Syrah Resources (ASX:SYR) Investor Presentation September 2014

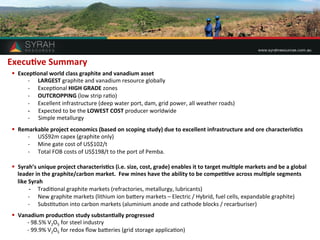

- 1. Execu&ve Summary § Excep&onal world class graphite and vanadium asset -‐ LARGEST graphite and vanadium resource globally -‐ Excep8onal HIGH GRADE zones -‐ OUTCROPPING (low strip ra8o) -‐ Excellent infrastructure (deep water port, dam, grid power, all weather roads) -‐ Expected to be the LOWEST COST producer worldwide -‐ Simple metallurgy § Remarkable project economics (based on scoping study) due to excellent infrastructure and ore characteris&cs -‐ US$92m capex (graphite only) -‐ Mine gate cost of US$102/t -‐ Total FOB costs of US$198/t to the port of Pemba. § Syrah’s unique project characteris&cs (i.e. size, cost, grade) enables it to target mul&ple markets and be a global leader in the graphite/carbon market. Few mines have the ability to be compe&&ve across mul&ple segments like Syrah -‐ Tradi8onal graphite markets (refractories, metallurgy, lubricants) -‐ New graphite markets (lithium ion baQery markets – Electric / Hybrid, fuel cells, expandable graphite) -‐ Subs8tu8on into carbon markets (aluminium anode and cathode blocks / recarburiser) § Vanadium produc&on study substan&ally progressed -‐ 98.5% V2O5 for steel industry -‐ 99.9% V2O5 for redox flow baQeries (grid storage applica8on) 1

- 2. Overview § Australian Stock Exchange listed § Head office based in Melbourne § Market capitalisa8on (undiluted) of A$821 million at A$5.02 per share as at 4 September 2014 § 163,470,076 shares on issue § 3,325,005 op8ons on issue § ~$29m cash on hand as at 30 June 2014 § Directors’ direct and indirect interests total 29% of current shares on issue Syrah Price and Volume – since Jan 2012 2 $7.00 $6.00 $5.00 $4.00 $3.00 $2.00 $1.00 $0.00 9,000,000 8,000,000 7,000,000 6,000,000 5,000,000 4,000,000 3,000,000 2,000,000 1,000,000 0 High: $5.99 January 2012 July 2012 January 2013 July 2013 January 2014 July 2014 Daily Volume Daily Closing Share Price

- 3. Board of Directors and Management Team Tom Eadie Non-‐Execu&ve Chairman q Twenty years experience within the junior resources sector and at technical to senior execu8ve levels with major mining companies q He is a past board member of Royalco Resources Ltd, the Australasian Ins8tute of Mining and Metallurgy (AUSIMM) and the Australian Mineral Industry Research Associa8on (AMIRA) q Currently also the Execu8ve Chairman of Copper Strike Paul Kehoe Managing Director q Accountant and geologist with extensive corporate finance and restructuring experience through previous senior management roles with PricewaterhouseCoopers and Grant Thornton q Worked with a group of ASX listed resource companies, performing company secretarial func8ons, business development and geology roles Tolga Kumova Execu&ve Director q 15 years experience in stockbroking, corporate finance and corporate restructuring q Specialised in Ini8al Public Offerings and capital requirements of mining focused companies Rhe] Brans Non-‐Execu&ve Director q Operated a consultancy providing project management services to the mining Industry for the past 20 years. q More than 35 years experience in the design and construc8on of mineral processing facili8es q Extensive African experience (Perseus Mining and Tiger Resources) José Caldeira Non-‐Execu&ve Director q Pre-‐eminent legal and regulatory professional in Mozambique with over 20 years’ experience q Currently a senior partner and head of the Corporate Law Prac8ce Group at Sal & Caldeira Advogados, Lda, a leading law firm in Mozambique q Extensive experience in supplying legal and regulatory consul8ng services in atural resources, foreign investment, infrastructure, civil, administra8ve, commercial and labour law, as well as li8ga8on 3

