ICI

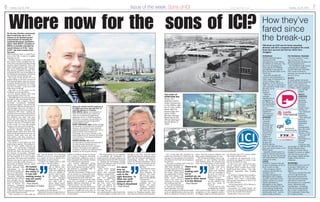

- 1. www.nebusiness.co.uk 76 www.nebusiness.co.ukIssue of the week: Sons of ICI Tuesday, July 28, 2009Tuesday, July 28, 2009 Where now for the sons of ICI? How they’ve fared since the break-up PETROPLUS SWISS-based Petroplus announced 200 redundancies at its Wilton oil refinery in February. The plant was developed 44 years ago by ICI/Phillips specifically to handle oil from the Ekofisk field in the North Sea. Petroplus bought the refinery, which produces a wide range of feedstocks as well as being a major producer of bio-diesel, in 2000. The site is currently in safe shutdown mode until a decision on its future is reached. While its strategic significance as a supplier to the Wilton site has diminished over the years, it was nevertheless a significant customer on the complex. ARTENIUS PLASTICS company Artenius - formerly part of a link-up between ICI and Dupont - turned over more than £300m in 2007/8 and 2008/9, but despite the healthy figures, more than 200 jobs have been put under threat at the Wilton plant. Spanish-owned parent La Seda de Barcelona posted a large pre-tax loss last month and administrators Deloitte stepped in today. LUCITE DUPONT merged with the acrylics businesses of ICI to form Lucite in 1993. The company, which employs around 280 on Teesside, has a manufacturing base in Billingham and a global research operation at the Wilton Centre. It’s Cassel Works operation at Billingham is the largest manufacturing base in the Lucite group, producing methyl methacrylate and methacrylic acid - used to make acrylic products. TTE TECHNICAL TRAINING TTE was created 17 years ago to carry on the apprenticeships tradition of ICI and British Steel. The Middlesbrough-based company now employs around 200 staff, with 60% of its work involved in training new recruits for the process sector. INVISTA IN April, global chemical giant Invista announced the closure of its former ICI textile nylon polymer plant at Wilton, which employed around 300 people. AGILITY LOGISTICS AGILITY’S specialty chemicals business provides supply chain services to the chemical industry worldwide. The chemical industry specialism originated from a management buy-out of the distribution division of ICI. The spin-off business flourished as a privately owned company and was bought in 2006 by PWC (Public Warehousing Company) Kuwait which changed its name to Agility and now forms part of a much larger, global $6.8bn supply chain services company. AKZONOBEL AKZONOBEL took over ICI in January 2008 when an £8bn takeover offer was agreed. The move marked the end of the ICI global brand. AkzoNobel launched its corporate brand strategy and said ICI would be discontinued as a corporate name, following wide consultation - including with the Evening Gazette. But it said it would keep ICI’s trademark Dulux dog for its paint brand. On the day Artenius announced that it had been put on the market as its Spanish parent concentrated on keeping its mainland European operations afloat, SUE SCOTT considers if Wilton is mortally wounded by recent failures or if the “sons of ICI” can learn lessons from the past. THE Germans have a word for it and, in the UK, it used to roughly translate as ICI. “Verbunt means a very large com- plex where many synergies are de- rived from one plant’s product being another plant’s feedstock. They can share energy systems and resources and work collaboratively,” explains Paul Booth, president of Sabic Pet- rochemicals UK, one of the pillars of the Wilton processing site, which has survived the current brutal cull. Like many of his former ICI col- leagues flung to the four corners of the corporate globe when the chem- ical giant divested itself, Mr Booth’s paymasters’ boardrooms are a long way from Teesside - in his case 3,189 miles away in Riyadh. And that is at the heart of the problems now facing Wilton. In ICI’s heyday, plants were hard wired together across the site. “Although there was a river running through it, they were physically con- nected, just like a jigsaw, but ICI exercised commercial flexibility around the margins,” says Mr Booth. “If you had crude oil coming in at one end through what was, in effect, a verbunt and you had many products - polymers, PET, vinyl - coming out the other, there were lots of processes and sub processes that were more or less efficient over time. One year maybe the PET business was doing very well and perhaps the aromatics business was not. ICI looked at that in the round; if it was still making money, it was not overly bothered. “When it was broken up in the ’90s, physically nothing changed and people stayed where they were. But commercial agreements were set up between those units that did not exist before and they became as inflexible as the pipes that hard wired them together.” The cracks in those pipes are now beginning to appear. The collapse in June of Dow, swiftly followed by Croda - two previously integrated companies - were the first real signs that the old order was giving way to the stresses of recession, although former ICI textile firm Invista’s clos- ure had hinted of it two months previously. The North Tees PetroPlus refinery, now up for sale by its Swiss parent, is another, while Artenius - a previously profitable plastics plant where local manage- ment decisions were subordinate to the boardroom battles go- ing on in Barcelona - also looks precarious. Artenius’ difficulties illustrate how Wilton’s past strength has be- come its present weak- ness. A former ICI company integrated into the Wilton supply chain, it was left crit- ically exposed when its Spanish par- ent hit the financial rocks. “This recession is a big wake-up call,” says Mr Booth. “As a chemical industry we are at a crossroads and as a nation we have to decide if it’s something we want to keep. “I believe we should since it adds £20m/day to the UK coffers.” Doomsayers who talk