SCV 2015 Nationwide Private Commercial Loan ProgramsMR

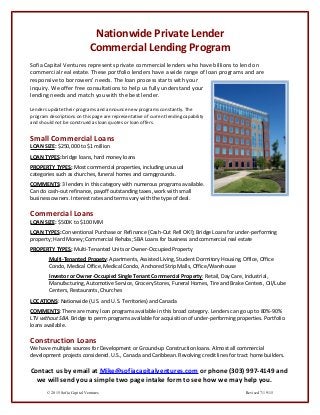

- 1. Nationwide Private Lender

Commercial Lending Program

Sofia Capital Ventures represents private commercial lenders who have billions to lend on

commercial real estate. These portfolio lenders have a wide range of loan programs and are

responsive to borrowers’ needs. The loan process starts with your

inquiry. We offer free consultations to help us fully understand your

lending needs and match you with the best lender.

Lenders update their programs and announce new programs constantly. The

program descriptions on this page are representative of current lending capability

and should not be construed as loan quotes or loan offers.

Small Commercial Loans

LOAN SIZE: $250,000 to $1 million

LOAN TYPES: bridge loans, hard money loans

PROPERTY TYPES: Most commercial properties, including unusual

categories such as churches, funeral homes and campgrounds.

COMMENTS: 3 lenders in this category with numerous programs available.

Can do cash-out refinance, payoff outstanding taxes, work with small

business owners. Interest rates and terms vary with the type of deal.

Commercial Loans

LOAN SIZE: $500K to $100 MM

LOAN TYPES: Conventional Purchase or Refinance (Cash-Out Refi OK!); Bridge Loans for under-performing

property; Hard Money; Commercial Rehabs; SBA Loans for business and commercial real estate

PROPERTY TYPES: Multi-Tenanted Units or Owner-Occupied Property

Multi-Tenanted Propety: Apartments, Assisted Living, Student Dormitory Housing, Office, Office

Condo, Medical Office, Medical Condo, Anchored Strip Malls, Office/Warehouse

Investor or Owner-Occupied Single Tenant Commercial Property: Retail, Day Care, Industrial,

Manufacturing, Automotive Service, Grocery Stores, Funeral Homes, Tire and Brake Centers, Oil/Lube

Centers, Restaurants, Churches

LOCATIONS: Nationwide (U.S. and U.S. Territories) and Canada

COMMENTS: There are many loan programs available in this broad category. Lenders can go up to 80%-90%

LTV without SBA. Bridge to perm programs available for acquisition of under-performing properties. Portfolio

loans available.

Construction Loans

We have multiple sources for Development or Ground-up Construction loans. Almost all commercial

development projects considered. U.S., Canada and Caribbean. Revolving credit lines for tract home builders.

Contact us by email at Mike@sofiacapitalventures.com or phone (303) 997-4149 and

we will send you a simple two page intake form to see how we may help you.

© 2015 Sofia Capital Ventures Revised 7/19/15