Kist bank presentation

•Download as PPTX, PDF•

0 likes•612 views

Report

Share

Report

Share

More Related Content

Viewers also liked

Viewers also liked (7)

Similar to Kist bank presentation

Similar to Kist bank presentation (6)

Working capital management ppt @ bec doms bagalkot

Working capital management ppt @ bec doms bagalkot

More from Abhyuday Shah

More from Abhyuday Shah (9)

Recently uploaded

(Vedika) Low Rate Call Girls in Pune Call Now 8250077686 Pune Escorts 24x7

(Vedika) Low Rate Call Girls in Pune Call Now 8250077686 Pune Escorts 24x7Call Girls in Nagpur High Profile Call Girls

VVIP Pune Call Girls Katraj (7001035870) Pune Escorts Nearby with Complete Sa...

VVIP Pune Call Girls Katraj (7001035870) Pune Escorts Nearby with Complete Sa...Call Girls in Nagpur High Profile

Top Rated Pune Call Girls Viman Nagar ⟟ 6297143586 ⟟ Call Me For Genuine Sex...

Top Rated Pune Call Girls Viman Nagar ⟟ 6297143586 ⟟ Call Me For Genuine Sex...Call Girls in Nagpur High Profile

Recently uploaded (20)

Call Girls Service Nagpur Maya Call 7001035870 Meet With Nagpur Escorts

Call Girls Service Nagpur Maya Call 7001035870 Meet With Nagpur Escorts

02_Fabio Colombo_Accenture_MeetupDora&Cybersecurity.pptx

02_Fabio Colombo_Accenture_MeetupDora&Cybersecurity.pptx

Best VIP Call Girls Noida Sector 18 Call Me: 8448380779

Best VIP Call Girls Noida Sector 18 Call Me: 8448380779

VIP Call Girls LB Nagar ( Hyderabad ) Phone 8250192130 | ₹5k To 25k With Room...

VIP Call Girls LB Nagar ( Hyderabad ) Phone 8250192130 | ₹5k To 25k With Room...

(Vedika) Low Rate Call Girls in Pune Call Now 8250077686 Pune Escorts 24x7

(Vedika) Low Rate Call Girls in Pune Call Now 8250077686 Pune Escorts 24x7

20240429 Calibre April 2024 Investor Presentation.pdf

20240429 Calibre April 2024 Investor Presentation.pdf

Log your LOA pain with Pension Lab's brilliant campaign

Log your LOA pain with Pension Lab's brilliant campaign

VVIP Pune Call Girls Katraj (7001035870) Pune Escorts Nearby with Complete Sa...

VVIP Pune Call Girls Katraj (7001035870) Pune Escorts Nearby with Complete Sa...

Call Girls Koregaon Park Call Me 7737669865 Budget Friendly No Advance Booking

Call Girls Koregaon Park Call Me 7737669865 Budget Friendly No Advance Booking

(ANIKA) Budhwar Peth Call Girls Just Call 7001035870 [ Cash on Delivery ] Pun...![(ANIKA) Budhwar Peth Call Girls Just Call 7001035870 [ Cash on Delivery ] Pun...](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![(ANIKA) Budhwar Peth Call Girls Just Call 7001035870 [ Cash on Delivery ] Pun...](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

(ANIKA) Budhwar Peth Call Girls Just Call 7001035870 [ Cash on Delivery ] Pun...

06_Joeri Van Speybroek_Dell_MeetupDora&Cybersecurity.pdf

06_Joeri Van Speybroek_Dell_MeetupDora&Cybersecurity.pdf

Pooja 9892124323 : Call Girl in Juhu Escorts Service Free Home Delivery

Pooja 9892124323 : Call Girl in Juhu Escorts Service Free Home Delivery

Top Rated Pune Call Girls Viman Nagar ⟟ 6297143586 ⟟ Call Me For Genuine Sex...

Top Rated Pune Call Girls Viman Nagar ⟟ 6297143586 ⟟ Call Me For Genuine Sex...

Kist bank presentation

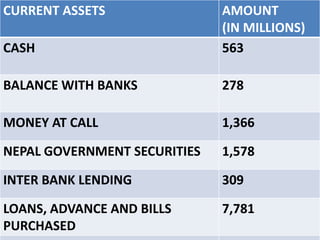

- 1. CURRENT ASSETS CASH AMOUNT (IN MILLIONS) 563 BALANCE WITH BANKS 278 MONEY AT CALL 1,366 NEPAL GOVERNMENT SECURITIES 1,578 INTER BANK LENDING 309 LOANS, ADVANCE AND BILLS PURCHASED 7,781

- 2. CURRENT LIABILITIES AMOUNT (IN MILLIONS NON INTEREST BEARING DEPOSITS 229 SAVING AND CALL DEPOSITS 4,902 FIXED DEPOSITS 3,076 BORROWINGS 500 PROPOSED DIVIDENDS 100 INCOME TAX PAYABLE 7.67 OTHER CURRENT LIABILITIES 247 TOTAL 9,061.67

- 4. CURRENT ASSETS CURRENT RATIO CURRENT LIABILITIES 1.33:1 THIS INDICATES THAT THE BANK DOESN’T HAVE THE ABILITY TO MEET IT’S CURRENT OBLIGATION AS THE SATISFACTORY CURRENT RATIO IS CONSIDERED 2:1,HOWEVER,THE RATIO ONLY MEASURES THE QUANTITATIVE ASPECT NOT THE QUALITATIVE ASPECT SO THIS DOESN’T MEAN THE BANK IS NOT PERFORMING WELL.

- 5. QUICK ASSETS • QUICK ASSETS=CURRENT ASSETS- AMOUNT (IN MILLIONS) CASH 563 BALANCE WITH BANKS 278 MONEY AT CALL 1,366 NEPAL GOVERNMENT SECURITIES 1,578 INTER BANK LENDINGS 309 OTHER CURRENT ASSETS 152 TOTAL 4,246

- 8. • DIVIDEND PER SHARE WAS 3.50% IN FY2008/09 WHICH HAS INCREASED TO 5.00% IN FY 2009/10 • HIGHER DPS INCREASES THE TRUST OF THE SHAREHOLDERS. • HIGHER THE DPS BETTER THE SATISFACTION OF THE SHAREHOLDERS

- 9. • THE TOTAL AMOUNT OF NON PERFORMING ASSET IN FY 2008/09 WAS 15,296,351 WHICH HAS INCREASED TO 24,090,030 IN FY 2009/10 • THE INCREASE IN NON PERFORMING ASSETS MEANS THE INCREASE IN RISK. IT WOULD BE BETTER FOR THE BANK IF THE BANK COULD DECREASE THE AMOUNT OF NON PERFORMING ASSET. • LOWER THE AMOUNT OF NON PERFORMING ASSET BETTER IT IS FOR THE BANK.