Capital Budgeting.docx

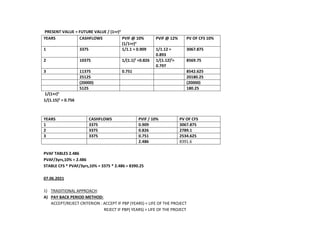

- 1. PRESENT VALUE = FUTURE VALUE / (1+r)n YEARS CASHFLOWS PVIF @ 10% (1/1+r)n PVIF @ 12% PV OF CFS 10% 1 3375 1/1.1 = 0.909 1/1.12 = 0.893 3067.875 2 10375 1/(1.1)2 =0.826 1/(1.12)2 = 0.797 8569.75 3 11375 0.751 8542.625 25125 20180.25 (20000) (20000) 5125 180.25 1/(1+r)n 1/(1.15)2 = 0.756 YEARS CASHFLOWS PVIF / 10% PV OF CFS 1 3375 0.909 3067.875 2 3375 0.826 2789.1 3 3375 0.751 2534.625 2.486 8391.6 PVAF TABLES 2.486 PVAF/3yrs,10% = 2.486 STABLE CFS * PVAF/3yrs,10% = 3375 * 2.486 = 8390.25 07.06.2021 1) TRADITIONAL APPROACH: A) PAY BACK PERIOD METHOD: ACCEPT/REJECT CRITERION : ACCEPT IF PBP (YEARS) < LIFE OF THE PROJECT REJECT IF PBP( YEARS) > LIFE OF THE PROJECT

- 2. CALCULATION OF PBP IF CASHFLOWS ARE STABLE PBP = INITIAL OUTLAY OF THE PROJECT / ANNUAL CASHFLOW 1) GIVEN: INVESTMENT = Rs.100000 ANNUAL CASHFLOW = Rs.20000 PBP = INITIAL OUTLAY OF THE PROJECT / ANNUAL CASHFLOW PBP = 5 YEARS 2) GIVEN : INVESTMENT = Rs.500000 PROFIT BEFORE TAX = Rs. 80000 LESS: TAX @50% = Rs.(40000) PAT = Rs.40000 ADD: DEP @12% 500000= 60000 CFAT = 100000 PBP = INITIAL OUTLAY OF THE PROJECT / ANNUAL CASHFLOW PBP = 500000/100000 = 5 YEARS 08.06.2021 SOL) INITIAL INVESTMENT IS RS.10000 STATEMENT SHOWING CALCULATION OF PBP YEARS CFAT CUMULATIVE CFAT 1 2000 2000 2 4000 6000 3 3000 9000 4 2OOO PBP = 3YEARS + (10000 – 9000) / 2000 PBP = 3YEARS +1000/2000 PBP = 3 YEARS + 0.5 PBP = 3.5 YEARS

- 3. OR PBP = 3YEARS,[ (10000 – 9000) / 2000 ] * 12 PBP = 3YEARS, 1000/2000 *12 PBP = 3 YEARS, 6 MONTHS Pb) Calculate PBP for the data below. Investment is Rs.15000. YEARS CFAT 1 1000 2 2000 3 4000 4 5000 5 8000 SOL) STATEMENT SHOWING CALCULATION OF PBP YEARS CFAT CUMULATIVE CFAT 1 1000 1000 2 2000 3000 3 4000 7000 4 5000 12000 5 8000 PBP = 4 Years + (15000 – 12000)/ 8000 PBP = 4 Years + 0.375 PBP = 4.375 years PBP = 4 years and (0.375*12) PBP = 4 years and 4.5 months Pb) For the following 2 projects calculate PBP Years Project X Project Y 0 -10000 -10000 1 4000 5000 2 4000 6000 3 2000 3000