- 4. Management and Technical Team Ian Stewart Project Manager q Over 20 years of experience in mining engineering, including on projects transi8oning from feasibility to construc8on to produc8on q Previous Project Manager roles with Centamin Plc, Crew Gold and the Klipspringer diamond mine in South Africa Ricardo Rodrigues Construc&on Manager q 15 years of experience in construc8on management and fluent in Portuguese q Previous Construc8on Manager roles with MoQ Macdonald and Mineral Deposits Michael Chan General Manager 4 q 35 years industry experience in senior opera8ons, project development and commercial roles q 10 years of extensive rare earth project experience including complex metallurgical flow sheet development. q Previous roles include General Manager of Project Development at Kimberly Rare Earths, Procurement/Supply Chain Manager at Arafura Resources Ltd and Commercial Manager for Lynas Corpora8on Ltd’s Malaysian Opera8ons Jeff Sterling Oversight Manager q 25 years of mechanical engineering experience in infrastructure engineering, construc8on and peer review q Currently Managing Director of Intech Engineers, an independent Australian engineering firm with project experience involving Fortescue Metals, Glencore, Atlas Iron, Western Areas and CopperCo / CST Mining Andrew Hickey Logis&cs Manager q Over 21 years of experience in logis8cs management. q Previous roles include administra8on and logis8cs manager at Alcoa of Australia, Opera8ons Manager at Trafigura and contracts and logis8cs manager at Oxiana (now OZ Minerals)

- 5. 5 Project Loca&on Tanzania Democra&c Republic of the Congo Angola Namibia Zambia Botswana Swaziland Lesotho South Africa Madagascar Malawi Kenya Uganda Mozambique Rwanda Burundi Tanzania HM Nachingwea Shikula Sasare Lunga Ngamiland Balama Zimbabwe ü Excellent all-‐weather roads, dam and power enabling strong project economics ü Container export through Port of Pemba or Port of Nacala ü Addi8onal ports currently being planned for construc8on in Pemba

- 7. § Balama is an excep8onal resource -‐ 1.15Bt of graphite resource at 10.2% TGC [1] and 0.23% V2O5 -‐ 117Mt of contained graphite and V2O5 -‐ Larger resource than the rest of the world’s reserves combined [2] -‐ Large high grade areas (>15% TGC) to be mined first § Balama also has one of the largest deposits of vanadium globally -‐ 2.7Mt of resource -‐ Approximately four 8mes the size of South Africa’s Rhovan deposit, the world’s largest opera8ng vanadium deposit (1) TGC = Total Graphi8c Carbon. (2) Calculated by USGS (Source: Mineral Commodi8es Summaries 2012—USGS). 7 Balama is the world’s largest deposit of high grade graphite

- 8. Comparison of flake graphite deposits globally 8 Contained Graphite in Resources (Mt) % Energiser/Malagasy Castle Archer Flinders Focus Graphite One Kibaran Syrah High Grade Total Mason Graphite Lamboo Lincoln Northern Graphite Valence Industries Stratmin Syrah East Syrah West Triton 80 70 60 50 40 30 20 10 -‐ (10) 0% 5% 10% 15% 20% 25% Head Grade (TGC) 1. Note that Syrah Resources uses a cutoff grade of 13% TGC in determining its resources versus cutoff grades of 2%-‐8% TGC used by other companies 2. Excludes deposits in China as no public data is available 3. Only includes deposits with a substantial flake graphite content

- 9. § Global Inferred Resource 1.15 Bt at 10.2% TGC and 0.23% V2O5 (Inferred) § A8va Zone – 51 Mt @ 19.9% TGC and 0.38% V2O5 (Measured, Indicated and Inferred) § Mepiche Zone – 214 Mt @ 16.0 % TGC and 0.43% V2O5 (Measured, Indicated and Inferred) § Mualia Zone – 117 Mt @ 17.7% TGC and 0.46% V2O5 (Inferred) 9 Mt Nassilala Continuous Graphite Exposure 9 Overview of Balama Resource: Mul&ple zones and grades available for different end markets

- 10. 10 Flake size distribu&on § Metallurgical test work on Balama East flake graphite shows that 56.8% of the processed material is coarse to very coarse (80+ mesh and above) § Spherical graphite was produced from fine grained Balama graphite (100 μm) resul8ng in a finer grained sphere which is ideal for lithium ion baQery use § Consumer baQery producers u8lise graphite with 90% distribu8on at <10 μm § The spherical graphite produced by Syrah consisted of the following distribu8ons and specifica8ons: 90% Distribu8on <6.63μm 50% Distribu8on <4.69μm 10% Distribu8on <2.73μm Flake graphite feed size 100 μm Specific surface area: 1.47sqm/cc Spherical graphite yield: 50% Spherical Graphite

