HDFC sec - MF scheme analysis - ICICI Pru Banking & Financial Services Fund

- 1. RETAIL RESEARCH ICICI Pru Banking & Financial Services Fund RETAIL RESEARCH Nov 10, 2015 Mutual Fund Scheme Analysis

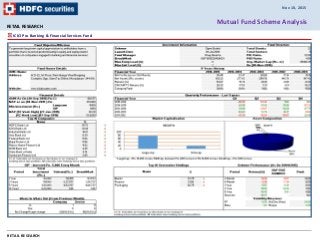

- 2. RETAIL RESEARCH Unit Growth of investments Vs. Benchmark: (Rebased to 100) Fund Performance Vis-a-vis Benchmark (Excess return): Key Points ICICI Pru Banking & Financial Services Fund is one of the flagship schemes from Equity sector – Banking category. Equity sector – Banking category invests predominantly in the banking sector stocks including public and private sector banks and financial institutions. ICICI Pru Banking & Financial Services Fund has showed consistently better performance over periods thanks to the fund manager’s efficiency on positioning the stocks from the banking sector that work well during all the phases irrespective of the market cycles notwithstanding the fact that the banking stocks are high beta stocks and react more sensitively to the short term turmoil that are seen in the macro side on the economy. The scheme registered +6%, 20% and +10% of CAGR returns for one, three and five year periods while the benchmark – S&P BSE Bankex posted +0.3%, 14% and 6% of returns respectively. For the same period, the category clocked +2%, +13% and +5% of returns respectively. Banking industry is one of the key drivers of a nation’s economy and its growth is dependent on the overall growth in the economy. It plays a significant role in the development of trade, commerce and industry of a nation. The banking sector in India stands on strong foundations of prudent policy framework laid by the regulators. This excellence has been proved in a scenario where the Indian banking industry managed to overcome all the headwinds from the global financial turmoil when the U.S sub-prime mortgage crisis occurred which resulted in bankruptcy and/or writing-off debt by some of well-known global banks. Since the performance of the banking sector relies mostly on the overall growth in the economy, the efficient policy actions taken by the regulator and the government to pave the way to the sustainable growth of the domestic economy which would result in appreciation in the prices of the banking stocks. The Reserve Bank of India has been on the path of initiating innovative measures for the betterment of the banking industry. Some of the proactive measures taken by the RBI in the recent periods are worth mentioning here such as in-principle approval given to 11 applicants to establish payment banks, allowing third-party white label automated teller machines (ATM) to accept international cards, allowing Indian alternative investment funds (AIFs) to invest abroad, flexible refinancing and repayment option for long- term infrastructure projects in order to increase the investment opportunities, been signed an MoU with European Central Bank on cooperation in central banking, allowing bonds issued by multilateral financial institutions like World Bank Group, the Asian Development Bank and the African Development Bank in India as eligible securities for interbank borrowing, allowing companies to issue overseas rupee denominated bonds to provide additional source of funding, etc.

