Olympic tax dodging

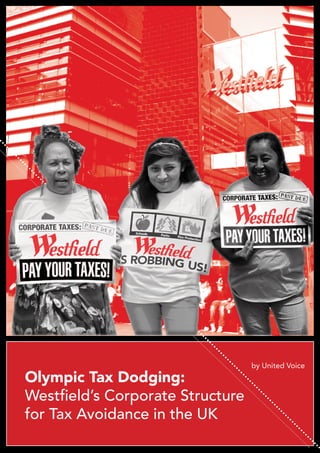

- 1. Olympic Tax Dodging: Westfield’s Corporate Structure for Tax Avoidance in the UK by United Voice

- 2. 2

- 3. And businesses who think they can carry on dodging that fair share, … they need to wake up and smell the coffee, because the public who buy from them have had enough. DAVID CAMERON UK PRIME MINISTER

- 4. United Voice - one of Australia’s largest unions - is organising to win better jobs, stronger communities, a fairer society and a sustainable future. United Voice has issued this report after a broad and ongoing examination of Westfield’s global corporate social responsibility track record. United Voice believes that multinational companies should have a positive impact in all of the communities in which they operate. Global trade unions, civil society groups and governments are increasingly focused on the issue of tax avoidance by multinational companies. Given that Australia will chair the G20 in 2014 and that corporate tax avoidance is on the agenda, United Voice believes that it is crucial that Australian companies operating globally show leadership in paying their fair share of taxes. United Voice previously prepared a report on Westfield’s property tax avoidance in the United States and has commissioned research into Westfield’s tax avoidance strategies in its home country, Australia. United Voice is pleased to work with community and union partners in the UK to encourage Westfield to genuinely support the communities in which it operates. Westfield must do better and pay its fair share. Published April 2014. For more information contact: westfieldwatch@unitedvoice.org.au

- 5. 5 Executive Summary The age of austerity has generated a growing outcry against multinational tax avoidance, with technology companies like Apple and Google receiving significant attention. This report examines the corporate structure of another global giant - Westfield, a ‘bricks and mortar’ company. By examining its company reports, we suggest how Westfield may not be paying its fair share of tax in the UK. Westfield is the world’s largest owner, operator and developer of shopping centres. It has a substantial and growing presence in the UK. In London, Westfield owns and operates Europe’s two largest shopping malls, including the London Olympics shopping centre at Stratford City. The company also has another £2 billion in planned developments in the London area. Westfield promotes itself as providing economic development and urban renewal to local communities. Yet behind these claims is a hidden story of a complex corporate structure apparently designed to avoid UK tax payments. Previous research into the accounts of Westfield Shoppingtowns Limited – Westfield’s main UK subsidiary – indicated that this subsidiary paid just £464,000 in tax between 2001 and 2011 on an income of £2.7 billion. Building on this research, this report suggests that in 2012 Westfield was able to shift up to 75% of its profits to related parties registered outside of the UK. A case study of Westfield’s Stratford City Shopping Centre also indicates that in 2012 Europe’s largest shopping centre had an effective tax rate of just 0.5%! At the heart of this story is Westfield’s complex corporate structure. The multinational has more than 150 subsidiaries registered in the UK and an unknown number of subsidiaries registered in tax havens like Jersey and Luxembourg.

- 6. 6 This complex corporate structure facilitates aggressive tax avoidance. The use of limited partnerships helps to shift profits to subsidiaries registered outside of the UK. In 2012, £93.7 million of Westfield’s reported profits were shifted offshore through limited partnerships, where the profit was no longer subject to UK taxation. The case study of Westfield Stratford City Shopping Centre also helps to explain Westfield’s tax avoidance strategy. This shopping centre is well-known as part of the 2012 London Olympics site. Westfield owns the centre in partnership with two of the world’s largest pension funds. Despite having strong responsible investment policies, these funds are a core part of the complex corporate structure used to avoid UK tax payments. In 2012, the Westfield Stratford City Shopping Centre made a reported profit of £39.7 million. The subsidiaries that own it paid a total of £211,028 in tax on that profit. This equates to an effective tax rate of 0.5%. How is this possible? Once again, Westfield appears to have used limited partnerships to shift 99% of Stratford City’s profits offshore. In 2012, £60.1 million went to other companies registered in Jersey, Guernsey and Delaware, where they were no longer subject to UK taxation. If this £60.1 million was taxed at the current corporate tax rate of 24%, the Stratford City Shopping Centre would have paid £14.4 million more in tax in 2012 alone. That’s 68 times more than the shopping centre actually paid! Previous investigations have revealed that Westfield’s tax avoidance is not unique to the UK, but appears to be part of the company’s global corporate policy. In 2012, Westfield avoided an estimated US$116.4 million (£72.2 million) in US local property tax. A recent analysis indicates Westfield is tax aggressive compared to other Australian based corporations. The company had an estimated effective corporate tax rate of under 4%, well below the 30% statutory rate. When multinationals and global investors fail to pay a fair share of taxes, communities suffer. We need to close these legal loopholes and change the tax laws. Until that happens, we need to pressure corporations and investors to follow the spirit of the law. That means paying tax to support communities where profits are made. Westfield received £200 million in taxpayer subsidies from the Olympic Development Agency ... it would take 944 years to repay this subsidy...

- 7. 7

- 8. 8 Contents Executive Summary 5 Westfield’s Corporate Structure in the UK 9 Possible Benefits of the Structure 12 Stratford City Case Study 17 Does Stratford City Pay its Fair Share of Corporate Tax 19 Stratford City and Related Party Transactions 28 Conclusion 34 Diagrams Diagram 1: Westfield UK Corporate Structure Diagram 2: Stratford City Shopping Centre Ownership Stucture Diagram 3: Distribution of Profit across the Stratford City Group Compared to Tax Paid Diagram 4: Profit/Loss, Tax Paid, Turnover and Distributions to Related Parties Diagram 5: Related Party Transactions across the Stratford City group of subsidiaries Appendixes Appendix 1: Who is Westfield in the UK? 37 Appendix 2: Westfield’s Jersey Subsidiaries 40 Appendix 3: Limited Partnerships 43 Appendix 4: Limited Partnerships and Profit Distribution 46 Endnotes 49 10-11 20-21 24-25 26-27 32-33