- 11. ü Economic Assessment Results (from Snowden Mining Study) has confirmed: − Low capital cost of US$92 M (graphite only) − Mine gate cost of US$102/t − Total FOB costs of US$198/t to the port of Pemba. − The projected opera8ng costs are boQom of the cost curve for graphite produc8on ü Drivers of low cost: − Open pit mining (no drill and blast) with negligible strip ra8o – Favorable infrastructure is assis8ng strong project economics—water, roads, power, port – High grade ore (30+ years of mining) and simple metallurgy − Affordable labour 11 Syrah is expected to be the lowest cost producer in the world [1] [1] Based on scoping study prepared by Snowden Mining Industry Consultants in June 2013

- 12. § Metallurgical test work has been conducted on Balama graphi8c material by two interna8onal laboratories § Uncomplicated graphite metallurgy via flota8on achieved high grade concentrate (96-‐98% TGC) and high recovery (92%) § Low levels of ash, vola8le, moisture and sulphur § Flowsheet op8misa8on currently being completed by pilot plant testwork § Metallurgical test work to date has shown that both uranium and vanadium are below detec8on limits in the graphite concentrate 12 Simple graphite metallurgy given quality of resource WHIMS: Wet High Intensity Magne&c Separator

- 13. Balama Vanadium -‐ highlights 13 ü Scoping Study on vanadium completed during July 2014 ü The market size is currently 140,000t/year V2O5, due to rise 50% by 2017 [1] ü Syrah plans to produce 5,000t/year based on Scoping Study ü Metallurgical test work has successfully produced a 99.9% V2O5 powder ü 98.5% vanadium pentoxide sells for between US$12.5 -‐ US$15 per kilo ü 99.9% vanadium pentoxide can sell for approximately US$50 per kilo ü 46 tonnes of 99.9% V2O5 is required per 1 MW of power genera8on. Energy storage market is forecast to be upwards of 300GW over the next 20 years [2] Balama 98.5% vanadium pentoxide concentrate from Stage 2 processing [1] Reference: TPP Squared Inc [2] Reference: ‘Projec8ons of the future costs electricity genera8on technologies ‘ CSIRO 2011 Balama 99.9% vanadium pentoxide concentrate from Stage 2 processing

- 14. Key metrics of the Balama Vanadium Scoping Study 14 Operational metrics Unit Financial metrics Unit Life of mine 1 years 20 Capex US$ m 80 Concentrate throughput (2.5% V2O5) 2 tpa 255,000 Price assumptions Min. 98% V2O5 US$/t (FOB) 12,000 Recov ery 99.9% V2O5 US$/t (FOB) 50,000 Min. 98% V2O5 % 58.5 HCl acid (33% concentration) 3 US$/t (FOB) 175 99.9% V2O5 % 19.5 Unit operating costs (Min. 98% & 99.9% V2O5) US$/t product 7,200 Product Total costs (Min. 98% & 99.9% V2O5) US$/t product 8,250 Min. 98% V2O5 tpa 3,804 99.9% V2O5 tpa 1,245 Post-tax NPV (10% discount rate) US$ m 330 Total tpa 5,049 Internal rate of return (IRR) % 59 By-product HCl acid (33% concentration) tpa 105,300 Payback period years 3.4 Refer ASX announcement dated 30 July 2014 for further details

- 15. 15 Metallurgy – Vanadium Simple flow sheet for the processing of Balama vanadium

- 16. PEMBA PORT § Located within close proximity of deep water port facili&es at Pemba (~240km) − Third largest port in Mozambique − Deep water container port − Also inves8ga8ng op8ons at the Port of Nacala ROAD § Main road connects Project to Pemba Port − Sealed, well maintained road to Monte Puez (~200km) − Remaining 40 km currently unsealed with construc8on underway to seal remaining distance by end of 2014 16 Key Infrastructure – Part 1

- 17. 17 Key Infrastructure – Part 2 WATER § Large regional dam, Chipembe, located only 12km from the Balamba processing plant − Dam underu8lised (local agriculture only) − Capacity required by Syrah have been contracted and allocated (2 M litres per annum) POWER § Region currently being connected to the Na&onal Power Grid − Power lines currently being installed between Balama town and Monte Puez − Hydroelectricity = very compe88ve energy costs − 4.7c per KWh peak rate for residen8al

- 18. Chalieco Memorandum of Understanding § MOU for o|ake for 80,000 tonnes of graphite per annum and a quan8ty of vanadium to be determined, signed with Chalieco, a member of the Chinalco Group § Par8es are currently nego8a8ng a legally binding o|ake agreement § Chalieco intends to use the graphite mainly as a subs8tute for petroleum coke, anthracite and other forms of carbon used to manufacture aluminium cathode and anode blocks 18 Aluminium anode block Aluminium cathode blocks

