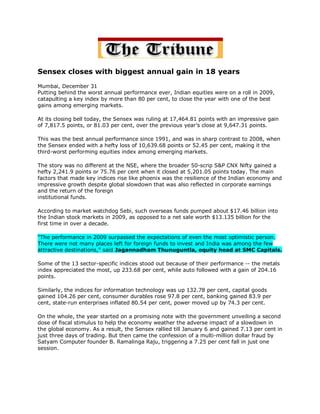

The Tribune 31 Dec 2009 Sensex Closes With Biggest Annual Gain In 18 Years

•

0 likes•51 views

“The performance in 2009 surpassed the expectations of even the most optimistic person. There were not many places left for foreign funds to invest and India was among the few attractive destinations,” said Jagannadham Thunuguntla, equity head at SMC Capitals.

Report

Share

Report

Share

Download to read offline

Recommended

"The performance in 2009 surpassed the expectations of even the most optimistic person. There were not many places left for foreign funds to invest and India was among the few attractive destinations," said Jagannadham Thunuguntla, equity head at SMC Capitals.Business News Dec 31, 2009 Bulls Came Storming Back To Indian Equities Markets

Business News Dec 31, 2009 Bulls Came Storming Back To Indian Equities MarketsJagannadham Thunuguntla

“A lot of good companies are currently at valuations that are too low and investors might not be ready to sell them off at such levels. This may have stemmed the loss,” said Jagannadham Thunuguntla, head of the capital markets arm and director of a major share brokerage firm, the New Delhi-based SMC Group.Daily Times India Jan 15, 2009 Equity Markets Slump, Reversing Previous Days ...

Daily Times India Jan 15, 2009 Equity Markets Slump, Reversing Previous Days ...Jagannadham Thunuguntla

Recommended

"The performance in 2009 surpassed the expectations of even the most optimistic person. There were not many places left for foreign funds to invest and India was among the few attractive destinations," said Jagannadham Thunuguntla, equity head at SMC Capitals.Business News Dec 31, 2009 Bulls Came Storming Back To Indian Equities Markets

Business News Dec 31, 2009 Bulls Came Storming Back To Indian Equities MarketsJagannadham Thunuguntla

“A lot of good companies are currently at valuations that are too low and investors might not be ready to sell them off at such levels. This may have stemmed the loss,” said Jagannadham Thunuguntla, head of the capital markets arm and director of a major share brokerage firm, the New Delhi-based SMC Group.Daily Times India Jan 15, 2009 Equity Markets Slump, Reversing Previous Days ...

Daily Times India Jan 15, 2009 Equity Markets Slump, Reversing Previous Days ...Jagannadham Thunuguntla

“A lot of good companies are currently at valuations that are too low and investors might not be ready to sell them off at such levels. This may have stemmed the loss,” said Jagannadham Thunuguntla, head of the capital markets arm and director of a major share brokerage firm, the New Delhi-based SMC Group.South Asia News Jan 15, 2009 Equity Markets Slump, Reversing Previous Days Gains

South Asia News Jan 15, 2009 Equity Markets Slump, Reversing Previous Days GainsJagannadham Thunuguntla

More Related Content

What's hot

“A lot of good companies are currently at valuations that are too low and investors might not be ready to sell them off at such levels. This may have stemmed the loss,” said Jagannadham Thunuguntla, head of the capital markets arm and director of a major share brokerage firm, the New Delhi-based SMC Group.South Asia News Jan 15, 2009 Equity Markets Slump, Reversing Previous Days Gains

South Asia News Jan 15, 2009 Equity Markets Slump, Reversing Previous Days GainsJagannadham Thunuguntla

What's hot (20)

Manglorean Jan 15, 2009 Equity Markets Slump, Reversing Previous Days Gains

Manglorean Jan 15, 2009 Equity Markets Slump, Reversing Previous Days Gains

Mid Session Report: Markets trading flat with bit of negative bias - ShareTip...

Mid Session Report: Markets trading flat with bit of negative bias - ShareTip...

