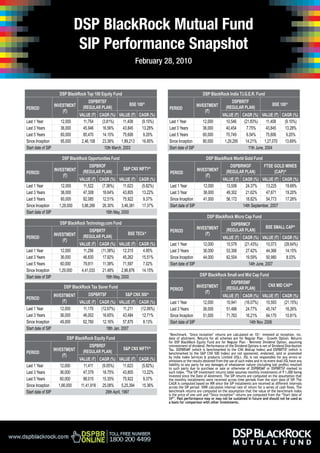

SIP Performance Snapshot

- 1. DSP BlackRock Mutual Fund SIP Performance Snapshot February 28, 2010 DSP BlackRock Top 100 Equity Fund DSP BlackRock India T.I.G.E.R. Fund DSPBRTEF DSPBRITF INVESTMENT BSE 100^ INVESTMENT BSE 100^ PERIOD (REGULAR PLAN) PERIOD (REGULAR PLAN) (`) (`) VALUE (`) CAGR (%) VALUE (`) CAGR (%) VALUE (`) CAGR (%) VALUE (`) CAGR (%) Last 1 Year 12,000 11,754 (3.81%) 11,408 (9.10%) Last 1 Year 12,000 10,546 (21.83%) 11,408 (9.10%) Last 3 Years 36,000 45,946 16.56% 43,845 13.28% Last 3 Years 36,000 40,454 7.75% 43,845 13.28% Last 5 Years 60,000 85,470 14.15% 75,606 9.20% Last 5 Years 60,000 70,749 6.54% 75,606 9.20% Since Inception 95,000 2,46,158 23.38% 1,89,213 16.95% Since Inception 80,000 1,29,295 14.21% 1,27,070 13.69% Start date of SIP 10th March, 2003 Start date of SIP 11th June, 2004 DSP BlackRock Opportunities Fund DSP BlackRock World Gold Fund DSPBROF DSPBRWGF FTSE GOLD MINES INVESTMENT S&P CNX NIFTY^ INVESTMENT PERIOD (REGULAR PLAN) PERIOD (REGULAR PLAN) (CAP)^ (`) (`) VALUE (`) CAGR (%) VALUE (`) CAGR (%) VALUE (`) CAGR (%) VALUE (`) CAGR (%) Last 1 Year 12,000 11,522 (7.36%) 11,623 (5.82%) Last 1 Year 12,000 13,506 24.37% 13,225 19.69% Last 3 Years 36,000 47,308 18.64% 43,805 13.22% Last 3 Year 36,000 49,302 21.62% 47,671 19.20% Last 5 Years 60,000 82,085 12.51% 75,922 9.37% Since Inception 41,000 56,172 18.82% 54,773 17.26% Since Inception 1,29,000 5,86,266 26.30% 3,46,381 17.37% Start date of SIP 14th September, 2007 Start date of SIP 16th May, 2000 DSP BlackRock Micro Cap Fund DSP BlackRock Technology.com Fund DSPBRMCF INVESTMENT BSE SMALL CAP^ DSPBRTF PERIOD (REGULAR PLAN) INVESTMENT BSE TECk^ (`) PERIOD (REGULAR PLAN) VALUE (`) CAGR (%) VALUE (`) CAGR (%) (`) VALUE (`) CAGR (%) VALUE (`) CAGR (%) Last 1 Year 12,000 10,579 (21.43%) 10,073 (28.64%) Last 1 Year 12,000 11,256 (11.38%) 12,315 4.95% Last 3 Years 36,000 53,306 27.42% 44,366 14.15% Last 3 Years 36,000 46,830 17.92% 45,262 15.51% Since Inception 44,000 62,504 19.59% 50,980 8.03% Last 5 Years 60,000 79,811 11.38% 71,597 7.02% Start date of SIP 14th June, 2007 Since Inception 1,29,000 4,41,033 21.48% 2,86,876 14.15% Start date of SIP 16th May, 2000 DSP BlackRock Small and Mid Cap Fund DSPBRSMF DSP BlackRock Tax Saver Fund INVESTMENT CNX MID CAP^ PERIOD (REGULAR PLAN) (`) INVESTMENT DSPBRTSF S&P CNX 500^ VALUE (`) CAGR (%) VALUE (`) CAGR (%) PERIOD (`) VALUE (`) CAGR (%) VALUE (`) CAGR (%) Last 1 Year 12,000 10,941 (16.07%) 10,593 (21.15%) Last 1 Year 12,000 11,170 (12.67%) 11,211 (12.06%) Last 3 Years 36,000 51,486 24.77% 45,747 16.26% Last 3 Years 36,000 46,002 16.65% 43,484 12.71% Since Inception 51,000 71,763 16.21% 64,170 10.81% Since Inception 49,000 62,760 12.16% 57,875 8.13% Start date of SIP 14th Nov. 2006 Start date of SIP 18th Jan. 2007 ^Benchmark. ‘Since inception’ returns are calculated on 10/- invested at inception, viz. DSP BlackRock Equity Fund date of allotment. Returns for all schemes are for Regular Plan - Growth Option. Returns for DSP BlackRock Equity Fund are for Regular Plan - Reinvest Dividend Option, assuming DSPBREF reinvestment of dividend. Performance of the Dividend Options is net of Dividend Distribution INVESTMENT S&P CNX NIFTY^ Tax. DSPBRSMF (which is benchmarked to the CNX Midcap Index) and DSPBRTSF (which is PERIOD (REGULAR PLAN) benchmarked to the S&P CNX 500 Index) are not sponsored, endorsed, sold or promoted (`) by India Index Services & products Limited (IISL). IISL is not responsible for any errors or VALUE (`) CAGR (%) VALUE (`) CAGR (%) omissions or the results obtained from the use of such index and in no event shall IISL have any Last 1 Year 12,000 11,411 (9.05%) 11,623 (5.82%) liability to any party for any damages of whatsoever nature (including lost profits) resulted to such party due to purchase or sale or otherwise of DSPBRSMF or DSPBRTSF marked to Last 3 Years 36,000 47,379 18.75% 43,805 13.22% such index. *The SIP investment returns table assumes monthly investments of ` 1,000 being invested since the Date of Allotment. The SIP returns are computed on the assumption that Last 5 Years 60,000 88,015 15.35% 75,922 9.37% the monthly installments were received across time periods from the start date of SIP. The CAGR is computed based on IRR since the SIP instalments are received at different intervals Since Inception 1,66,000 11,41,918 25.08% 5,25,394 15.36% across the SIP period. XIRR calculates internal rate of return for a series of cash flows. The Start date of SIP 29th April, 1997 benchmark returns are computed on the assumption that the value of the benchmark index is the price of one unit and “Since inception” returns are computed from the “Start date of SIP”. Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments.

