More Related Content

Similar to Savills - Ha Noi Market Brief Q3 2009 ENG

Similar to Savills - Ha Noi Market Brief Q3 2009 ENG (20)

More from savillsvietnam (7)

Savills - Ha Noi Market Brief Q3 2009 ENG

- 1. Office for Lease

Ha Noi, Vietnam Q3/2009

Supply trends

Grade C in Q3 2009 posted 78% in the occupancy rate with

Three new office buildings namely Plaschem (Long Bien US$17 per square metre per month in the average rent.

Dist.), CEO Tower (Tu Liem Dist.) and Handi Resco Tower

(Ba Dinh Dist.) coming online in Q3 2009 increased the total Demand trends

supply of Grade A, B & C offices to 493,000 sq m, consisting

of 12 Grade A; 30 Grade B and 32 Grade C buildings. Demand of both Grade A and Grade B, as measured by net

Thirty-two Grade C office buildings included since Q3 2009 absorption, bounced back in Q3 2009 due to positive signals

added nearly 120,000 sq m of office space to the total current of the global economic recovery. However, it is observed that

supply (*) new businesses are still cautious and less willing to take risks

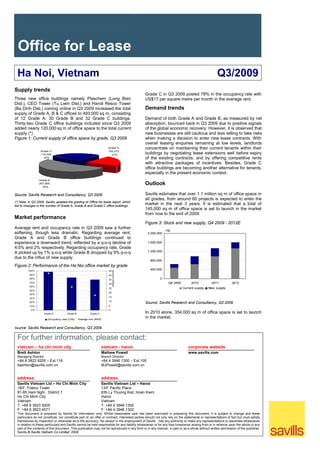

Figure 1: Current supply of office space by grade, Q3 2009 when making a decision to enter new lease contracts. With

overall leasing enquiries remaining at low levels, landlords

Grade A, concentrate on maintaining their current tenants within their

Grade C, 105,275 ,

119,305, 21% buildings by negotiating lease extensions well before expiry

24% of the existing contracts, and by offering competitive rents

with attractive packages of incentives. Besides, Grade C

office buildings are becoming another alternative for tenants,

especially in the present economic context.

Grade B,

.

267,995 ,

55%

Outlook

Source: Savills Research and Consultancy, Q3 2009 Savills estimates that over 1.1 million sq m of office space in

all grades, from around 60 projects is expected to enter the

(*) Note: In Q3 2009, Savills updated the grading of Office for lease report, which

led to changes in the number of Grade A, Grade B and Grade C office buildings .

market in the next 3 years. It is estimated that a total of

145,000 sq m of office space is set to launch in the market

from now to the end of 2009.

Market performance

Figure 3: Stock and new supply, Q4 2009 - 2012E

Average rent and occupancy rate in Q3 2009 saw a further

m2

softening, though less dramatic. Regarding average rent, 2,000,000

Grade A and Grade B office buildings continued to

experience a downward trend, reflected by a q-o-q decline of 1,600,000

4.5% and 2% respectively. Regarding occupancy rate, Grade

1,200,000

A picked up by 1% q-o-q while Grade B dropped by 9% q-o-q

due to the influx of new supply.

800,000

Figure 2: Performance of the Ha Noi office market by grade

400,000

US$/sq m/month

100% 45

90% 40

80% 35 0

70% 30 Q4 2009 2010 2011 2012

60%

25 Current supply New supply

50%

20

40%

15

30%

10

20% Source: Savills Research and Consultancy, Q3 2009

10% 5

0% 0

Grade A Grade B Grade C In 2010 alone, 354,000 sq m of office space is set to launch

Occupancy rate (LHS) Average rent (RHS)

in the market.

Source: Savills Research and Consultancy, Q3 2009

For further information, please contact:

vietnam – ho chi minh city vietnam - hanoi corporate website

Brett Ashton Mathew Powell www.savills.com

Managing Director Branch Director

+84 8 3823 9205 – Ext.116 +84 4 3946 1300 – Ext.105

bashton@savills.com.vn MJPowell@savills.com.vn

address address

Savills Vietnam Ltd – Ho Chi Minh City Savills Vietnam Ltd – Hanoi

18/F, Fideco Tower 13/F Pacific Place

81-85 Ham Nghi , District 1 83b Ly Thuong Kiet, Hoan Kiem

Ho Chi Minh City Hanoi

Vietnam Vietnam

T: +84 8 3823 9205 T: +84 4 3946 1300

F: +84 8 3823 4571 F: +84 4 3946 1302

This document is prepared by Savills for information only. Whilst reasonable care has been exercised in preparing this document, it is subject to change and these

particulars do not constitute, nor constitute part of, an offer or contract, interested parties should not only rely on the statements or representations of fact but must satisfy

themselves by inspection or otherwise as to the accuracy. No person in the employment of Savills has any authority to make any representations or waranties whatsoever

in relation to these particulars and Savills cannot be held responsible for any liability whatsoever or for any loss howsoever arising from or in reliance upon the whole or any

part of the contents of this document. This publication may not be reproduced in any form or in any manner, in part or as a whole without written permission of the publisher,