- 19. Asmet Memorandum of Understanding § MOU for o|ake for 100,000 – 150,000 tonnes of graphite per annum at a price of approximately US$1,000 per tonne over an ini8al 5 year period, signed with Asmet (UK) Limited, a European trader of metallurgical consumables (including carbon) to the iron, steel and aluminium industries § Graphite intended to be used by Asmet as a recarburiser in mainly foundry applica8ons and high quality steel produc8on § Syrah will provide Asmet with two to three tonnes of sample graphite products for tes8ng § Subject to successful comple8on of this testwork, Syrah and Asmet will be required to nego8ate, in good faith, a formal o|ake agreement for the sale of graphite 19 Engine block made from gray iron which uses graphite Recarburiser pellet made from Balama graphite as a carbon alloy

- 20. § Significant investment has been made in local infrastructure − Water bores drilled for use in neighbouring villages and Infrastructure programs commenced at Balama hospital § Strong supporter of local economies − Large employer of local labour and developing training programmes to develop a local workforce § Balama opera8ons will invest in local agricultural development for food supplies § Strong focus on improving local community health and educa8on 20 Community Development

- 21. Timeline to Produc&on 21 Q2 CY14 Q3 CY14 Q4 CY14 Q1 CY15 Q2 CY15 Q3 CY15 Q4 CY15 Q1 CY16 Q2 CY16 Environmental Approval Bankable Feasibility Study Construction ull Production Commissioning Full Production In just 5 years, Syrah Resources will have progressed from a grass roots explorer to a leading graphite producer Debt Financing

- 23. 23 Syrah has the ability to serve mul&ple segments of the market as a result of size and low cost Price Volume Market Size Tradi8onal Graphite Market • Natural Flake • BaQeries/new applica8ons US$700-‐3,000/t US$3,500+/t 1Mt 80Kt US$1 billion US$320 million Subs8tu8on/Alterna8ve Markets • Synthe8c Graphite – Electrodes – Carbon – Blocks Up to US$15,000/t 1Mt US$12 billion Carbon Market • Green Petroleum Coke • Calcined Petroleum Coke • Other < US$1,000/t 30Mt 7Mt 13Mt US$24 billion Addressable Market Low Cost Largest Resource Potential to capture multiple market segments

- 24. Spherical Graphite – Ba]ery Anode § High quality spherical graphite was produced from Balama flake graphite § Spherical graphite was produced from fine grained Balama graphite (100 microns) resul8ng in finer grained sphere which is most ideal for lithium ion baQery applica8ons § Consumer electronic baQeries require sub 10 micron due to higher surface area and energy density requirements § Historically, automo8ve baQeries have used 15-‐20 micron material due to cost § Significant interest for Balama spherical graphite has been shown by Asian based baQery groups § Spherical graphite pilot plant has been constructed and samples will be sent to all major baQery producers in the coming months 24

- 25. Alterna&ve Markets 25 Synthe&c Graphite Market Carbon Market US$12 billion market US$24 billion market 7Mt 13Mt 50Mt Annual Consump&on (Mt) Calcined Petroleum Coke Anodes for Aluminium Others (GPC etc) 38% 11% 8% 43% Synthe8c Carbon Synthe8c Graphite Others Synthe8c Graphite Blocks Synthe8c Graphite Electrode

- 26. § Green petroleum coke is used in anode blocks a}er calcina8ons by aluminium smelters § Used in reduc8on process of Al2O3 to aluminium metal (Al) § Low sulfur and high carbon material is required § High quality raw material is scarce in the market § Supply deficit of high quality material § 560 kg of anodes consumed per ton of aluminium produced § 450 kg of green coke or 360 kg of calcined petroleum coke required for one tonne of aluminium produc8on § Over 13 million tonnes per year of anodes required for aluminium produc8on § Over eight million tonnes per year of calcined petroleum coke is required 26 Anode Blocks for Aluminum

- 27. 27 Recarburiser—Carbon Raiser § Calcined petroleum coke is the main source § Main use is as a carbon addi8ve in iron and steel produc8on mainly in electrical arc furnaces § Low sulfur, high carbon material is required § Graphite is the best material for this applica8on as it is pure carbon and soluble in molten metal § Supply deficit of high quality material § Recarburiser requirements vary by raw material and final product − 30–40 kg is required per ton of iron by scrap metal − 3–30 kg is required per ton of pig iron − 1–2.5 kg is required per ton of steel § Over seven million tonnes of calcined petroleum coke is traded per year § The total value of this trade is over US$3 billion per year