- 9. 9 Although Westfield’s UK branch only operates five shopping centres and two development sites, it manages a corporate structure that consists of more than 150 subsidiaries in the UK alone.1 These subsidiaries interrelate and interact in a highly complicated way. Additionally, the company maintains other subsidiaries in the secrecy jurisdictions of Jersey, Luxemburg and Delaware. Many of these tax haven based subsidiaries are ultimate parent companies of subsidiaries operating in the UK. Although the company itself has an extremely complex corporate structure, only one of these subsidiaries reports having any employees – Westfield Shoppingtowns, which is responsible for the day-to-day management of Westfield’s UK and Europe operations.2 While the function of some subsidiaries is clear, for many others it is not. Moreover, the company has established complex ownership structures which are difficult to understand at face value. The subsidiaries can broadly be split into the following categories (in order of prevalence): • Limited Partnerships (and companies that act as General Partners to Limited Partnerships) • Companies that invest in property through other subsidiaries – sometimes in a very indirect way • Companies which exist to hold an interest in a limited partnership – in some instances this interest is less than 1% • Development companies • Utilities companies, which provide electricity or other utilities to shopping centres • Companies which manage the business of other subsidiaries • Financiers to group undertakings • Holding companies • Companies that manage car parks • Property Managers and Letting Agents (Westfield Shoppingtowns is the only subsidiary in this category) The first three categories make up more than 50% of all of Westfield’s subsidiaries in the UK. Westfield currently owns its UK subsidiaries primarily via a holding company in Australia – Westfield Holdings. Westfield Holdings in turn owns a number of subsidiaries registered in Australia and Jersey which act as parent companies for the remaining subsidiaries in a complex network of ownership. The most important of these are Cavemont Pty Ltd and Westfield UK Acquisitions (Jersey) Ltd, registered in Jersey. Westfield’s UK operations are divided between these two companies. Westfield’s Corporate Structure in the UK

- 10. 10 Diagram 1: Westfield’s UK Corporate Structure The following diagram is a simplified representation of the company’s operations in the UK. It also identifies which elements of the structure belong to which shopping centre.

- 11. 11

- 12. 12 Possible Benefits of the Structure Westfield relies heavily on the use of limited partnerships to structure their operations in the UK. A limited partnership requires one or more limited partners in addition to a general partner. Limited partners are by definition limited in their liability to the company, while general partners shoulder the bulk of legal and financial liability. In a legal sense, the limited partners will often provide all of the capital needed for the operation of the partnership, while the general partner oversees the management of the capital.3 This is a particularly useful way for a company to manage joint venture partnerships. Limited partnerships also offer tax advantages, in that the partnership itself is not obliged to pay tax. Tax is instead paid by each individual partner once profits have been redistributed from the partnership.4 If, however, a partner is registered in a separate jurisdiction (for instance, in a tax haven such as Jersey), they do not usually pay tax on the profits generated by the limited partnership within the UK (there are exceptions for income such as rents and in some situations where it can be shown that management was in the UK). Limited partnerships utilised by Westfield report their taxation obligations in the following manner: It appears that both Westfield and their joint venture institutional investor partners have successfully utilised these structures to channel money into subsidiaries registered in secrecy jurisdictions such as Jersey and Guernsey. Appendix 3 of this report demonstrates in detail the extent to which limited partnerships have been utilised by Westfield in the UK as well as their association with subsidiaries registered in Jersey, Guernsey and Delaware. A couple of specific examples here help to demonstrate this point:

- 13. 13 In this example, only the General Partner, Stratford Retail Shopping Centre Investments (No. 1) General Partner Limited, pays tax in the UK. This means that potentially only 0.5% of the profits of this partnership are taxable in the UK.5 Example 1 Example 2 In this example, four companies registered in the UK have an interest in this partnership, which combined equals 1.5%. These four companies potentially pay tax in the UK; however the remaining 98.5% is held by companies registered in Jersey, which probably do not pay tax in the UK.6 Example 3 In this example, only the General Partner, White City Investments (No. 1) General Partner Limited, is definitely taxable in the UK. This means that maybe only 0.5% of the profits of this partnership are taxable. The remaining 99.5% interest is held by a Jersey Unit Trust.7

- 14. 14 This report examines the distribution of profit reported by limited partnerships owned by Westfield in the UK demonstrating: (See Appendix 4) • 75% of profits reported by these limited partnerships in 2012 were distributed to subsidiaries registered outside of the UK. • A further 7% was distributed to other limited partnerships registered in the UK, leaving just 18% of reported profits distributed to companies registered and paying tax in the UK.

- 15. 15 The distribution of profits to companies registered outside of the UK suggests that these profits may not have been taxed within the UK. If these profits were taxed at the current corporate tax rate of 24%, Westfield would have paid an additional £22.4 million in UK tax in 2012.8 While these structures appear to have tax advantages, they also have the additional advantage of being difficult to trace. Through complex corporate structures, Westfield has hidden its use of tax havens. The most recent list of Westfield owned subsidiaries in Jersey was published in 2010. Since then, Westfield has ceased disclosing the full list of overseas subsidiaries. It is evident that the 2010 list does not reflect the current state of the company’s use of the Jersey tax havens, and therefore the full extent of the company’s association with secrecy jurisdictions is unknown but may be quite extensive. Appendix 2 of this report details 35 known subsidiaries registered in tax havens. In February 2014, United Voice contacted the Westfield Group to ask why the company ceased disclosing its overseas subsidiaries. The company responded that these subsidiaries were not considered to be ‘material to our securityholders’.9 Distribution of profits from Westfield Limited Partnerships in 2012

- 16. 16 ... taxes need to be fair, as well as low, in order to preserve the legitimacy of free markets… The essential principle is that you should normally pay tax in the country where you’ve earned the revenue. Tony Abbott Prime Minister of Australia

