More Related Content

Similar to Construction Realtor Flyer

Similar to Construction Realtor Flyer (20)

Construction Realtor Flyer

- 1. This document is not a Consumer Credit Advertisement and is intended for Real Estate Broker use only. The information above is provided to assist real

estate agents and is not a consumer credit advertisement as defined by Regulation Z.

Loan approval is subject to credit approval and program guidelines. Not all loan programs are available in all states for all loan amounts. Interest rates and program

terms are subject to change without notice. Visit usbank.com to learn more about U.S. Bank products and services. Mortgage and Home Equity products are offered by

U.S. Bank National Association. Deposit products are offered through U.S. Bank National Association, Member FDIC. ©2015 U.S. Bank

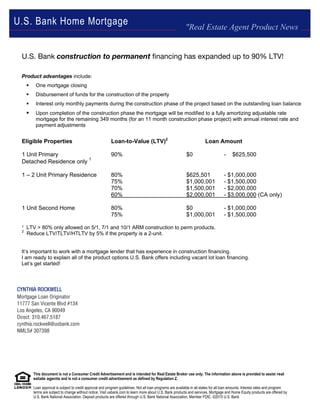

U.S. Bank construction to permanent financing has expanded up to 90% LTV!

Product advantages include:

One mortgage closing

Disbursement of funds for the construction of the property

Interest only monthly payments during the construction phase of the project based on the outstanding loan balance

Upon completion of the construction phase the mortgage will be modified to a fully amortizing adjustable rate

mortgage for the remaining 349 months (for an 11 month construction phase project) with annual interest rate and

payment adjustments

Eligible Properties Loan-to-Value (LTV)2

Loan Amount

1 Unit Primary 90% $0 - $625,500

Detached Residence only

1

1 – 2 Unit Primary Residence 80% $625,501 - $1,000,000

75% $1,000,001 - $1,500,000

70% $1,500,001 - $2,000,000

60% $2,000,001 - $3,000,000 (CA only)

1 Unit Second Home 80% $0 - $1,000,000

75% $1,000,001 - $1,500,000

¹ LTV > 80% only allowed on 5/1, 7/1 and 10/1 ARM construction to perm products.

2

Reduce LTV/TLTV/HTLTV by 5% if the property is a 2-unit.

It’s important to work with a mortgage lender that has experience in construction financing.

I am ready to explain all of the product options U.S. Bank offers including vacant lot loan financing.

Let’s get started!

"Real Estate Agent Product News

U.S. Bank Home Mortgage

CYNTHIA ROCKWELL

Mortgage Loan Originator

11777 San Vicente Blvd #134

Los Angeles, CA 90049

Direct: 310.467.5187

cynthia.rockwell@usbank.com

NMLS# 307398