- 4. Sol) Statement showing calculation of PBP for Project X Years CFAT Cumulative CFAT 1 4000 4000 2 4000 8000 3 2000 10000 PBP for Project X is 3 Years Statement showing calculation of PBP for Project Y Years CFAT Cumulative CFAT 1 5000 5000 2 6000 3 3000 PBP = 1 Year + (10000 – 5000) / 6000 PBP = 1 year + 0.833 PBP = 1.833 Years Decision: We accept Project Y over Project X because the calculated PBP for Project Y is lesser than the PBP of Project X. B) RATE OF RETURN METHOD ( PERCENTAGE) OR ARR ACCOUNTING RATE OF RETURN NET PROFIT 1) ARR = AVERAGE ANNUAL PROFITS AFTER DEP & TAXES / AVERAGE INVESTMENT * 100 AVG. ANNUAL PROFITS AFTER DEP & TAXES = Total Profits / NO. OF YEARS AVG. INVESTMENT = Total Investment / 2 OR AVG. INVESTMENT = (COST – SCRAP)/ 2 + WORKING CAPITAL + SCRAP VALUE ACCEPT IF ARR > ROR REJECT IF ARR < ROR Pb) Determine ARR for machines A and B. Particulars Machine A Machine B Cost 56125 56125 Life 5 5

- 5. Salvage value ( Scrap) 3000 3000 Income Tax 55% 55% Additional working capital 5000 6000 Years 1 3375 11375 2 5375 9375 3 7375 7375 4 9375 5375 5 11375 3375 Total Profits 36875 36875 SOL) ARR = AVERAGE ANNUAL PROFITS AFTER DEP & TAXES / AVERAGE INVESTMENT * 100 CALCULATION OF ARR FOR MACHINE A AVERAGE ANNUAL PROFITS AFTER DEP & TAXES = 36875/ 5 AVERAGE ANNUAL PROFITS AFTER DEP & TAXES = 7375. AVG. INVESTMENT = (COST – SCRAP)/ 2 + WORKING CAPITAL + SCRAP VALUE = (56125 – 3000)/ 2 + 5000 + 3000 = 26563 + 8000 = 34563 ARR FOR MACHINE A = 7375 / 34563 * 100 ARR FOR MACHINE A = 21.33% ARR FOR MACHINE B = 20.73 % 18.02.2022 Pb) The following cash flows are given below for projects X and Y. Investment in both the projects is Rs.3000. Calculate PBP and suggest.

- 6. Years Project X Project Y 1 1300 900 2 1100 900 3 900 900 4 640 900 5 640 900 Sol) Statement showing calculation of PBP for Project X Years CFAT Cumulative CFAT 1 1300 1300 2 1100 2400 3 900 4 640 5 640 PBP = 2 years + (3000 – 2400) / 900 PBP = 2.67 Years. Calculation of PBP for Project Y PBP = Investment / Annual CFAT PBP = 3000 / 900 PBP = 3.33 Years. Decision: Since PBP of Project X is lesser than the PBP of Project Y, we accept Project X. Pb) Calculate ARR for the following project if ROR is 10%. Initial Investment is Rs. 40000 Years PAT( Profit After Tax) 1 10000 2 8000

- 7. 3 6000 4 2000 ARR = Average annual net profit / Average Investment * 100 Average annual net profit = 26000 / 4 = Rs. 6500 Average Investment = Total Investment / 2 Average Investment = 40000 / 2 = 20000 ARR = 6500 / 20000 * 100 ARR = 32.5% > ROR ARR > ROR Decision: Accept the given project. Discounted PBP: (DPBP) Under this method, after calculating the present values for each year, then the cumulative CFAT are calculated. Then the procedure for calculating DPBP is same as that of PBP. Pb) Calculate i) PBP ii) DPBP For the following data: Cost = Rs. 50000 Life = 5 Years

- 8. Cost Of Capital = 10% Years CFAT 1 5000 2 20000 3 30000 4 30000 5 10000 Sol) Statement showing calculation of PBP Years CFAT Cumulative CFAT 1 5000 5000 2 20000 25000 3 30000 4 30000 5 10000 PBP = 2 years + (50000 – 250000) / 30000 PBP = 2.833 Years. Statement showing calculation of DPBP Years CFAT PVIF @ 10% Discounted CFAT or Present Value of CFAT Cumulative Discounted CFAT 1 5000 0.909 4545 4545 2 20000 0.826 16520 21065 3 30000 0.751 22530 43595

