the Facility is located. 27. Waiver The waiver by either party of a breach or violation of any provisions of this agreement shall not operate as or be construed as a waiver of any subsequent breach hereof. 28.' Venue This agreement shall be interpreted, construed, and governed according to the laws of the State of California, County of Ventura. 29. Assignment This agreement shall inure to the benefit of and bind the successors, assigns, heirs, executors, and administrators of the parties. However, this lease is not assignable, and no subleasing other than month to month stabling and pasturing of horses shall be permitted without Landlords prior written approval, which Landlord may withhold at Landlords sole discretion. 30. Severability A determination by a court of competent jurisdiction that any provision of this Lease or any part thereof is illegal or unenforceable shall not cancel or invalidate the remainder of such provision or this Lease, which shall remain in full force and effect. 32. Incorporation of Prior Agreements; Modifications. This Lease is the only agreement between the parties pertaining to the lease of the Facility and no other agreements are effective. All amendments to this Lease shall be in writing and signed by all parties. Any other attempted amendment shall be void. (b) Maintain Tenant's right to possession, in which case this Lease shall continue in effect whether or not Tenant has abandoned the Facility. In such event, Landlord shall be entitled to enforce all Landlord's rights and remedies under this Lease, including the right to recover the rent as it becomes due; 26. Attorneys Fees If any legal action or other proceeding is brought for the enforcement of this agreement, or for the interpretation of same, or because of an alleged dispute, breach, default or misrepresentation in connection with any of its provisions, the successful or prevailing party shall be entitled to recover all attorneys fees and all costs, whether legally recoverable under the Code of Civil Procedure or not, incurred in that action, enforcement or proceeding, in addition to any other relief to which it may be entitled. allowing interest on unpaid amounts at the rate of fifteen percent (15%) per annum, or such lesser amount as may then be the maximum lawful rate. As used in subpart (iii) above, the "worth at the time of the award" is computed by discounting such amount at the discount rate of the Federal Reserve Bank of San Francisco at the time of the award, plus one percent (1%). If Tenant has abandoned the Facility, Landlord shall have the option of (i) retaking possession of the Facility and recovering from Tenant the amount specified in this Paragraph, or (ii) proceeding under Paragraph (b); 31. Interpretation The captions of the Articles or Sections of this Lease are to assist the parties in reading this Lease and are not a part of the terms or provisions of this Lease. Whenever required by the context of this Lease, the singular shall include the plural and the plural shall include the singular. The masculine, feminine and neuter genders shall each include the other. In any provision relating to the conduct, acts or omissions of Tenant, the term "Tenant" shall include Tenant's managers, agents, employees, contractors, invitees, clients, successors or others using the Facility with Tenant's expressed or implied permission.

- 13. Executed on the date first above written. Somerset, LLC Address: Guarantor Address: John A. RedA^id Guarantor Address: Maureen C. Redmond Guarantor Address: By:____ ._________ Geraldine Redmond, Manager PO Box 25070 Ventura,CA.93002 12808 Greene Ave. LA, CA. 90066 12808 Greene Ave. LA, CA. 90066 12808 Greene Ave. LA, CA. 90066 12808 Greene Ave. LA, CA. 90066 ________________ La. Gerafdine Redmond Sulphur Mountain Land and Livestock Co., LLC Address: Pacific Coast Management, Manager, By Mark Maravelas, CFO 34. Confidentiality. Tenant agrees that except as required by law, it shall keep confidential, and shall not disclose to any third party, the terms, provisions and contents of this Lease, or any information relating to this Lease. All waivers must be in writing and signed by the waiving party. Landlord's failure to enforce any provision of this Lease or its acceptance of rent shall not be a waiver and shall not prevent Landlord from enforcing that provision or any other provision of this Lease in the future. No statement on a payment check from Tenant or in a letter accompanying a payment check shall be binding on Landlord. Landlord may, with or without notice to Tenant, negotiate such check without being bound to the conditions of such statement. 00037 35. Fax Signatures This agreement may be signed in counterpart and signatures shall be faxed to the other party. A document containing all signatures, whether original or faxed signatures, shall constitute an original agreement

- 14. Exhibit A Monthly Minimum Rent Schedule $8,000 January 1,2002 ■ $5,500 February 1, 2002 $6,000 March 1, 2002 $6,000 April 1, 2002 $6,500 May 1, 2002 $6,500 June 1,2002 $7,000 July 1,2002 $7,000 August 1, 2002 September 1, 2002 $7,500 October 1, 2002 $7,500 $8,000 November 1, 2002 $8,000 December 1, 2002 i 000377

- 15. Security Deposit Payment Schedule Tenant shall pay the $16,000.00 security deposit to Landlord, in installments, on or before the following dates: On or before November 23, 2001 the sum of $ 8,000.00 On or before January 1,2002 the sum of $ 3,000.00 On or before February 1, 2002 the sum of $ 5,000.00 Dl Date. Tenant. c mW 030378

