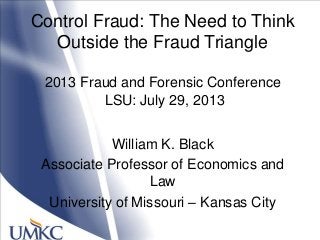

"Control Fraud: The Need to Think Outside the Fraud Triangle" 2013 Fraud and Forensic Conference. LSU: July 29, 2013. William K. Black. Associate Professor of Economics and Law. University of Missouri – Kansas City. http://www.benzinga.com/users/william-k-black

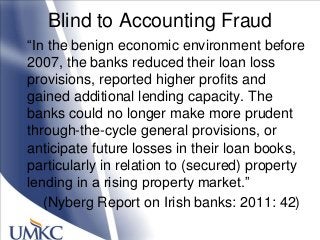

![IAS 39: criminogenic

―The higher reported profits also enabled

increased dividend and remuneration

distributions during the Period. All of this

led to reduced provisioning buffers….‖

―the incurred-loss model [IAS 39] also

restricted the banks‘ ability to report

early provisions for likely future loan

losses as the crisis developed from

2007 onwards.‖ (Nyberg 2011: 42-43

Right, ―the banks‖ wanted to report

higher provisions in Nyberg‘s alternate

reality. Listen to the Anglo Irish tapes.](https://image.slidesharecdn.com/williamkblackoncontrolfraud2013-130716110453-phpapp01/85/William-K-Black-on-Control-Fraud-2013-8-320.jpg?cb=1373972941)

![Accounting Fraud = Sure Thing

―[M]any economists still [do] not understand

that a combination of circumstances in the

1980s made it very easy to loot a [bank] with

little risk of prosecution. Once this is clear, it

becomes obvious that high-risk strategies that

would pay off only in some states of the world

were only for the timid. Why abuse the system

to pursue a gamble that might pay off when

you can exploit a sure thing with little risk of

prosecution?‖ (Akerlof & Romer 1993: 4-5](https://image.slidesharecdn.com/williamkblackoncontrolfraud2013-130716110453-phpapp01/85/William-K-Black-on-Control-Fraud-2013-10-320.jpg?cb=1373972941)

![Fraud in the S&L Debacle

―The typical large failure [grew] at an

extremely rapid rate, achieving

high concentrations of assets in

risky ventures…. [E]very

accounting trick available was

used…. Evidence of fraud was

invariably present as was the

ability of the operators to ―milk‖ the

organization‖ (NCFIRRE 1993)](https://image.slidesharecdn.com/williamkblackoncontrolfraud2013-130716110453-phpapp01/85/William-K-Black-on-Control-Fraud-2013-22-320.jpg?cb=1373972941)

![―Now we know better‖

―Neither the public nor economists foresaw that

[S&L deregulation was] bound to produce

looting. Nor, unaware of the concept, could

they have known how serious it would be.

Thus the regulators in the field who understood

what was happening from the beginning found

lukewarm support, at best, for their cause. Now

we know better. If we learn from experience,

history need not repeat itself‖ (George Akerlof

& Paul Romer.1993: 60).](https://image.slidesharecdn.com/williamkblackoncontrolfraud2013-130716110453-phpapp01/85/William-K-Black-on-Control-Fraud-2013-23-320.jpg?cb=1373972941)

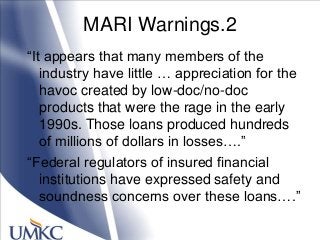

![MARI‘s 5 Warnings: 2006

• Stated income loans ―are open

invitations to fraudsters‖

• Study: fraud incidence is ―90 percent‖

• ―[T]he stated income loan deserves the

nickname used by many in the industry,

the ‗liar‘s loan.‘‖](https://image.slidesharecdn.com/williamkblackoncontrolfraud2013-130716110453-phpapp01/85/William-K-Black-on-Control-Fraud-2013-27-320.jpg?cb=1373972941)