- 17. 17 The diagram of the company’s UK structure represented earlier in this report has been greatly simplified and reflects only about a third of all of Westfield’s subsidiaries registered in the UK and almost none of those registered in Jersey. A map of the complete structure would be much more convoluted, involving many more subsidiaries and a complex network of ownership across multiple jurisdictions. The case study of a single shopping centre – Westfield Stratford City – helps to demonstrate the complexity of the company’s corporate structures. A total of 28 subsidiaries registered in Australia, the UK, Jersey, Guernsey and the US are involved in the ownership, management and development of Westfield Stratford City.10 Only one of these companies – Westfield Shoppingtowns Limited – reports having any employees.11 Westfield Stratford City is a joint venture partnership between Westfield Holdings, the Canadian Pension Plan Investment Board (CPPIB) and the APG, a Dutch pension fund manager. APG is the wholly-owned asset management subsidiary of ABP, one of the world’s largest pension funds. CPPIB is also in the top 10 of global pension fund investors and both funds have robust responsible investment policies. CPPIB and APG each own a 25% interest in this property and collectively own a 50% interest. The title of the land that shopping centre occupies is registered to two subsidiaries – Stratford City Shopping Centre (No. 2) Nominee A Limited and Stratford City Shopping Centre (No. 2) Nominee B Limited.12 These two subsidiaries are jointly controlled by Westfield, APG and CPPIB via the jointly owned subsidiary Stratford City JV Business Manager Limited.13 In addition to having directors on the board of this company, CPPIB and APG also have directors on the boards of at least 7 other companies that are part of this complex structure.14 Diagram 2 demonstrates that this joint venture is managed primarily through several limited partnerships, where the limited partners are primarily registered in the secrecy jurisdictions of Jersey, Guernsey and Delaware15 . CPPIB and APG own their interests in the shopping centre via two mutually owned subsidiaries – Canneth BM (Shareholder) Co. Ltd registered in Jersey and Canneth Limited Partnership Inc. registered in Guernsey. In 2012 they received income and distributions worth £230.5 million.16 It appears that these pension funds also avoid UK tax payments through this structure. Westfield, as joint owner, manager and developer of the centre, has a much more complicated relationship to the shopping centre. Financially, its ownership of the property seems to be managed through two Jersey Unit Trusts, however a number of subsidiaries are also owned through the Australian-based subsidiary Cavemont Pty Ltd. The actual development of the centre was managed by Stratford City Developments Limited, a subsidiary of another Jersey based subsidiary. Meanwhile, the management of the centre’s physical operations is run by Westfield Shoppingtowns Limited, which is a subsidiary of an entirely separate arm of the company – the Australian registered Westfield American Investments Pty Ltd – and relates to the rest of the shopping centre structure principally through extracting management fees from the other subsidiaries in the group. Stratford City Case Study ABP, with 2.8 million beneficiaries, is the pension fund for Dutch government, public and education workers. CPPIB is a national pension plan covering 18 million Canadians. Both funds are joint venture partners to Stratford City.

- 18. 18 ...traditional defence of compliance is dead; the distinction between evasion (illegal) and avoidance (lawful) has dissolved in the eyes of governments, NGOs and citizens Corporate Citizenship

- 19. 19 Does Stratford City Pay its Fair Share of Corporate Tax? The impact of the corporate structure is apparent when we assess the finances of the Stratford City group of subsidaries as a whole. In particular, the way in which the structure may facilitate tax avoidance becomes clearer. At first glance, the Stratford City Shopping Centre contributed £1.3 million to tax in 2012. Overall, the group made a combined profit of £33.4 million. This therefore equates to an effective tax rate of around 4%. Despite this, these first impressions are misleading primarily because of the inclusion of Westfield Shoppingtowns into the analysis. Although Westfield Shoppingtowns is a key part of the Stratford City group, it is also responsible for the management of four other centres and two development sites. Therefore, the accounts of this subsidiary do not exclusively reflect the finances of Stratford City. If we discount the accounts of Westfield Shoppingtowns, the discrepancy between profits made and tax paid is even starker (see Diagram 3 below). In this instance, the group as a whole made a combined profit of £39.7 million but paid just £211,028 in tax. This equates to an effective tax rate of 0.5%. To truly understand how this outcome is achieved, it is useful to look at which subsidiaries reported a profit and which reported a loss. Diagram 3 (below) indicates that 4 subsidiaries reported a loss of £21.4 million combined. Just one of these subsidiaries paid tax equal to £798, while one other received a tax rebate worth £18,568. By contrast, 9 subsidiaries reported a profit of £61.2 million combined. Of these 9 subsidiaries, just 5 paid tax worth £229,663. However, when we look at where the profit is concentrated, we see that the subsidiaries reporting the largest amount of profits are limited partnerships, which combined account for 98.7% (or £60.3 million) of the group’s combined reported profits.17 As stated earlier, limited partnerships do not themselves pay tax, since tax is calculated once the money is redistributed to the individual partners. The Stratford City group of subsidiaries made £39.7 million but paid £211,028 in tax, an effective tax rate of 0.5%.

- 20. 20 Diagram 2 It is also possible to identify which elements of the structure belong to which shopping centre: Diagram 2: Stratford City Shopping Centre Ownership Structure

- 21. 21

- 22. 22 Table 1: Accounts of the Stratford City Group, 2012 Subsidiary Profit Turnover Tax Paid ETR18 Stratford City Developments -£21,216,643 £12,777,573 £0 Stratford Utilities Limited £590,757 £7,022,339 £141,455 Stratford Cch Limited -£132,081 £4,583,696 £798 Stratford City Car Park Limited -£70,398 £2,913,425 -£18,568 Stratford City JV Business Manager Limited £58,013 £64,000 £1,030 Stratford City Shopping Centre (No. 2) General Partner Limited -£5,636 £0 £0 Stratford City Shopping Centre (No. 1) General Partner Limited £146,170 £0 £50,992 Stratford Retail Shopping Centre Investments (No. 1) General Partner Limited £557 £0 £18,433 Stratford Retail Shopping Centre Investments (No. 2) General Partner Limited £1,252 £0 £17,753 SUBTOTAL – Subsidiaries -£20,628,009 £27,361,033 £211,893 Limited Partnerships Stratford City Shopping Centre (No. 2) Limited Partnership £938,000 £4,062,000 £0 Stratford City Shopping Centre (No. 1) Limited Partnership £47,344,000 £109,371,000 £0 Stratford Retail Shopping Centre Investments (No. 1) Limited Partnership £6,057,656 £0 £0 Stratford Retail Shopping Centre Investments (No. 2) Limited Partnership £6,035,381 £0 £0 SUBTOTAL - Limited Partnerships £60,375,037 £113,433,000 £0 TOTAL GROUP (Ex-Shoppingtowns) £39,747,028 £140,794,033 £211,893 0.5% Westfield Shoppingtowns Ltd -£6,393,000 £172,176,000 £1,078,000 TOTAL GROUP (Plus Shoppingtowns) £33,354,028 £312,970,033 £1,289,893 3.9%

