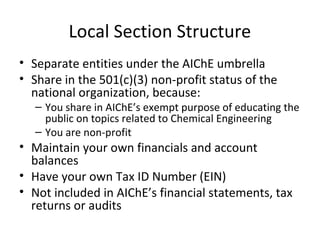

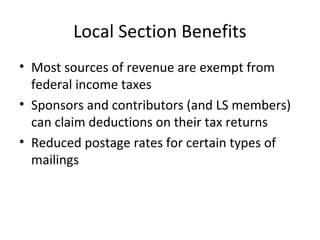

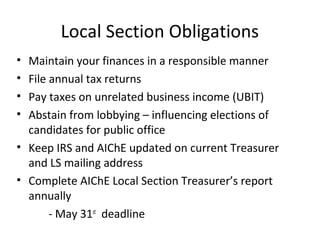

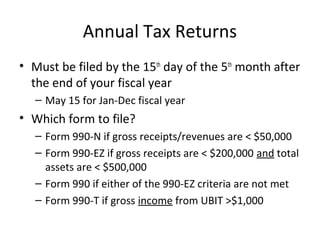

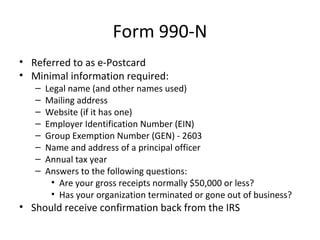

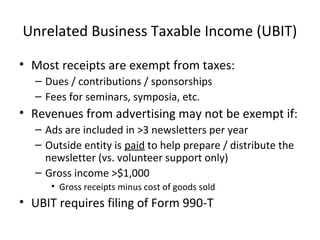

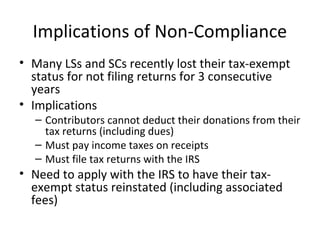

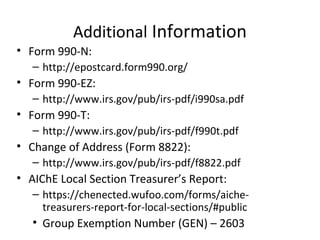

This document provides information and guidance for local AIChE sections on accounting, taxes, and annual reporting obligations. It outlines that local sections are separate non-profit entities under AIChE that must file annual tax returns, either a Form 990-N, 990-EZ, or 990 depending on revenues and assets. It also notes that sections must pay taxes on unrelated business income over $1,000 and file Form 990-T, and that failing to file tax returns for three years can result in a section losing its tax-exempt status. The document reviews quarterly dues payments to sections and annual reporting deadlines.