- 9. 4 30000 0.683 20490 5 10000 0.621 6210 DPBP = 3 Years + (50000 – 43595) / 20490 DPBP = 3.313 Years. Pb) Calculate DPBP for the following project at COC of 8%. Investment is Rs.150000. Years CFAT 1 50000 2 75000 3 125000 4 130000 5 80000 Sol) Years CFAT PVIF @ 8% Discounted CFAT Cumulative CFAT 1 50000 0.926 46300 46300 2 75000 0.857 64275 110575 3 125000 0.794 99250 4 130000 0.735 95550 5 80000 0.681 54480 DPBP = 2 Years + (150000 – 110575) / 99250 DPBP = 2.397.

- 10. 21.02.2022 DISCOUNTED TECHNIQUES OF CAPITAL BUDGETING: 1) Calculate Discounted Payback Period if the cash flows are Rs.50000 for a life of 10 years with initial investment of Rs.200000. ROR is at 12% 1 / (1.12)n STATEMENT SHOWING CALCULATION OF DPBP YEARS CFS PVIF @ 12% DISCOUNTED CASH FLOWS/ PV OF CASHFLOWS CUMULATIVE CFS 1 50000 0.8929 44645 44645 2 50000 0.7972 39860 84505 3 50000 0.7118 35590 120095 4 50000 0.6355 31775 151870 5 50000 0.5674 28370 180240 6 50000 0.5066 25330 7 50000 0.4523 22615 8 50000 0.4039 20195 9 50000 0.3606 18030 10 50000 0.3220 16100 DPBP = 5 YEARS + (200000 – 180240)/25330 DPBP = 5 YEARS + 0.780

- 11. PBP = 5.78 YEARS SOL) STATEMENT SHOWING CALCULATION OF PBP USING TRADITIONAL METHOD YEARS ANNUAL CFS CUMULATIVE CFS 1 5000 5000 2 20000 25000 3 30000 4 30000 5 10000 PBP = 2 YEARS + (50000 – 25000)/ 30000 PBP = 2.83 YEARS STATEMENT SHOWING CALCULATION OF DPBP YEARS ANNUAL CFS PVIF @ 10 % PV OF CFS CUMULATIVE PV OF CFS 1 5000 0.909 4545 4545 2 20000 0.826 16520 21065 3 30000 0.751 22530 43595 4 30000 0.683 20490 5 10000 0.621 6210 PBP = 3 YEARS + (50000 – 43595)/ 20490 PBP = 3.312 YEARS 2) NET PRESENT VALUE (NPV): NPV is a time value of money approach. In evaluating the investment proposal. Under this method, all cash inflows and outflows are converted to their present values and then the technique of NPV is applied.

- 12. STEP WISE CALCULATION: STEP 1 : DETERMINE THE COC (ROR) STEP 2 : CALCULATE PV OF CASHFLOWS STEP 3: TAKE TOTAL PV OF cash inflows STEP 4 : CALCULATE NPV = TPV OF CIFS – TPV OF COFS STEP 5: ACCEPT THE PROPOSAL IF NPV IS POSITIVE; REJECT THE PROPOSAL IF NPV IS NEGATIVE. Pb) Calculate NPV for Projects X and Y and suggest which project is feasible if COC is 10%. Cost of Project X is Rs.20000 and cost of Project Y is Rs.30000. YEARS PROJECT X PROJECT Y 1 5000 20000 2 10000 10000 3 10000 5000 4 3000 3000 5 2000 2000 5( SCRAP) 1000 2000 SOL) STATEMENT SHOWING CALCULATION OF NPV FOR PROJECT X COST: Rs. 20000 YEARS CFS PVIF @ 10% PV OF Cash Inflows 1 5000 0.909 4545 2 10000 0.826 8260 3 10000 0.751 7510 4 3000 0.683 2049 5 2000 0.621 1242 5( SCRAP VALUE) 1000 0.621 621 TOTAL OF PV OF Cash Inflows LESS: TOTAL PV OF COFS PVIF for Year 0 is always = 1 24227 (20000)

