Buying a Home Now Truths and Myths

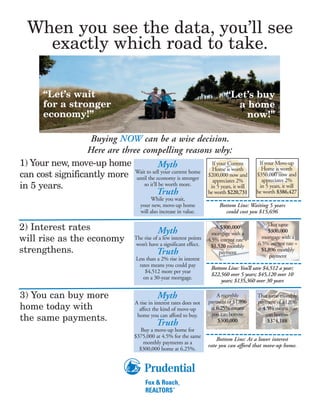

- 1. When you see the data, you’ll see exactly which road to take. “Let’s wait “Let’s buy for a stronger a home economy!” now!” Buying NOW can be a wise decision. Here are three compelling reasons why: 1) Your new, move-up home Myth If your Current If your Move-up Home is worth Home is worth can cost significantly more Wait to sell your current home $200,000 now and until the economy is stronger $350,000 now and appreciates 2% appreciates 2% in 5 years. so it’ll be worth more. in 5 years, it will in 5 years, it will Truth be worth $220,731 be worth $386,427 While you wait, your new, move-up home Bottom Line: Waiting 5 years will also increase in value. could cost you $15,696 That same 2) Interest rates Myth A $300,000 $300,000 mortgage with a will rise as the economy The rise of a few interest points won’t have a significant effect. 4.5% interest rate = mortgage with a 6.5% interest rate = $1,520 monthly strengthens. Truth payment $1,896 monthly Less than a 2% rise in interest payment rates means you could pay Bottom Line: You’ll save $4,512 a year; $4,512 more per year $22,560 over 5 years; $45,120 over 10 on a 30-year mortgage. years; $135,360 over 30 years 3) You can buy more Myth A monthly That same monthly A rise in interest rates does not payment of $1,896 payment of $1,896 home today with affect the kind of move-up at 6.25% means at 4.5% means you home you can afford to buy. you can borrow can borrow the same payments. Truth $300,000 $374,188 Buy a move-up home for $375,000 at 4.5% for the same Bottom Line: At a lower interest monthly payments as a rate you can afford that move-up home. $300,000 home at 6.25%.