- 28. § Used in electrical arc furnaces for steel and iron produc8on § Special grade petroleum coke called “Needle Petroleum Coke” is used § High carbon grade and very low sulfur material is required with crystalline structure (a}er graphi8sing) § Required 1,000 degrees C baking and 3,000 degrees C of graphi8sa8on process = very high energy consump8on § 2.5 kg of electrode is consumed for produc8on of 1 mt of steel § 1.5 million tonnes of consump8on of electrodes per year § Over US$3.5 billion market trade value § Using natural graphite could create a huge cost saving as it could enable skipping the graphi8sa8on process 28 Graphite Electrodes

- 29. § +50 mesh, 98% C minimum, flake graphite required for expandable graphite produc8on § Mainly used in graphite foils, flame retardants and insula8on material § Increasing use in technology product (in tablets and mobile phones) as a heat transfer agent § 40,000 produced in 2012 § Sells for between US$3,000–US$5,000 per tonne § Balama graphite confirmed to be expandable 29 Expandable Graphite

- 30. 30 Electrical Graphite § Uses include carbon brushes and lamp carbon § Very high grade, very low impurity synthe8c graphite is used § Crystalline structure is very important for electrical applica8on and natural flake graphite has the perfect crystalline structure § Over two million tonnes per year market trade volume § Over US$3 billion per year trade value

- 31. 31 Vanadium demand by applica&on 2012 Source: TTP Squared, Inc & Metal Bulle8n 80,733 tonnes Steel Alloy 92.0% Titanium Alloy 3.0% Chemicals 3.0% Energy Storage 1.0% Other 1.0%

- 32. 32 Global vanadium produc&on 2012 Source: TPP Squared, Inc China 53.0% Europe 8.0% South Africa 18.0% Russia 10.0% North America 6.0% Other Countries 5.0% 71,508 tonnes

- 33. 33 Global Vanadium Supply and Demand Forecast 140,000 120,000 100,000 80,000 60,000 40,000 20,000 0 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Tonnes Vanadium (Metric) Source: Merchant Research and Consul8ng. Consump8on Produc8on § Tight vanadium supply/demand balance forecast over the next five years expected to be driven by strengthening steel demand and China moving to grade 3 rebar § Poten8al demand for energy storage could further add to the supply deficit significantly in the coming years

- 34. 34 Vanadium industry cash cost curve § The following figure shows the average cash costs for co-‐product slag, primary ore and secondary vanadium producers in 2012 Tonnes Vanadium (Metric) Cost (USD per kg Vanadium) Source: TPP Squared, Inc

- 35. 35 Poten&al sources of new supply § The following table shows the known vanadium projects currently being developed by listed en88es around the world Metric Unit Project Location Ownership % Life of mine years Strip ratio Concentrate throughput V2O5 % Syrah Resources Largo Resources TNG Limited American Vanadium Maracas Brazil 100 29 6.27 : 1 Mount Peake NT, Australia 100 20 0.95 : 1 3.4 1.0 to 1.5 Balama Mozambique 100 20 0.11 : 1 2.5 Gibellini Nev ada, USA 100 Unavailable 0.22 : 1 Unavailable Production tpa 3,804 V2O5 (Min. 98%) 6,376 V2O5 11,000 V2O5 (99%) 5,171 V2O5 tpa 1,245 V2O5 (99.9%) 4,899 FeV 290,000 TiO2 tpa 900,000 Fe2O3 (99.9%) Price assumption US$/kg 12.0 V2O5 (Min. 98%) 14.0 V2O5 20.3 V2O5 (99%) 24.1 V2O5 US$/kg 50.0 V2O5 (99.9%) 28.0 FeV 0.4 TiO2 (55%) US$/kg 0.2 Fe2O3 (99.9%) Total costs US$/kg 8.3 V2O5 (Min. 98% & 99.9%) 7.0 V2O5 75.5 V2O5, TiO2 & Fe2O3 9.0 V2O5 US$/kg 15.6 FeV Total capex US$ m 80.0 235.0 563.0 95.5 Discount rate % 10.0 8.0 8.0 7.0 NPV US$ m 330.0 Post tax 554.0 Post tax 2,600 Pre or post-tax Source: Company presenta8ons and stock exchange announcements not specified 170.1 Pre or post-tax not specified IRR % 59.2 Post tax 26.3 Post tax 38.0 Pre-tax 43.0 Pre or post-tax not specified Payback period years 3.4 Unavailable Potentially 4 2.4