- 17. Vi & -G* 000477 ! 0 co 0 0 O i! gj g co 0 p g> a co CD hJ ro GJ co a> 3 ‘s GJ g g CD k> o GJ CD g kj ?O s o i 8 _CD g CO QJ CO CD ro CD co _ro CD CD co CD g 3 g S' o_ ZJ O CD i 3 a 3 o Q_J CT £ 5; . 05 if o GJ co 2 W r 5 o w 4x 1GJ O 2” ro CD £ I g p co « ' o re CO £ GJ io CD £ 2 0 4A N s ■w CD K co w ”kj CD CO o CO 2 0 • «» 0 O g 0 G> s 0 G» CD !° CD I i s s I I ca <A FO hJ GJ CO CD O p OJ s 4^. CO I 6 Kj (D 5 o w ro DJ CD g ■G9 a p o I !••• 0 GJ . 03 CO rj I II CQ o I G*> CD GJ CD CD W □1 IXJ Kj co ) ZJ o I R g E1 o 3g 3 to ffl -*■ Oi 0 GJ ID CD 0 r* •& o o o -* /•» dj ro CD *» GJ s GJ *J *4 CO CO CO 0 P P £» O 0 -* I.. HO HI o g i -o -o 2 2 g g ii 3 2 s § □ x- I P - o S LI § s w a> 0 , o -V» 4^ «» O G. GJ GJ — j* G> eo oi -x M 0 0O&0 p A p M 0 o o CO kl M O O 0 GJ 0 W CD ro —■ M CO 0 •£>. •>! ;-*■ e p DJ p CD O CD GJ 4x O 0 CO 2 - S ass g

- 18. Rent & RGA $ 24,896.41 Sub-Total RGA 15,500.00 S Sub-Total minimum rent Other Lease Charges $ 7,833.12 S 48,229.53 000002 3/14/2003 Page 1 of 1 Summary Rent RGA Somerset costs 030314.xls SOMERSET FARMS RENT . RGA a OTHER LEASE CHARGES As of Maron 14. 2003 Balance of June RGA______________ July RGA____________________ August RGA ___________________ September RGA__________________ October RGA____________________ Novemoer RGA__________________ Nov Credit for 50% of Amt over S100K December RGA October minimum rent Novemoer minimm rent Propane Refrigerator Replacement______ Equestrian Center Diesel <300 gal e 1.26/gai) Shavings (200 bales @37/ bale)_______ 5%’Late Fee on October Minimum Rent 5% Late Fee on November Minimum Rent Balance due on 5/8-8/15 electrical______ 8/15-10/31 electncal__________________ Accounting Fees (61.75 hrs @ $50/hr) Sub-Total Other Lease Charges 7,500.00 8,000.00 2,068.80 378.00 1,400,00 375.00 400,00 58.36 65.46 3,087.50 2,763.11 4,323,40 4,798.80 5,341,50 5.341.50 2,967.50 (3,606.90) 2,967.50

- 19. RGA Paid RGA Due (651.50) (9,145.50) 34,041.91 Total S100,000 Threshold Calculation S 86,372.31 '•00003 3/14/2003 Page 1 of 1 60,000.00 26,372.31 7,500.00 5,341.50 8,000.00 (3,606.90) 2,967.50 2,967.50 93,872.31 99,213.81 107,213.81 Oct Minimum Rent Oct RGA (90%) Nov Minimum Rent Nov - Credit for 50% over $100k Nov RGA (50% of RGA) Dec RGA (50% of RGA) RGA Summary Somerset costs 030314.xls Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Nov Dec Balance RGA Due Somerset Farms Summary or RGA Balance & When S100k Threshold Reached 651.50 252.00 288.00 2,590.56 2,714.40 5,412.15 4,323.40 4,798.80 5,341.50 5,341.50 (3,606.90) 2,967.50 2,967.50 (2,655.00) (2,535.00) (2,548.00) 7,846.11 9,634.51 11,885.31 17,226.81 22,568.31 18,961.41 21,928.91 24,896.41 RGA Credit 52,075 plus Somerset check $580.00 Minimum rent paid Jan 02 - Sep 02 RGA Due Jan 02 - Sep 02________ Sub-Total Jan 02-Sep 02 651.50 252.00 540.00 (252.00) 2,878.56 (504.00)

- 20. Sales Receipt Dais Sale No. 2/4/2003 429 Sold To I Rap Ship Dale Ship Via FOB Payment Method Check No. PR 2/4/2003 VISA Description Qty Amount Item * 1 Thank you (oryour buaueu. Subtotal SI,920.00 Sales Tax (7.75%) S148.80 Total Si068.80 Phone # Fax# E-mail Web Site 1-858-587-9766 1-858-587-9865 info@cxplorcappliance3.com www.crploraappliances.com i ;0'0CO 4 !wvca:oi CO/ZL/Z Soooooocooo <- E «OWd CWXDEFERR.J ___________ L 1I 1 I.840.00T 80.00T . Explorer Appliance Corp. 7010 Carroll Road San Diego, CA 92121 Pacific Coast managmeat 3501 Canada Larga Rd Ventura, CA 93001 Tel* 805-643-6093 GRQ15 Gas double door refrigerator Shipping, delivery, packaging, warehousing A insurance charges. ORQ15 Shipping 1 Ship To Pacific Coan managment Bob Haber 3501 Canada Larga Rd Ventura, CA93001 Tel* 805-643-6093

