Electric and hybrid cars -updated

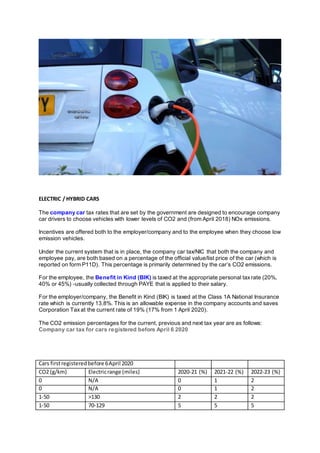

- 1. ELECTRIC / HYBRID CARS The company car tax rates that are set by the government are designed to encourage company car drivers to choose vehicles with lower levels of CO2 and (from April 2018) NOx emissions. Incentives are offered both to the employer/company and to the employee when they choose low emission vehicles. Under the current system that is in place, the company car tax/NIC that both the company and employee pay, are both based on a percentage of the official value/list price of the car (which is reported on form P11D). This percentage is primarily determined by the car’s CO2 emissions. For the employee, the Benefit in Kind (BIK) is taxed at the appropriate personal taxrate (20%, 40% or 45%) -usually collected through PAYE that is applied to their salary. For the employer/company, the Benefit in Kind (BIK) is taxed at the Class 1A National Insurance rate which is currently 13.8%. This is an allowable expense in the company accounts and saves Corporation Taxat the current rate of 19% (17% from 1 April 2020). The CO2 emission percentages for the current, previous and next tax year are as follows: Company car tax for cars registered before April 6 2020 Cars firstregisteredbefore 6April 2020 CO2 (g/km) Electricrange (miles) 2020-21 (%) 2021-22 (%) 2022-23 (%) 0 N/A 0 1 2 0 N/A 0 1 2 1-50 >130 2 2 2 1-50 70-129 5 5 5

- 2. 1-50 40-69 8 8 8 1-50 30-39 12 12 12 51-54 <30 15 15 15 55-59 16 16 16 60-64 17 17 17 65-69 18 18 18 70-74 19 19 19 75-79 20 20 20 80-84 21 21 21 85-89 22 22 22 90-94 23 23 23 95-99 24 24 24 100-104 25 25 25 105-109 26 26 26 110-114 27 27 27 115-119 28 28 28 120-124 29 29 29 125-129 30 30 30 130-134 31 31 31 135-139 32 32 32 140-144 33 33 33 145-149 34 34 34 150-154 35 35 35 155-159 36 36 36 160+ 37 37 37 * Add4% for dieselsuptoa maximumof 37% (unlessRDE2compliant).Diesel plug-inhybridsare classedasalternative fuel vehicles,sothe 4% diesel supplementdoesnotapplytothese vehicles irrespectiveof RDE2 compliance Cars firstregisteredfrom6April 2020 CO2 (g/km) Electricrange (miles) 2020-21 (%) 2021-22 (%) 2022-23 (%) 0 N/A 0 1 2 Jan-50 >130 0 1 2 Jan-50 70-129 3 4 5 Jan-50 40-69 6 7 8 Jan-50 30-39 10 11 12 Jan-50 <30 12 13 14 51-54 13 14 15 55-59 14 15 16 60-64 15 16 17 65-69 16 17 18 70-74 17 18 19 75-79 18 19 20 80-84 19 20 21 85-89 20 21 22 90-94 21 22 23

- 3. 95-99 22 23 24 100-104 23 24 25 105-109 24 25 26 110-114 25 26 27 115-119 26 27 28 120-124 27 28 29 125-129 28 29 30 130-134 29 30 31 135-139 30 31 32 140-144 31 32 33 145-149 32 33 34 150-154 33 34 35 155-159 34 35 36 160-164 35 36 37 165-169 36 37 37 170+ 37 37 37 Until 1 April (5 April 2021 for income tax) a low or zero emission car can qualify for a 100% first year allowance (FYA) if its CO2 emissions do not exceed 50g/km and the car is purchased new and unused. A similar 100% FYA applies for zero emission vans, where the vehicle is purchased newand unused before 1 April 2021, or 5 April 2021 for income tax. First Year Allowances are a type of Capital Allowance and these are deductible against profits and this in turn reduces the amount of Corporation Taxthat a company pays. Therefore, the cost of a car with CO2 of 50 or less will be fully deductible against profit in the year that it is bought. With the huge tax breaks for both business and employee, it is not difficult to see why contractors and small business owners who do not already own an electric vehicle should be thinking about investing in one. Quick example If a contractor purchases a car that costs £30,000 and the BIK rate is 25% and he is taxed at basic rate tax at his highest rate, he will pay £1,500 in tax (30,000 x 0.25 x 0.2) for each year that the company owns the car and provides it to him. There is also of course the fuel benefit to take into account if you are provided with fuel by your company which I have not included here. If you opted for an efficient electric/hybrid car instead what could you save? At the moment, low CO2 cars are taxed at 16% therefore for an energy efficient car costing £40,000 the annual tax charge (if the contractor is taxed at 20% at his highest rate) would be £1,280 (40,000 x 0.16 x 0.2). In 2020/21, the savings will be more significant when the lowest BIK bracket falls to just 0% therefore for the same energy efficient car costing £40,000 the annual tax charge (if the contractor is taxed at 20% at his highest tax rate) would be £0 (40,000 x 0.00 x 0.2). In reality, hybrid and electric vehicles are currently more expensive vehicles to buy but even taking this into account you would pay far less tax per annum.

- 4. As a contractor of your own business the savings above would pale into insignificance when you compare what you can save with the First Year Allowance. A £40,000 investment into an electric vehicle would generate a £7,600 saving in Corporation Tax. Link to Contractor Advice UK group on LinkedIn https://www.linkedin.com/groups/4660081/