South Asia News Jan 15, 2009 Equity Markets Slump, Reversing Previous Days Gains

South Asia News Jan 15, 2009 Equity Markets Slump, Reversing Previous Days Gains

Thaindian Jan 15, 2009 Equity Markets Slump, Reversing Previous Days Gains

Thaindian Jan 15, 2009 Equity Markets Slump, Reversing Previous Days Gains

Big News Jan 15, 2009 Equity Markets Slump, Reversing Previous Days Gains

Big News Jan 15, 2009 Equity Markets Slump, Reversing Previous Days Gains

Sindh Today July 11, 2009 Sensex Loses Way, Plummets 253 Points

Sindh Today July 11, 2009 Sensex Loses Way, Plummets 253 Points

New Kerala July 11, 2009 Sensex Loses Way, Plummets 253 Points

New Kerala July 11, 2009 Sensex Loses Way, Plummets 253 Points

Sulekha July 11, 2009 Sensex Loses Way, Plummets 253 Points

Sulekha July 11, 2009 Sensex Loses Way, Plummets 253 Points

SME Times July 11, 2009 Sensex Loses Way, Plummets 253 Points

SME Times July 11, 2009 Sensex Loses Way, Plummets 253 Points

Blog Coverage Taragana July 11, 2009 Sensex Loses Way, Plummets 253 Points

Blog Coverage Taragana July 11, 2009 Sensex Loses Way, Plummets 253 Points

Inditop July 11, 2009 Sensex Loses Way, Plummets 253 Points

Inditop July 11, 2009 Sensex Loses Way, Plummets 253 Points

Andhra Headlines July 11, 2009 Sensex Loses Way, Plummets 253 Points

Andhra Headlines July 11, 2009 Sensex Loses Way, Plummets 253 Points

South Asia News July 11, 2009 Sensex Loses Way, Plummets 253 Points

South Asia News July 11, 2009 Sensex Loses Way, Plummets 253 Points

Khabrein Info July 11, 2009 Sensex Loses Way, Plummets 253 Points

Khabrein Info July 11, 2009 Sensex Loses Way, Plummets 253 Points

Thaindian July 11, 2009 Sensex Loses Way, Plummets 253 Points

Thaindian July 11, 2009 Sensex Loses Way, Plummets 253 Points

Yahoo News July 11, 2009 Sensex Loses Way, Plummets 253 Points

Yahoo News July 11, 2009 Sensex Loses Way, Plummets 253 Points

Sify News July 11, 2009 Sensex Loses Way, Plummets 253 Points

Sify News July 11, 2009 Sensex Loses Way, Plummets 253 Points

Daily Times India July 11, 2009 Sensex Loses Way, Plummets 253 Points

Daily Times India July 11, 2009 Sensex Loses Way, Plummets 253 Points

Similar to The Tribune 31 Dec 2009 Sensex Closes With Biggest Annual Gain In 18 Years

SMC Capitals Equity Head Jagannadham Thunuguntla said, "Today's market movement was more about volatility and volume. Traders came with a vengeance as they did not get a chance to participate in yesterday's rally. Though the market is appearing to be stable, there is huge difference in terms of stock level."Two Circles May 21, 2009 Markets In Self Correcting Mode In Topsy Turvy Trade

Two Circles May 21, 2009 Markets In Self Correcting Mode In Topsy Turvy TradeJagannadham Thunuguntla

SMC Capitals Equity Head Jagannadham Thunuguntla said, "Today's market movement was more about volatility and volume. Traders came with a vengeance as they did not get a chance to participate in yesterday's rally. Though the market is appearing to be stable, there is huge difference in terms of stock level."The Sentinel May 21, 2009 Markets In Self Correcting Mode In Topsy Turvy Trade

The Sentinel May 21, 2009 Markets In Self Correcting Mode In Topsy Turvy TradeJagannadham Thunuguntla

SMC Capitals Equity Head Jagannadham Thunuguntla said, "Today's market movement was more about volatility and volume. Traders came with a vengeance as they did not get a chance to participate in yesterday's rally. Though the market is appearing to be stable, there is huge difference in terms of stock level."Financial Chronicle May 19, 2009 Markets In Self Correcting Mode In Topsy Tur...

Financial Chronicle May 19, 2009 Markets In Self Correcting Mode In Topsy Tur...Jagannadham Thunuguntla

“Satyam has indeed dented investor and business confidence with this new revelation,” said Jagannadham Thunuguntla, head of the capital markets arm and director of India's fourth largest share brokerage firm, the Delhi-based SMC Group.Nerve News Jan 7, 2009 Markets Plummet As Investors Panic After Satyam Shocker

Nerve News Jan 7, 2009 Markets Plummet As Investors Panic After Satyam ShockerJagannadham Thunuguntla

“Satyam has indeed dented investor and business confidence with this new revelation,” said Jagannadham Thunuguntla, head of the capital markets arm and director of India's fourth largest share brokerage firm, the Delhi-based SMC Group.Newstrack Jan 7, 2009 Markets Plummet As Investors Panic After Satyam Shocker

Newstrack Jan 7, 2009 Markets Plummet As Investors Panic After Satyam ShockerJagannadham Thunuguntla

“Satyam has indeed dented investor and business confidence with this new revelation,” said Jagannadham Thunuguntla, head of the capital markets arm and director of India's fourth largest share brokerage firm, the Delhi-based SMC Group.Net India 123 Jan 7, 2009 Markets Plummet As Investors Panic After Satyam Sho...

