US Data Show Inflation, Already Low, Slowed Further in July

•Download as PPTX, PDF•

1 like•1,869 views

US inflation slowed further in July by almost all measures, and continues to run well below the Fed's 2% target

Report

Share

Report

Share

Recommended

Recommended

Residential Issues And Trends Forum Robert Dietz, PhD NAHB

Residential Issues And Trends Forum Robert Dietz, PhD NAHBSouthwest Riverside County Association of Realtors

More Related Content

What's hot

Residential Issues And Trends Forum Robert Dietz, PhD NAHB

Residential Issues And Trends Forum Robert Dietz, PhD NAHBSouthwest Riverside County Association of Realtors

What's hot (20)

All Major US Inflation Indicators Fall Below Fed Targets in May

All Major US Inflation Indicators Fall Below Fed Targets in May

Latest GDP Revisions Carry Mixed Message for Elections

Latest GDP Revisions Carry Mixed Message for Elections

GDP Growth Remains Slow in Q1 2012, Corporate Profits Fall

GDP Growth Remains Slow in Q1 2012, Corporate Profits Fall

US Job Growth Weak in June, Unemployment Holds Steady

US Job Growth Weak in June, Unemployment Holds Steady

US Employment Data: Strong Jobs Report Leads Off the Election Season

US Employment Data: Strong Jobs Report Leads Off the Election Season

US Jobs Data: Strong January Report Contiues Upward Trend

US Jobs Data: Strong January Report Contiues Upward Trend

How Chronic Budget Optimism Helped Dig The Hole We Are In

How Chronic Budget Optimism Helped Dig The Hole We Are In

Residential Issues And Trends Forum Robert Dietz, PhD NAHB

Residential Issues And Trends Forum Robert Dietz, PhD NAHB

Inflation about to become a massive headache for central bankers

Inflation about to become a massive headache for central bankers

October Job Growth Still Slow but Better News in the Details

October Job Growth Still Slow but Better News in the Details

Lecture 5 - Finance for Micro-Renewable Professionals

Lecture 5 - Finance for Micro-Renewable Professionals

Viewers also liked

Viewers also liked (8)

US CPI Inflation Remains Near Zero as Sequester Looms

US CPI Inflation Remains Near Zero as Sequester Looms

How do we Know if the Federal Debt is Sustainable?

How do we Know if the Federal Debt is Sustainable?

US Q3 GDP: Good News in the Headlines but Bad News in the Details

US Q3 GDP: Good News in the Headlines but Bad News in the Details

As Exports Soar, US Economy Closes in on Fed's Targets

As Exports Soar, US Economy Closes in on Fed's Targets

Quantitative Easing and the Fed 2008-2014: A Tutorial

Quantitative Easing and the Fed 2008-2014: A Tutorial

Similar to US Data Show Inflation, Already Low, Slowed Further in July

Similar to US Data Show Inflation, Already Low, Slowed Further in July (20)

US Gross Domestic Income Growth Outpaces GDP Growth in Q4 2011

US Gross Domestic Income Growth Outpaces GDP Growth in Q4 2011

More from Ed Dolan

More from Ed Dolan (20)

Is the Federal Budget Out of Control? A Tutorial on Debt Dynamics

Is the Federal Budget Out of Control? A Tutorial on Debt Dynamics

How Liberals and Conservatives Can Talk About Climate change

How Liberals and Conservatives Can Talk About Climate change

US GDP Grows at 5 Percent in Q3 2014, Best of Recovery

US GDP Grows at 5 Percent in Q3 2014, Best of Recovery

US GDP Grows 2.4% in Q1, but Government and Export Sectors Weaken

US GDP Grows 2.4% in Q1, but Government and Export Sectors Weaken

US Unemployment Rate falls to 7.5 percent in April; Job Gains Revised Up

US Unemployment Rate falls to 7.5 percent in April; Job Gains Revised Up

Recently uploaded

call girls in Sant Nagar (DELHI) 🔝 >༒9953056974 🔝 genuine Escort Service 🔝✔️✔️

call girls in Sant Nagar (DELHI) 🔝 >༒9953056974 🔝 genuine Escort Service 🔝✔️✔️9953056974 Low Rate Call Girls In Saket, Delhi NCR

Booking open Available Pune Call Girls Wadgaon Sheri 6297143586 Call Hot Ind...

Booking open Available Pune Call Girls Wadgaon Sheri 6297143586 Call Hot Ind...Call Girls in Nagpur High Profile

Top Rated Pune Call Girls Aundh ⟟ 6297143586 ⟟ Call Me For Genuine Sex Servi...

Top Rated Pune Call Girls Aundh ⟟ 6297143586 ⟟ Call Me For Genuine Sex Servi...Call Girls in Nagpur High Profile

(Vedika) Low Rate Call Girls in Pune Call Now 8250077686 Pune Escorts 24x7

(Vedika) Low Rate Call Girls in Pune Call Now 8250077686 Pune Escorts 24x7Call Girls in Nagpur High Profile Call Girls

VIP Independent Call Girls in Mumbai 🌹 9920725232 ( Call Me ) Mumbai Escorts ...