- 13. NET PRESENT VALUE 4227 STATEMENT SHOWING CALCULATION OF NPV FOR PROJECT Y COST: Rs. 30000 YEARS CFS PVIF @ 10% PV OF CFS 1 20000 0.909 18180 2 10000 0.826 8260 3 5000 0.751 3755 4 3000 0.683 2049 5 2000 0.621 1242 5( SCRAP VALUE) 2000 0.621 1242 TOTAL OF PV OF CFS LESS: TOTAL PV OF COFS NET PRESENT VALUE 34728 (30000) 4728 Decision: We accept Project Y because NPV of Project Y is Higher than the NPV of Project X. Pb) Calculate NPV of Project A at 12% COC for the following Cash Flows if the initial Investment is Rs.16200. YEARS CASH INFLOWS 1 8000 2 7000 3 6000 Sol) Years Cash Inflows PVIF @ 12% Present Value of Cash Inflows 1 8000 0.893 7144 2 7000 0.797 5579 3 6000 0.712 4272 Total Present Value of Cash Inflow (-) Total Present Value Of Cash Outflow NPV 16995 (16200) 795

- 14. Decision: Accept the given Project A as its NPV is Positive. PROFITABILITY Index/ BENEFITR COST RATIO. It is a time adjusted method for evaluating the investment proposal. It is termed as Benefit Cost Ratio because, numerator measures benefits and denominator measures cost. PI can be measured in a) per rupee method (b) in percentage. a) PI ( Per Rupee) =Total PV of Cash inflows / Total PV of Cash outflows. Accept if PI > 1 ; Reject if PI < 1 b) PI (Percentage) = Total PV of Cash inflows / Total PV of Cash outflows * 100 Accept if PI > 100 ; Reject if PI < 100 Pb) Initial Cash Outlay is Rs.25000 Years Cash Inflows 1 10000 2 7500 3 12500 4 5000 Discount Factor is 10% Sol) Years Cash inflows PVIF @ 10% PV of Cash Inflows 1 10000 0.909 9090 2 7500 0.826 6195 3 12500 0.751 9388 4 5000 0.683 3415 Total PV of Cash Inflows 28088

- 15. PI( Per Rupee) =Total PV of Cash inflows / Total PV of Cash outflows. PI = 28088 / 25000 PI = 1.123 PI> 1. Therefore we accept the project. Pb) The management of Z Ltd. Proposes to invest Rs.8000 in a project which will give earnings for 5 years as below: Years Cash flows 1 3000 2 4000 3 3000 4 2000 5 2000 Suggest whether project is worthwhile to accept using a) DPBP b) NPV c) PI Discount rate is 10 % Sol) a) Statement showing calculation of DPBP Years Cash inflows PVIF @ 10% PV of Cash Inflows Cumulative Cash Inflows 1 3000 0.909 2727 2727 2 4000 0.826 3304 6031 3 3000 0.751 2253 4 2000 0.683 1366 5 2000 0.621 1242 DPBP = 2 Years + (8000 – 6031) / 2253 DPBP = 2.873 Years

- 16. b) Statement showing calculation of NPV Years Cash inflows PVIF @ 10% PV of Cash Inflows 1 3000 0.909 2727 2 4000 0.826 3304 3 3000 0.751 2253 4 2000 0.683 1366 5 2000 0.621 1242 Total PV of Cash inflows Less: Total PV of Cash Outflow NPV 10892 (8000) 2892 c) PI ( Per Rupee) =Total PV of Cash inflows / Total PV of Cash outflows. PI = 10892 / 8000 PI = 1.36 Decision: DPBP < Life of Project. Therefore, we accept the proposal NPV is positive, therefore we accept the proposal PI > 1, therefore, we accept the proposal. Under the given 3 techniques the proposal should be accepted. Thus, the proposal accepted. INTERNAL RATE OF RETURN. This method is also known as Yield method. IRR is a rate which actually equates the PV of cash inflows with PV of cash outflows. This is the rate actually earned by the project. Under this method, the project is accepted if IRR > COC or Cut-off rate and rejected if IRR < COC or Cut-off rate. IRR is calculated using trial and error method.

