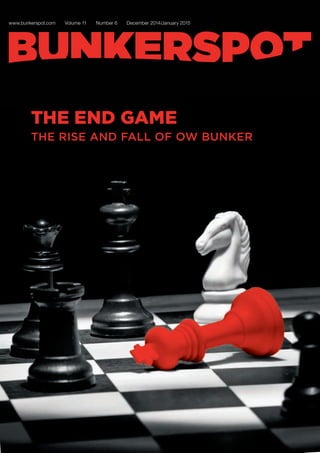

It has been a tumultuous year for the bunker industry, with significant events that have ramifications for insurers and the insured. New sulfur restrictions in fuel will take effect in January 2015, prompting suppliers to find alternatives like LNG. Cybercrime has also become a major threat, with hackers targeting the bunker industry through scams and attacks that can cause widespread damage. Two major bankruptcies, including the largest independent bunker supplier OW Bunker, have profoundly reduced the available credit insurance capacity for the industry. These issues present complex challenges for effectively managing risk.