- 21. 9-52 AM Memo Amount Num Date =3.~ 123.32 123.82 TOTAL 000005 Somerset1 Somerset * 'f Cree • to Jay Redmond acct )2 to Jay Redmono acct eiec 2/23-3/26 3/27-5/7 elec billing Apply Credit balance from R. Haber account Jay p/3-6/10 genset billing Rch Haber apt. 5/8-6/10 billing mv 12074 Reis Hater apt. 6/11 -8/15 billing mv 12101 SMLLC Jay genset fuel 8-16-10/1 Jays 10/2-10/30 Genset Fuel Billing Type SMLLC.LLC Jay Redmond 2.29/2002 HL us • 0/1/2002 : C/31/2002 Tc;a -a. Reamend Pacific Coast Management, inc. Open Invoices A:! Transactions •711 a.ZZ 123.52 12037 12053 12077 12075 7433249699 12094 7433914011 12101 12103 12105 12115

- 22. I 2 fl NJ — (£> a -M O' u - co co —a co ct ct gj nj o —■ CT O> gj nj —* co ct "m co cj o. co co -~i co ct ct gj nj o — a —* —* — N NJ NJ CT GJ N O CJ O J NJ CO U A CJ Q N a O CT ■1 000006 I I i — GJ QI W W N N) - CO CT GJ NJ NJ -4 a <O co co -o> a co nj a O GJ NJ — CO -N. -4 CT NJ CT NJ CO CO A. J 1 I s I I §SgggS§| I d% si 223*8“ O O O-kOOOO CT CT CTOCJ^CT’-Ck GJ NJ A. -4 GJ A. — CO r r II s1 91 =' S CO co hf SSsSMij g g||s| gggggg* □ 1 g i 0 fl h 8 f . I “ IO I i ’I § s - § § S § 2 SSggggSs, g 5 s ~ s ~ ■ft P o’ * « <-> >> 5§*s=±sa — O CO — CT ‘-4 CTO CT CT CT O- 4K CJ W NJ - S S £ 2 =• NJ NJ — A O O Cl Cl o CT CT ** NJ O O CD ’ 1 itiit 1 in •it 2 > 1 I T 8 “■ > ?» hi ut — Mi O O OOO.OOOo-o ® GJ GJ CTCDCTCOCTA.5® ® CO -a. CD — 4k — OCT"' .......J a " 4k — — <D0® CT ^4 A.CT — NJGJCnOC^ NJ NJ ' — ACJOCOCT — *"* Pe7»/c c?(- J XH/ 3 Ci -a. cn

- 23. October 11, 2002 via hand delivery Re: Somerset Farms Maintenance Dear Somerset Farms LLC, Vej David Blake Cl itfie/d 000577 Geraldine Redmond Somerset Farms LLC Attached you will find our client’s list of Maintenance and Repairs which need to be done pursuant to your lease with Sulphur Mountain Land and Livestock Co., LLC dated November 23, 2001. Pursuant to paragraph 13 of the aforesaid lease, you have ten days to correct the required maintenance, or complete the repair of replacement Should you fail to correct the maintenance, or complete the repairs or replacement within the ten day period, our client will Gause said maintenance, repairs or replacement to be done and bill the costs of said maintenance, repairs or replacement to you. dbc/kt encl. davio Blake Chatfield EMAIL! DAVIOaLAKEC@YAHOO.COM ily-yours, LAW OFFICES C .vid Blake Chatfield A2.5 ZENO WAY OAK PARK, CALIFORNIA 9 1377 (8 1 3) B79- 1239 FAX (8 13) 879-9 1 3 3

- 24. Vei ily yours David Blake Chatfieh DBC/kt 000576 The rent that is payable by defendants under the lease, as specified in the lease and Exhibit “A”, is the “Minimum Rent" per month as listed in “exhibit “A*, plus ninety percent of any and all net revenue received from RGA7 Paragraph 5 of the Lease also provides that if the total of the Minimum Rent and the RGA exceeds $100,000 at any time during the TMP (twelve month period), the amount in excess of $100,000 shall be divided 50 percent to Landlord and 50 percent to TenanL “Thereafter, Tenant shall retain 50 percent of the RGA and pay landlord fifty percent of the RGA, monthly, in lieu of the minimum rent and ninety percent of the RGA, until the end of the TMP.” In addition, the second paragraph of Paragraph 5 specifies other terms relating to division of other income and calculation of RGA which was to be paid monthly to plaintiff. Your clients had requested improvements to the property and there is still a balance due which our client is seeking from your clients in the amount of $15,326.82. In addition, your clients ceased the maintenance and repair of the premises in September of 2002 and our client is hereby requesting payment for required maintenance and repair in the amount of $29,893.43 to be made pursuant to the terms of the lease. In addition, your clients’ actions caused our client to incur additional damages, including trip cancellation costs, which our client will pursue from your clients at trial. Our client’s calculation of the rent and RGA is based upon the accounting provided to plaintiff by defendants during discovery. This accounting differed from the figures provided by the defendants prior to the litigation. Your clients had the right to, and did in fact, sublease the premises. In fact, the sublease continued until the conclusion of your clients’ lease term. Our client did not terminate your clients’ right to possession and is, pursuant to Civil Code Section 1951.4, permitted to enforce all of its rights and remedies under the lease, including the right to recover the rent as it becomes due under the lease. As the calculations reveal, your clients met the $100,000 threshold in November of 2002. Therefore, their scherjijed Minimum Rent for November 2002 was credited for that portion over $100,000 and the RGA was calculated at the 50-50 split provided for in the lease. Because the rert and RGA exceeded $100,000 in November 2002, the Minimum Rent was not due in Deosmber, only a 50-50 split of the RGA. The total of rent, RGA and other lease charges owed by your clients is $48,229.53. It is clear to us that your clients will not be the prevailing parties in this litigation. Continuing to advise the pursuit of this litigation is not in the best interests of your clients and we again urge you to speak with them about bringing this matter to a conclusion now, prior to a further escalation of attorneys fees in the next round of discovery, motions and trial preparation.