- 23. 23 When we look at the structures of these limited partnerships, we learn that 99.5% of its profits were distributed to subsidiaries registered outside of the UK. These subsidiaries were registered in the secrecy jurisdictions of Jersey, Guernsey and Delaware. This suggests that these profits may not have been taxed within the UK jurisdiction. If this amount was taxed at the current corporate tax rate of 24%, the Stratford City shopping centre would have paid an additional £14.4 million in tax – or 68 times more than was actually paid in 2012. Table 2: Distribution of Profits from Stratford City Limited Partnerships Subsidiary Profit/Loss before tax Distributions to UK companies % of profit Distributions to Tax Havens/ Other Jurisdictions % of profit Stratford City Shopping Centre (No. 1) Limited Partnership £47,344,000 £236,720 0.5% £47,107,280 99.5% Stratford City Shopping Centre (No. 2) Limited Partnership £938,000 £4,690 0.5% £933,310 99.5% Stratford Retail Shopping Centre Investments (No. 1) Limited Partnership £6,057,656 £30,288 0.5% £6,027,368 99.5% Stratford Retail Shopping Centre Investments (No. 2) Limited Partnership £6,035,381 £30,177 0.5% £6,005,204 99.5% TOTAL £60,375,037 £301,875 0.5% £60,073,162 99.5% Without this complex corporate structure, the Stratford City shopping centre would have paid an additional £14.4 million in tax – or 68 times more than was actually paid in 2012.

- 24. 24 Diagram 3: Distribution of Profit Across the Stratford City Group Compared to Tax Paid

- 25. 25

- 26. 26 Diagram 4: Profit/Loss, Turnover and Distributions at Stratford City

- 27. 27

- 28. 28 Another aspect within the accounts of Westfield’s Stratford City subsidiaries which may be of interest from a tax perspective is the disclosure of a large number of related party transactions taking place within the group and between the group and other related parties owned by Westfield and its joint venture partners. Unlike most other UK-based subsidiaries owned by Westfield, the majority of the subsidiaries examined in the Stratford City case study disclose the details of its related party transactions within its annual accounts. An analysis of these disclosures reveals dozens of transactions, equalling more than £668.4 million flowing between subsidiaries and other related parties in 2012. These transactions reflect: • loans made between related parties; • management fees (paid principally to Westfield Shoppingtowns Limited); • payments for the provision of services (e.g. from related parties that offer utilities services); and • distributions made to partners of limited partnerships. The last of these is not technically a related party transaction and has been recorded in Diagram 4 in orange, to demonstrate the flow of profits from the group to limited partners registered externally to the UK. The pink arrows indicate transactions which have been disclosed but not in sufficient detail to understand where the money was directed. The sums of money recorded in the accounts range from just £1 to more than £170 million. Stratford City and Related Party Transactions

- 29. 29 Example 1: Stratford Utilities Limited Two specific examples are useful to help explain the flows of money represented in Diagram 5. This subsidiary has a stated purpose of: ‘the acquisition and distribution of electricity to the tenants of the Westfield Stratford City Shopping Centre.’ Amounts due from other related parties: • During the 2012 financial year, Stratford Utilities Limited recharged energy costs to the following subsidiaries: ÜÜ Stratford City Car Park Limited - £30,229 ÜÜ Stratford City Developments Limited - £24,969 ÜÜ Stratford City Offices (No. 5) Limited Partnership - £131,144 ÜÜ Stratford City Shopping Centre (No. 1) Limited Partnership - £179,618 • An additional payment of £5,818 was due from Retail Utilities Solutions Limited, the purpose of which is not disclosed. Amounts due to other related parties • At the end of the 2012 financial year, the company owed management costs to Westfield Shoppingtowns Limited worth £3,726. This was the balance after the company paid management fees worth £669,976 during the financial year. • The company received a loan worth £10,000 from Westfield UK Finance Limited. • The company also owed £5,998 to Stratford CCH Limited, the purpose of which is not disclosed.

- 30. 30 Example 2: Stratford City Shopping Centre (No. 1) Limited Partnership The same mapping can be followed through for the remaining subsidiaries, to produce diagram 5, which maps money flows across the Stratford City group of subsidiaries. While it is impossible to really understand the purpose and nature of these transactions, the sheer volume of related party transactions not only highlights the complex nature of Westfield’s UK group structure but also raises some questions as to the purpose of this structure. Accountants and economists have both pointed out the relationship between related party transactions and tax avoidance. Chen-Kuo and Wen-Wen state that one of the core reasons behind the development of related party transactions as a strategic accounting method was to help ‘realize the minimization of overall tax burden among the related parties.’ Transfer pricing between related parties registered in different international jurisdictions is one of the key mechanisms for this.19 Sikka and Willmott have argued that ‘transfer pricing practices are responsive to opportunities for determining values in ways that are consequential for enhancing private gains, and thereby contributing to relative social impoverishment, by avoiding the payment of public taxes’.20 A large proportion of related party transactions appear to be undertaken by limited partnerships. Additionally, these partnerships also distribute profits to limited partners, as follows. The stated purpose of this partnership is ‘to carry on the business of directly or indirectly maintaining and letting property for investment purposes. The principal activity of the Partnership continued to be the development, ownership and management of the Westfield Stratford City Shopping Centre, London.’ At the end of 2012, the Partnership was owed £2.6 million from related parties, and in turn owed £464.6 million to related parties. The Partnership also paid £64.3 million to related parties in distributions. Amounts due from other related parties • At the end of the 2012 financial year, Stratford CCH Limited owed the Partnership a loan worth £2,587,550 (including interest). The Partnership also owed Stratford CCH Limited £249,840 for cooling and heating services, leaving a balance of £2,338,310. • Additional payments were due from the following related parties, for reasons that were not disclosed: ÜÜ Stratford City Car Park Limited - £79,000 ÜÜ Stratford City JV Business Manager Limited - £4,000 ÜÜ Stratford City Offices (No. 5) Limited Partnership - £188,000 ÜÜ Stratford City Shopping Centre (No. 2) Limited Partnership - £26,000 ÜÜ Stratford City Shopping Centre Jersey Unit Trust (No. 1) - £13,000 Amounts due to other related parties • The Partnership owed management fees worth £143,910,422 to Westfield Shoppingtowns Limited • The Partnership had a loan worth £170,917,142 from Canneth Limited Partnership Inc, a Guernsey based subsidiary of CPPIB and APG. • The Partnership has a loan worth £170,917,142 from Westfield UK Finance Limited. • Additional payments were due to the following related parties, for reasons that were not disclosed: ÜÜ o MH (No. 1) Limited Partnership - £6,000 ÜÜ o Stratford City Offices (No. 4) Limited Partnership - £2,000 ÜÜ o Stratford City Shopping Centre (No.1) General Partner Limited - £1,134,000 ÜÜ o Stratford Retail Shopping Centre Investments (No. 1) General Partner Limited - £21,000 ÜÜ o Stratford Retail Shopping Centre Investments (No. 2) General Partner Limited - £21,000 ÜÜ o Stratford Utilities Limited - £180,000 ÜÜ o The Wilmslow (No. 3) Limited Partnership - £5,000 Distributions made to other related parties • During the year, the Partnership apportioned £237,000 worth of profit to Stratford City Shopping Centre (No. 1) General Partner Limited and £47,107,000 to Stratford Managing Trustee Limited, which then redistributed it to Stratford City Shopping Centre Jersey Unit Trust (No. 1). • Subsequent to the end of the financial year, the Partnership distributed profits worth £17 million to the Partners.

