ACCELERATE GROWTH FOR TRAVEL APPS

Learn how leading travel apps are using data to accelerate growth! Download this eguide to get powerful insights on:

Defining a Travel App Data Collection Strategy

Correctly Evaluating Vendor Effectiveness

7 Use Cases for Leveraging Data to Drive KPIs

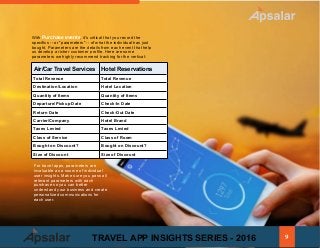

How to Convince More App Users to Buy In-App

Apps are a crucial part of travel marketing in 2016. Download the equide today to improve your effectiveness and nail your KPIs.