- 25. ! Jays Ofice ■ Trailer J I Amount 100.00 58.50 58.75 S 822.50 1 1 1 45.00 45.00 S 1,800.00 7.oo; S 9,882.13 Total 45.00 262.25 000494 176.25 ; 7.00 ■ 27.00 ; I 7.00; . I I 7.00; . I I 27.00 ; . I Equestrian Center Tack Room Wash Rack Total Hours Hourly Rate SOMERSET FARMS Improvement Labor Summary Dan Armstrong Vicente Mejia Luis Rojas Harvey Hooten $ 60.75 $ 20.25 $ 14.00 $ 40.00 S 6,075.00 5 1,184.63 I 59.00 ; 58.50 ! 58.75 | • Dressage , Ring

- 26. Dan Armstrong Hours Description Date 7.00 7.00 Sub-Total Sub-Total 7.00 27.00 Sub-Total Sub-Total 59.00 100.00 Total Hours 000495 Install tack room walls/door Build racks Build racks Build racks & install Layout wash rack Set poles for wash rack Set up wash rack forms Pour concrete Demo old wash rack & re-grade Set up wash rack forms Pour & finish wash rack cement Remove debris from wash rack area 04/16/02 05/08/02 10.00 10.00 5.00 2.00 1.00 10.00 10.00 10.00 10.00 5.00 8.00 5.00 2.00 5.00 SOMERSET FARMS Improvements Equestrian Center 5/29/2002 Cut pipe from fence around covered arena and clean up Wash Rack 04/24/02 04/25/02 04/29/02 05/01/02 05/02/02 05/03/02 05/06/02 05/08/02 Tack Room 04/24/02 04/30/02 05/03/02 05/09/02 Javs Office Trailer Clean Jay’s office trailer Prepare trailer for moving. Fix flat tire. Move & set up

- 27. Vicente Mejia Hours Description Date Total Hours 000496 04/30/02 05/01/02 05/02/02 SOMERSET FARMS Improvements 3.50 10.00 10.00 10.00 10.00 10.00 5.00 58.50 Wash Rack 04/25/02 Set poles for wash rack 04/26/03 Set poles for wash rack 04/29/02 Set up wash rack forms Set up wash rack forms Pour concrete Demo old wash rack & re-grade 05/03/02 Set up wash rack forms

- 28. Luis Rojas Hours Date Description Total Hours 000497 05/01/02 05/02/02 05/03/02 SOMERSET FARMS Improvements 3.75 10.00 10.00 10.00 10.00 10.00 5.00 58.75 Wash Rack 04/25/02 Set poles for wash rack 04/26/03 Set poles for wash rack 04/29/02 Set up wash rack forms 04/30/02 Set up wash rack forms Pour concrete Demo old wash rack & re-grade Set up wash rack forms

- 29. Harvey Hooten Date Description Hours Dressage Ring Total Hours 45.00 000498 08/19/02 08/20/02 08/21/02 08/22/02 08/23/02 Work w/Avalon Engineering grading area Work w/Avalon Engineering grading area Set poles,-help with grading Relocate water line Finish with grading, move poles, clean up 9.00 9.00 10.00 8.00 9.00 SOMERSET FARMS Improvements

- 30. ' / Total May Boarding costs S 4,130.00 Somerset 50% $ 2,065.00 SMLLC 50% $ 2,065.00 Steve, Is this information correct? Mark I Summary of Cost to be split by Somerset and SMLLC Boarding costs of L. Canty for the month of May are split 50/50 May 2002 Split Cost Somerset Annual Gross Profit.xls 4/23/02 Hay purchased for feeding in first 2 weeks of May 5/15/02 Hay purchased for feeding in last 2 weeks of May 5/15/02 Manuel Abesha - 2 weeks boarding labor 5/31/02 Manuel Abesha - 2 weeks boarding labor Jay said you had agreed to pay 50% of the boarding cost on Laurie Canty's horsed for the month of May. This was due to construction not being complete. 1,355.00 1,375.00 700.00 700.00 Based on the numbers Jay gave me, Somerset would get a credit of $2,065.00. Z^ ill I tit 6/11/02 000532

