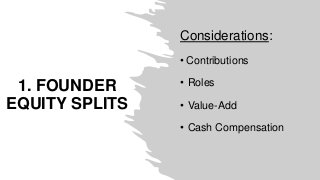

From day one, it's crucial to put your company on the right path. With proper planning, you can avoid a number of common problems, such as cofounder disputes, tax issues, and cap tables that would make investors run for the doors.

Startup equity is one of those things that most founders struggle with unless they have an MBA.

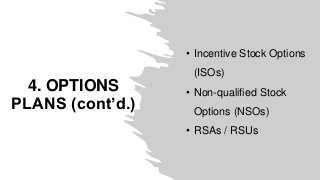

On September 9th, 2020 at 10:00 am PDT Nicole Hatcher, Bret Waters, Brian McAllister, and Louis Lehot shed some light on the best practices and insights to apply when splitting equity for the first time. See the recording on YouTube channel #askasiliconvalleylawyer