TO GET A PDF VERSION OF THIS REPORT, PLEASE FOLLOW CHINA TECH INSIGHTS' OA ON WECHAT (OA ID:chinatechinsights), AND REPLY "DOWNLOAD" TO GET ACCESS.

E-Sports, as an emerging new sector in China, is advancing at the speed of light. In 2016, E-Sports became an important part of China’s gaming industry with a market valued at 3 billion USD and 170 million users. Along with the expansion of E-Sports, we see an increasingly mature industry with blooming niche sectors. Related businesses, including copy right distribution, fan-based operations, franchise and e-commerce, will also see an increase together with E-Sports.

Penguin Intelligence joins hands with Tencent E-Sports have launched this report based on product data, consumer surveys, and industry insights. In this report, we’ll discuss:

1) The profile of E-Sports audiences in China and their behaviors

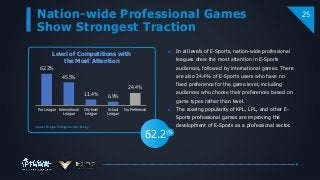

2) Most popular fields in Chinese E-Sports

3) Opportunities in each link of the value chain

4) User expectations for future tournaments