Savills.© Savills Vietnam Co Limited. 2009

- 2. Retail

Ha Noi, Vietnam Q3/2009

Supply Trends The CBD is still on top in terms of rents, from approximately

US$40 to US$150 with occupancy rate of almost above 90

Savills classifies the four main retail groups as follows: percent. Right behind the CBD is the secondary area with

1) Shopping centre/ shopping mall, Department Store and average rents varying from US$20 per square metre per

Hypermarket, 2) Supermarket (with area of 300 sq m or more), month to a very high US$120 per square metre per month.

3) Wholesale centre, and 4) Retail podium. Rents in suburban area are relatively low, from US$7 to US$50

per square metre per month.

Vincom Galleries is the only new shopping centre coming

online in Q3 2009 with a net area of nearly 15,000 square Demand Trends

metres. In Q3 2009, the total retail space is about 360,000

square metres, contributed by ten shopping centre/ Despite the economy slowdown, Vietnamese retail sales of

department store/ hypermarket, seventy-eight supermarkets goods and services have maintained growth rates of about 20

and electronics marts, two wholesale centres, and twelve retail percent. Savills expects that the demand for retail space will

podiums. The CBD area performed quite well with a stable rent increase slightly as economy recovery is remaining on track.

and full occupancy most the time, while inappropriate market However, high CPI might once again threaten spending on

positioning of projects has made it difficult for suburban and non-essentials, negatively affecting the retail sector.

secondary areas to operate effectively.

Future Outlook

Figure 1: Market share of retail area by location, Q3 2009

Figure 3: Stock and New Supply, Q4 2009 - 2012

CBD Secondary Suburban Existing stock Future stock

sq m

100% 1,200,000

90%

80% 1,000,000

70%

60% 800,000

50%

40% 600,000

30%

400,000

20%

10% 200,000

0%

Q1 2009 Q2 2009 Q3 2009 0

Source: Savills Research & Consultancy, Q3 2009 2009 2010 2011 2012

Figure 2: Market share of retail area by type, Q3 2009 Source: Savills Research & Consultancy, Q2 2009

Retail Podiums

Hypermarket Figure 3 shows that there will be about 11,200 square metres

Supermarkets 5%

24% possibly coming on line in Q4 2009. Projects that expect to

31%

open in Q4 2009 include Tam Da Plaza (249A Thuy Khue) and

M5 building (Nguyen Chi Thanh Street). There will be

approximately 82,000 square metres of retail space entering

the market by 2010 due to the completion of some major

projects such as Cua Nam, Hang Da market, Ha Noi Plaza and

Sky City Tower. By 2011, Ha Noi is expected to have total new

Shopping center supply of retail area of about 425,000 square metres. The

Wholesales 16%

Centres

Department store majority of future supply is located in the secondary area.

8%

16%

Source: Savills Research & Consultancy, Q3 2009

For further information, please contact:

vietnam – ho chi minh city vietnam - hanoi corporate website

Brett Ashton Matthew Powell www.savills.com

Managing Director Branch Director

+84 8 3823 9205 – Ext.116 +84 4 3946 1300 – Ext.105

bashton@savills.com.vn MJPowell@savills.com.vn

address address

Savills Vietnam Ltd – Ho Chi Minh City Savills Vietnam Ltd – Hanoi

18/F, Fideco Tower 13/F Pacific Place

81-85 Ham Nghi , District 1 83b Ly Thuong Kiet, Hoan Kiem

Ho Chi Minh City Hanoi

Vietnam Vietnam

T: +84 8 3823 9205 T: +84 4 3946 1300

F: +84 8 3823 4571 F: +84 4 3946 1302

This document is prepared by Savills for information only. Whilst reasonable care has been exercised in preparing this document, it is subject to change and these

particulars do not constitute, nor constitute part of, an offer or contract, interested parties should not only rely on the statements or representations of fact but must satisfy

themselves by inspection or otherwise as to the accuracy. No person in the employment of Savills has any authority to make any representations or waranties whatsoever

in relation to these particulars and Savills cannot be held responsible for any liability whatsoever or for any loss howsoever arising from or in reliance upon the whole or any

part of the contents of this document. This publication may not be reproduced in any form or in any manner, in part or as a whole without written permission of the publisher,

