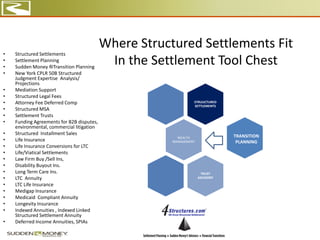

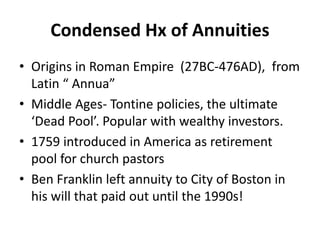

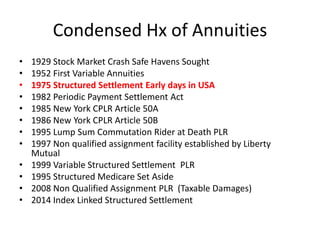

Structured settlements remain a crucial tool for managing financial outcomes in personal injury and workers' compensation cases, offering tax benefits and risk management. They have a long history and are supported by regulated insurance companies, demonstrating their stability and relevance over time. Alongside structured settlements, various financial products and strategies allow individuals to address longevity risk and manage their investments effectively.

![A Structured Settlement Is…

• A core tool in the settlement tool chest

• Like a ‘job’ that you can never be fired

from. [ without taxes on most damages in

PI/WD cases, also WC]

• A way to reduce cost of an MSA by 20-30%

• A way to defer taxes for taxable damages

or attorney fees payable to individual

lawyers or law firms

And that’s for starters!

©4structures.com®LLC 2017](https://image.slidesharecdn.com/structuredsettlements2017-170121101834/85/Why-People-Do-Structured-Settlements-2018-3-320.jpg)