VIP Independent Call Girls in Mumbai 🌹 9920725232 ( Call Me ) Mumbai Escorts ...dipikadinghjn ( Why You Choose Us? ) Escorts

Top Rated Pune Call Girls Lohegaon ⟟ 6297143586 ⟟ Call Me For Genuine Sex Se...

Top Rated Pune Call Girls Lohegaon ⟟ 6297143586 ⟟ Call Me For Genuine Sex Se...Call Girls in Nagpur High Profile

Top Rated Pune Call Girls Viman Nagar ⟟ 6297143586 ⟟ Call Me For Genuine Sex...

Top Rated Pune Call Girls Viman Nagar ⟟ 6297143586 ⟟ Call Me For Genuine Sex...Call Girls in Nagpur High Profile

From Luxury Escort Service Kamathipura : 9352852248 Make on-demand Arrangemen...

From Luxury Escort Service Kamathipura : 9352852248 Make on-demand Arrangemen...From Luxury Escort : 9352852248 Make on-demand Arrangements Near yOU

Top Rated Pune Call Girls Dighi ⟟ 6297143586 ⟟ Call Me For Genuine Sex Servi...

Top Rated Pune Call Girls Dighi ⟟ 6297143586 ⟟ Call Me For Genuine Sex Servi...Call Girls in Nagpur High Profile

VIP Call Girl Service Andheri West ⚡ 9920725232 What It Takes To Be The Best ...

VIP Call Girl Service Andheri West ⚡ 9920725232 What It Takes To Be The Best ...dipikadinghjn ( Why You Choose Us? ) Escorts

VIP Independent Call Girls in Bandra West 🌹 9920725232 ( Call Me ) Mumbai Esc...

VIP Independent Call Girls in Bandra West 🌹 9920725232 ( Call Me ) Mumbai Esc...dipikadinghjn ( Why You Choose Us? ) Escorts

VIP Call Girl in Mumbai Central 💧 9920725232 ( Call Me ) Get A New Crush Ever...

VIP Call Girl in Mumbai Central 💧 9920725232 ( Call Me ) Get A New Crush Ever...dipikadinghjn ( Why You Choose Us? ) Escorts

Top Rated Pune Call Girls Sinhagad Road ⟟ 6297143586 ⟟ Call Me For Genuine S...

Top Rated Pune Call Girls Sinhagad Road ⟟ 6297143586 ⟟ Call Me For Genuine S...Call Girls in Nagpur High Profile

Recently uploaded (20)

Solution Manual for Financial Accounting, 11th Edition by Robert Libby, Patri...

Solution Manual for Financial Accounting, 11th Edition by Robert Libby, Patri...

call girls in Sant Nagar (DELHI) 🔝 >༒9953056974 🔝 genuine Escort Service 🔝✔️✔️

call girls in Sant Nagar (DELHI) 🔝 >༒9953056974 🔝 genuine Escort Service 🔝✔️✔️

Booking open Available Pune Call Girls Wadgaon Sheri 6297143586 Call Hot Ind...

Booking open Available Pune Call Girls Wadgaon Sheri 6297143586 Call Hot Ind...

Business Principles, Tools, and Techniques in Participating in Various Types...

Business Principles, Tools, and Techniques in Participating in Various Types...

Call Girls Banaswadi Just Call 👗 7737669865 👗 Top Class Call Girl Service Ban...

Call Girls Banaswadi Just Call 👗 7737669865 👗 Top Class Call Girl Service Ban...

Top Rated Pune Call Girls Aundh ⟟ 6297143586 ⟟ Call Me For Genuine Sex Servi...

Top Rated Pune Call Girls Aundh ⟟ 6297143586 ⟟ Call Me For Genuine Sex Servi...

(Vedika) Low Rate Call Girls in Pune Call Now 8250077686 Pune Escorts 24x7

(Vedika) Low Rate Call Girls in Pune Call Now 8250077686 Pune Escorts 24x7

VIP Independent Call Girls in Mumbai 🌹 9920725232 ( Call Me ) Mumbai Escorts ...

VIP Independent Call Girls in Mumbai 🌹 9920725232 ( Call Me ) Mumbai Escorts ...

Top Rated Pune Call Girls Lohegaon ⟟ 6297143586 ⟟ Call Me For Genuine Sex Se...

Top Rated Pune Call Girls Lohegaon ⟟ 6297143586 ⟟ Call Me For Genuine Sex Se...

Vasai-Virar Fantastic Call Girls-9833754194-Call Girls MUmbai

Vasai-Virar Fantastic Call Girls-9833754194-Call Girls MUmbai

Top Rated Pune Call Girls Viman Nagar ⟟ 6297143586 ⟟ Call Me For Genuine Sex...

Top Rated Pune Call Girls Viman Nagar ⟟ 6297143586 ⟟ Call Me For Genuine Sex...

From Luxury Escort Service Kamathipura : 9352852248 Make on-demand Arrangemen...

From Luxury Escort Service Kamathipura : 9352852248 Make on-demand Arrangemen...

Top Rated Pune Call Girls Dighi ⟟ 6297143586 ⟟ Call Me For Genuine Sex Servi...