- 31. 31 There are some forms of avoidance that have become so aggressive that I think it is right to say these raise ethical issues, and it’s time to call for more responsibility and for governments to act accordingly. David Cameron UK Prime Minister

- 32. 32 Diagram 5: Related Party Transactions Across the Stratford City Group of Subsidiaries

- 33. 33

- 34. 34 This report has investigated some of the ways that Westfield appears to be avoiding paying its fair share of UK taxes. Despite this, Westfield continues to present itself as a responsible corporation that gives back to local communities. When Westfield London opened in 2008, the company claimed to have ‘transformed a derelict 43-acre former railway yard in Shepherd’s Bush into a genuine community hub,’ in the process creating more than 8,000 full-time and part-time jobs.21 The same logic has also convinced governments of the need to support major corporations like Westfield through government subsidies. In 2009, Westfield’s Chief Operating Officer in the UK, Peter Miller argued that UK taxpayer money should be funnelled into supporting development corporations as a way of increasing urban regeneration: ‘Regeneration schemes of the past decade in which private developers shoulder the majority of the costs up front are no longer viable under the current economic climate. Westfield supports a more collaborative approach between public and private sectors which will spread the risk and ultimately allow much needed regeneration projects to be brought forward much more quickly than under present circumstances. … With a typical scheme generating millions of pounds of tax revenue, it makes sense for new legislation to allow local authorities and the Treasury to use that money to kick- start the development which would result in wide spread benefits, not least to the local community where such investment is so greatly needed.’ 22 Conclusion

- 35. 35 In 2011, Westfield received £200 million in taxpayer subsidies from the Olympic Development Agency to develop infrastructure surrounding the Stratford City Shopping Centre.23 Despite this, it would take 944 years to repay this subsidy based on the 2012 company taxes paid on this property. At the time the subsidy was granted, the media reported that the money was given to Westfield in lieu of paying for infrastructure upgrades in some of the poorest areas of Wales.24 We are left wondering whether communities would have benefited more from an investment in infrastructure rather than through subsidising the world’s largest shopping centre owner. The disjuncture between Westfield’s words and its actions as a corporate taxpayer is stark. As Westfield prepares to spend £2 billion on further developments at Westfield London and in Croydon, local and national governments should put measures in place to make sure that Westfield, and its investment partners, are paying a fair share of tax. UK communities should be very wary of the public image put forward by Westfield and start to question why a ‘bricks and mortar’ development company needs so many Jersey- based subsidiaries. Westfield also recently announced a conditional agreement to sell its interests in 3 UK regional shopping centres – Merry Hill, Derby and Sprucefield – for £597 million. Will these sales generate UK tax revenues? Will the new owner, Intu Properties plc, maintain a similar complex corporate structure to avoid UK tax payments? Tax avoidance is widespread amongst UK- based companies and encouraged by leading accountancy firms.25 As Prem Sikka has noted: ‘Opaque corporate structures, complex transactions, secrecy and offshore jurisdictions have become a hallmark of tax avoidance schemes. The UK’s 100 largest companies listed on the London Stock Exchange have more than 34,000 subsidiaries and joint ventures. Around 8,000 of these are located in sparsely populated tax havens that offer low tax rates or require limited disclosure to other tax authorities. 98 of the FTSE 100 companies have a presence in tax havens.’ 26 Yet, what is unique about Westfield is that a property company is using tax avoidance practices similar to those used by technology and financial firms. An almost impenetrable web of complex related party transactions and limited partnerships appears to allow the company to shift debt and profit around in order to minimise tax payments. For many years, tax planning strategies of this nature have flown under the radar of governments, shareholders and the public alike. Yet, with a growing focus on corporate tax avoidance, attitudes are rapidly changing. Speaking to the World Economic Forum in January 2013, UK Prime Minister David Cameron said: ‘there are some forms of avoidance that have become so aggressive that I think it is right to say these raise ethical issues, and it is time to call for more responsibility and for governments to act accordingly. … Individuals and businesses must pay their fair share. And businesses who think they can carry on dodging that fair share, …they need to wake up and smell the coffee, because the public who buy from them have had enough.’ 27 In 2011, Corporate Citizenship, a corporate consulting firm issued a report, Tax as a Corporate Responsibility Issue, which stated that the ‘traditional defence of compliance is dead; the distinction between evasion (illegal) and avoidance (lawful) has dissolved in the eyes of governments, NGOs and citizens.’28 Due to growing interest in the issue, they have produced a 2014 report, Tax: Time for Action, to guide companies on how to respond to the continuing debate on corporate tax avoidance. 29 Institutional investors and other shareholders are beginning to take notice as well.

