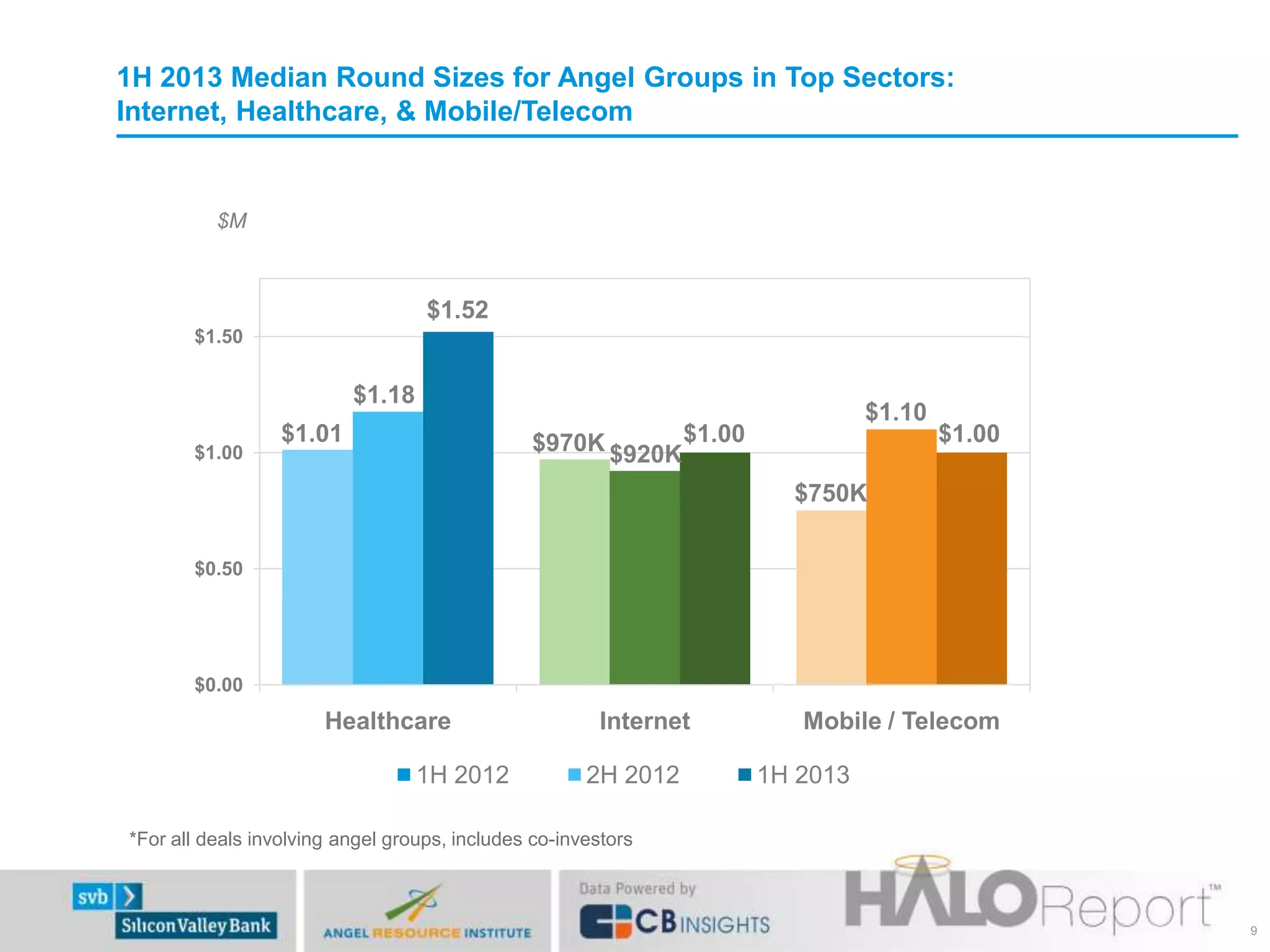

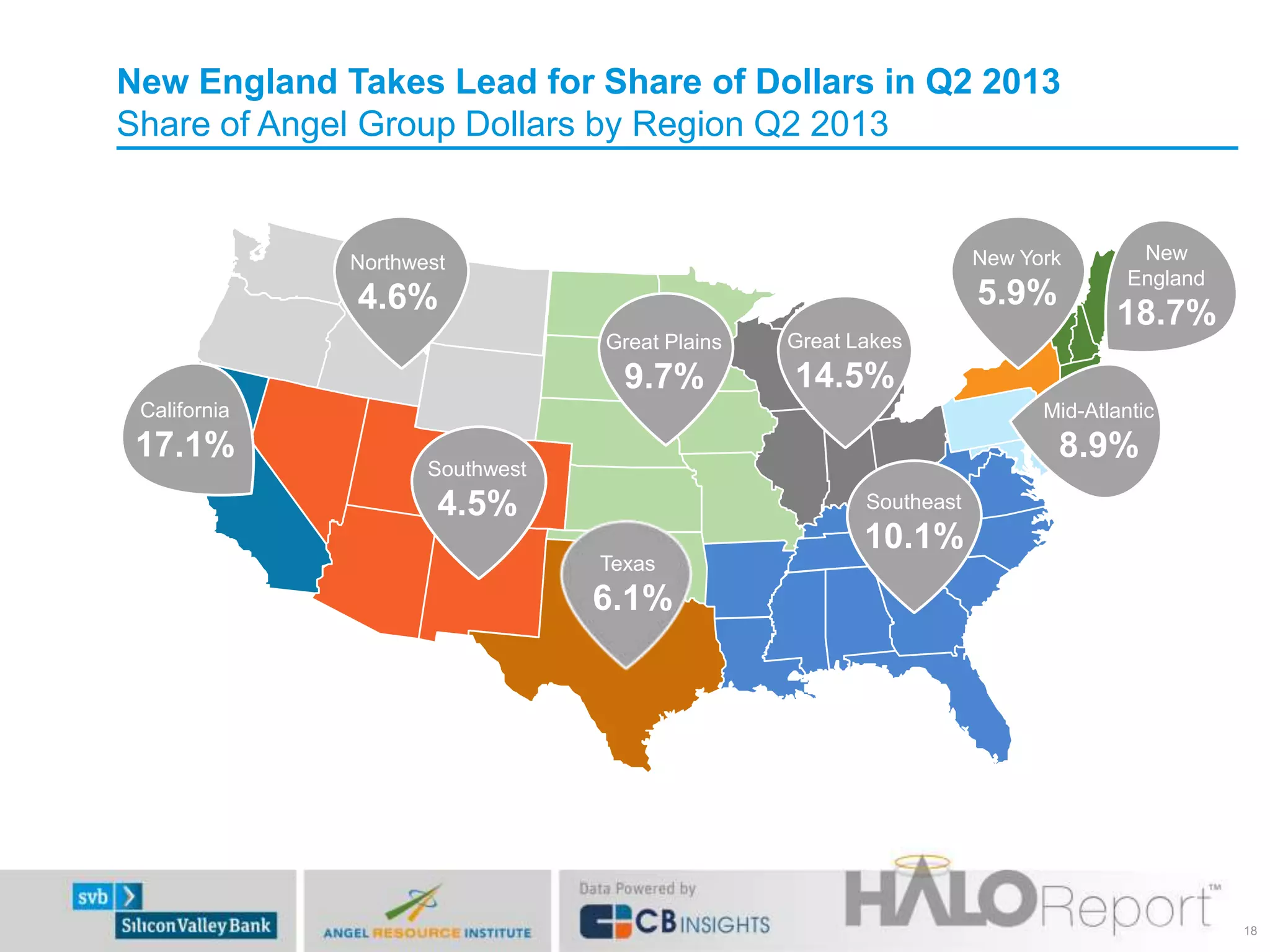

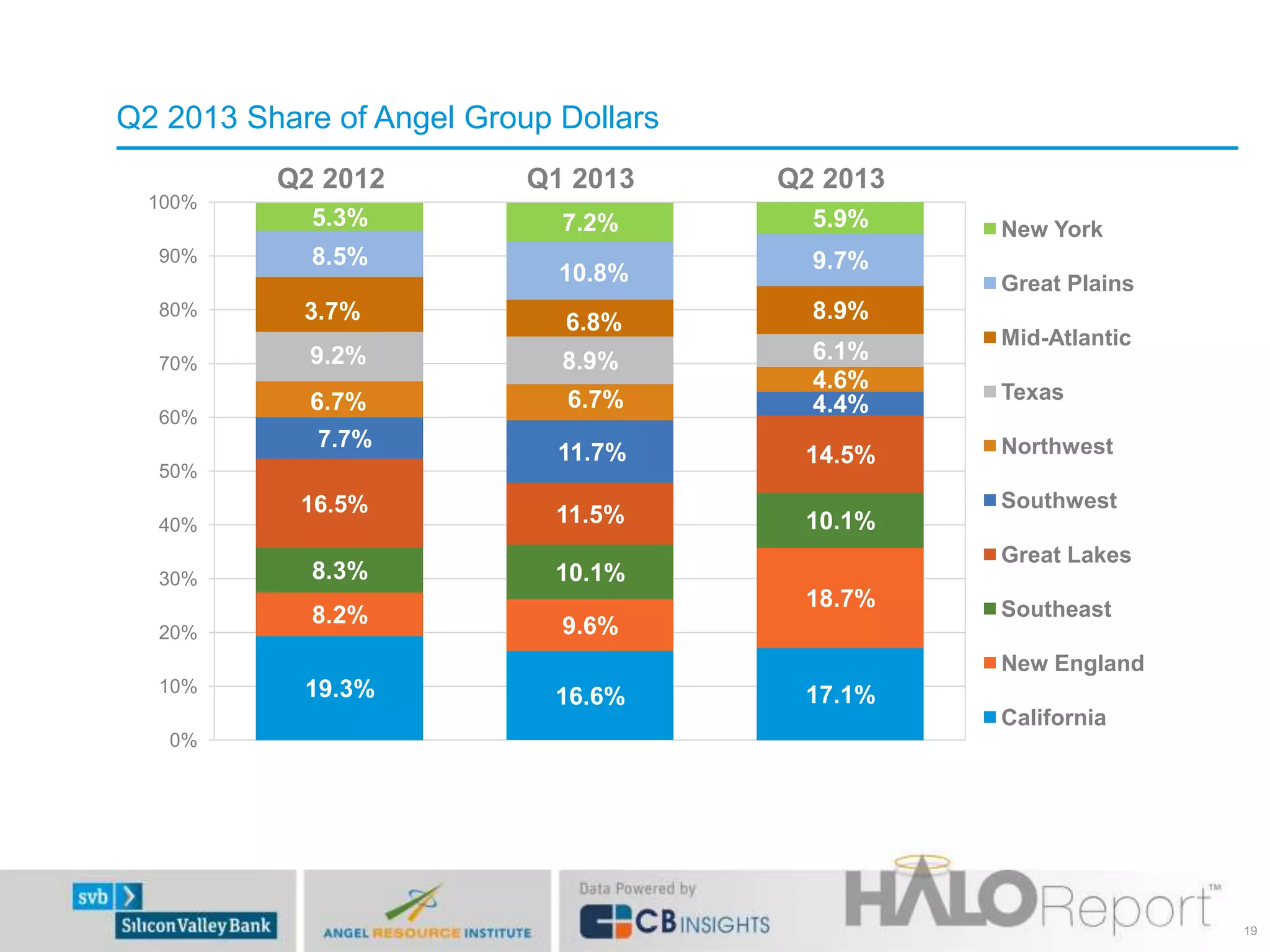

The Q2 2013 Halo Report highlights trends in angel group investments, noting a median round size of $590k and stable pre-money valuations of $2.5 million. A significant 74% of angel group deals are syndicated, with educational technology being a notable sector for active angel groups. The report provides comprehensive insights into regional trends, investment sectors, and overall investment activities by angel groups in North America.