Cendan05 Sale Unduly Benefits Owners

•Download as PPS, PDF•

0 likes•385 views

Report

Share

Report

Share

Recommended

Presentation slides from the ICSA Irish Region Directors' Duties (Cork) CPD event that took place on 10 April 2018ICSA Irish Region Directors' Duties (Cork) CPD event, 10 April 2018

ICSA Irish Region Directors' Duties (Cork) CPD event, 10 April 2018Institute of Chartered Secretaries and Administrators

Sometimes it’s difficult to decide which type of buy sell agreement to recommend when dealing with QPSC, S Corp, and LLCs. Should it be a stock redemption plan funded with employer owned insurance or a cross purchase plan funded by cross owned insurance?

Get expert insight from Russell E. Towers JD, CLU, ChFC

Vice President, Business & Estate Planning at Brokers' Service Marketing Group ( A brokerage general agency for financial professionals).Buy Sell Planning for QPSC, S Corp, and LLC Professional Practice Owners

Buy Sell Planning for QPSC, S Corp, and LLC Professional Practice OwnersBSMG | Brokers' Service Marketing Group

Recommended

Presentation slides from the ICSA Irish Region Directors' Duties (Cork) CPD event that took place on 10 April 2018ICSA Irish Region Directors' Duties (Cork) CPD event, 10 April 2018

ICSA Irish Region Directors' Duties (Cork) CPD event, 10 April 2018Institute of Chartered Secretaries and Administrators

Sometimes it’s difficult to decide which type of buy sell agreement to recommend when dealing with QPSC, S Corp, and LLCs. Should it be a stock redemption plan funded with employer owned insurance or a cross purchase plan funded by cross owned insurance?

Get expert insight from Russell E. Towers JD, CLU, ChFC

Vice President, Business & Estate Planning at Brokers' Service Marketing Group ( A brokerage general agency for financial professionals).Buy Sell Planning for QPSC, S Corp, and LLC Professional Practice Owners

Buy Sell Planning for QPSC, S Corp, and LLC Professional Practice OwnersBSMG | Brokers' Service Marketing Group

The current Federal environment requires creativity, drive and passion to succeed. Part of this creativity manifests itself in the strategies your company employs to continue its growth or maintain its current position. A number of CEOs have asked GTSC about joint ventures - why you would choose to form one, how they are formed, the different types and the legal considerations.

Join us to hear from several small businesses that formed joint ventures and engage with them to learn how they did it, why, and whether or not they would do it again. Also, hear from some of the leading industry experts on the legal and operational considerations to consider in setting up your joint venture.

About the GTSC Market Solutions Series

The Market Solutions Series provides an inside look at creative successful interactions in the Federal homeland and national security market. These intimate roundtables take members inside the "story" and allow them to understand the market components and forces that resulted in success. The Market Solution Series was developed in response to members who were interested in creative ways to partner and team to win business with the Federal government.

Our Speakers:

Devon E. Hewitt, Member, Protorae Law PLLC, guest of LeapFrog Solutions

Lisa Martin, CEO, LeapFrog Solutions

Brian Nault, President, BlueWater Federal Solutions

Malcolm Sandilands, Partner, Dickstein Shapiro LLP

Market Solutions Series: Focus on Joint Venture Structures & Implementations

Market Solutions Series: Focus on Joint Venture Structures & ImplementationsGovernment Technology and Services Coalition

More Related Content

What's hot

The current Federal environment requires creativity, drive and passion to succeed. Part of this creativity manifests itself in the strategies your company employs to continue its growth or maintain its current position. A number of CEOs have asked GTSC about joint ventures - why you would choose to form one, how they are formed, the different types and the legal considerations.

Join us to hear from several small businesses that formed joint ventures and engage with them to learn how they did it, why, and whether or not they would do it again. Also, hear from some of the leading industry experts on the legal and operational considerations to consider in setting up your joint venture.

About the GTSC Market Solutions Series

The Market Solutions Series provides an inside look at creative successful interactions in the Federal homeland and national security market. These intimate roundtables take members inside the "story" and allow them to understand the market components and forces that resulted in success. The Market Solution Series was developed in response to members who were interested in creative ways to partner and team to win business with the Federal government.

Our Speakers:

Devon E. Hewitt, Member, Protorae Law PLLC, guest of LeapFrog Solutions

Lisa Martin, CEO, LeapFrog Solutions

Brian Nault, President, BlueWater Federal Solutions

Malcolm Sandilands, Partner, Dickstein Shapiro LLP

Market Solutions Series: Focus on Joint Venture Structures & Implementations

Market Solutions Series: Focus on Joint Venture Structures & ImplementationsGovernment Technology and Services Coalition

What's hot (20)

Avoiding Traps in Your Transition: Negotiating Your Bonus Arrangement and Emp...

Avoiding Traps in Your Transition: Negotiating Your Bonus Arrangement and Emp...

Market Solutions Series: Focus on Joint Venture Structures & Implementations

Market Solutions Series: Focus on Joint Venture Structures & Implementations

Viewers also liked

How the Taubman Health Sciences Library created a program for making video tutorials.Instant Access: Using Technology to Bridge the Access Gap at the Library

Instant Access: Using Technology to Bridge the Access Gap at the LibraryUniversity of Michigan Taubman Health Sciences Library

Viewers also liked (16)

In plain language and in plain sight around the globe

In plain language and in plain sight around the globe

Merger Out Of Existence Wfhm Into Wells Fargo Bank Na May 2004

Merger Out Of Existence Wfhm Into Wells Fargo Bank Na May 2004

Jon Rubin & Katherine Spivey - User-Useful Government Websites: Intersection ...

Jon Rubin & Katherine Spivey - User-Useful Government Websites: Intersection ...

Cpa Cpe Why Consider A Real Estate Investment In The Current Market July 2009

Cpa Cpe Why Consider A Real Estate Investment In The Current Market July 2009

Instant Access: Using Technology to Bridge the Access Gap at the Library

Instant Access: Using Technology to Bridge the Access Gap at the Library

National Health Care Reform: What is it and What Does it Mean to You?

National Health Care Reform: What is it and What Does it Mean to You?

Similar to Cendan05 Sale Unduly Benefits Owners

Similar to Cendan05 Sale Unduly Benefits Owners (20)

Introduction to ESOPs Greater Washington Societypptx

Introduction to ESOPs Greater Washington Societypptx

Negotiating and Drafting Cash Collateral/DIP Financing Orders (Series: Bankru...

Negotiating and Drafting Cash Collateral/DIP Financing Orders (Series: Bankru...

MIT enterprise forum alternative financing - 11-17-11

MIT enterprise forum alternative financing - 11-17-11

When company directors face personal liability risk

When company directors face personal liability risk

Companies in Financial Difficulties - Duties and Liabilities of Directors und...

Companies in Financial Difficulties - Duties and Liabilities of Directors und...

More from SAVE AMERICA ONE MORTGAGE AT A TIME

Sd Sd Wells Fargo Home Mortgage Merging Into Wells Fargo Bank National Assoc ...

Sd Sd Wells Fargo Home Mortgage Merging Into Wells Fargo Bank National Assoc ...SAVE AMERICA ONE MORTGAGE AT A TIME

More from SAVE AMERICA ONE MORTGAGE AT A TIME (10)

Sd Sd Wells Fargo Home Mortgage Merging Into Wells Fargo Bank National Assoc ...

Sd Sd Wells Fargo Home Mortgage Merging Into Wells Fargo Bank National Assoc ...

Cendan05 Sale Unduly Benefits Owners

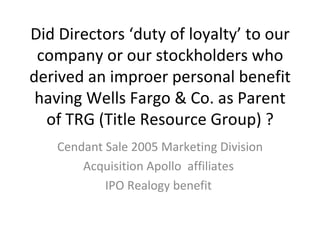

- 1. Did Directors ‘duty of loyalty’ to our company or our stockholders who derived an improer personal benefit having Wells Fargo & Co. as Parent of TRG (Title Resource Group) ? Cendant Sale 2005 Marketing Division Acquisition Apollo affiliates IPO Realogy benefit