Net India 123 Jan 7, 2009 Markets Plummet As Investors Panic After Satyam Sho...Jagannadham Thunuguntla

Similar to The Tribune 31 Dec 2009 Sensex Closes With Biggest Annual Gain In 18 Years (20)

IndiaeNews Dec 1, 2008 Equities Erase Gains, Key Index Sheds 252 Points

IndiaeNews Dec 1, 2008 Equities Erase Gains, Key Index Sheds 252 Points

Nerve News Nov 19, 2008 Bears Prevail Again, Key Index Ends Below 9,000

Nerve News Nov 19, 2008 Bears Prevail Again, Key Index Ends Below 9,000

Nerve News Dec 30, 2008 Healthy Buying Pushes Markets Up

Nerve News Dec 30, 2008 Healthy Buying Pushes Markets Up

Two Circles May 21, 2009 Markets In Self Correcting Mode In Topsy Turvy Trade

Two Circles May 21, 2009 Markets In Self Correcting Mode In Topsy Turvy Trade

The Sentinel May 21, 2009 Markets In Self Correcting Mode In Topsy Turvy Trade

The Sentinel May 21, 2009 Markets In Self Correcting Mode In Topsy Turvy Trade

Yahoo News May 19, 2009 Markets In Self Correcting Mode In Topsy Turvy Trade

Yahoo News May 19, 2009 Markets In Self Correcting Mode In Topsy Turvy Trade

Financial Chronicle May 19, 2009 Markets In Self Correcting Mode In Topsy Tur...

Financial Chronicle May 19, 2009 Markets In Self Correcting Mode In Topsy Tur...

IBN Live Jan 7, 2009 Markets Plummet As Investors Panic After Satyam Shocker

IBN Live Jan 7, 2009 Markets Plummet As Investors Panic After Satyam Shocker

Nerve News Dec 31, 2008 Markets Fall On Years Last Day Of Trade

Nerve News Dec 31, 2008 Markets Fall On Years Last Day Of Trade

Scottrade May 21, 2009 Foreign Funds Investment Crosses $3 Bn Mark

Scottrade May 21, 2009 Foreign Funds Investment Crosses $3 Bn Mark

Nerve News Jan 7, 2009 Markets Plummet As Investors Panic After Satyam Shocker

Nerve News Jan 7, 2009 Markets Plummet As Investors Panic After Satyam Shocker

Nerve News Dec 29, 2008 Markets Start Years Last Week With A Bang

Nerve News Dec 29, 2008 Markets Start Years Last Week With A Bang

India E News Dec 31, 2008 Markets Fall On Years Last Day Of Trade

India E News Dec 31, 2008 Markets Fall On Years Last Day Of Trade

Newstrack Jan 7, 2009 Markets Plummet As Investors Panic After Satyam Shocker

Newstrack Jan 7, 2009 Markets Plummet As Investors Panic After Satyam Shocker

India PR Wire Dec 1, 2008 Equities Erase Gains, Key Index Sheds 252 Points

India PR Wire Dec 1, 2008 Equities Erase Gains, Key Index Sheds 252 Points

India PR Wire Dec 30, 2008 Healthy Buying Pushes Markets Up

India PR Wire Dec 30, 2008 Healthy Buying Pushes Markets Up

Net India 123 Jan 7, 2009 Markets Plummet As Investors Panic After Satyam Sho...

Net India 123 Jan 7, 2009 Markets Plummet As Investors Panic After Satyam Sho...

More from Jagannadham Thunuguntla

More from Jagannadham Thunuguntla (20)

Infra cos pay over $1 billion in finance, interest costs in H1 - 25.11.2013

Infra cos pay over $1 billion in finance, interest costs in H1 - 25.11.2013

Recently uploaded

Recently uploaded (20)

Black magic specialist in pakistan usa dubai oman karachi multan canada londo...

Black magic specialist in pakistan usa dubai oman karachi multan canada londo...

asli amil baba bengali black magic kala jadu expert in uk usa canada france c...

asli amil baba bengali black magic kala jadu expert in uk usa canada france c...

black magic removal amil baba in pakistan karachi islamabad america canada uk...

black magic removal amil baba in pakistan karachi islamabad america canada uk...

Certified Kala Jadu, Black magic specialist in Rawalpindi and Bangali Amil ba...

Certified Kala Jadu, Black magic specialist in Rawalpindi and Bangali Amil ba...

Current scenario of Energy Retail utilities market in UK

Current scenario of Energy Retail utilities market in UK

amil baba kala jadu expert uk amil baba kala jadu removal uk amil baba in mal...

amil baba kala jadu expert uk amil baba kala jadu removal uk amil baba in mal...

Amil baba powerful kala jadu in islamabad rawalpindi - Amil baba in lahore Am...

Amil baba powerful kala jadu in islamabad rawalpindi - Amil baba in lahore Am...

