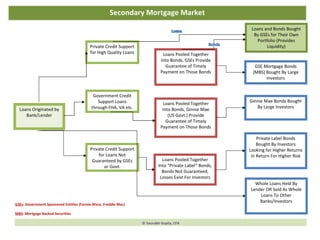

Secondary Mortgage Market

- 1. Whole Loans Held By Lender OR Sold As Whole Loans To Other Banks/Investors Loans Originated by Bank/Lender Private Credit Support for High Quality Loans Government Credit Support Loans through FHA, VA etc. Private Credit Support for Loans Not Guaranteed by GSEs or Govt. Loans and Bonds Bought By GSEs for Their Own Portfolio (Provides Liquidity) Loans Pooled Together Into Bonds, GSEs Provide Guarantee of Timely Payment on Those Bonds Loans Pooled Together Into Bonds, Ginnie Mae (US Govt.) Provide Guarantee of Timely Payment on Those Bonds Loans Pooled Together Into “Private Label” Bonds, Bonds Not Guaranteed, Losses Exist For Investors GSE Mortgage Bonds (MBS) Bought By Large Investors Ginnie Mae Bonds Bought By Large Investors Private Label Bonds Bought By Investors Looking for Higher Returns In Return For Higher Risk GSEs : Government Sponsored Entities (Fannie Mace, Freddie Mac) MBS : Mortgage Backed Securities © Saurabh Gupta, CFA Secondary Mortgage Market