- 36. 36 A recent report by Sustainalytics, a research and analysis firm for responsible investors, stated that the ‘global debate is shifting and as regulators look to crack down on corporate tax avoidance, it is in companies’ best interests to proactively adopt responsible tax practices. First and foremost, MNCs should not locate group companies in tax havens unless there is a justification based on legitimate economic activity.’30 It is therefore surprising to find two of the largest global investors – CPPIB and APG – entangled in Westfield’s tax avoidance practices. Both funds have responsible investment policies that should preclude them from these types of aggressive tax avoidance practices. CPPIB states that: ‘We believe that organizations that manage Environmental, Social and Governance (ESG) factors effectively are more likely to create sustainable value over the long-term than those that do not. …As an owner, we monitor ESG factors and actively engage with companies to promote improved management of ESG, ultimately leading to enhanced long-term outcomes in the companies and assets in which 18 million CPP contributors and beneficiaries have a stake.’ 31 Similarly APG states that managing ‘pension assets is about more than realizing financial gains’ and that APG is ‘a leader in Responsible Investment in real estate.’ 32 While institutional investors such as these funds are expected to effectively manage tax liabilities, participating in this aggressive tax avoidance scheme is another story. It seems clear that by any standard, the aggressive tax avoidance outlined in this report falls far outside of what is deemed responsible practice for long-term institutional investors. Westfield, CPPIB and APG may well find that their participation in these schemes places them behind the times in a world where corporate tax avoidance is receiving increased scrutiny. Not only should companies like Westfield adopt responsible tax practices, but CPPIB and APG and other institutional investors must incorporate a review of tax practices as a core part of their responsible investment policies. Aggressive tax minimisation may generate nominally higher returns in the short term, but undermines communities, investments and economic interests over the long-term. Westfield’s tax avoidance strategies need to be scrutinised by all of the relevant authorities, including in the UK and Australia. Both Governments need to follow their tough talk on tax avoidance with effective action. Given that Australia is currently leading the G20, Westfield’s global tax avoidance practices provide the Australian Government with a home-grown example of why national and global rules need to be changed to stop aggressive tax avoidance by multinational corporations. A recent report by the Sydney-based Lowy Institute discussed progress ‘in combatting tax evasion and avoidance’.33 A key finding of the report was that, ‘Australia should focus on taxpayers in G20 countries disclosing more targeted information about their tax planning strategies. Public disclosure is a powerful tool and does not require the negotiation of complicated international agreements.’ Ironically, the Lowy Institute shares a chairman and three other board members with Westfield. It would be encouraging if Westfield set a positive example and improved disclosure and transparency on its own tax planning strategies. Westfield’s tax avoidance practices in the UK are not illegal, but clearly violate the spirit of the law. Global tax rules need to be changed to create a fair system that gives back to the communities where profits are generated. In the meantime, corporations and institutional investors need to be held to a higher moral standard. Westfield, and its shareholders and investment partners, may learn that a backlash to aggressive tax avoidance practices can create significant regulatory risk, financial costs and reputational damage.

- 37. 37 Appendix 1: The Westfield Group, with 21,856 retailers in 9.6 million square meters of retail space, owns and operates one of the world’s largest shopping centre portfolios with 99 centres located in Australia, New Zealand, the United States and the United Kingdom.35 Westfield (WDC) is headquartered in Sydney and is one of the largest entities listed on the Australian Securities Exchange. In 2012, Westfield shopping centres had more than 1.1 billion customer visits which generated AU$40 billion (£23.7 billion) in retail sales. Westfield’s global property portfolio was valued at AU$67.8 billion (£40.2 billion).36 In 2012, Westfield made a net profit of AU$1.72 billion (£1 billion) and was managing an AU$12 billion (£7.1 billion) development pipeline.37 Westfield started operating in the UK in 2000.38 Since then, Westfield claims that it has developed ‘one of the United Kingdom’s most outstanding shopping centre portfolios’.39 Westfield currently operates five shopping centres in the UK and has just signed a partnership agreement with Hammerson to develop a sixth centre in Croydon. Westfield’s UK portfolio currently generates income growth of 4-5%.40 Westfield claims average retail sales for Westfield London and Stratford City as £829 per square feet (combined).41 Centre Retailers Retail Space (ft2 ) Customers (per year) Retail Sales (£m) Joint Venture Partner Westfield London 374 1.8 million 27.7 million £961.9 Commerz Real (50%) Stratford City 358 1.9 million 45.9 million £940.1 APG (25%), CPPIB (25%) Westfield Derby (Derbyshire) 231 1.1 million 25 million Hermes (33.3%) Merry Hill (West Midlands) 294 1.7 million 23 million QIC (66.7%) Sprucefield (Northern Ireland) 5 231,166 None Westfield Croydon Hammerson (50%) Westfield Bradford £301,875 0.5% 99.5% DEVELOPMENT DEVELOPMENT Who is Westfield in the UK?

- 38. 38 The Westfield brand in the UK Westfield has developed the two largest shopping centres in Europe – Westfield London and Westfield Stratford City. Combined, these two centres attract around 70 million shoppers each year, generating close to £2 billion in sales. The company claims to develop shopping centres that are highly productive, offer strong franchise value, and attract the world’s leading retail brands. Westfield believes that its centres are ‘an essential part of the community’s social and economic fabric’.42 Since 2000, Westfield claims to have ‘invested over £5.2bn and created over 25,000 permanent jobs in the UK’.43 Westfield has built its brand in the UK partially on the basis of its capacity to impact on the lives of local communities through economic development and urban regeneration. Its Westfield London site, opened in 2008, was said to have ‘transformed a derelict 43-acre former railway yard in Shepherd’s Bush into a genuine community hub,’ in the process creating more than 8,000 full-time and part-time jobs.44 A similar message was delivered around Westfield Stratford City, at the London Olympics site. Most recently, Westfield has joined in partnership with Hammerson to form the Croydon Partnership which they claim ‘will transform Croydon’s two main shopping centres Whitgift and Centrale into a retail and leisure destination which will reposition Croydon as the best place to shop, work and live in South London.’ It sees this as an opportunity to deliver growth, create thousands of jobs and breathe ‘new life into long neglected corners of South London’. The plan involved £1 billion worth of redevelopment, which is said to include the creation of 5,000 new jobs. Construction is not scheduled to begin until 2015 and completion is forecast for 2017. 44

