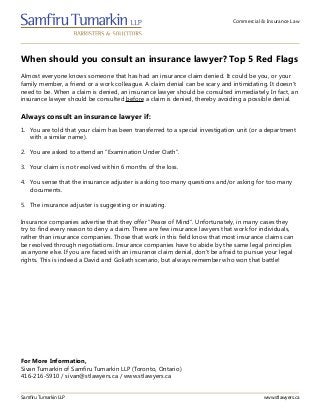

When Should You Consult An Insurance Lawyer? Top 5 Red Flags

•

0 likes•377 views

Almost everyone knows someone that has had an insurance claim denied. It could be you, or your family member, a friend or a work colleague. A claim denial can be scary and intimidating. It doesn’t need to be. When a claim is denied, an insurance lawyer should be consulted immediately. In fact, an insurance lawyer should be consulted before a claim is denied, thereby avoiding a possible denial.

Report

Share

Report

Share

Download to read offline

Recommended

Recommended

The Active Management Value Ratio (AMVR) is a variation of the popular cost-benefit analysis metric commonly uased in the business world the evaluate projects. The AMVR uses the incremental costs and incremental returns between an actively managed mutual fund and an index fund to evaluate the cost-efficiency, or cost-inefficiency, of an actively managed fund relative to a comparable index fund.

The AMVR allows plan sponsors, trustees, and other investment fiduciaries to avoid unwanted fiduciary liability. The AMVR allows attorneys and investors to easily assess the prudence of actively managed mutual funds in terms of investment prudence.

"Active Management Value Ratio", "AMVR" and the "InvestSense" logo are trademarks of InvestSense, LLC.The Active Management Value Ratio: The New Science of Benchmarking Investment...

The Active Management Value Ratio: The New Science of Benchmarking Investment...James Watkins, III JD CFP®

Russian Call Girls Rohini Sector 6 💓 Delhi 9999965857 @Sabina Modi VVIP MODELS 24/55

Booking Contact Details :-

WhatsApp Chat :- [+91-9999965857 ]

The Best Call Girls Delhi At Your Service

Russian Call Girls Delhi Doing anything intimate with can be a wonderful way to unwind from life's stresses, while having some fun. These girls specialize in providing sexual pleasure that will satisfy your fetishes; from tease and seduce their clients to keeping it all confidential - these services are also available both install and outcall, making them great additions for parties or business events alike. Their expert sex skills include deep penetration, oral sex, cum eating and cum eating - always respecting your wishes as part of the experience

(27-April-2024(PSS)

Two shots with one girl: ₹4000/in-call, ₹7000/out-call

Body to body massage with : ₹4500/in-call

Full night for one person: ₹7000/in-call, ₹12000/out-call

Delhi Russian Escorts provide clients with the opportunity to experience an array of activities - everything from dining at upscale restaurants to watching the latest movies. Hotel call girls are available year-round to offer unforgettable experiences and fulfill all of your erotica desires. Escort services go beyond the traditional notion of call girls by providing clients with customized experiences beyond dinner companionship to social events. (27-April-2024(PSS)

Mahipalpur | Majnu Ka Tilla | Aerocity | Delhi,Noida | Gurgaon | Paharganj | GTB Nagar | Sarita Vihar | Chattarpur | Dwarka | Rajouri Garden | Connaught Place | Janakpuri

▂▃▄▅▆▇█▓▒░░▒▓█▇▆▅▄▃▂📢N-C-R⭐VIP⭐GENUINE🅰️█▬█⓿▀█▀💋 𝐆𝐈𝐑𝐋 💥ANAL SEX💥 BDSM💥69 POSE💥LIP KISS💥 DEEP SUCKING WITHOUT CONDOM💥 CUM ON FACE💥 NUDE DANCE💥 BOOBS RUBBING💥 LICKING💥HAND JOB 💏GIRLFRIEND EXPERIENCE💏 ❣️College girls, ❣️Russian girls, ❣️Working girls, ❣️North-east girls, ❣️ Punjabi girls, etc........................

EROTIC MASSAGE💥Russian Call Girls Rohini Sector 6 💓 Delhi 9999965857 @Sabina Modi VVIP MODEL...

Russian Call Girls Rohini Sector 6 💓 Delhi 9999965857 @Sabina Modi VVIP MODEL...Call Girls In Delhi Whatsup 9873940964 Enjoy Unlimited Pleasure

SkyLaw is thrilled to announce that we have once again been selected to receive Canadian Lawyer's Top 10 Corporate Law Firms Award! We are honoured to be recognized by our peers for SkyLaw's "overall excellence, client satisfaction, and the high calibre of lawyers and leadership."

SkyLaw’s Andrea Hill was interviewed for Canadian Lawyer's article announcing the winners, and here is an excerpt.Andrea Hill Featured in Canadian Lawyer as SkyLaw Recognized as a Top Boutique

Andrea Hill Featured in Canadian Lawyer as SkyLaw Recognized as a Top BoutiqueSkyLaw Professional Corporation

More Related Content

More from Enercare Inc.

More from Enercare Inc. (7)

Auto Insurance Dispute: Top 5 things to keep in mind

Auto Insurance Dispute: Top 5 things to keep in mind

Employee Privacy Rights: New Developments in the Law

Employee Privacy Rights: New Developments in the Law

Recently uploaded

The Active Management Value Ratio (AMVR) is a variation of the popular cost-benefit analysis metric commonly uased in the business world the evaluate projects. The AMVR uses the incremental costs and incremental returns between an actively managed mutual fund and an index fund to evaluate the cost-efficiency, or cost-inefficiency, of an actively managed fund relative to a comparable index fund.

The AMVR allows plan sponsors, trustees, and other investment fiduciaries to avoid unwanted fiduciary liability. The AMVR allows attorneys and investors to easily assess the prudence of actively managed mutual funds in terms of investment prudence.

"Active Management Value Ratio", "AMVR" and the "InvestSense" logo are trademarks of InvestSense, LLC.The Active Management Value Ratio: The New Science of Benchmarking Investment...

The Active Management Value Ratio: The New Science of Benchmarking Investment...James Watkins, III JD CFP®

Russian Call Girls Rohini Sector 6 💓 Delhi 9999965857 @Sabina Modi VVIP MODELS 24/55

Booking Contact Details :-

WhatsApp Chat :- [+91-9999965857 ]

The Best Call Girls Delhi At Your Service

Russian Call Girls Delhi Doing anything intimate with can be a wonderful way to unwind from life's stresses, while having some fun. These girls specialize in providing sexual pleasure that will satisfy your fetishes; from tease and seduce their clients to keeping it all confidential - these services are also available both install and outcall, making them great additions for parties or business events alike. Their expert sex skills include deep penetration, oral sex, cum eating and cum eating - always respecting your wishes as part of the experience

(27-April-2024(PSS)

Two shots with one girl: ₹4000/in-call, ₹7000/out-call

Body to body massage with : ₹4500/in-call

Full night for one person: ₹7000/in-call, ₹12000/out-call

Delhi Russian Escorts provide clients with the opportunity to experience an array of activities - everything from dining at upscale restaurants to watching the latest movies. Hotel call girls are available year-round to offer unforgettable experiences and fulfill all of your erotica desires. Escort services go beyond the traditional notion of call girls by providing clients with customized experiences beyond dinner companionship to social events. (27-April-2024(PSS)

Mahipalpur | Majnu Ka Tilla | Aerocity | Delhi,Noida | Gurgaon | Paharganj | GTB Nagar | Sarita Vihar | Chattarpur | Dwarka | Rajouri Garden | Connaught Place | Janakpuri

▂▃▄▅▆▇█▓▒░░▒▓█▇▆▅▄▃▂📢N-C-R⭐VIP⭐GENUINE🅰️█▬█⓿▀█▀💋 𝐆𝐈𝐑𝐋 💥ANAL SEX💥 BDSM💥69 POSE💥LIP KISS💥 DEEP SUCKING WITHOUT CONDOM💥 CUM ON FACE💥 NUDE DANCE💥 BOOBS RUBBING💥 LICKING💥HAND JOB 💏GIRLFRIEND EXPERIENCE💏 ❣️College girls, ❣️Russian girls, ❣️Working girls, ❣️North-east girls, ❣️ Punjabi girls, etc........................

EROTIC MASSAGE💥Russian Call Girls Rohini Sector 6 💓 Delhi 9999965857 @Sabina Modi VVIP MODEL...

Russian Call Girls Rohini Sector 6 💓 Delhi 9999965857 @Sabina Modi VVIP MODEL...Call Girls In Delhi Whatsup 9873940964 Enjoy Unlimited Pleasure

SkyLaw is thrilled to announce that we have once again been selected to receive Canadian Lawyer's Top 10 Corporate Law Firms Award! We are honoured to be recognized by our peers for SkyLaw's "overall excellence, client satisfaction, and the high calibre of lawyers and leadership."