- 17. IRR = Lower Rate +(HPV of Cash Inflows – Initial Investment) / (HPV of Cash Inflows - LPV of Cash Inflows) * Difference in Rate. Pb) From the following information relating to two projects X and Y, calculate IRR and state which project is better. Particulars Project X Project Y Life 10Years 8 Years Cost Rs. 180000 200000 Savings( Annual Cash flows) Rs. 30000 40000 Sol) Statement showing calculation of PV of Cash inflows for Project X Years Cash inflows PVIF @10% PVIF @ 15% 1 30000 0.909 0.870 2 30000 0.826 0.756 3 30000 0.751 0.658 4 30000 0.683 0.572 5 30000 0.621 0.497 6 30000 0.564 0.432 7 30000 0.513 0.376 8 30000 0.467 0.327 9 30000 0.424 0.284 10 30000 0.386 0.247 PVAF @ 10% for 10 Years = 6.145 PVAF @ 15% for 10 years = 5.019 TPV of Cash Inflows @ 10% = 6.145 * 30000 = 184350 (HPV) TPV of Cash Inflows @ 15% = 5.019 * 30000 = 150570 (LPV) IRR = Lower Rate +(HPV of Cash Inflows – Initial Investment) / (HPV of Cash Inflows - LPV of Cash Inflows) * Difference in Rate.

- 18. IRR = 10 + (184350 – 180000) / (184350 – 150570) * 5 IRR = 10 + (4350 / 33780) * 5 IRR = 10 + (0.128 *5) IRR = 10 + 0.64 IRR = 10.64 % for Project X Statement showing calculation of PV of Cash inflows for Project Y Years Cash inflows PVIF @10% PVIF @ 15% 1 40000 0.909 0.870 2 40000 0.826 0.756 3 40000 0.751 0.658 4 40000 0.683 0.572 5 40000 0.621 0.497 6 40000 0.564 0.432 7 40000 0.513 0.376 8 40000 0.467 0.327 PVAF @ 10% for 8 years= 5.335 PVAF @ 15% for 8 years = 4.487 TPV of Cash Inflows @ 10% = 5.335 * 40000 = 213400 (HPV) TPV of Cash Inflows @ 15% = 4.487 * 40000 = 179480 (LPV) IRR = Lower Rate + (HPV of Cash Inflows – Initial Investment) / (HPV of Cash Inflows - LPV of Cash Inflows) * Difference in Rate. IRR = 10 +(213400 – 200000) / (213400 - 179480) * 5 IRR = 10 + (13400 / 33920)* 5

- 19. IRR = 10 + (0.395* 5) IRR = 10 + 1.975 IRR = 11.975 for Project Y Decision: IRR of Project Y is > than the IRR of Project X, therefore we accept Project Y. Pb) Calculate IRR for the investment and suggest about its acceptability if cost of capital is 12% Years Cash flows 0 25000 1 10000 2 7500 3 12500 4 5000 Sol) Statement showing calculation of IRR using Trial and Error method Years Cash inflows PVIF @ 12% PV of Cash inflows PVIF @ 18% PV of Cash inflows 1 10000 0.893 8930 0.847 8470 2 7500 0.797 5978 0.718 5385 3 12500 0.712 8900 0.609 7613 4 5000 0.636 3180 0.516 2580 26988 (HPV) 24048 (LPV) IRR = Lower Rate + (HPV of Cash Inflows – Initial Investment) / (HPV of Cash Inflows - LPV of Cash Inflows) * Difference in Rate. IRR = 12% + (26988 – 25000) / (26988 – 24048) * 6 IRR = 12 % + (1988 / 2940) * 6