Savills.© Savills Vietnam Co. Limited. 2009

- 3. Hotel

Ha Noi, Vietnam Q3/2009

Supply Trends Demand Trends

The hotel market supply has increased from 5,576 rooms to The demand of the hotel market across all grades decreased

5,678 rooms in Q3 2009 due to the entering of the 4-star slightly in Q3 2009 due to a reduction in the number of

Mercure Ha Noi La Gare Hotel that provides 102 rooms. The international visitors to Ha Noi. There were about 76,000

whole city currently has ten 5-star hotels accounting for 2,983 international arrivals to Ha Noi in September 2009, down by

rooms and six 4-star hotels including 1,083 rooms. 9.6% against last month and reducing by 21.4% compared to

September 2008. The total number of arrivals in the first nine

Revenue per available room (RevPAR), Q3 2008 – Q3 2009 months was about 745,000, down by 19.8% compared to the

same period last year. The global crisis and H1N1 epidemic

RevP A R (US$ ) 5-star 4-star 4 and 5-star

still are the main reasons leading to the reduction.

120

100

Outlook

80 Savills estimates that about 1,180 new hotel rooms will enter

the market by the year 2010 and nearly 1,000 of those rooms

60 will be in the Tu Liem and Cau Giay districts in the western

suburbs of Ha Noi. It is noted that the Dan Chu and Oriental

40

Pearl projects have been delayed until 2010.

20

Existing Stock and Future Supply

0

No . o f ro o ms Existing sto ck New supply

Q3 2008 Q4 2008 Q1 2009 Q2 2009 Q3 2009

Source: Savills Research & Consultancy, Q3 2009 12,000

(*)The average room rate is the estimated average room rates exclusive of 5% 10,000

service charge and 5% VAT.

8,000

The industry performance decreased continuously in Q3 2009 6,000

due to the global economic crisis and H1N1 flu. The RevPAR

for 5-star hotel sector has shown a significant decline at about 4,000

10% quarter on quarter. RevPAV for the 4-star segment is

2,000

unchanged from Q2 2009.

0

The average room rate of the 5-star hotel sector decreased 2010 2011 Future

10% quarter on quarter. The average occupancy of the

segment in Q3 2009 stayed at 51% as in the last two quarters, Source: Savills Research & Consultancy, Q3 2009

which was the lowest rate in the last four years.

The total number of international visitors to Viet Nam in Q4

The average rental rate of the 4-star sector continued to 2009 might decline compared to Q4 2008, in spite of the

decrease by 5% against Q2 2009 and about 22% compared to second step of the “Impressive Viet Nam” campaign being

the same period last year. Meanwhile, the average occupancy extended until the end of 2009 and the government’s decision

increased from 52% in Q2 2009 to 54% in Q3 2009. to spend more to promote the program. This is because the

tourism industry has not recovered yet and Viet Nam tour

prices are likely higher than other countries in Asia area.

For further information, please contact:

vietnam – ho chi minh city vietnam - hanoi corporate website

Brett Ashton Matthew Powell www.savills.com

Managing Director Branch Director

+84 8 3823 9205 – Ext.116 +84 4 3946 1300 – Ext.105

bashton@savills.com.vn MJPowell@savills.com.vn

address address

Savills Vietnam Ltd – Ho Chi Minh City Savills Vietnam Ltd – Hanoi

18/F, Fideco Tower 13/F Pacific Place

81-85 Ham Nghi , District 1 83b Ly Thuong Kiet, Hoan Kiem

Ho Chi Minh City Hanoi

Vietnam Vietnam

T: +84 8 3823 9205 T: +84 4 3946 1300

F: +84 8 3823 4571 F: +84 4 3946 1302

This document is prepared by Savills for information only. Whilst reasonable care has been exercised in preparing this document, it is subject to change and these

particulars do not constitute, nor constitute part of, an offer or contract, interested parties should not only rely on the statements or representations of fact but must satisfy

themselves by inspection or otherwise as to the accuracy. No person in the employment of Savills has any authority to make any representations or waranties whatsoever

in relation to these particulars and Savills cannot be held responsible for any liability whatsoever or for any loss howsoever arising from or in reliance upon the whole or any

part of the contents of this document. This publication may not be reproduced in any form or in any manner, in part or as a whole without written permission of the publisher,

Savills.© Savills Vietnam Co. Limited. 2009

- 4. Apartment for sale

Ha Noi, Vietnam Q3/2009

Supply Trends 2009 had a definite impact on buyers’ decision.