![―Disconcerting Results‖

The result of the [Fitch loan file]

analysis was disconcerting…as

there was the appearance of

fraud or misrepresentation in

almost every file.

the files indicated that fraud was not

only present, but, in most cases,

could have been identified with

adequate underwriting …prior to

the loan funding. [Fitch 11.07]](https://image.slidesharecdn.com/williamkblackoncontrolfraud2013-130716110453-phpapp01/85/William-K-Black-on-Control-Fraud-2013-29-320.jpg?cb=1373972941)

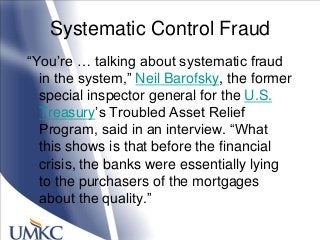

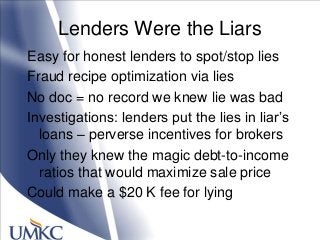

![Lenders put the lies in liar‘s loans

―[Many originators invent] non-existent

occupations or income sources, or

simply inflat[e] income totals to support

loan applications. Importantly, our

investigations have found that most

stated income fraud occurs at the

suggestion and direction of the loan

originator, not the consumer.‖ Tom

Miller, AG, Iowa, 2007 testimony to Fed.](https://image.slidesharecdn.com/williamkblackoncontrolfraud2013-130716110453-phpapp01/85/William-K-Black-on-Control-Fraud-2013-32-320.jpg?cb=1373972941)

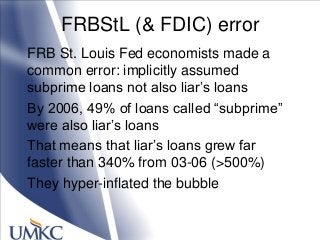

![“Alt-A: The Forgotten Segment of the

Mortgage Market” (FRBStL 2010)

―[B]etween 2003 and 2006 … subprime

and Alt-A [loans grew ] 94 and 340

percent, respectively.

The higher levels of originations after

2003 were largely sustained by the

growth of the nonprime (both the

subprime and Alt-A) segment of the

mortgage market.‖](https://image.slidesharecdn.com/williamkblackoncontrolfraud2013-130716110453-phpapp01/85/William-K-Black-on-Control-Fraud-2013-33-320.jpg?cb=1373972941)

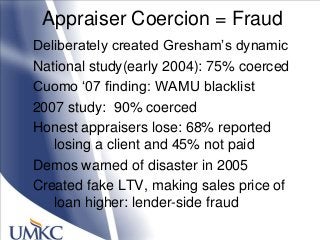

![Gresham‘s dynamic: appraisers

Art is to suborn, not defeat, ―controls‖

―From 2000 to 2007, a coalition of appraisal

organizations … delivered to Washington

officials a public petition; signed by 11,000

appraisers…. [I]t charged that lenders were

pressuring appraisers to place artificially

high prices on properties [and] ―blacklisting

honest appraisers‖ and instead assigning

business only to appraisers who would hit

the desired price targets.‖( FCIC 2011: 18)](https://image.slidesharecdn.com/williamkblackoncontrolfraud2013-130716110453-phpapp01/85/William-K-Black-on-Control-Fraud-2013-36-320.jpg?cb=1373972941)

![―Most reputable‖ banks are frauds

―although there is substantial

heterogeneity across underwriters, a

significant degree of misrepresentation

exists across all underwriters, which

includes the most reputable financial

institutions.‖ [ Id: 29]](https://image.slidesharecdn.com/williamkblackoncontrolfraud2013-130716110453-phpapp01/85/William-K-Black-on-Control-Fraud-2013-37-320.jpg?cb=1373972941)