- 39. 39 Westfield London Westfield London ‘changed the face of shopping in the capital’.46 In 2011, Westfield London was ranked number one shopping centre in the UK by Javelin Group.47 This centre was used as a case study in the 2011 sustainability report to prove the impact that Westfield has had on economic development and urban regeneration in the UK. Westfield London was said to have ‘transformed a derelict 43-acre former railway yard in Shepherd’s Bush into a genuine community hub which today attracts well over 26 million visits each year’. Westfield claims to have engaged in extensive community consultation over the development. ‘The outcome has been a world class retail and leisure site that has transformed the local environment by providing West London with a new community hub that integrates efficiently with its surrounds and provides the trade area with retail, leisure and community facilities and services.’ Westfield also claims that the new development ‘stimulated the local economy through job creation. During the project’s construction more than 10,000 jobs were created and more than 8,000 full-time and part-time jobs on completion’.48 Westfield Stratford City, London Westfield Stratford City is Europe’s largest urban shopping centre.49 Westfield has hailed the site as an example of its commitment to urban regeneration and economic development. The project is said to have ‘transformed a former industrial site into a community hub’. Although the site benefited in the short term from the influx of visitors during 2012 Olympics, ‘the development of this area however, was always with a long-term focus well beyond the Olympic Games, and it has resulted in many positive economic impacts that will have a lasting legacy for the local region’. Once again, community consultation was said to be a key part of the development process. Westfield also claims the project benefited the community through job creation: ‘Around 27,000 construction jobs were created during the build of Westfield Stratford City with approximately 10% of the workforce comprised of Newham residents. … On completion of Westfield Stratford City up to 10,000 permanent jobs were provided in retail, hotels and leisure – with over 40% of new workers living in the local host borough area and over 2,600 in Newham alone. At least 2,000 of these roles went to long-term local unemployed people.’ Croydon Partnership Westfield has joined in partnership with Hammerson’s to form the Croydon Partnership which it claim ‘will transform Croydon’s two main shopping centres Whitgift and Centrale into a retail and leisure destination which will reposition Croydon as the best place to shop, work and live in South London.’ It sees this as an opportunity to deliver growth, create thousands of jobs and breathe ‘new life into long neglected corners of South London’. The plan involved £1 billion worth of redevelopment, which is said to include the creation of 5,000 new jobs. Construction is not scheduled to begin until 2015 and completion is forecast for 2017.50 Recent media has heralded the role that Westfield is currently playing in redeveloping some of the most blighted areas of London. A recent article in The Australian argued in relation to the Croydon development that ‘Westfield will lead the transformation of this concrete and soul-less grime into a shiny, sparkling, vibrant destination of 2018’.51 Westfield Bradford Westfield has owned land in the West Yorkshire city of Bradford since 2004, but has consistently failed to develop this site into a shopping centre, despite receiving planning approvals from the local government. The pre-existing structures at the site were demolished between 2004 and 2006, but the site has remained empty since then. Westfield cited a lack of anchor tenants as causing the delay. The delays caused widespread anger amongst the residents of Bradford, leading to a protest movement called Occupy Westfield, which occupied the site for a period of some weeks in mid-2012. At the end of 2012, Westfield sold the site to Meyer Bergman, while retaining the right to the development. Construction on the centre began in December 2013. It appears Westfield will also retain management rights of the centre once it is constructed.

- 48. 48

- 49. 49 Endnotes 1. This report has relied on detailed mapping of Westfield’s corporate structure utilising a combination of the online corporate database provided by DueDil and company reports requested from Companies House. The complexity of Westfield’s UK structure, the company’s extensive use of subsidiaries in secrecy jurisdictions such as Jersey and the limited disclosure that Westfield provides shareholders with regards to their subsidiary holdings means that a complete map of the company has not been possible. The information presented here is based where possible on information provided within the company reports themselves and is correct to the best of our knowledge. In March 2014, after research for this report was largely completed, Westfield announced a conditional agreement to sell 3 UK regional shopping centres - Merry Hill, Derby and Sprucefield - for £597 million. 2. Westfield Shoppingtowns employed a total of 591 employees in 2012. See Westfield Shoppingtowns Limited, Report and Financial Statements, 31 December 2012, p.16. 3. See Companies House, Limited Partnerships: http://www.companieshouse.gov.uk/about/gbhtml/gpo2. shtml. Accessed 12 March 2014. Limited Partnerships and Limited Liability Partnerships: https://www.gov. uk/business-legal-structures/limited-partnership-and-limited-liability-partnership. Accessed 12 March 2014. 4. See Limited Partnerships, HM Revenue and Customs: http://www.hmrc.gov.uk/manuals/cgmanual/cg27020. htm. Accessed 12 March 2014. 5. Stratford Retail Shopping Centre Investments (No. 1) General Partner Limited, Report and Financial Statements, 31 December 2012. 6. MH (No. 1) General Partner Limited, Report and Financial Statements, 31 December 2012. 7. White City Investments (No. 1) General Partner Limited, Report and Financial Statements, 31 December 2012. 8. The 75% of profits made by limited partnerships and distributed to subsidiaries registered outside the UK comes to a total of £93.7 million in 2012. The amount that would have been paid had these profits been distributed to companies registered in the UK is found by applying the current corporate tax rate of 24%. 9. Correspondence between United Voice National President Michael Crosby and Simon Tuxen, Westfield Group Company Secretary, 21 February 2014. 10. This case study is based on an assessment of the 2012 financial accounts of twenty-eight subsidiaries directly related to the operation of Stratford City Shopping Centre, as well as numerous other subsidiaries which interact with these subsidiaries. The ownership structure is represented on the following page. 11. Westfield Shoppingtowns employed a total of 591 employees in 2012. See Westfield Shoppingtowns Limited, Report and Financial Statements, 31 December 2012, p.16. 12. Land Title for Westfield Stratford City, Montfichet Road, London (E20 1EJ). Title number EGL557876, Land Registry, Telford Office. 13. Stratford City Shopping Centre (No. 2) Nominee A Limited, Report and Financial Statements, 31 December 2012. Stratford City Shopping Centre (No. 2) Nominee B Limited, Report and Financial Statements, 31 December 2012. Stratford City JV Business Manager Limited, Report and Financial Statements, 31 December 2012.

