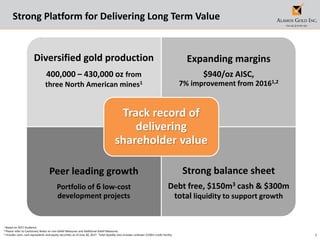

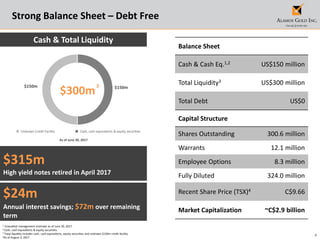

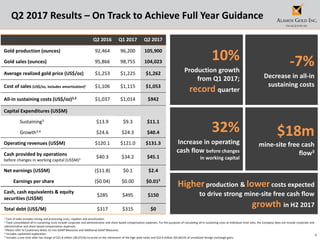

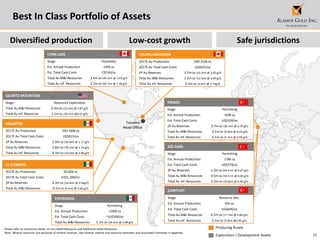

The August 2017 Corporate Presentation provides an overview of Alamos Gold Inc. It cautions readers that certain statements in the presentation regarding forecasts, estimates, potential mineralization, and future plans and objectives are forward-looking statements that involve risks and uncertainties. It also notes that figures presented are in US dollars unless otherwise indicated, and provides information on non-GAAP measures and additional GAAP measures used. The presentation highlights Alamos Gold's diversified gold production, expanding margins, peer-leading growth portfolio, and strong balance sheet with no debt.