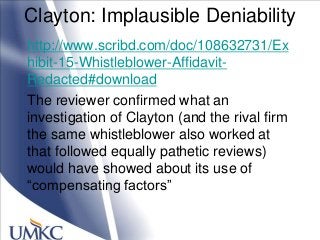

![Calomiris: ―Plausible deniability‖

―asset managers were placing someone

else‘s money at risk, and earning huge

salaries, bonuses and management fees for

being willing to pretend that these were

reasonable investments. [T]hey may have

reasoned that other competi[tors] were

behaving similarly, and that they would be

able to blame the collapse (when it

inevitably came) on an unexpected shock.‖

―Who knew?‖](https://image.slidesharecdn.com/williamkblackoncontrolfraud2013-130716110453-phpapp01/85/William-K-Black-on-Control-Fraud-2013-45-320.jpg?cb=1373972941)

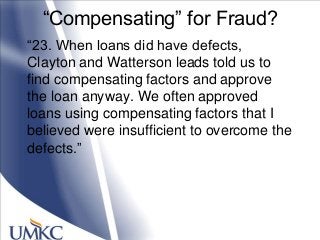

![A ―Cheat Sheet‖ for Cheating

24. We often considered as compensating

factors items such as the number of years

the borrower had been employed], the

borrower‘s assets, and the LTV and CLTV

ratios. At both Clayton and Watterson, due

diligence underwriters … were required to

be creative in order to find compensating

factors. On many jobs, the leads gave us a

cheat sheet of compensating factors to

make it easier for us to find them.‖](https://image.slidesharecdn.com/williamkblackoncontrolfraud2013-130716110453-phpapp01/85/William-K-Black-on-Control-Fraud-2013-54-320.jpg?cb=1373972941)

![Gresham‘s: Auditors

―[A]busive operators of S&L[s] sought out

compliant and cooperative accountants.

The result was a sort of "Gresham's

Law" in which the bad professionals

forced out the good.‖ (NCFIRRE 1993)](https://image.slidesharecdn.com/williamkblackoncontrolfraud2013-130716110453-phpapp01/85/William-K-Black-on-Control-Fraud-2013-58-320.jpg?cb=1373972941)

![―Gresham‘s‖ Dynamic

―[D]ishonest dealings tend to drive honest

dealings out of the market. The cost of

dishonesty, therefore, lies not only in

the amount by which the purchaser is

cheated; the cost also must include the

loss incurred from driving legitimate

business out of existence.‖ George

Akerlof (1970).](https://image.slidesharecdn.com/williamkblackoncontrolfraud2013-130716110453-phpapp01/85/William-K-Black-on-Control-Fraud-2013-61-320.jpg?cb=1373972941)

![―Now We Know Better‖

―Neither the public nor economists foresaw

that [S&L deregulation was] bound to

produce looting. Nor, unaware of the

concept, could they have known how

serious it would be. Thus the regulators in

the field who understood what was

happening from the beginning found

lukewarm support, at best, for their cause.

Now we know better. If we learn from

experience, history need not repeat itself‖

(George Akerlof & Paul Romer.1993: 60).](https://image.slidesharecdn.com/williamkblackoncontrolfraud2013-130716110453-phpapp01/85/William-K-Black-on-Control-Fraud-2013-67-320.jpg?cb=1373972941)

![SAS 99: Professional Skepticism

―.13 Due professional care requires the

auditor to exercise professional skepticism.

