Report

Share

Download to read offline

Recommended

Presentation by John Hurley, Visiting Policy Fellow Centre for Global Development and former lead US negotiator for the Addis Ababa Action Agenda at SITE Development Day 2017Presentation by John Hurley, Visiting Policy Fellow Centre for Global Develop...

Presentation by John Hurley, Visiting Policy Fellow Centre for Global Develop...Stockholm Institute of Transition Economics

Recommended

Presentation by John Hurley, Visiting Policy Fellow Centre for Global Development and former lead US negotiator for the Addis Ababa Action Agenda at SITE Development Day 2017Presentation by John Hurley, Visiting Policy Fellow Centre for Global Develop...

Presentation by John Hurley, Visiting Policy Fellow Centre for Global Develop...Stockholm Institute of Transition Economics

More Related Content

Similar to NAB Infographic- final

Similar to NAB Infographic- final (20)

The US National Advisory Board Issues Policy Recommendations To Encourage Imp...

The US National Advisory Board Issues Policy Recommendations To Encourage Imp...

Virtuix Series A 2 - Investment Opportunity or Poor Deal?

Virtuix Series A 2 - Investment Opportunity or Poor Deal?

NAB Infographic- final

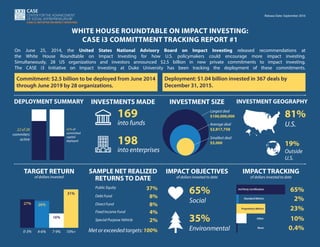

- 1. CASE i3: INITIATIVE ON IMPACT INVESTING Release Date: September 2016 WHITE HOUSE ROUNDTABLE ON IMPACT INVESTING: CASE i3 COMMITTMENT TRACKING REPORT #1 On June 25, 2014, the United States National Advisory Board on Impact Investing released recommendations at the White House Roundtable on Impact Investing for how U.S. policymakers could encourage more impact investing. Simultaneously, 28 US organizations and investors announced $2.5 billion in new private commitments to impact investing. The CASE i3 Initiative on Impact Investing at Duke University has been tracking the deployment of these commitments. TARGET RETURN of dollars invested SAMPLE NET REALIZED RETURNS TO DATE IMPACT OBJECTIVES of dollars invested to date IMPACT TRACKING of dollars invested to date DEPLOYMENT SUMMARY 22 of 28 commiters active 42% of committed capital deployed INVESTMENTS MADE 169 into funds 198 into enterprises INVESTMENT GEOGRAPHY 81% U.S. 19% Outside U.S. 0-3% 4-6% 10%+7-9% 27% 26% 16% 31% 37%Public Equity 8%Debt Fund 8%Direct Fund 4%Fixed Income Fund 2%Special Purpose Vehicle 35% Environmental 65% Social Met or exceeded targets: 100% 65%3rd Party Certification 2% 23% 10% 0.4% Standard Metrics Proprietary Metrics Other None CASE i3: INITIATIVE ON IMPACT INVESTING Release Date: September 2016 Commitment: $2.5 billion to be deployed from June 2014 through June 2019 by 28 organizations. Deployment: $1.04 billion invested in 367 deals by December 31, 2015. INVESTMENT SIZE $100,000,000 Largest deal $2,817,758 Average deal $5,000 Smallest deal

- 2. CASE i3: INITIATIVE ON IMPACT INVESTING Release Date: September 2016 Thank you to the 28 organizations and investors who committed over $2.5 billion to impact investing: