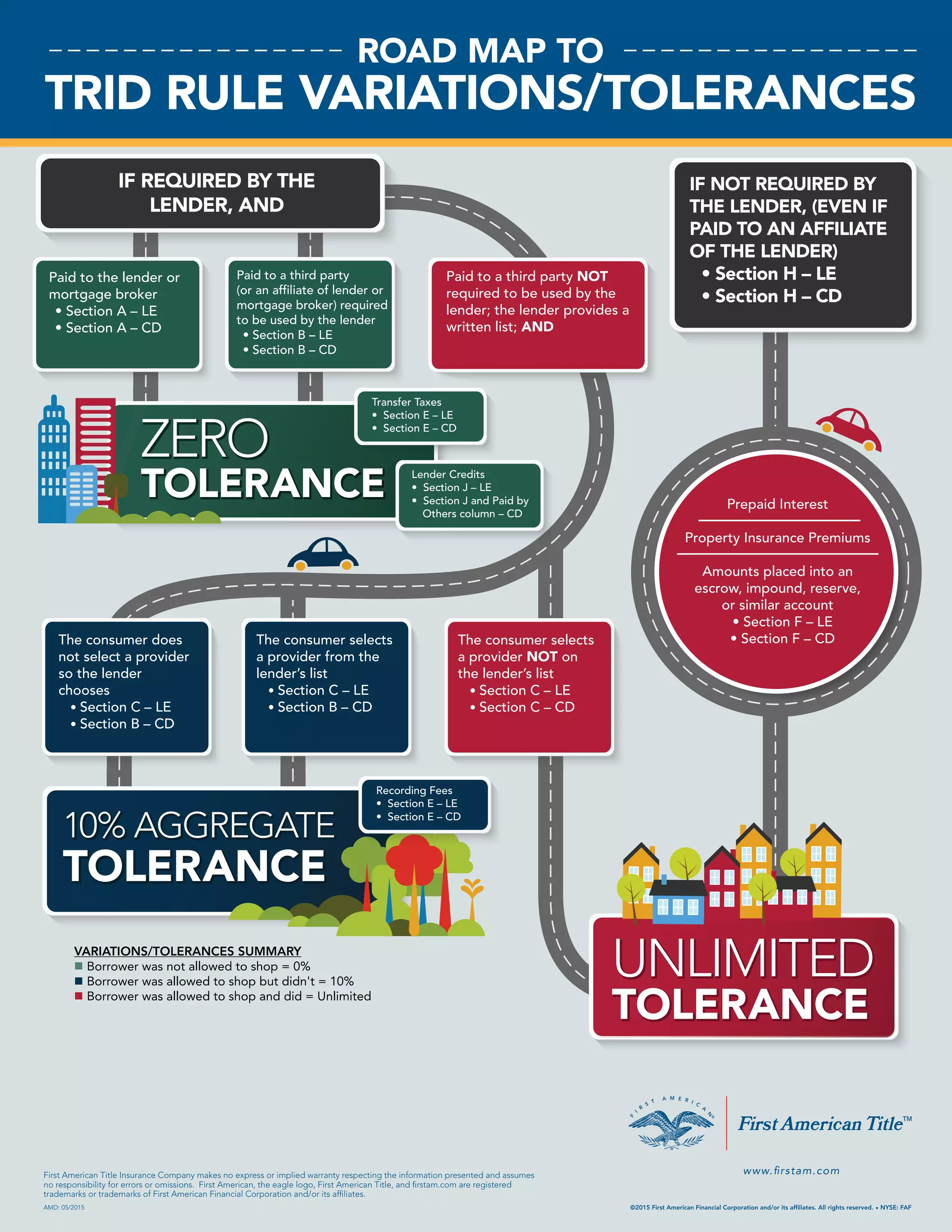

The document outlines variations and tolerances that apply to certain closing cost disclosures under the TILA-RESPA Integrated Disclosure (TRID) rule. It provides guidelines for fees depending on whether the borrower was not allowed to shop, was allowed to shop but did not, or was allowed to shop and did select a service provider. Fees paid to the lender or required by the lender have zero tolerance, while fees for services the borrower was allowed to choose from have a 10% aggregate tolerance if no provider was chosen or unlimited tolerance if a provider was chosen.