Professional skepticism is an attitude that

includes a questioning mind and a critical

assessment of audit evidence. [P]rofessional

skepticism requires an ongoing questioning of

whether the information and evidence

obtained suggests that a material

misstatement due to fraud has occurred.‖](https://image.slidesharecdn.com/williamkblackoncontrolfraud2013-130716110453-phpapp01/85/William-K-Black-on-Control-Fraud-2013-77-320.jpg?cb=1373972941)

![SAS 99: Fraud Risk Factors

―.31 [T]he auditor may identify events or

conditions [―fraud risk factors‖] that indicate

incentives/pressures to perpetrate fraud,

opportunities to carry out the fraud, or

attitudes/rationalizations to justify a

fraudulent action. Fraud risk factors do not

necessarily indicate the existence of fraud;

however, they often are present in

circumstances where fraud exists.‖

Fraud risk factors are always

present due to the risk of control

fraud.](https://image.slidesharecdn.com/williamkblackoncontrolfraud2013-130716110453-phpapp01/85/William-K-Black-on-Control-Fraud-2013-78-320.jpg?cb=1373972941)

![SAS 99: Fraud Flags

―.35 [O]bserving that individuals have the

requisite attitude to commit fraud, or

identifying factors that indicate a

likelihood that management or other

employees will rationalize committing a

fraud, is difficult at best.‖

It is ―difficult.‖ So what do we know about humans when

it comes to performing an analytical task that is very

difficult and would harm the audit partner‘s self-interest?](https://image.slidesharecdn.com/williamkblackoncontrolfraud2013-130716110453-phpapp01/85/William-K-Black-on-Control-Fraud-2013-79-320.jpg?cb=1373972941)

![SAS 99.36: Death to the Triangle

―[T]he significance of incentives/pressures

may result in a risk of material misstatement

due to fraud, apart from the significance of

the other two conditions. For example, an

incentive/pressure to achieve an earnings

level to preclude a loan default, or to "trigger"

incentive compensation plan awards, may

alone result in a risk of material

misstatement due to fraud.‖](https://image.slidesharecdn.com/williamkblackoncontrolfraud2013-130716110453-phpapp01/85/William-K-Black-on-Control-Fraud-2013-80-320.jpg?cb=1373972941)

![SAS 99.37

“The auditor's identification of fraud risks

also may be influenced by characteristics

such as the size, complexity, and ownership

attributes of the entity. [I]n … a larger entity,

the auditor ordinarily considers factors that

generally constrain improper conduct by

management, such as the effectiveness of

the audit committee and the internal audit

function, and the existence and

enforcement of a formal code of conduct.‖

Seriously? A ―code‖ adopted by Ken Lay

―generally constrain[s] improper conduct

by management‖? On what planet?](https://image.slidesharecdn.com/williamkblackoncontrolfraud2013-130716110453-phpapp01/85/William-K-Black-on-Control-Fraud-2013-82-320.jpg?cb=1373972941)

![SAS 99.39

―Certain accounts, classes of transactions,

and assertions that have high inherent risk

because they involve a high degree of

management judgment and subjectivity also

may present risks of material misstatement

due to fraud because they are susceptible

to manipulation by management.‖

[.39 also warns of ―complex accounting

principles‖]

Control frauds cluster because

CEOs cause the firm to operate in

these areas that optimize fraud.](https://image.slidesharecdn.com/williamkblackoncontrolfraud2013-130716110453-phpapp01/85/William-K-Black-on-Control-Fraud-2013-83-320.jpg?cb=1373972941)

![SAS 99.54

―In addressing an identified risk of material

misstatement due to fraud involving

accounting estimates, the auditor may want

to supplement the audit evidence…. (For

example, [in] evaluating the reasonableness

of management's estimate of the fair value

of a derivative), it may be appropriate to

engage a specialist or develop an

independent estimate for comparison to

management's estimate.‖](https://image.slidesharecdn.com/williamkblackoncontrolfraud2013-130716110453-phpapp01/85/William-K-Black-on-Control-Fraud-2013-86-320.jpg?cb=1373972941)

![SAS 99.65: Make the Number

―[I]nformation coming to the auditor's

attention may indicate a risk that

adjustments to the current-year estimates

might be recorded at the instruction of

management to arbitrarily achieve a

specified earnings target.‖](https://image.slidesharecdn.com/williamkblackoncontrolfraud2013-130716110453-phpapp01/85/William-K-Black-on-Control-Fraud-2013-88-320.jpg?cb=1373972941)

![SAS 99 Appendix: Fraud Flags

c. ―[M]anagement … is threatened by the

entity's financial performance [due to]:

Significant financial interests in the entity

Significant … compensation … contingent

upon achieving aggressive target

d. [E]xcessive pressure on management or

operating personnel to meet financial targets‖

Reactive v. opportunistic control fraud](https://image.slidesharecdn.com/williamkblackoncontrolfraud2013-130716110453-phpapp01/85/William-K-Black-on-Control-Fraud-2013-89-320.jpg?cb=1373972941)

![Audit Committee Fantasy.2

―The audit committee … can [deter] senior

management [from fraud] by ensuring

[that] any attempt by [them] to involve

employees in committing or concealing

fraud would lead promptly to reports from

such employees to appropriate persons,

including the audit committee).‖](https://image.slidesharecdn.com/williamkblackoncontrolfraud2013-130716110453-phpapp01/85/William-K-Black-on-Control-Fraud-2013-95-320.jpg?cb=1373972941)

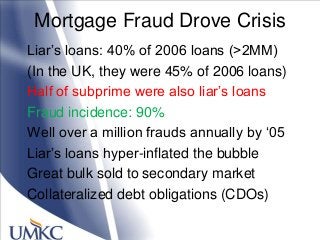

![―Liar‘s loan‖ was a Hint

When the stated incomes were compared

to the IRS figures: [90%] of the stated

incomes were exaggerated by 5% or

more. [A]lmost 60% were exaggerated

by more than 50%. [T]he stated income

loan deserves the nickname used by

many in the industry, the ―liar‘s loan‖

(MARI 2006).

50% of ―subprime‖ was liar‘s loans by ‗06](https://image.slidesharecdn.com/williamkblackoncontrolfraud2013-130716110453-phpapp01/85/William-K-Black-on-Control-Fraud-2013-108-320.jpg?cb=1373972941)

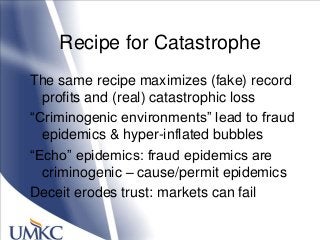

![Criminogenic Ideology

Mankiw (1993): ―it would be irrational for

savings and loans [CEOs] not to loot.‖

This was in response to Akerlof & Romer

(1993) ―Looting: Bankruptcy for Profit.‖

Bastiat and Sutherland warned us

Effective regulation aids market efficiency

by countering perverse Gresham‘s

dynamics: cheaters must not prosper.](https://image.slidesharecdn.com/williamkblackoncontrolfraud2013-130716110453-phpapp01/85/William-K-Black-on-Control-Fraud-2013-131-320.jpg?cb=1373972941)

![Greenspan v. Brooksley Born

―‗Well, Brooksley, I guess you and I will

never agree about fraud‘ [Greenspan]

‗What is there not to agree on?‘ [Born]

‗Well, you probably will always believe there

should be laws against fraud, and I don‘t

think there is any need for a law against

fraud,‘ she recalls. Greenspan, Born says,

believed the market would take care of

itself.‖ [Genesis of CFMA‘s 2000 black hole]](https://image.slidesharecdn.com/williamkblackoncontrolfraud2013-130716110453-phpapp01/85/William-K-Black-on-Control-Fraud-2013-132-320.jpg?cb=1373972941)

![Gresham‘s & the Auditors

―[A]busive operators of S&L[s] sought

out compliant and cooperative

accountants. The result was a sort

of "Gresham's Law" in which the

bad professionals forced out the

good.‖ (NCFIRRE 1993)

Same pattern: credit rating

agencies, appraisers & stock

analysts](https://image.slidesharecdn.com/williamkblackoncontrolfraud2013-130716110453-phpapp01/85/William-K-Black-on-Control-Fraud-2013-136-320.jpg?cb=1373972941)