- 31. Rent & RGA 24,896.41 S Sub-Total RGA S 15,500.00 Sub-Total minimum rent Other Lease Charges S 7,833.12 $ 48,229.53 000002 3/14/2003 Page 1 of 1 Summary Rent RGA Somerset costs 030314.xls SOMERSET FARMS RENT / RGA & OTHER LEASE CHARGES As of March 14, 2003 Balance of June RGA______________ July RGA___________________ August RGA________________ September RGA__________________ October RGA____________________ November RGA _____________ Nov Credit for 50% of Amt over S100K December RGA October minimum rent November minimm rent Propane Refrigerator Replacement______ Equestrian Center Diesel (3oo gal @ 1.26/gai) Shavings (200 bales @ $7 / bale) 5%'Late Fee on October Minimum Rent 5% Late Fee on November Minimum Rent Balance due on 5/8-8/15 electrical_______ 8/16-10/31 electrical__________________ Accounting Fees (61.75 hrs @ S50/hr) Sub-Total Other Lease Charges 2,763.11 4,323.40 4,798,80 5,341,50 5,341,50 2,967.50 (3,606.90) 2,967,50 7,500.00 8,000.00 2,068.80 378.00 1,400,00 375.00 400.00 58.36 65.46 3,087.50

- 32. RGA Paid RGA Due (651.50) Total (9,145.50) 34,041.91 S100,000 Threshold Calculation $ 86,372.31 000003 Page 1 of 1 3/14/2003 7,500.00 5,341.50 8,000.00 60,000.00 26,372.31 Balance RGA Due Oct Minimum Rent Oct RGA (90%) Nov Minimum Rent Nov - Credit for 50% over $100k Nov RGA (50% of RGA) Dec RGA (50% of RGA) RGA Summary Somerset costs 030314.xls Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Nov Dec Somerset Farms Summary of RGA Balance & When S100k Threshold Reached 651.50 252.00 288.00 2,590.56 2,714.40 5,412.15 4,323.40 4,798.80 5,341.50 5,341.50 (3,606.90) 2,967.50 2,967.50 (252.00) (504.00) (2,655.00) (2,535.00) (2,548.00) 651.50 252.00 540.00 2,878.56 ^5,088t96- 7,846.11 9,634.51 11,885.31 17,226.81 22,568.31 18,961.41 21,928.91 24,896.41 RGA Credit $2,075 plus Somerset check $580.00 Minimum rent paid Jan 02 - Sep 02 RGA Due Jan 02 - Sep 02 Sub-Total Jan 02-Sep 02 93,872.31 99,213.81 107,213.81 (3,606.90) 5 ; 2,967.50 2,967.50

- 33. ent By: ; Sales Receipt Sale No. Date 2/4/2003 429 Ship To Sold To FOB Rep Ship Via Ship Date Payment Method Check No. PR 2/4/2003 VISA Amount Qty Description Item 1 Thank you foryour businesi Subtotal $1,920.00 Sale* Tax (7.75%) $148.80 Total $2,068.80 Phone# Fax# Web Site E-mail 1-858-587-9766 1-858-587-9865 www.cxploroippliuces.com info@txplorvappliance3.com ‘'>0'0'004 iHVES'-OI- EO/ZL/2 :peat aoe y Joooooooooo -c- Z »Oud CWXDEFERR... _ ____________ L GRQ15 Gas double door refrigerator Shipping, delivery, packaging, warehousing &. insurance charges. l,840.00T 80.00T Explorer Appliance Corp. 7010 Carroll Road San Diego, CA 92121 Pacific Com rauiagmcat 3501 Canada Large Rd Ventura, CA 93001 TeW 805-643-6093 Pacific Com managment Bob Haber 3501 Canada Larga Rd Ventura, CA93001 TeW 805-643-6093 ORQI5 Shipping I J.

- 34. 9:52 AM Y ’5-33 Amount Memo Type Num Date 123.32 Totai SMLLC.LLC 123.82 TOTAL 000005 Pacific Coast Management, Inc. Open Invoices All Transactions SMLLC.LLC Jay Redmond 3/29/2002 5.9/2002 5-8/2002 6/10/2002 7,10/2Q02 3/15/2002 9.6/2002 9/6/2002 9/6/2002 10/1/2002 10/31/2002 Tcta' Jay Redmond P 12037 12053 12077 12075 7433249699 12094 7433914011 12101 12103 12105 12115 (2ccco: IH! 13.20 123.32 Somerset elec 2/23-3/26 Somerset 3/27-5/7 elec billing Apply Credit balance from R. Haber account Jay 3/3-6/10 genset billing partial elec pyt Jay’s genset 6/11 -8/15 Rcls Haber apt. 5/8-6/10 billing inv 12074 to Jay Redmond acct Reis Haber apt. 6/11 -8/15 billing inv 12102 to Jay Redmond acct SMLLC Jay genset fuel 8-16-10/1 Jays 10/2-10/30 Genset Fuel Billing nvp.ce C-ed’t Meme r-.-z.ze “a/mer.i invcce invoice invC'Ce irvo.ee

