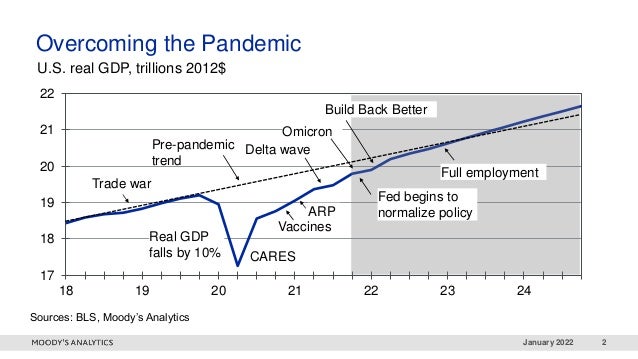

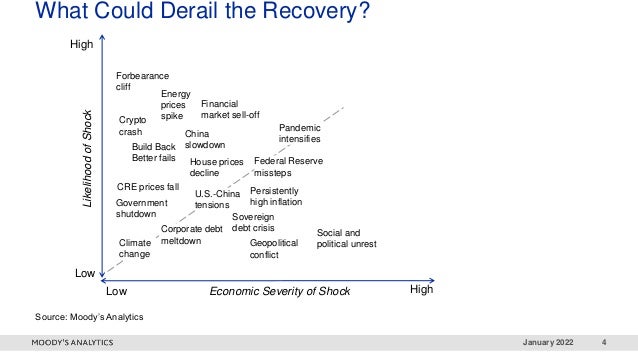

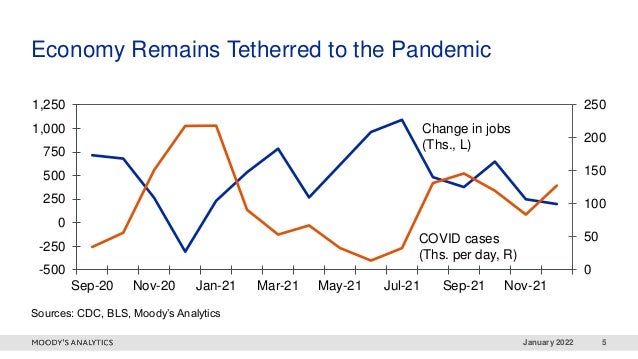

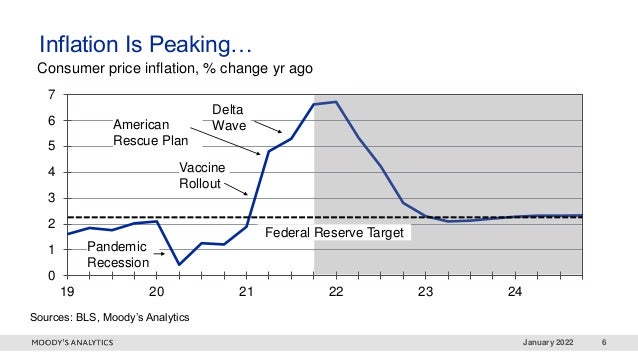

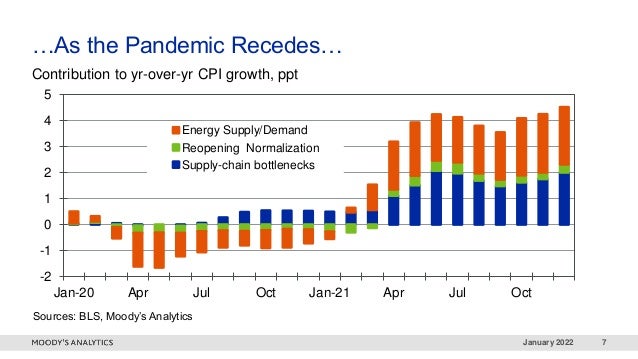

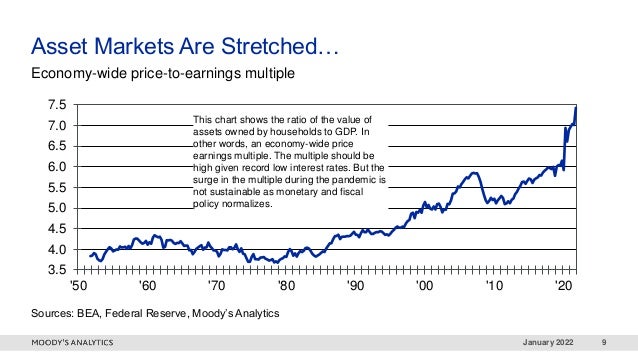

The document discusses the impact of the pandemic on the U.S. economy as of January 2022, indicating a 10% decline in real GDP and ongoing challenges like inflation and economic recovery. Factors that could derail recovery include high inflation, geopolitical tensions, and potential corporate debt crises. Overall, the economy remains closely tied to the pandemic's trajectory and policy responses, with asset markets being particularly stretched.