Top Rated Pune Call Girls Dighi ⟟ 6297143586 ⟟ Call Me For Genuine Sex Servi...

VIP Call Girl Service Andheri West ⚡ 9920725232 What It Takes To Be The Best ...

VIP Call Girl Service Andheri West ⚡ 9920725232 What It Takes To Be The Best ...

Vip Call US 📞 7738631006 ✅Call Girls In Sakinaka ( Mumbai )

Vip Call US 📞 7738631006 ✅Call Girls In Sakinaka ( Mumbai )

WhatsApp 📞 Call : 9892124323 ✅Call Girls In Chembur ( Mumbai ) secure service

WhatsApp 📞 Call : 9892124323 ✅Call Girls In Chembur ( Mumbai ) secure service

VIP Independent Call Girls in Bandra West 🌹 9920725232 ( Call Me ) Mumbai Esc...

VIP Independent Call Girls in Bandra West 🌹 9920725232 ( Call Me ) Mumbai Esc...

VIP Call Girl in Mumbai Central 💧 9920725232 ( Call Me ) Get A New Crush Ever...

VIP Call Girl in Mumbai Central 💧 9920725232 ( Call Me ) Get A New Crush Ever...

Top Rated Pune Call Girls Sinhagad Road ⟟ 6297143586 ⟟ Call Me For Genuine S...

Top Rated Pune Call Girls Sinhagad Road ⟟ 6297143586 ⟟ Call Me For Genuine S...

US Data Show Inflation, Already Low, Slowed Further in July

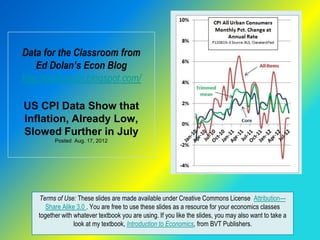

- 1. Data for the Classroom from Ed Dolan’s Econ Blog http://dolanecon.blogspot.com/ US CPI Data Show that Inflation, Already Low, Slowed Further in July Posted Aug. 17, 2012 Terms of Use: These slides are made available under Creative Commons License Attribution— Share Alike 3.0 . You are free to use these slides as a resource for your economics classes together with whatever textbook you are using. If you like the slides, you may also want to take a look at my textbook, Introduction to Economics, from BVT Publishers.

- 2. Headline Inflation was Near Zero The headline inflation rate in the latest BLS inflation report was zero for July, as it was for June Using unrounded data and stating the monthly change at an annual rate, seasonally adjusted inflation was 0.6% Energy prices fell in July, while food prices rose slightly. The largest price increases were for health care goods and services Posted Aug. 17, 2012 on Ed Dolan’s Econ Blog http://dolanecon.blogspot.com

- 3. Weak Energy Prices Bring Core Inflation Down Food and energy prices are volatile and usually account for much of the month-to-month change in the CPI Their effect can be removed by taking food and energy out of the CPI. The result is called the core inflation rate. The rate of core inflation for July, stated as an annual rate, was 1.09% Seasonally adjusted energy prices fell, let by lower prices for electricity and natural gas. Refinery disruptions caused an increase in retail gasoline prices Posted Aug. 17, 2012 on Ed Dolan’s Econ Blog http://dolanecon.blogspot.com

- 4. Trimmed Mean Inflation Also Remains Low Another way to remove volatility is the 16% trimmed mean CPI published by the Federal Reserve Bank of Cleveland. It removes the 8% of prices that increase most and the 8% that increase least in each month (or decrease most), whatever they are The 16 percent trimmed mean CPI slowed to an annual rate of 1.29 percent in July Posted Aug. 17, 2012 on Ed Dolan’s Econ Blog http://dolanecon.blogspot.com

- 5. Which Measure is Best? The CPI for all items gives the most accurate measure of current changes in the cost of living Economists at the Fed look closely at the core and trimmed mean CPIs to judge the effect of monetary policy on underlying inflationary trends The Fed considers inflation of about 2 percent to be consistent with prudent monetary policy. All three measures shown here were below the target for July Posted Aug. 17, 2012 on Ed Dolan’s Econ Blog http://dolanecon.blogspot.com

- 6. The Longer Term Trend To see longer term trends in inflation, it is useful to look at year- on-year changes, which compare each month’s price level with that of the same month in the year before All y-o-y measures of inflation rates slowed during the global recession, then rose again for most of 2011. The three measures shown here have moved steadily downward in 2012. All are close to or below the Fed’s targets Posted Aug. 17, 2012 on Ed Dolan’s Econ Blog http://dolanecon.blogspot.com

- 7. Index of Sticky Prices Falls Some prices, like those for food and energy, are flexible. They change daily in response to market condtions Others, like those for restaurant food, insurance, clothing, and medical care are sticky. Sellers of those goods adjust prices only when they are sure changes in market conditions will last Economists at the Atlanta Fed publish an index of sticky prices, which they think is a better indicator of future inflation trends than the CPI The rate of inflation measured by sticky prices showed sharply in July Posted Aug. 17, 2012 on Ed Dolan’s Econ Blog http://dolanecon.blogspot.com