SkyLaw’s Andrea Hill was interviewed for Canadian Lawyer's article announcing the winners, and here is an excerpt.Andrea Hill Featured in Canadian Lawyer as SkyLaw Recognized as a Top Boutique

Andrea Hill Featured in Canadian Lawyer as SkyLaw Recognized as a Top BoutiqueSkyLaw Professional Corporation

Recently uploaded (20)

The Active Management Value Ratio: The New Science of Benchmarking Investment...

The Active Management Value Ratio: The New Science of Benchmarking Investment...

CAFC Chronicles: Costly Tales of Claim Construction Fails

CAFC Chronicles: Costly Tales of Claim Construction Fails

Audience profile - SF.pptxxxxxxxxxxxxxxxxxxxxxxxxxxx

Audience profile - SF.pptxxxxxxxxxxxxxxxxxxxxxxxxxxx

8. SECURITY GUARD CREED, CODE OF CONDUCT, COPE.pptx

8. SECURITY GUARD CREED, CODE OF CONDUCT, COPE.pptx

PPT- Voluntary Liquidation (Under section 59).pptx

PPT- Voluntary Liquidation (Under section 59).pptx

589308994-interpretation-of-statutes-notes-law-college.pdf

589308994-interpretation-of-statutes-notes-law-college.pdf

Russian Call Girls Rohini Sector 6 💓 Delhi 9999965857 @Sabina Modi VVIP MODEL...

Russian Call Girls Rohini Sector 6 💓 Delhi 9999965857 @Sabina Modi VVIP MODEL...

How do cyber crime lawyers in Mumbai collaborate with law enforcement agencie...

How do cyber crime lawyers in Mumbai collaborate with law enforcement agencie...

IBC (Insolvency and Bankruptcy Code 2016)-IOD - PPT.pptx

IBC (Insolvency and Bankruptcy Code 2016)-IOD - PPT.pptx

The doctrine of harmonious construction under Interpretation of statute

The doctrine of harmonious construction under Interpretation of statute

Andrea Hill Featured in Canadian Lawyer as SkyLaw Recognized as a Top Boutique

Andrea Hill Featured in Canadian Lawyer as SkyLaw Recognized as a Top Boutique

KEY NOTE- IBC(INSOLVENCY & BANKRUPTCY CODE) DESIGN- PPT.pptx

KEY NOTE- IBC(INSOLVENCY & BANKRUPTCY CODE) DESIGN- PPT.pptx

Municipal-Council-Ratlam-vs-Vardi-Chand-A-Landmark-Writ-Case.pptx

Municipal-Council-Ratlam-vs-Vardi-Chand-A-Landmark-Writ-Case.pptx

6th sem cpc notes for 6th semester students samjhe. Padhlo bhai

6th sem cpc notes for 6th semester students samjhe. Padhlo bhai

Introduction to Corruption, definition, types, impact and conclusion

Introduction to Corruption, definition, types, impact and conclusion

When Should You Consult An Insurance Lawyer? Top 5 Red Flags

- 1. Commercial & Insurance Law When should you consult an insurance lawyer? Top 5 Red Flags Samfiru Tumarkin LLP www.stlawyers.ca Almost everyone knows someone that has had an insurance claim denied. It could be you, or your family member, a friend or a work colleague. A claim denial can be scary and intimidating. It doesn’t need to be. When a claim is denied, an insurance lawyer should be consulted immediately. In fact, an insurance lawyer should be consulted before a claim is denied, thereby avoiding a possible denial. 1. You are told that your claim has been transferred to a special investigation unit (or a department with a similar name). 2. You are asked to attend an “Examination Under Oath”. 3. Your claim is not resolved within 6 months of the loss. 4. You sense that the insurance adjuster is asking too many questions and/or asking for too many documents. 5. The insurance adjuster is suggesting or insuating. Always consult an insurance lawyer if: Insurance companies advertise that they offer “Peace of Mind”. Unfortunately, in many cases they try to find every reason to deny a claim. There are few insurance lawyers that work for individuals, rather than insurance companies. Those that work in this field know that most insurance claims can be resolved through negotiations. Insurance companies have to abide by the same legal principles as anyone else. If you are faced with an insurance claim denial, don’t be afraid to pursue your legal rights. This is indeed a David and Goliath scenario, but always remember who won that battle! For More Information, Sivan Tumarkin of Samfiru Tumarkin LLP (Toronto, Ontario) 416-216-5910 / sivan@stlawyers.ca / www.stlawyers.ca