- 3. RETAIL RESEARCH On government side, there are various reforms undertaken by the central government including an announcement of a capital infusion of Rs 6,990 crore (US$ 1.05 billion) in nine state run banks, launching of Credit Guarantee Fund Scheme to provide guarantee cover for collateral free credit facilities upto Rs 1 Crore (US$ 0.15 million) for financing Micro and Small Enterprises (MSEs), a draft proposals to encourage electronic transactions, including income tax benefits for payments made through debit or credit cards, an establishment of the US$ 100 billion New Development Bank (NDB) envisaged by the five-member BRICS group, etc. Going forward, there are positive business sentiments, improved consumer confidence, more controlled inflation, enhanced spending on infrastructure, speedy implementation of projects and continuation of reforms are likely to prop-up the domestic economic growth. Hence, with the decline in interest rates, gradual improvement in macros and the government’s efforts towards resolving issues related to the sector are expected to provide further impetus to growth would suggest the rapid growth of India’s banking sector. It is worth noting that, like other Sector funds, banking sector funds are also high risk – high return funds. Concentrated investment approach makes these funds more risky than diversified equity oriented funds. Banks as a sector is a high beta sector; in the sense that it rises and falls more than the broader markets. Performance: As a category, the Banking sector showed above average returns in the recent periods but posted relatively better returns over periods. However, the performance of the ICICI Pru Banking & Fin Serv fund has been commendable as it outperformed all the peers, benchmarks and overall equity diversified category. Considering the performance during various cycles, the Banking category posted outperforming returns during all bull runs but posted underperforming returns during bear runs. Seeing the performance of the schemes in the category on various cycles, all the top schemes showed almost similar returns. Portfolio: The scheme prefers to allocate maximum assets into the stocks that belong to the private sector banks (59% as per the latest portfolio). HDFC Bank, ICICI Bank and IndusInd Bank are the stocks that topped in its latest portfolio having weights of 15.7%, 10.4% and 10% to its net assets respectively. In the last six month period, the scheme added three new stocks and exited from one. The Turnover ratio of the scheme stood at 39%. The expense ratio of 2.67% for the scheme is lower compared to the category average of 2.82%. The corpus of the scheme as per latest data (Sep 2015) was at Rs. 884 crore. The scheme is managed jointly by Mr. Vinay Sharma since Feb 2015. As far as risk measures are concerned, the scheme seems to be high risky while compared to peers as it generated 24% (category 23.5%) of Annualized Standard Deviation that generated for last 3 years period. Relatively better performing schemes from Equity – Banking Category: Scheme Name Inception Date Benchmark Latest Corpus (Rs Crs) Expense Ratio (%) Trailing Returns (%) Rolling Returns (%) Standard Deviation (Annualized) Exit Load 1 Year CAGR 3 Years CAGR 5 Years CAGR 7 Years CAGR 6 Months Absolute 1 Year CAGR 2 Years CAGR 3 Years CAGR ICICI Pru Banking & Financial Serv (G) Aug-08 BSE BANKEX 903 2.67 5.56 19.82 10.43 22.62 14.61 30.26 21.80 18.42 24.06 1.00% on or before 1Y Reliance Banking Fund - (G) May-03 Bank Nifty 2129 2.34 3.48 16.1 6.35 22.32 12.50 24.51 19.14 18.88 26.24 1.00% on or before 1Y Religare Invesco Banking Fund (G) Jul-08 Bank Nifty 83 2.9 7.67 14.8 6.42 19.39 12.39 26.88 18.94 15.24 23.71 1.00% on or before 1Y Benchmark: Bank Nifty 0.51 14.51 5.49 18.58 10.97 20.44 14.09 14.17 S&P BSE BANKEX 0.34 14.28 5.61 19.22 11.20 20.79 13.86 13.53 CNX NIFTY -3.4 12.14 5.06 14.36 6.55 11.66 8.64 8.59 Note: NAV Value as on Nov 04, 2015.

- 4. RETAIL RESEARCH Market Cap Break up: Riskometer: Top 10 stocks as per the latest portfolio: Top sectors exposure during the last one year period:

- 5. RETAIL RESEARCH Point to point returns performance: Equity – Banking category Vs. Other Equity oriented categories: During various market cycles: Risk as measured by the Standard Deviation (Annualized):

- 6. RETAIL RESEARCH Indices performance: Year on year performance of the major Sectors and Thematic indices over the last 10 years period:

- 7. RETAIL RESEARCH Analyst: Dhuraivel Gunasekaran. RETAIL RESEARCH Tel: (022) 3075 3400 Fax: (022) 2496 5066 Corporate Office HDFC securities Limited, I Think Techno Campus, Building - B, "Alpha", Office Floor 8, Near Kanjurmarg Station, Opp. Crompton Greaves, Kanjurmarg (East), Mumbai 400 042 Phone: (022) 3075 3400 Fax: (022) 2496 5066 Website: www.hdfcsec.com Email: hdfcsecretailresearch@hdfcsec.com Disclaimer: Mutual Funds and Debt investments are subject to risk. Past performance is no guarantee for future performance This document has been prepared by HDFC Securities Limited and is meant for sole use by the recipient and not for circulation. This document is not to be reported or copied or made available to others. It should not be considered to be taken as an offer to sell or a solicitation to buy any security. The information contained herein is from sources believed reliable. We do not represent that it is accurate or complete and it should not be relied upon as such. We may have from time to time positions or options on, and buy and sell securities referred to herein. We may from time to time solicit from, or perform investment banking, or other services for, any company mentioned in this document. This report is intended for non- Institutional Clients This report has been prepared by the Retail Research team of HDFC Securities Ltd. The views, opinions, estimates, ratings, target price, entry prices and/or other parameters mentioned in this document may or may not match or may be contrary with those of the other Research teams (Institutional, PCG) of HDFC Securities Ltd.