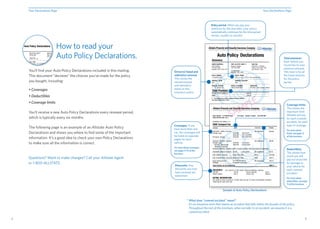

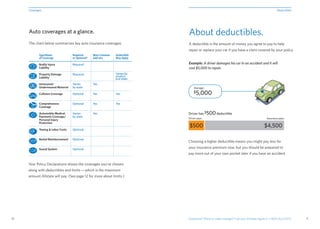

This document provides an overview of auto insurance coverage, deductibles, and what to do in the event of an accident. It explains how to read the auto insurance policy declarations, including information on covered drivers and vehicles, applicable discounts, coverage types and limits, and deductible amounts. It also offers contact information for policyholders who have additional questions or want to make changes to their coverage.