- 50. 50 14. These companies are: Stratford City Shopping Centre (No. 1) General Partner Limited; Stratford City Shopping Centre (No. 2) General Partner Limited; Stratford City Car Park Ltd; Stratford CCH Limited; Stratford Utilities Limited; Stratford Retail Shopping Centre Investments (No. 1) General Partner Limited; and Stratford Retail Shopping Centre Investments (No. 2) General Partner Limited. Directors are listed in the Report and Financial Statements, 31 December 2012, for each of these companies and include at least one senior employee of CPPIB and APG. 15. Stratford City Shopping Centre (No. 1) General Partner Limited, Report and Financial Statements, 31 December 2012. Stratford City Shopping Centre (No. 2) General Partner Limited, Report and Financial Statements, 31 December 2012. Stratford Retail Shopping Centre Investments (No. 1) General Partner Limited, Report and Financial Statements, 31 December 2012. Stratford Retail Shopping Centre Investments (No. 2) General Partner Limited, Report and Financial Statements, 31 December 2012. 16. Canneth BM (Shareholder) Co. Limited, Annual Return, 1 January 2013, Jersey Registry of Companies. Distributions are reported in the accounts of limited partnerships as per the previous footnote. 17. This figure has been calculated by aggregating the accounts of all subsidiaries reporting a profit (and removing the accounts of those reporting a loss), which comes to a total combined profit of $61.2 million. The $60.4 million in profit reported by limited partnerships represents a share of 98.7%. 18. Effective Tax Rate (ETR) is here calculated by taking tax paid as a percentage of reported profit. 19. Lee Chen-Kuo, and Chuang Wen-Wen, ‘Study on the Motives of Tax Avoidance and the Coping Strategies in the Transfer Pricing of Transnational Corporations,’ Journal of American Academy of Business, Cambridge, Vol. 12, No. 1 (2007), pp.154-160. 20. Prem Sikka and Hugh Willmott, ‘The Dark Side of Transfer Pricing: Its role in tax avoidance and wealth retentiveness,’ Critical Perspectives on Accounting, Vol. 21, No. 4, (2010), pp.342-356 21. http://westfield2011.sustainability-report.com.au/development-westfield-london 22. BCSC, ‘Mps Call For Local Government Bonds To Fund Regeneration Projects And Help During Recession’ 30 June 2009 http://www.bcsc.org.uk/news_art.asp?news_id=427. Accessed 12 March 2014. 23. Jonathan Prynn, ‘Westfield given £200m to help build roads around mall,’ London Evening Standard, 16 September 2011. http://www.standard.co.uk/news/westfield-given-200m-to-help-build-roads-around- mall-6444220.html. Accessed 12 March 2014. 24. ‘Wales has ‘lost out’ over £200m Olympic grant for London shopping mall,’ Wales Online, 21 September 2011, http://www.walesonline.co.uk/news/wales-news/wales-lost-out-over-200m-1811754. Accessed 12 March 2014. 25. Simon Bowen, ‘PwC created “extraordinary” structure “to avoid tax on UK properties”, say MPs,’ The Guardian, 26 April 2013. 26. Prem Sikka, ‘The Tax Avoidance Industry,’ Radical Statistics, Issue 107, (2012), pp.15-30 27. David Cameron, “Prime Minister David Cameron’s speech to the World Economic Forum in Davos”, 24 January 2013. https://www.gov.uk/government/speeches/prime-minister-david-camerons-speech-to-the- world-economic-forum-in-davos, Accessed 7 April 2014. 28. Tuffrey, Mike, Truesdale, Peter and Hardyment, Richard, ‘Tax as a Corporate Responsibility Issue’, Corporate Citizenship, May 2011. 29. http://www.corporate-citizenship.com/our-insights/tax-time-for-action/ Accessed 18 March 2014. 30. Sustainalytics, “It’s Time to Call For More Responsibility” Multi-National Corporations and Tax Transparency: Issues for Responsible Investors, June 2013, p.5 31. http://www.cppib.com/en/how-we-invest/responsible-invest-approach.html Accessed 17 March 2014.

- 51. 51 32. http://www.apg.nl/en/apg-as-asset-manager/responsible-investing Accessed 17 March 2014. 33. The Lowy Institute, ‘Tax, Infrastructure, Anti-Corruption, Energy and the G20’ October 2013. http://www. lowyinstitute.org/publications/tax-infrastructure-anti-corruption-energy-and-g20 Accessed 25 March 2014. 34. Ibid. 35. http://corporate.westfield.com/about/ Accessed 29 October 2013. 36. http://corporate.westfield.com/about/ Accessed 29 October 2013. All currency conversions made via http:// www.xe.com using the exchange rate $1 AUD = £0.59 GBP as at 29 October 2013. 37. Chairman’s Review, Westfield Group Shareholder Review, 30 April 2013. http://corporate.westfield.com/wp- content/uploads/2013/05/Shareholder-review-lores-FINAL.pdf 38. http://corporate.westfield.com/properties/uk/ 39. http://corporate.westfield.com/properties/uk/ 40. Westfield Group, 2013 Half Year Results, 29 August 2013, p. 6 http://corporate.westfield.com/wp-content/ uploads/2013/08/WDC_Results_Presentation-290813.pdf 41. Westfield Group, 2013 Half Year Results, 29 August 2013, p. 8 http://corporate.westfield.com/wp-content/ uploads/2013/08/WDC_Results_Presentation-290813.pdf 42. http://thecroydonpartnership.com/ 43. http://thecroydonpartnership.com/ 44. http://westfield2011.sustainability-report.com.au/development-westfield-london 45. http://thecroydonpartnership.com/ 46. http://corporate.westfield.com/properties/uk/ 47. http://corporate.westfield.com/properties/uk/ 48. http://westfield2011.sustainability-report.com.au/development-westfield-london 49. http://corporate.westfield.com/properties/uk/ 50. http://thecroydonpartnership.com/ 51. http://www.theaustralian.com.au/business/property/buoyant-westfield-gives-london-a-new-lease-on-life/ story-fn9656lz-1226720479091