- 2. DSP BlackRock Equity Fund (DSPBREF) is an open ended growth Scheme, seeking to generate long term capital appreciation, from a portfolio that is substantially constituted of equity securities and equity related securities of issuers domiciled in India. Asset Allocation: Equity & equity related securities: 90%-100%; Debt & money market securities: 0%-10% (Debt securities/instruments are deemed to include securitised debts). DSP BlackRock Top 100 Equity Fund (DSPBRTEF) is an open ended growth Scheme, seeking to generate capital appreciation, from a portfolio that is substantially constituted of equity securities and equity related securities of the 100 largest corporates, by market capitalisation, listed in India. Asset Allocation: Equity & equity related securities: 90%-100%; Debt, securitised debt & money market securities: 0%-10%. DSP BlackRock Opportunities Fund (DSPBROF) is an open ended growth Scheme, seeking to generate long term capital appreciation and whose secondary objective is income generation and the distribution of dividend from a portfolio constituted of equity and equity related securities concentrating on the Investment Focus of the Scheme. Asset Allocation: Equity and equity related securities: 80%-100%; Fixed income securities (Debt & money market securities): 0%-20% (Debt securities/instruments are deemed to include securitised debts). DSP BlackRock India T.I.G.E.R Fund (The Infrastructure Growth and Economic Reforms Fund) (DSPBRITF) is an open ended diversified equity Scheme, seeking to generate capital appreciation, from a portfolio that is substantially constituted of equity securities and equity related securities of corporates, which could benefit from structural changes brought about by continuing liberalization in economic policies by the Government and/or from continuing investments in infrastructure, both by the public and private sector. Asset Allocation: Equity & equity related securities: 90%-100%; Debt, securitised debt & money market securities 0%-10%; ADR, GDR & foreign securities: 0%-25%. DSP BlackRock Technology.com Fund (DSPBRTF) is an open ended growth Scheme, seeking to generate long term capital appreciation, and whose secondary objective is income generation and the distribution of dividend from a portfolio constituted of equity and equity related securities concentrating on the investment focus of the Scheme. Asset Allocation: Equity & equity related securities: 80%-100%; Fixed income securities (Debt & money market securities): 0%-20% (Debt securities/instruments are deemed to include securitised debts). DSP BlackRock Small and Mid Cap fund (DSPBRSMF) is an open ended equity growth scheme, primarily seeking to generate long term capital appreciation from a portfolio substantially constituted of equity and equity related securities, which are not part of top 100 stocks by market capitalization. Asset Allocation: Equity and equity related securities which are-(A) not part of top 100 stocks by market cap: 65% - 100%, (B) in the top 100 stocks by market cap: 0% - 35%; Of (A) & (B), investments in ADRs, GDRs & foreign securities: 0% - 25%; Debt and Money Market Securities: 0% - 10%. DSP BlackRock Tax Saver Fund (DSPBRTSF) is an open ended equity linked savings scheme, whose primary investment objective is to seek to generate medium to long-term capital appreciation from a diversified portfolio that is substantially constituted of equity and equity related securities of corporates, and to enable investors avail of a deduction from total income, as permitted under the Income Tax Act, 1961 from time to time. Asset Allocation: Equity and equity related securities: 80% to 100%; (investments in ADRs, GDRs and foreign equity securities: 0% to 20%); Debt, securitised debt and money market securities: 0% to 20% (Exposure to Securitised debt will not exceed 10% of the net assets of the Scheme). DSP BlackRock Micro Cap Fund (DSPBRMCF) The primary investment objective of the Scheme is to seek to generate long term capital appreciation from a portfolio that is substantially constituted of equity and equity related securities, which are not part of the top 300 companies by market capitalisation. Asset Allocation: Equity and equity related securities which are-(A) not part of top 300 stocks by market cap: 65% - 100%, (B) in the top 300 stocks by market cap: 0% - 35%; Of 1(A) & 1(B), investments in