- 35. o cn ct xx gj w nj M -* gd nj ct -tx co xx. = 6 sSeSeS • ssSsaSs -* -* a Ln io -* ct ? o 1 nj -* co m s ci u -* co cn n to o o w w O —* CD Xk —X —x Xx CT —-“X —* gj nj —x cd co -4 cn gj Xx CD Cl N CO D Q CJ NJ O —‘ O tx ~k GA GA GA tn tn tn tn fn NJ NJ Xx (2 O Cl Cl O CT CO Xx nj O o co 000006 I J I i 8 r ?= £ a I I m Q. II I I I8 NJ & □C^eSSKg NJ IO GJ Xx GJ O ~4 CD v» ga <z> tn ga «a tn e» I1 s? "I g f Gi O CO GJ CT CT Cl Xx CT CT O CT O Xx CD GJ GJ CT Xx. _x NJ NJ o CT <n tn tn tn tn tn tn tn p p pppooo GJ GJ CT CD CT U1 CT XX. GD Xx. Cl -• 4x -• O Cl -.'I I 2 % 8 f I iO I I ! CT CT CT .Xx. GJ GJ NJ 01 03 ° 338=8X53 -» -» o co -- ci o O § I J f-2 !i 11 o o i § I i 5". CD Q (D j — nj | Xx. CT GJ GJ GJ Xx. xx D GJ I Xx. GJ O CO CT O CT [ CT CT CT O NJ GJ CT — O| kj co CT CO CT tn tn tn tn tn tn tn tn p p o -* o p o o CT CT CT O CT kj CT Xx. GJ NJ Xx. —4 GJ Xx, -xx (0 tn tn tn tn tn tn tn tn -X GJ CT GJ GJ NJ NJ -» CD CT GJ NJ NJ ~U CO CO CT CT Xx. CT Xx. CT NJ CD O Xx. GJ NJ Lx CO K -4 CT 'J NJ CT NJ CT CD Xx igiiiHtn II •HS8 HHt |i 1 iihslss ?388§°So 8 §35^85 S 8 8§S8°S "peyn/c c?(_ J (/ 3 ^TLt-'c 13 s © > UI <n '• qf 3 OOOGJOOOOo‘T3o a> O « ° —* Xx —x-xj-MO-xCO^® CT 74 Xx. CT NJ GJ CT O O nj nj L L a b ui 0 - "

- 36. Rent & RGA 23,452.50 $ Sub-Total RGA $ 15,500.00 Sub-Total minimum rent Other Lease Charges 7,966.03 S Sub-Total Other Lease Charges $ 46,918.53 000473 7/19/2003 Page 1 of 1 Summary Rent RGA Somerset costs 030719.xls SOMERSET FARMS RENT / RGA & OTHER LEASE CHARGES As of March 14. 2003 Propane Refrigerator Replacement______________ Equestrian Center Diesel (400 gal a 1.27/gai)________ Shavings (200 bales Q S7 / bale)_______________ 5% Late Fee on October Minimum Rent__________ 5% Late Fee on November Minimum Rent________ Balance due on 5/8-8/15 electrical______________ 8/16-10/31 electrical__________________________ Accounting Fees (61.75 hrs @ S50/hr) as of 3/14/03 October minimum rent November minimm rent Balance of July RGA_____________ _ August RGA_____________________ September RGA__________________ October RGA_________________ __ November RGA________________ __ Nov Credit for 50% of Amt over S100K December RGA__________________ 4,020.50 4,977.00 5,341,50 5,341,50 2,967,50 (2,163.00) 2,967.50 7,500.00 8.000.00 2,068.80 510.91 1,400,00 375.00 400,00 58.36 65.46 3,087.50

- 37. RGA Paid RGA Due (651.50) (9,145.50) Total 32,598.00 $100,000 Threshold Calculation $ 83,484.50 600474 Page 1 of 1 7/19/2003 60,000.00 23,484.50 Oct Minimum Rent Oct RGA (90%) Nov Minimum Rent Nov - Credit for 50% over $100k Nov RGA (50% of RGA) Dec RGA (50% of RGA) RGA Summary Somerset costs 030719.xls Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Nov Dec Balance RGA Due Somerset Farms Summary of RGA Balance & When S100k Threshold Reached 455.00 315.00 545.00 625.00 1,485.00 5,418.00 4,323.00 4,977.00 5,341.50 5,341.50 (2,163.00) 2,967.50 2,967.50 (252.00) (504.00) (2,655.00) (2,535.00) (2,548.00) 4,780.50 6,568.50 8,997.50 14,339.00 19,680.50 17,517.50 20,485.00 23,452.50 455.00 118.50 663.50 1,036.50 RGA Credit $2,075 plus Somerset cfiedc $580.00 Minimum rent paid Jan 02 - Sep 02 RGA Due Jan 02 - Sep 02 Sub-Total Jan 02-Sep 02 7,500.00 5,341.50 8,000.00 (2,163.00) 2,967.50 WlOfllg 2,967.50 ■ 90,984.50 96,326.00 104,326.00 y