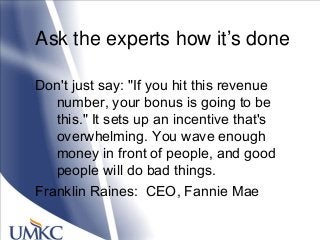

![Do as I say, not as I do

―By now every one of you must have 6.46 [EPS]

branded in your brains. You must be able to say it in

your sleep, you must be able to recite it forwards and

backwards, you must have a raging fire in your belly

that burns away all doubts, you must live, breath and

dream 6.46, you must be obsessed on 6.46…. After

all, thanks to Frank, we all have a lot of money riding

on it…. We must do this with a fiery determination,

not on some days, not on most days but day in and

day out, give it your best, not 50%, not 75%, not

100%, but 150%.‖](https://image.slidesharecdn.com/williamkblackoncontrolfraud2013-130716110453-phpapp01/85/William-K-Black-on-Control-Fraud-2013-138-320.jpg?cb=1373972941)

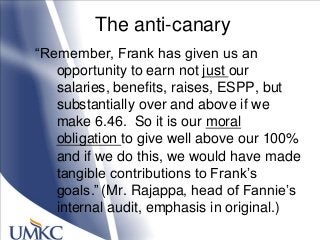

![Underling Compensation

―In many popular accounts of the global

financial crisis [pay] conjures up images

of top management bonuses, or the

practice of awarding stock options on a

large scale. However, in Ireland at least,

one should not neglect incentives set for

middle-level bank management and

indeed loan officers.‖ 2010 Ireland Rep.

But the CEOs created those

incentives](https://image.slidesharecdn.com/williamkblackoncontrolfraud2013-130716110453-phpapp01/85/William-K-Black-on-Control-Fraud-2013-140-320.jpg?cb=1373972941)

![―Don‘t Ask; Don‘t Tell‖

Any request for loan level tapes is

TOTALLY UNREASONABLE!!! Most

investors don't have it and can't

provide it. [W]e MUST produce a

credit estimate. It is your

responsibility to provide those credit

estimates and your responsibility to

devise some method for doing so.

[S&P ‘01, emphasis in the original.]](https://image.slidesharecdn.com/williamkblackoncontrolfraud2013-130716110453-phpapp01/85/William-K-Black-on-Control-Fraud-2013-145-320.jpg?cb=1373972941)

![Courage v. Dogma

―there was a socio-political context in which

it would have taken some courage to

seem to prick the Irish property bubble.‖

―generic weaknesses in [EU] regulation and

supervision‖

Contrast to the S&L Debacle: Gray v. a majority of

the House, President Reagan, Speaker Wright & the

Keating Five. Took them all on simultaneously.](https://image.slidesharecdn.com/williamkblackoncontrolfraud2013-130716110453-phpapp01/85/William-K-Black-on-Control-Fraud-2013-154-320.jpg?cb=1373972941)

![Gresham‘s Grim Dynamic

―[I]t was a slippery slope. What

happened in '04 and '05 with respect

to subordinated tranches is … our

competition, Fitch and S&P, went

nuts. Everything was investment

grade. We lost 50% of our coverage

[business share]….‖

[Moody‘s 2007]](https://image.slidesharecdn.com/williamkblackoncontrolfraud2013-130716110453-phpapp01/85/William-K-Black-on-Control-Fraud-2013-177-320.jpg?cb=1373972941)

![If you don‘t count it….

Property crime rates in 2007 were

at or near the lowest levels

recorded since 1973, the first

year that such data were

available. Property crime rates

fell during the previous 10

years (1998-2007) [12.17.08]

http://www.ojp.usdoj.gov/bjs/pub/press/cv07pr.htm

Reality: Property crime: never higher](https://image.slidesharecdn.com/williamkblackoncontrolfraud2013-130716110453-phpapp01/85/William-K-Black-on-Control-Fraud-2013-181-320.jpg?cb=1373972941)