of Wilton tum- bling like a pack of cards and a gathering crisis are quickly si- lenced - and, in truth, the complex, helped by the chemical cluster group NEPIC, has done well to attract major invest- ment including MGT Power’s £500m biomass plant, in the teeth of the downturn. Behind the scenes, though, they are sufficiently worried to convene a war cabinet of industry bosses to thrash out a letter to Business Secretary Lord Mandelson calling for cash to keep companies like Artenius ticking over while buyers are found. The current difficulties facing Wilton are dramatically different from anything that has gone before and demand a “paradigm shift” in thinking, says Paul Booth. His new incarnation of Wilton will not be based on commodity feed- stocks but a knowledge supply chain, and government must intervene. “Everybody is trying to do the right thing but everybody is going in slightly different directions so the result is inertia,” says Mr Booth. “It’s about how we herd all the cats to head in the right direction. And as much as I would love to do that, to think any multi-national will is living in dreamland. “The Government has to organise, to co-ordinate the endeavour to- wards focused research, picking out things that it wants the UK to be good at - getting the technology strategy board and industry and universities all homing in the same direction.” Mark Lewis, energy advisor to NEPIC, agrees that managed change is needed fast. “If the credit crunch had not happened, things would have changed more gradu- ally but, when your back’s up against the wall, you have to do something to manage the cash,” he says. “We are working hard to understand what the future ought to be like and we are starting to see that, with the wider investments that are coming such as MGT and the National Industral Bi- otechnology Facility (at Wilton’s Centre for Process Industries), these things are the future but they are not going to be here to- morrow.” Paul Booth’s future landscape is even more visionary. He believes “the land- fills of today are go- ing to be the oilfields of tomorrow”. Having created a problem for the planet, the petro chemical industry could rescue both it- self and the envir- onment by breaking asunder what man had previously joined together. “For a long time the chemical in- dustry has survived on North Sea oil and gas. It’s not going to be switched off tomorrow, but they are not going to last forever. “We may as well get used to the fact that there’s going to be a shift from naturally oc- curring resources to how we make the polymers of the future. That’s about the application of know- ledge and taking a dif- ferent route, whether that’s a bio route or a synthesis of some other pre-existing material.” For a new feedstock to be based on previously used materials, the sup- ply chain going out of the home needs to be as sophisticated as the one that filled it with plastic bottles in the first place. And the process industry can play a part in shaping that, he says. “The chemical industry has an op- portunity to start looking forwards and thinking about the concept and what the implications of that would be. There is no point waiting until we’re washed up on a beach and thinking what are we going to do next; we need to think about it in the lifeboat,” he says. Being a pragmatist, he also believes the past has much to teach us. It may well be time to rebuild the verbunt and crucial to that will be the urgent completion of the upgrader project, the biggest single investment planned for Teesside since ICI’s arrival, which will extract oil from sand. It would be an opportunity to re- constitute the jigsaw to create a new picture of Wilton, he says. In this brave new world, next gen- eration polymers will be created alongside those created from tradi- tional fossil fuel sources - but with different separation lines feeding them. For all that to happen fast enough to make a difference, he believes gov- ernment must enter a partnership with private enterprise to skew it in the right direction. “I don’t think there’s such a thing as a free market,” he says. “Sometimes we might decide we need to do something extraordinary to one for the benefit of the whole.” Spoken like a true son of ICI. THE break up of ICI saw its former operating divisions sold off to companies throughout the world. Some have survived and thrived; others have struggled. Among the 30,000 staff ICI employed at its height were three men who have an enduring influence on Teesside. PAUL BOOTH, above, now president of Sabic UK Petrochemicals, started his career as a mechanical engineering apprentice for ICI. In 1999 he became Huntsman’s European vice-president of manufacturing and technology before joining SABIC in 2007. SANDY ANDERSON, right, helped manage the handover of several of the company’s divisions. He entered ICI as a chemical engineering graduate in 1965 and rose to become Senior Vice President for Technology. He is now a member of the board of governors at Teesside University and chairman of Yarm-based bioethanol company Ensus. GEORGE RITCHIE, left, senior vice-president of human resources and IT for utility provider Sembcorp is a passionate advocate for the chemical industry. He heads up the regional employers’ board for the National Skills Academy for the Process Industry. THE START OF SOMETHING BIG: Above, ICI’s polythene works under construction in the 1950s, right, the ICI nylon works, below right the famous logo and below, Prime Minister Ramsay McDonald at the official opening of the Oil Works in 1935 ICI looked at things in the round; if it was still making money, it was not overly bothered - Paul Booth, president of Sabic It’s about how we herd all the cats in the right direction. To think any multi national will is living in dreamland - Paul Booth There is no point waiting until we’re washed up; we need to think about it in the lifeboat - Paul Booth