The total number of apartments available for sale from projects The housing demand from speculators was still low in Q3 2009

that are currently active in Q3 2009 is about more than 1,000 due to the stock market’s rapid recovery in the second quarter

units. The majority of primary supply is concentrated in Tu Liem, and continuing to grow hotter during the third quarter of 2009.

Dong Da and Hai Ba Trung districts. This causes investors to focus much more on the stock market

than the property market.

Performance of the primary market (All Types) in Q3 2009

Outlook

Primary supply (LHS)

No . o f apartments so ld in Q3 2009 (LHS)

Units Average primary asking price excl. VA T (RHS) US$/sq m From the period Q4 2009 up to 2012, it is estimated that there

600 4,000 will be at least 10,000 apartments launched in the market. Of

which, nearly 34% of the apartments belongs to Tu Liem

3,500

500 District, and approximately 30% are located in Cau Giay

3,000 District.

400

2,500

Despite difficult domestic economic conditions foreseen in the

300 2,000 short-term, the fundamentals for residential property demand

1,500 in Ha Noi should persist. However, delays and cancellations in

200

implementing projects may happen accordingly and, therefore,

1,000

supply forecasts may require a downward revision.

100

500

The primary market in Q4 2009 is expected to receive a new

0 0

Tu Liem Dong Da Hai Ba Trung Ba Dinh Hoan Kiem

supply of nearly 2,000 units.

Source: Savills Research & Consultancy, Q3 2009 Future supply from Q4 2009 up to 2012 by district

Units

The number of successful transactions in the overall primary 4,000

market in Q3 2009 was lower than the previous quarter. Only 3,500

around 400 apartments sold in Q3 2009 accounting for nearly 3,000

38% of the primary market in comparison to 610 apartments

2,500

sold in Q2 2009. That is probably due to the lack of

2,000

diversification of products in this market.

1,500

The overall average primary asking price in Q3 2009 is about 1,000

US$1,830 per square metre, which was an increase of 5.5% 500

against Q2 2009.

0

Tu Liem Cau Giay Dong Da Hoang Mai Ba Dinh Thanh Xuan Long Bien Hai Ba

The secondary market seems to have performed better than Q2 Trung

2009. The average secondary asking prices have increased on Source: Savills Research & Consultancy, Q3 2009

all twelve studied districts, by 15.6% on average against Q2

2009. In this market, asking prices range from US$660 - Savills believes that Q4 2009 will see no considerable change

US$4,200 per square metre. in primary asking price of apartments of all grades against Q3

2009. However, prices and performance in the secondary

Demand Trends market may be impacted, partly due to the enforcement of

personal income tax levied on real property transfers since the

Current demand in Q3 2009 in Ha Noi has not met with supply. end of September 2009.

Only about 435 apartments are sold in the primary market and

the upward trend on prices in the secondary market against Q2

For further information, please contact:

vietnam – ho chi minh city vietnam - hanoi corporate website

Brett Ashton Matthew Powell www.savills.com

Managing Director Branch Director

+84 8 3823 9205 – Ext.116 +84 4 3946 1300 – Ext.105

bashton@savills.com.vn MJPowell@savills.com.vn

address address

Savills Vietnam Ltd – Ho Chi Minh City Savills Vietnam Ltd – Hanoi

18/F, Fideco Tower 13/F Pacific Place

81-85 Ham Nghi , District 1 83b Ly Thuong Kiet, Hoan Kiem

Ho Chi Minh City Hanoi

Vietnam Vietnam

T: +84 8 3823 9205 T: +84 4 3946 1300

F: +84 8 3823 4571 F: +84 4 3946 1302

This document is prepared by Savills for information only. Whilst reasonable care has been exercised in preparing this document, it is subject to change and these

particulars do not constitute, nor constitute part of, an offer or contract, interested parties should not only rely on the statements or representations of fact but must satisfy

themselves by inspection or otherwise as to the accuracy. No person in the employment of Savills has any authority to make any representations or waranties whatsoever

in relation to these particulars and Savills cannot be held responsible for any liability whatsoever or for any loss howsoever arising from or in reliance upon the whole or any

part of the contents of this document. This publication may not be reproduced in any form or in any manner, in part or as a whole without written permission of the publisher,