ADRs, GDRs & foreign securities: 0% - 25%; Debt and Money Market Securities: 0% - 35% (Debt securities may include securitised debt upto 10% of the net assets). DSP BlackRock World Gold Fund (DSPBRWGF) is an open ended fund of funds scheme, investing in gold mining companies through an international fund, and the primary investment objective is to seek capital appreciation by investing predominantly in units of BGF - WGF. The Scheme may, at the discretion of the Investment Manager, also invest in the units of other similar overseas mutual fund schemes, which may constitute a significant part of its corpus. Asset Allocation: Units of BGF – WGF or other similar overseas mutual fund scheme(s): 90% to 100%; Money market securities and/or units of money market/liquid schemes of DSP BlackRock Mutual Fund: 0% to 10%. Common Features: SIP only in Regular Plan, SWP & STP available in each plan of the scheme. Nomination facility available, subject to applicable conditions as per the Statement of Additional Information (SAI) and Scheme Information Document (SID). Declaration of NAV on all Business Days. Redemption normally within 5 Business Days. Sale and Redemption of Units on all Business Days at Purchase Price and Redemption Price respectively. Minimum investment: Rs. 5,000/- (Reg. Plan)/Rs. 1 crore (Inst. Plan). Entry load: NIL. Exit load: Holding Period < 12 months: 1%, Holding Period >= 12 months: NIL. (Exit Load for DSPBRMCF: For holding period from the date of allotment: < 24 months: 1.00%; >= 24 months: Nil). Investors shall bear the recurring expenses of the Scheme in addition to the expenses of the underlying scheme(s) in which the Scheme will make investment. Specific Features for DSPBRTSF: SIP facility available. SWP & STP available subject to completion of 3 year lock-in period. Minimum investment : Rs. 500/-. Entry load : Nil; Exit load : N.A. Redemption, subject to the completion of a 3 year lock-in period. Statutory Details: DSP BlackRock Mutual Fund was set up as a Trust and the settlors/sponsors are DSP ADIKO Holdings Pvt. Ltd. & DSP HMK Holdings Pvt. Ltd. (collectively) and BlackRock Inc. (Combined liability restricted to Rs. 1 lakh). Trustee: DSP BlackRock Trustee Company Pvt. Ltd. Investment Manager: DSP BlackRock Investment Managers Pvt. Ltd. Risk Factors: Mutual funds, like securities investments, are subject to market and other risks and there can be no assurance that the Scheme’s objectives will be achieved. As with any investment in securities, the NAV of Units issued under the Scheme can go up or down depending on the factors and forces affecting capital markets. Past performance of the sponsor/AMC/mutual fund does not indicate the future performance of the Scheme. Investors in the Scheme are not being offered a guaranteed or assured rate of return. Each Scheme/Plan is required to have (i) minimum 20 investors and (ii) no single investor holding>25% of corpus. If the aforesaid point (i) is not fulfilled within the prescribed time, the Scheme/Plan concerned will be wound up and in case of breach of the aforesaid point (ii) at the end of the prescribed period, the investor’s holding in excess of 25% of the corpus will be redeemed as per SEBI guidelines. The names of the Schemes do not in any manner indicate the quality of the Schemes, their future prospects or returns. For scheme specific risk factors, please refer the Scheme Information Document (SID). For more details, please refer the Key Information Memorandum cum Application Forms, which are available on the website, www.dspblackrock.com, and at the ISCs/Distributors. If the SEBI limits for overseas investments allowed to the Fund are expected to be exceeded, subscriptions and switches into the Scheme may be temporarily suspended / SIP/STP into the Scheme may be terminated. Investors in DSPBRNRNEF shall bear the proportionate recurring expenses of underlying schemes in addition to the expenses of the Scheme. DSPBRSMF (which is benchmarked to the CNX Midcap Index) and DSPBRTSF (which is benchmarked to the S&P CNX 500 Index), is not sponsored, endorsed, sold or promoted by India Index Services & products Limited (IISL). IISL is not responsible for any errors or omissions or the results obtained from the use of such index and in no event shall IISL have any liability to any party for any damages of whatsoever nature (including lost profits) resulted to such party due to purchase or sale or otherwise of DSPBRSMF or DSPBRTSF marked to such index. Please read the Scheme Information Document and Statement of Additional Information carefully before investing.