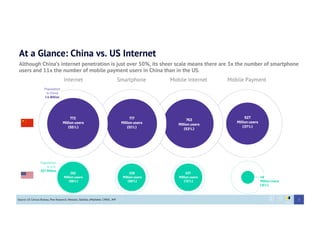

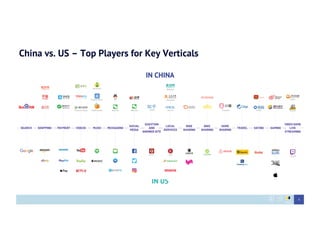

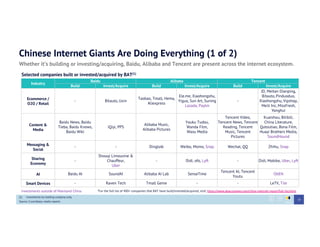

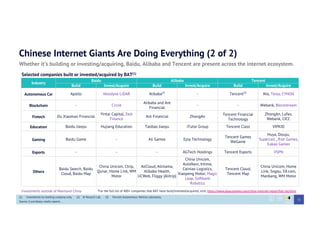

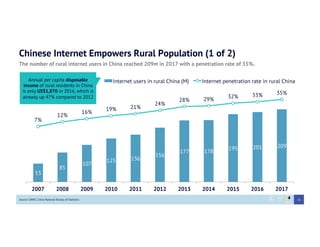

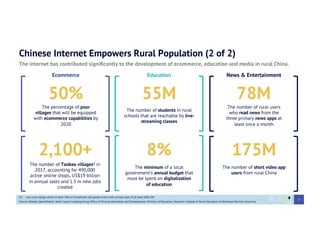

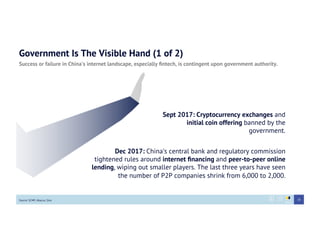

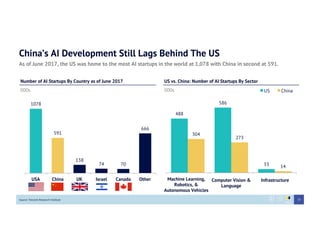

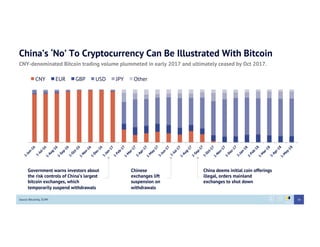

This document provides an overview of the Chinese internet landscape in 2018. It discusses four main themes: Chinese internet companies embracing 'social+', Chinese internet giants expanding into various sectors, the internet empowering China's rural population, and the Chinese government playing a visible role. Specific details include Baidu, Alibaba and Tencent investing in over 400 companies across industries, over 200 million rural internet users in China, and short video and e-commerce helping rural economic development.