- 20. IRR = 12% + (0.676) * 6 IRR = 12 % + 4.056 IRR = 16.056 % Decision: Since IRR > COC that is 16.056% > 12 %, we accept the investment proposal. Pb) From the following information calculate NPV, PI, IRR of the project @ discount rate of 10%. Years Cash Flows 0 50000 1 20000 2 15000 3 25000 4 10000 Sol) Statement showing calculation of NPV and PI Years Cash inflows PVIF @ 10 % PV of cash inflows 1 20000 0.909 18180 2 15000 0.826 12390 3 25000 0.751 18775 4 10000 0.683 6830 Total PV of Cash inflows Less: Total PV of Cash outflows NPV PI = Total PV of Cash inflow / Total PV of Cash outflows PI = 56175 (50000) 6175 56175 / 50000 1.1235 Statement showing calculation of IRR using Trial and Error Method Years Cash inflows PVIF @ 15% PV of cash inflows PVIF @ 18 % PV of cash inflows

- 21. 1 20000 0.870 17400 0.847 16940 2 15000 0.756 11340 0.718 10770 3 25000 0.658 16450 0.609 15225 4 10000 0.572 5720 0.516 5160 50910 (HPV) 48095 (LPV) IRR = Lower Rate + (HPV of Cash Inflows – Initial Investment) / (HPV of Cash Inflows - LPV of Cash Inflows) * Difference in Rate. IRR = 15 + (50910-50000) / 50910 – 48095) * 3 IRR = 15 + (910 / 2815) * 3 IRR = 15 + (0.3232) * 3 IRR = 15 + 0.97 IRR = 15.097 % Notes to be considered: Traditional methods Discounted methods Methods Inflows to be considered Methods Inflows to be considered Payback period method CFAT Discounted Payback period method CFAT Accounting rate of return method PAT Net Present Value Method CFAT Internal rate of return method CFAT Profitability Index method CFAT

- 22. Particulars Rs Earnings before interest and tax (EBIT) XXXX Less: Interest (XXX) Earnings before tax XXX Less: Tax (XXX) Earnings after Tax / Profit after Tax (PAT) XXX Add: Depreciation XXX CFAT XXXX Depreciation = (Cost of the project – Scrap Value) / Life of the Project. Pb) A chemical company, is considering to invest in a project that costs Rs.400000. The estimated salvage value is null. Tax rate is 15%. The company uses straight line method for calculating depreciation. The expected cash flows before depreciation and tax are as below: Years Expected cash flows before depreciation and tax 1 100000 2 150000 3 200000 4 250000 5 300000 Calculate NPV and suggest whether to accept or reject the proposal. Sol) Depreciation = (Cost of the project – Scrap Value) / Life of the Project Depreciation = (400000 – 0) / 5 Depreciation = 80000

- 23. Years Expected cash flows before depreciation and tax Less: Depreciation (Rs.80000) EBIT Less: Tax @ 15% EAT / PAT Add: Depreciation CFAT 1 100000 (80000) 20000 (3000) 17000 80000 97000 2 150000 (80000) 70000 (10500) 59500 80000 139500 3 200000 (80000) 120000 (18000) 102000 80000 182000 4 250000 (80000) 170000 (25500) 144500 80000 224500 5 300000 (80000) 220000 (33000) 187000 80000 267000 Statement showing calculation of NPV Years CFAT PVIF @ 10 % PV of Cash Inflows 1 97000 0.909 88173 2 139500 0.826 115227 3 182000 0.751 136682 4 224500 0.683 153334 5 267000 0.621 165807 Total PV of Cashinflows Less: Total PV of Cash outflows NPV 659223 (400000) 259223 Decision: Accept the given investment proposal because NPV is Positive.