Infra is moving from a cyclical to a structural story - Rupesh Patel

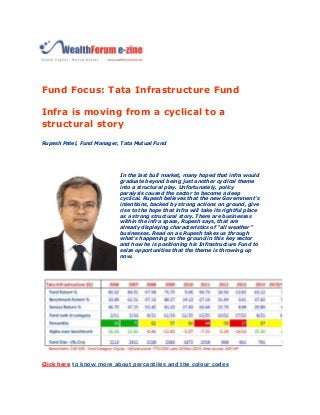

- 1. Fund Focus: Tata Infrastructure Fund Infra is moving from a cyclical to a structural story Rupesh Patel, Fund Manager, Tata Mutual Fund In the last bull market, many hoped that infra would graduate beyond being just another cyclical theme into a structural play. Unfortunately, policy paralysis caused the sector to become a deep cyclical. Rupesh believes that the new Government's intentions, backed by strong actions on ground, give rise to the hope that infra will take its rightful place as a strong structural story. There are businesses within the infra space, Rupesh says, that are already displaying characteristics of "all weather" businesses. Read on as Rupesh takes us through what's happening on the ground in this key sector and how he is positioning his Infrastructure Fund to seize opportunities that the theme is throwing up now. Click here to know more about percentiles and the colour codes

- 2. WF: There is clearly sizeable Government focus on infrastructure development. What tangible evidence do you see on the ground that leads you to believe that intentions are indeed being translated into action? Rupesh Patel: I agree with you that the Government's focus on infrastructure is very evident from number of measures which they have announced in the Budget. If you look at it in terms of tangible evidence on ground, I think there is definitely significant activity happening on the road sector. Over the last few months, NHAI has cancelled a number of projects which were awarded earlier but work could not be started because of number of reasons. These projects are being restructured and are being retendered again in a new format. In the Dec 14 quarter alone, NHAI has tendered projects for over 4000 kms. Then we have the successful coal block allocations and the process for environment clearances being eased. We are seeing a lot of ground work for implementing the Government's smart cities initiative. So clearly, intentions are now being translated into effort on ground - and this should help revive the investment cycle in the economy. WF: Some experts worry about the quality of balance sheets in the infra segment, due to high leverage and unproductive assets. How serious is this issue and how do you cover off this risk in your stock selection? Rupesh Patel: Many projects got stuck in the last few years on account of delays in receiving approvals. Aggressive bidding and Leverage on balance sheets caused further stress. And, efforts to deleverage did not really take off as a poor investment climate in the country meant that there were few buyers for these assets. There are many of these assets that are attractive, at the right price. One has to evaluate on a case to case basis. Now, with an improved economic outlook, it is no longer so difficult to find buyers - the key is for valuations to be seen as reasonable by both sides. The situation was indeed serious for many infra companies, but I think going forward, you will see some interesting opportunities from deleveraging transactions, which can unlock value for some companies. WF: After the sharp run up over 2014, the infra segment is no longer undervalued. Now that mean reversion on valuations has happened, what is the investment case going forward for this sector? Rupesh Patel: Yes I agree that valuations are no longer as cheap as they were 12 months ago. The gap between defensives and cyclicals has narrowed. Looking ahead, we must remember that we are coming out of a cyclical downturn and there is simultaneously huge

- 3. focus on reviving the investment cycle. Both factors point to a huge opportunity for the infrastructure sector. Further, history suggests that cyclical stocks post much higher earnings growth during an economic recovery than defensives. You are likely to see earnings surprises on the upside rather than the downside in the quarters ahead. This will support valuations. Going forward, it is going to be robust earnings that should sustain infrastructure stocks. WF: Which segments within the infra space appear most attractive to you now? Rupesh Patel: One segment we are positive on is EPC and BOT players. (EPC: Engineering, Procurement, Construction. BOT: Build - Operate - Transfer). We are focusing on companies that have shown discipline in the last few years in bidding for projects and companies with healthy balance sheets run by good managements. Another segment we are optimistic on is cement companies. Cement is a very good play on the infra theme. We believe revival in cement demand will enhance capacity utilization and significantly boost earnings. WF: Your Infrastructure Fund turned in a robust performance in 2014 and has started off 2015 on a sound note. What are some of the calls that worked well for you? Rupesh Patel: I would say its largely right stock selection in the right segment. Cement, EPC and BOT players were key contributors to performance. Similarly we took some calls on select financials which has also paid well for the fund. WF: The years 2008-2013 saw the fund delivering a negative alpha. Is this because infrastructure as a sector lagged the broad market, which is the benchmark for this fund? What strategies can you adopt in such a thematic fund when the theme underperforms the market? Rupesh Patel: Being a thematic fund, the performance of the fund would have a very high correlation with the developments happening in the sector. If we look at this period 2008 to 2013, the Infrastructure sector faced many challenges, which are well known. During this period, CNX Infra index came down by about 60%, which is reflective of what happened to the companies in the sector. One very positive aspect that we see today, which is evident in some of the stocks in our portfolio too, is that many of these are strong structural stories, which therefore means they are relatively less prone to violent fluctuations of the underlying sector. Building products companies are a good case in point. These are businesses with good brands, good

- 4. distribution, high ROCEs and ROEs - all characteristics of "all weather" businesses and not classical cyclical plays. As more businesses play into structural themes within the broad infra space, that itself can bring some stability into portfolio performance, over time. Disclaimer: The views expressed in this article are personal in nature and in is no way trying to predict the markets or to time them. The views expressed are for information purpose only and do not construe to be any investment, legal or taxation advice. Any action taken by you on the basis of the information contained herein is your responsibility alone and Tata Asset Management will not be liable in any manner for the consequences of such action taken by you. Please consult your Financial/Investment Adviser before investing. The views expressed in this article may not reflect in the scheme portfolios of Tata Mutual Fund. Mutual Fund investments are subject to market risks, read all scheme related documents carefully http://www.wealthforumezine.net/FundFocusTATAMF170315.html#.VQ-ZstKUemE