TREB Condo Market Commentary

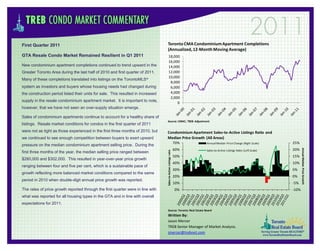

- 1. First Quarter 2011 Toronto CMA Condominium Apartment Completions (Annualized, 12-Month Moving Average) GTA Resale Condo Market Remained Resilient in Q1 2011 18,000 16,000 New condominium apartment completions continued to trend upward in the 14,000 Greater Toronto Area during the last half of 2010 and first quarter of 2011. 12,000 10,000 Many of these completions translated into listings on the TorontoMLS® 8,000 system as investors and buyers whose housing needs had changed during 6,000 the construction period listed their units for sale. This resulted in increased 4,000 2,000 supply in the resale condominium apartment market. It is important to note, 0 however, that we have not seen an over-supply situation emerge. Sales of condominium apartments continue to account for a healthy share of Source: CMHC; TREB Adjustment listings. Resale market conditions for condos in the first quarter of 2011 were not as tight as those experienced in the first three months of 2010, but Condominium Apartment Sales-to-Active Listings Ratio and we continued to see enough competition between buyers to exert upward Median Price Growth (All Areas) 70% Annual Median Price Change (Right Scale) 25% pressure on the median condominium apartment selling price. During the Annual Median Price Growth 60% Sales-to-Active Listings Ratio (Left Scale) 20% Sales-to-Active Listings ratio first three months of the year, the median selling price ranged between 50% 15% $280,000 and $302,000. This resulted in year-over-year price growth 40% 10% ranging between four and five per cent, which is a sustainable pace of 30% 5% growth reflecting more balanced market conditions compared to the same 20% 0% period in 2010 when double-digit annual price growth was reported. 10% -5% The rates of price growth reported through the first quarter were in line with 0% -10% what was reported for all housing types in the GTA and in line with overall expectations for 2011. Source: Toronto Real Estate Board Written By: Jason Mercer TREB Senior Manager of Market Analysis. jmercer@trebnet.com