Savills.© Savills Vietnam Co. Limited. 2009

- 5. Serviced Apartment

Ha Noi, Vietnam Q3/2009

Supply Trends Demand Trends

The total supply of the serviced apartment market in Q3 2009 Generally, demand of the Ha Noi serviced apartment market

increased to more than 219,000 square metres by the addition reduced across all three grades compared to Q2 2009. It is

of 100 units from Hanoi Fraser Suites building, located at 51 likely due to the shift of a certain amount of expatriates to the

Xuan Dieu Street, Tay Ho District. Among these 100 new secondary lease market from the owners’ apartments.

units, there are two penthouses introduced to the serviced

apartment market for the first time. The serviced apartment demand in the Ha Noi market is

mainly from expatriates working for embassies, international

Currently, forty-one studied buildings in seven districts of Ha NGOs and foreign companies. Although the signal of

Noi provide nearly 2,200 units for tenants. Supply stock is economic recovery has been seen in many countries in the

classified into studio, from 1-bedroom to 6-bedroom and world such as UK, America, etc, there may continue, in the

penthouse. They range in size from more than 40 square short-term, to be a slight decrease in demand. International

metres to 560 square metres. companies are still facing difficulties due to the lasting

economic crisis and are still weighing whether to return to Viet

Market performance of Ha Noi Serviced Apartment, Nam for doing business long-term.

Q3 2008 – Q3 2009

Occupancy rate (LHS) Average Rent (RHS) Outlook

US$/ sq m/ month

Stocks and New Supply, 2009E Future

100% 30 Units Stock New supply

4,000

25

80%

3,500

20

60% 3,000

15

2,500

40%

10 2,000

20%

5 1,500

0% 0 1,000

Q3 2008 Q4 2008 Q1 2009 Q2 2009 Q3 2009

500

Source: Savills Research & Consultancy, Q3 2009

0

*Estimated average achievable rent and service charge, exclusive of 2009 2010 2011 2012 Future

VAT, on a net area basis. Source: Savills Research & Consultancy, Q3 2009

Since Q3 2008, the serviced apartment market has witnessed In Q4 2009, new supply (10 units) is expected from Hanoi

continuous reductions of the average rent rate. Q3 2009 Fraser Suites in Tay Ho. By 2012, another seven serviced

showed a significant quarter on quarter reduction of 4.8%, apartment projects are scheduled to complete and provide

equivalent to US$1.2 per square metre per month. more than 1,200 units for the market.

The average occupancy rate of the serviced apartment market Vinh Tuy Bridge has just been officially put into operation. Nhat

in Q3 2009 declined to 88%, down 3% compared to Q2 2009. Tan Bridge is planning to be completed by 2012. There are

It seems this reduction has been caused by the addition of many large on-going infrastructure projects connecting the

about 100 units, which is equal to around 4% growth of supply western zone of Ha Noi (previously Ha Tay) to the city centre,

stock against Q2 2009. such as the extension of Le Van Luong Road and Metro Cat

Linh – Ha Dong. All such projects might have positive a impact

on the serviced apartment market in the future.

For further information, please contact:

vietnam – ho chi minh city vietnam - hanoi corporate website

Brett Ashton Matthew Powell www.savills.com

Managing Director Branch Director

+84 8 3823 9205 – Ext.116 +84 4 3946 1300 – Ext.105

bashton@savills.com.vn MJPowell@savills.com.vn

address address

Savills Vietnam Ltd – Ho Chi Minh City Savills Vietnam Ltd – Hanoi

18/F, Fideco Tower 13/F Pacific Place

81-85 Ham Nghi , District 1 83b Ly Thuong Kiet, Hoan Kiem

Ho Chi Minh City Hanoi

Vietnam Vietnam

T: +84 8 3823 9205 T: +84 4 3946 1300

F: +84 8 3823 4571 F: +84 4 3946 1302

This document is prepared by Savills for information only. Whilst reasonable care has been exercised in preparing this document, it is subject to change and these

particulars do not constitute, nor constitute part of, an offer or contract, interested parties should not only rely on the statements or representations of fact but must satisfy

themselves by inspection or otherwise as to the accuracy. No person in the employment of Savills has any authority to make any representations or waranties whatsoever

in relation to these particulars and Savills cannot be held responsible for any liability whatsoever or for any loss howsoever arising from or in reliance upon the whole or any

part of the contents of this document. This publication may not be reproduced in any form or in any manner, in part or as a whole without written permission of the publisher,

Savills.© Savills Vietnam Co. Limited. 2009