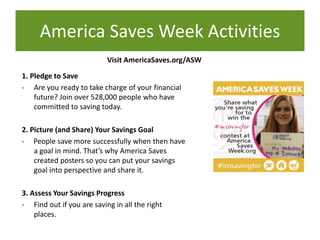

The America Saves campaign aims to motivate low to moderate-income households in the U.S. to save and build wealth, highlighting the importance of financial action and automatic saving during America Saves Week. Key strategies include paying off high-cost debt, saving for emergencies, and participating in employer retirement programs. The initiative encourages Americans to assess their financial condition, create budgets, and make savings automatic through various methods, including direct deposits and tax refunds.