- 36. Vanadium Redox Ba]ery (VRB) 36 § Poten8al large driver of vanadium demand for grid storage applica8ons § VRBs can beQer match electricity supply and demand in real 8me § Increases grid efficiency and poten8ally reduces the number of power plants required § VRBs could capture ~17% of the energy grid storage market by 2017 [1] § ~46 tonnes of V2O5 is required for 1 MW capacity using VRBS for grid storage [2] § Global market for energy storage over the next 10 years could be upwards of 300 GW and US$200-‐US$600 billion in value [3] § Sumitomo Electric Industries is currently working with Hokkaido Electric Power to store electricity using VRBs in order to stabilise its grid network § VRBs require high purity V2O5 greater than 99.9% purity § In addi8on, impuri8es such as nickel, cobalt or copper need to be reduced to negligible levels in the V2O5 [1] Reference: Lux Research [2] Reference: University of Tennessee [3] Reference: Kema Inc. Vanadium compounds have the ability to take on four oxida&on states which makes vanadium very useful for electrical energy storage applica&ons.

- 37. 37 Disclaimer This presenta8on is for informa8on purposes only. Neither this presenta8on nor the informa8on contained in it cons8tutes an offer, invita8on, solicita8on or recommenda8on in rela8on to the purchase or sale of shares in any jurisdic8on. This presenta8on may not be distributed in any jurisdic8on except in accordance with the legal requirements applicable in such jurisdic8on. Recipients should inform themselves of the restric8ons that apply in their own jurisdic8on. A failure to do so may result in a viola8on of securi8es laws in such jurisdic8on. This presenta8on does not cons8tute financial product advice and has been prepared without taking into account the recipient's investment objec8ves, financial circumstances or par8cular needs and the opinions and recommenda8ons in this presenta8on are not intended to represent recommenda8ons of par8cular investments to par8cular persons. Recipients should seek professional advice when deciding if an investment is appropriate. All securi8es transac8ons involve risks, which include (among others) the risk of adverse or unan8cipated market, financial or poli8cal developments. Certain statements contained in this presenta8on, including informa8on as to the future financial or opera8ng performance of Syrah Resources Limited (Syrah Resources) and its projects, are forward-‐looking statements. Such forward-‐looking statements: are necessarily based upon a number of es8mates and assump8ons that, whilst considered reasonable by Syrah Resources, are inherently subject to significant technical, business, economic, compe88ve, poli8cal and social uncertain8es and con8ngencies; involve known and unknown risks and uncertain8es that could cause actual events or results to differ materially from es8mated or an8cipated events or results reflected in such forward-‐looking statements; and may include, among other things, Statements regarding targets, es8mates and assump8ons in respect of metal produc8on and prices, opera8ng costs and results, capital expenditures, ore reserves and mineral resources and an8cipated grades and recovery rates, and are or may be based on assump8ons and es8mates related to future technical, economic, market, poli8cal, social and other condi8ons. Syrah Resources disclaims any intent or obliga8on to update publicly any forward looking statements, whether as a result of new informa8on, future events or results or otherwise. The words “believe”, “expect”, “an8cipate”, “indicate”, “contemplate”, “target”, “plan”, “intends”, “con8nue”, “budget”, “es8mate”, “may”, “will”, “schedule” and other similar expressions iden8fy forward-‐looking statements. All forward-‐looking statements made in this presenta8on are qualified by the foregoing cau8onary statements. Investors are cau8oned that forward-‐looking statements are not guarantees of future performance and accordingly investors are cau8oned not to put undue reliance on forward-‐looking statements due to the inherent uncertainty therein. Syrah Resources has prepared this presenta8on based on informa8on available to it at the 8me of prepara8on. No representa8on or warranty, express or implied, is made as to the fairness, accuracy or completeness of the informa8on, opinions and conclusions contained in the presenta8on. To the maximum extent permiQed by law, Syrah Resources, its related bodies corporate (as that term is defined in the Corpora&ons Act 2001 (Cth)) and the officers, directors, employees, advisers and agents of those en88es do not accept any responsibility or liability including, without limita8on, any liability arising from fault or negligence on the part of any person, for any loss arising from the use of the Presenta8on Materials or its contents or otherwise arising in connec8on with it.

- 38. 38 Thank you