- 38. Amount Rate # Horses 225.00 $ 675.00 1 s 675.00 Arena S 2,320.00 Sub-Total S 1,800,00 300.00 S S 1,800.00 Red Bam S 4,210.00 Sub-Total Green Barn 3 2,180.00 Sub-Total $ 225.00 $ I Corrals 225.00 $ 225.00 $ J Corrals 225.00 $ 225.00 3 225.00 Total 38 $11,635.00 Less Costs $ (150.00) 38 3 (5,700.00) Net RGA Per Month $ 5,341.50 000475 3 5,935.00 X 90% SOMERSET FARMS Sep - Dec Monthly RGA Based on September Occupancy S S 3 3 3 3 3 3 350.00 3 3,150.00 265.00 3 1,060.00 350.00 450.00 415.00 265.00 3 $ S East Barn Sub-Total CLR Pasture Sub-Total 2 3 7 8 6, 6 3 1 1 6 1 2 1 9 4 13 5 1,050.00 450.00 415.00 265.00 300.00 3 2,100.00 220.00 3 220.00

- 39. Is I o > o p IS o 005619 2 CD Is* JET 1 o ro w NJ & O 4* CD CD c ro co co J-*’ §2 jn g -4 g ■M g ■bi g CO g CD cn g 03 g CO g J-4 g 5 g CO g cn cn g 03 g 05 g C |Q |Z O |< HT § s' g 3 73 <0 3 73 > o =R Is I?3 S' S' 3 3 r-fr r-> —k _1 o o :£ U) (/) rj -». O 7J o s jpl o ST 71 0 > b5 OT O s co cn 7J Q 2. I |o q cn co o 71 Q > ? CO cn CD g o “g o O) g o 71 O > U =R CD ro tn 5 CD cn cn cn i g G> g O g O g o S 5' ? 3 o I Q. g O tn o CD CD — o co to g o s cn CD ro CD § ra cn M a CD CO ro CD 6 CD CD L<nL<» IsIs ■M, k 1 iq CD, lc CD Z g ’* JO J-* 4k co CO N3 ■M CD F l!O |~ li3 CJ ig r |S o res -o ’*1 s ■=i co o cn m S o n. o ~ 3 5’ g ■g 3 o _x co 0 W 71 • Q ra q as® o o s a M -*■ w Tn 2. ° h CD 3 Q. 3 > t (D 0-^2 5 S' 1° 3 of-F f3 ° o -h 73 ! 3 3 v> > s= I” 73 v> o f" g t£2 ro 5

- 40. II no -m N3 !x3 cn tn o o Is gj CD O O -* cn cn a o CO CH l> co CD o a _g> IP in tn 2 o Is GO G) no co -t. co co nj -4 nj —*■ oo o no tn o a> 4* o nj a ~sj co a co to co cn tn II l<> o 4x CO -si O cn g ■u 005629 NJ CO ct> cn cn lc s s s X 33 tn GJ cn g IS 173 GJ cn co o NJ on cn cn m q o z £ CD -a -»■ NJ NJ N) CD CD CD O 3 ta ra i 2 —X -X 4x “cd co tn cn o co cn co cn cn a m ro co CD o I NJ £ cn cn tn CD tn G) GJ -* cn tn o co co ->■ o o o NJ NJ CO CD O CD GJ GJ — CD CD O ss o o NJ CO o cn cn cn O o -a CD CD O o o 4x GJ 5 w P po O § GJ NJ GJ -N. CD O O O CO GJ NJ CD cd on GJ GJ -» cn cn o -*• 4x CD —J O GJ —x -tx cn cn o o -*• CD on o o o NJ co -4 O o o o cn cn -n cn o o NJ -4 NJ NJ GJ O to CD CD isi Iz > GJ tn o o o 3- z 5‘ im o’ nT §1 o a o cn cn o o a NJ cn cn cd o HF CD m O ST 8-S 0 W o I II s'! im H im p □3 DJ Q > Q. < S' 3 q o 5- a 3 3 J = O 3 o 2> u> O ET g ?g 5 ro > m w > 5 -A □ Q o o > o° 2 (D -a cn cn cn o o o cn cd 4X0 cn cn o o tn o tn co o O CD o o CO o CO 4x tn tn a ,« o o o o o o a co co -* cn tn o o o o o i^ii f O o ’ o §■ S S g I ro tn o05 i > ro _-*■ _NJ CD CO CT) JX C O O Q) GJ O O GJ NJ O O CD CD CD CH CD CD CD CJ O 0 11 CD o’ S' §■§ co •“g II SI -a NJ GJ NJ Vj cn “co o cn o cn o o o o o s*