Retail sector trends for 2024 | European Business Review

Retail sector trends for 2024 | European Business Review

najoomi asli amil baba kala jadu expert rawalpindi bangladesh uk usa

najoomi asli amil baba kala jadu expert rawalpindi bangladesh uk usa

DIGITAL COMMERCE SHAPE VIETNAMESE SHOPPING HABIT IN 4.0 INDUSTRY

DIGITAL COMMERCE SHAPE VIETNAMESE SHOPPING HABIT IN 4.0 INDUSTRY

najoomi asli amil baba kala jadu expert rawalpindi bangladesh uk usa

najoomi asli amil baba kala jadu expert rawalpindi bangladesh uk usa

No 1 Top Love marriage specialist baba ji amil baba kala ilam powerful vashik...

No 1 Top Love marriage specialist baba ji amil baba kala ilam powerful vashik...

cost-volume-profit analysis.ppt(managerial accounting).pptx

cost-volume-profit analysis.ppt(managerial accounting).pptx

20240419-SMC-submission-Annual-Superannuation-Performance-Test-–-design-optio...

20240419-SMC-submission-Annual-Superannuation-Performance-Test-–-design-optio...

The Tribune 31 Dec 2009 Sensex Closes With Biggest Annual Gain In 18 Years

- 1. Sensex closes with biggest annual gain in 18 years Mumbai, December 31 Putting behind the worst annual performance ever, Indian equities were on a roll in 2009, catapulting a key index by more than 80 per cent, to close the year with one of the best gains among emerging markets. At its closing bell today, the Sensex was ruling at 17,464.81 points with an impressive gain of 7,817.5 points, or 81.03 per cent, over the previous year’s close at 9,647.31 points. This was the best annual performance since 1991, and was in sharp contrast to 2008, when the Sensex ended with a hefty loss of 10,639.68 points or 52.45 per cent, making it the third-worst performing equities index among emerging markets. The story was no different at the NSE, where the broader 50-scrip S&P CNX Nifty gained a hefty 2,241.9 points or 75.76 per cent when it closed at 5,201.05 points today. The main factors that made key indices rise like phoenix was the resilience of the Indian economy and impressive growth despite global slowdown that was also reflected in corporate earnings and the return of the foreign institutional funds. According to market watchdog Sebi, such overseas funds pumped about $17.46 billion into the Indian stock markets in 2009, as opposed to a net sale worth $13.135 billion for the first time in over a decade. “The performance in 2009 surpassed the expectations of even the most optimistic person. There were not many places left for foreign funds to invest and India was among the few attractive destinations,” said Jagannadham Thunuguntla, equity head at SMC Capitals. Some of the 13 sector-specific indices stood out because of their performance -- the metals index appreciated the most, up 233.68 per cent, while auto followed with a gain of 204.16 points. Similarly, the indices for information technology was up 132.78 per cent, capital goods gained 104.26 per cent, consumer durables rose 97.8 per cent, banking gained 83.9 per cent, state-run enterprises inflated 80.54 per cent, power moved up by 74.3 per cent. On the whole, the year started on a promising note with the government unveiling a second dose of fiscal stimulus to help the economy weather the adverse impact of a slowdown in the global economy. As a result, the Sensex rallied till January 6 and gained 7.13 per cent in just three days of trading. But then came the confession of a multi-million dollar fraud by Satyam Computer founder B. Ramalinga Raju, triggering a 7.25 per cent fall in just one session.

- 2. Till February, the barometer index was oscillating between 9,000-odd points and 10,300- levels. But as signs of a prolonged economic recession receded the world over, Indian equities found more takers and reflected in steady rise in the index. By the beginning of May, it was trading comfortably around the 12,000-point mark and gave a thumping welcome to the electoral victory of the Congress party-led United Progressive Alliance -- that even saw suspension of trading as indices hit the upper circuit twice. The remaining months saw a steady rise with interim corrections even as events like the presentation of an industry-friendly Budget boosted investor sentiments. Top five gainers during 2009 were Tata Motors, up 398.33 per cent at Rs.792.60; Mahindra and Mahindra, up 293.23 per cent at Rs.1,080.80; Sterlite Industries, up 230.45 per cent at Rs.861.65; Hindalco, up 211.23 per cent at Rs.160.75; and Maruti Suzuki, up 199.88 per cent at Rs.1,559.65. Only three stocks ended lower -- Bharti Airtel was down 54.02 per cent at Rs.328.80; Reliance Communications was down 23.92 per cent at Rs.172.90; and Reliance Industries, which ended lower since the company declared a 1:1 bonus. Looking ahead, the markets expect some more action once the government’s divestment programme gets under way, even as investors have their fingers crossed on when the Sensex will breach the magical 21,000 mark. — IANS