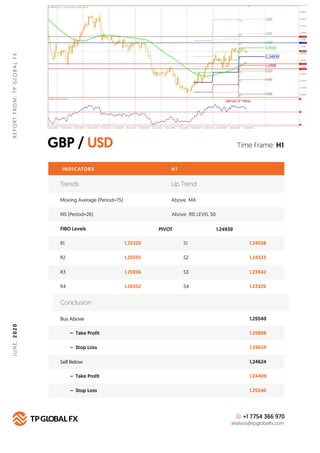

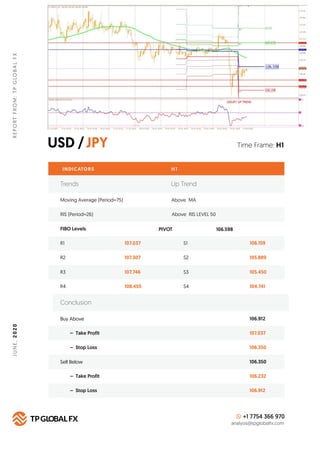

The daily analysis report from TP Global FX indicates that the New Zealand dollar is falling notably against major currencies following an unchanged interest rate decision, while most Asian markets are positive and gold prices are at a record high since 2012. Key trends for major currency pairs like USD/JPY, AUD/USD, and EUR/USD are outlined, highlighting resistance and support levels crucial for traders. Additionally, the report emphasizes the risks of forex trading and advises potential investors to seek independent financial advice.

![XAU / [GOLD]USD

REPORTFROM:TPGLOBALFXJUNE,2020

Time Frame: H1

INDICATORS H 1

FIBO Levels PIVOT

R1 1770.82 S1 1752.70

Buy Above 1773.82

1779.39

1755.13

1755.13

1749.03

1773.82

– Take Profit

– Stop Loss

Sell Below

– Take Profit

– Stop Loss

R2 1776.43 S2 1747.09

R3 1785.49 S3 1738.03

R4 S4 1723.36

Conclusion

+1 7754 366 970

analysis@tpglobalfx.com

1761.76

Trends Up Trend

Moving Average (Period=75) Above MA

RIS (Period=26) Above RIS LEVEL 50

1800.16](https://image.slidesharecdn.com/dailyanalysisreportjune242020-200624055324/85/Daily-Forex-Technical-Analysis-Report-June-24-2020-8-320.jpg)