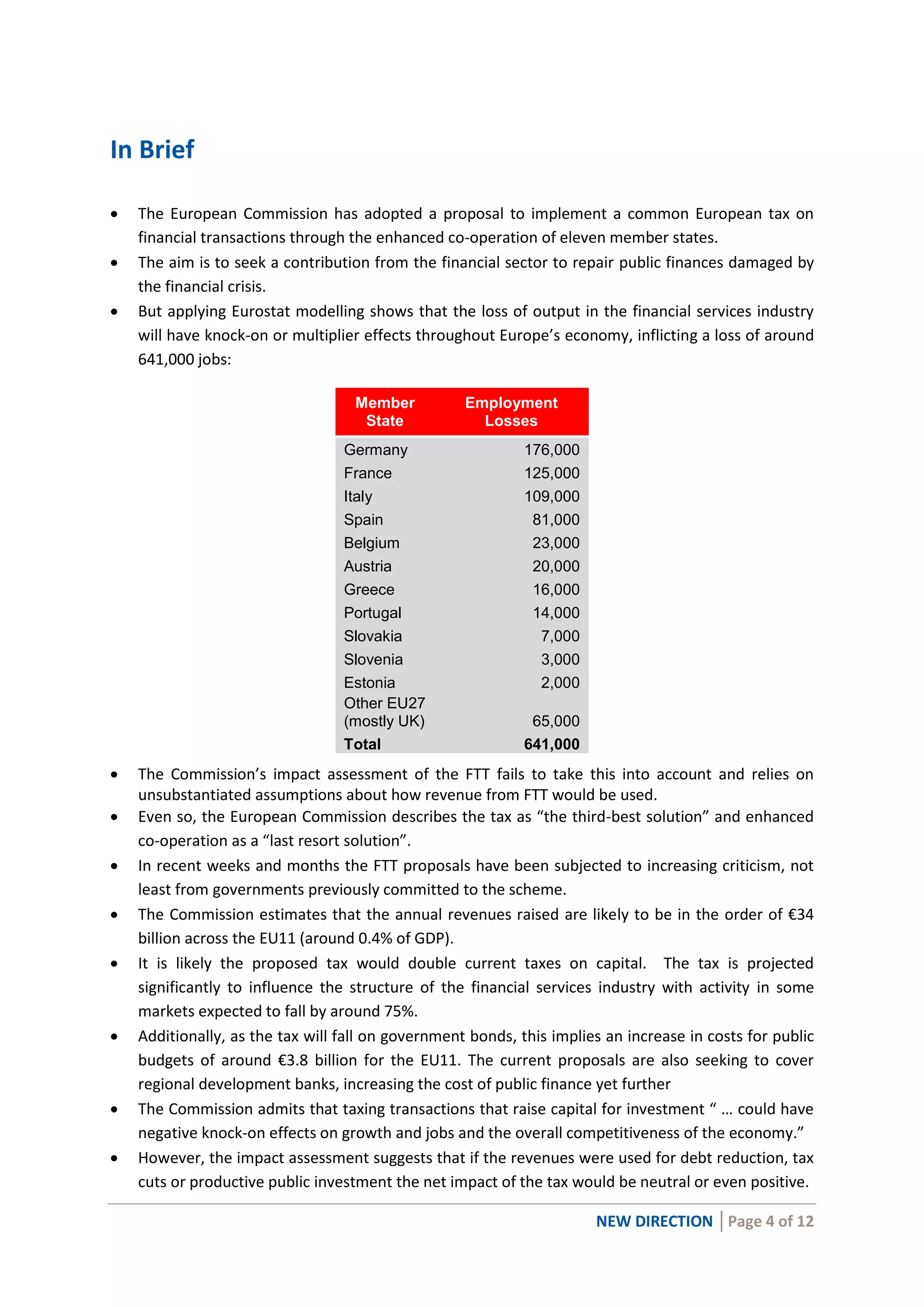

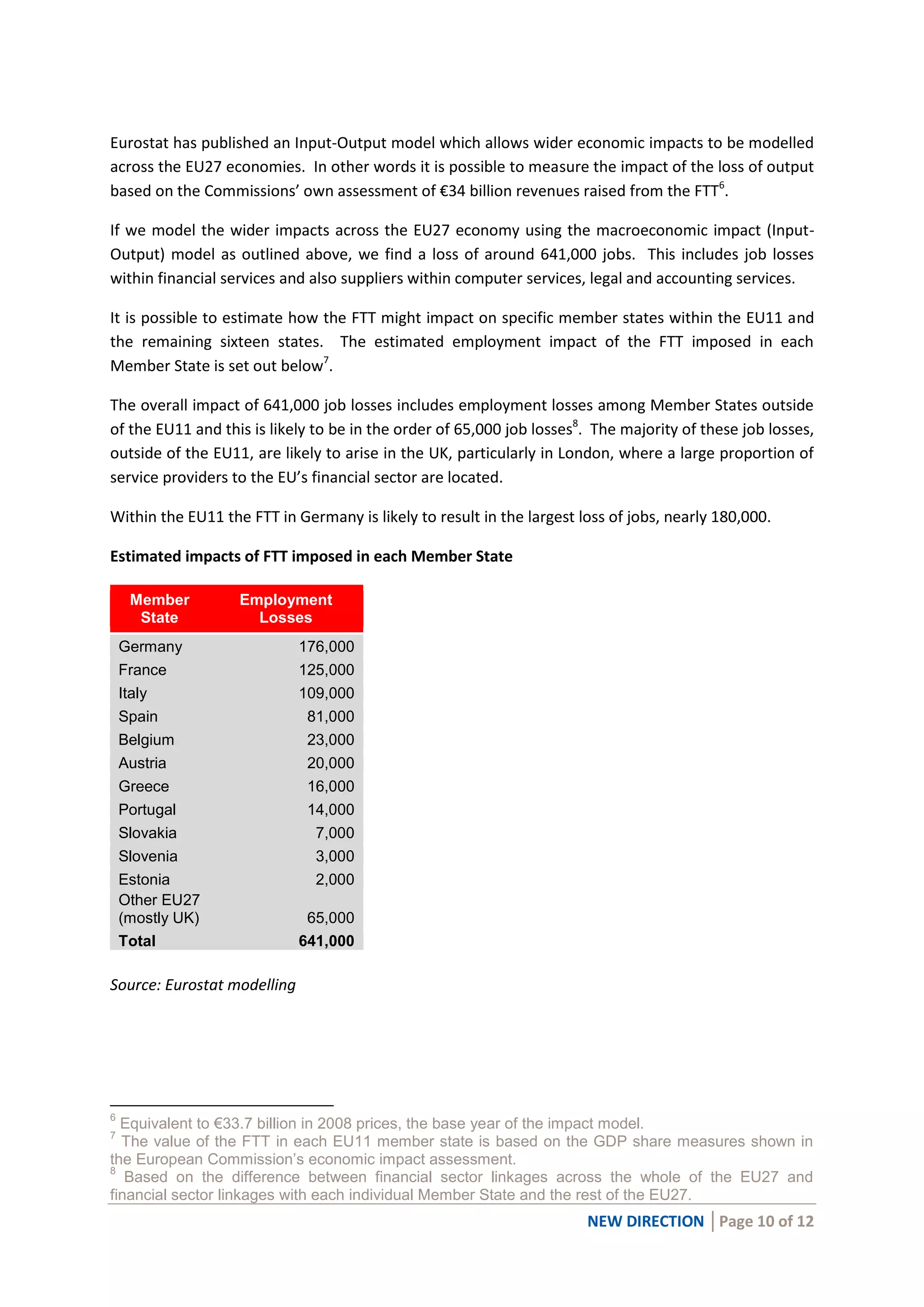

The document summarizes a report analyzing the economic impact of implementing a European Financial Transactions Tax (FTT). It finds that applying the tax would result in significant job losses across Europe. Specifically:

- Modeling estimates the tax would cause over 641,000 job losses in the EU, including over 176,000 in Germany, 125,000 in France, and 109,000 in Italy.

- The tax is projected to double current taxes on capital and reduce activity in some financial markets by around 75%.

- Imposing the tax risks reducing economic growth, investment, and job creation. It could also undermine public finances by taxing government bond transactions.

- The European Commission's impact assessment of the FTT fails