- 41. NJ GT CO 3 as CD Xx o o 111 g 10 co 1= 10 l> 10 2 o 10 co nj gj CD |0 > o cn cn O "J NJ N) o o o o g GJ gj cn cn I I s co to — o o o I! 1<- In I! It- p «J> GJ —X -A (o -x O O -U s o J2 o o s o Icc m l I co m pj g c icq m pj S o I! Ib £ < 5 ! p o o s CD o o' o 23 = 2 — co GJ GJ 03 GJ cn cn o o g § 5 3 3 CO to CO CD CO -x o o o CD CO — o o o -x -q CD NJ O O Xx GJ CD -4 O CD g O o 8 co o GJ GJ cn m cn CD CD -x -M GJ GJ NJ NJ O NJ GJ CD NJ GJ '-J O o o -- NJ 0*1 o O CD -x CD CD CD o o M1 O F g3 CD Gj cn GJ Xx G) O o o NJ NJ NJ CD G~l O -» GJ CD GO o o -X K) co o o o C GJ CD CO GJ NJ CD X- o g'ss’g 5' O O Q O CD OJ CD CD S’ 52. -x co gj -vj -=; cn cn cn o ° oooo^ —X JO p "gj To cn "cn CD NJ O NJ Cl Cl CO <£3 -x CJ _ O <=> O GJ C O O HF — Xx GJ .2 ssag-s NJ CD CD CD Q CD O O O p NJ CD 00 G> X- 2: 0 0 0 0 3 o o o o Q nj_ —NJ NJ 03 O O O O -x -x NJ p p P P P P T-* co "o "co Tn "xx -A *vl C3 GJ CD O -A CDCD-AOC»<DOCO gggO S 8 S S - I3 NJ N3 "-X 03 Xx cn co CD O Cl ■X -A "cn 03000-003010 2 o o o o G 0 56 21- o qF CD 3 -X (£2 O <D -* GJ p Gl CD CO *Xx —» GJ CD CO C C3 CD o 03 NJ NJ N) GJ XX NJ NJ CD O CD CD -x| CD CD O g2 2 NJ 03 O -A .A -A Lx 5x3 NJ NJ Xx Xx. -A cn C OJ =:

- 42. % o a o o a a o c o a o o o o o o o o o c o Si W M N N “ U N M |m ■ CD CD CD IBs l> |(D |> Io I-3 Io r< l§ _A J. -1 CJ GJ —k p 4^ JD JO ct — cn o cn a -j. 4x cn s co s tn Ol ■< GJ (fl -U -~l M b 0 5 S £ J fe |<_ r< Is I i(D li < S s IB O CD o o O CD o o o o o o a a CD ba to k CD U1 CD N rJ w cn cn iy jo jo gj cn IO '— GJ CD CD GJ GJ -4 O -I N in w o to W G) ■£- Si u gj k ct m •o co cn o tn GT -i O O S cn CD ''I tO to -t- co k> cn O "4 gj gj jo _a> cn GJ GJ GJ cn kj kJ CD IO CD CD -E* 4^ —*■ CO Cl A O -£>. —1 Is S Is 3 is gs IH If Im ICD a cn tO GJ _GJ T't CD § 3 £ s <2 g S £ ? 45. O Xk CO bJ Co 3 £ K 5 g £ g <§ ° 2 5 ? 2. -X to NJ O —“■ CD O O cnuioSocoaJ % 2, f i ° c ~ S ro ro ro (n cn ba k- ^-i ~a ~k co N <fl C W C ~ ca -4 cn ~4 ba O r1- -*■ k)CD CD k) GJ -fl-CO O CD to -v!cn o on |8 3 I—< i? h 1 ra ?■? •g 5 ° § f I 3 g § S - g; a > 11 £ cn I I ^4 ■O GJ G> W GJ GJ JO JJJ CD SKEggog a a t f .-^--1 -A--" s i I =•• 5; $ § o a S S gj k 2 sf f Hi i

- 43. X SOMERSET FARMS LLC EQUESTRIAN FACILITY - LEASE TERM REPORT -12/15/02 A. $ 50% Under Clause 5 relevant Terms are: B. Alternative Base Number 100,000 $ Balance Due 12,052 G05S23 i i Formula information extracted from enclosed Consolidated Analysis of Minimum Rents and RGA - 2002. Less Tenant Paid Minimum Rent Less Tenant RGA Paid Less Jackson Federal Levy SULPHUR MOUNTAIN LAND MID LIVESTOCK CO., LLC (LANDLORD) AND SOMERSET FARMS LLC ( TENANT) 83,500 76,000 100,000 24,557 12,278 2,731 9,116 (76,000) (9,116) (2,832) Minimum Rent Schedule- Minimum Rent Paid( Inc Sec. Deposit ) Alternative Base Number Net RGA Net RGA Tenant 10% of RGA Tenant RGA Paid

- 44. ANALYSIS OF SOMERSET FARMS LLC GROSS INCOME VERSUS SECURITY DEPOSITS AND MONTHLY MINIMUM RENT DECEMBER 2001 THROUGH MAY 2002. MINIMUM RENT PAID $32,000.00 SECURITY DEPOSITS $16,000.00 TOTAL $48,000.00 GROSS PROCEEDS $4,763.00 SOURCE: 12/16/2002 SOMERSET FARMS LLC ANALYSIS OF MINIMUM RENTS & RGA 2002 BASED (IN PART) ON INFORMATION OBTAINED FROM A.E.S. MANAGEMENT.

- 45. 0 November 11, 2002 To: Somerset Farms b 16 hours @ $30.00 hr o- i o )Z_ $480.00 fa 300 - Finish all books for Somerset Farms and Geraldine Redmond. Go through all receipts. Print reports forJohn and David Blake Chatfield. Make computerbackups forJohn. My Bookie 25219 Wheeler Rd. Newhall, Ca 91321 661+259-5191