CA$HFLOW EXPRESS - Featuring Anthony Patrick with New Harvest Ventures

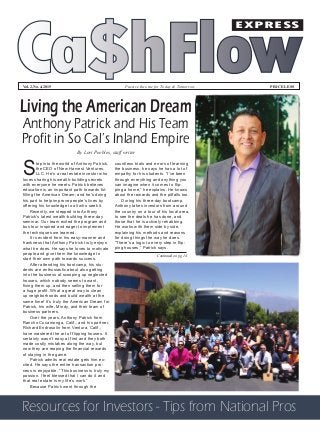

- 1. Ca$hFlow EXPRESS Passive Income for Today & Tomorrow PRICELESSVol. 2, No. 4, 2015 Continued on pg. 14 S tep into the world of Anthony Patrick, the CEO of New Harvest Ventures, LLC. He’s a real estate investor who loves sharing his wealth-building secrets with everyone he meets. Patrick believes education is an important path towards ful- filling the American Dream; and he’s doing his part to help improve people’s lives by offering his knowledge to all who seek it. Recently, we stepped into Anthony Patrick’s latest wealth-building three-day seminar. Our team exited the program and bus tour inspired and eager to implement the techniques we learned. It is evident from his easy-manner and frankness that Anthony Patrick truly enjoys what he does. He says he loves to motivate people and give them the knowledge to start their own path towards success. After attending his bootcamp, his stu- dents are enthusiastic about also getting into the business of scooping up neglected houses, which nobody seems to want, fixing them up, and then selling them for a huge profit. What a great way to clean up neighborhoods and build wealth at the same time! It’s truly the American Dream for Patrick, his wife, Mindy, and their team of business partners. Over the years, Anthony Patrick from Rancho Cucamonga, Calif., and his partner, Richard Endrosolin from Ventura, Calif., have mastered the art of flipping houses. It certainly wasn’t easy at first and they both made costly mistakes along the way, but now they are reaping the financial rewards of staying in the game. Patrick admits real estate gets him ex- cited. He says the entire transaction pro- cess is enjoyable. “This business is truly my passion. I feel blessed that I can do it and that real estate is my life’s work.” Because Patrick went through the Resources for Investors - Tips from National Pros Living the American Dream Anthony Patrick and His Team Profit in So Cal’s Inland Empire countless trials and errors of learning the business, he says he has a lot of empathy for his students. “I’ve been through everything and anything you can imagine when it comes to flip- ping a home,” he explains. He knows about the rewards and the pitfalls too. During his three-day bootcamp, Anthony takes investors from around the country on a tour of his local area, to see the deals he has done, and those that he is actively rehabbing. He works with them side by side, explaining his methods and reasons for doing things the way he does. “There’s a logic to every step in flip- ping houses,” Patrick says. By Lori Peebles, staff writer

- 2. Nationwide Financing Up to 75% LTV Recourse & Non-Recourse Aquisition Line Available Up to 30-Year Amoritization . . . . . . . . . . . . . . . . . . . . . . . . PROPERTY TYPES Single-Family Residences 2-4 Family Units • Condos Townhomes • Apartments Mixed-Use Residential real estate investors aren’t used to having easy options for financing, re-financing and unlocking equity from their rental properties. Until now. At B2R Finance, residential rental mortgages are all we do. That means we’re committed to finding faster, easier and smarter options for you. For example, we provide blanket loans allowing you to eliminate multiple mortgages and “package” several properties into a single loan. We also make asset-based loans that consider the cash flow of your rental property rather than your personal debt-to-income ratio. In short, we provide innovative solutions that are tailor- made for real estate investors. B2R Finance L.P., NMLS ID # 1133465, 1901 Roxborough Road, Suite 110, Charlotte, NC 28211. B2R Finance L.P. is not a residential mortgage lender. B2R Finance L.P. only makes loans with a commercial purpose and is not currently authorized to make such loans in all jurisdictions. Your specific facts and circumstances will determine whether B2R Finance L.P. has the authority to approve loans in your specific jurisdiction. B2R Finance L.P. operates out of several locations, but not all locations conduct business in all jurisdictions. Arizona Mortgage Banker License BK#0926974. Minnesota: This is not an offer to enter into an agreement. Any such offer may only be made in accordance with the requirements of Minn. Stat. §47.206(3), (4). Oregon Mortgage Lender #ML-5283. 855.710.0227 B2Rfinance.com We’ve been looking for a way to refinance our rental properties. B2R was the answer. Brian Evans Investor Plano, TX “B2R walked us through the process and made sure we were comfortable every step of the way.” - Brian Evans

- 3. Co-publishedbyRealty411 CashFlow Express • Page 3 CONTENTS 1 The American Dream Is Realized 4 Publisher’s Letter - Due Diligence 6 From Rehabbing Homes to Hotels 10 It’s Time to Self Direct Your Future 12 Colony American Finance Wants to Jumpstart Your SFR Portfolio 15 Lending Money with Land Trusts 18 Sensei’s Secrets to Tripling Profits 20 The Dangers of Turn-Key Rentals 21 Cashflow without Tenants or Toilets 22 Can’t Find Leads? Go with Probate! 30 Multifamily Gains Investor Interest pg. 21 pg. 6 pg. 18 pg. 12 Join Our VIP Social Network FREE Limited-Time Membership @ REALTY411GUIDE.ning.com Find Events, Deals, Friends Download Free Publications GOT QUESTIONS? NEED INFO? Contact us online at: Info@realty411guide.com Or call: 805.693.1497 Alia Ott and her partner, Terri Garner, are bullish about investing in self storage. Read about Alia’s journey in this fascinating niche. Photographs above: Step inside Stacee Nelson’s hotel rehab in Texas. Colony American Finance wants to Jumpstart Your SFR Portfolio.

- 4. CashFlow Express • Page 4 FOUNDER & EDITOR Linda Pliagas info@realty411guide.com EDITORIAL STAFF Tim Houghten Stephanie Mojica Lori Peebles COPY EDITOR Morgan Schaal PHOTOGRAPHER John DeCindis Passive Income for Today & Tomorrow Ca$hFlow EXPRESS Yes!You can be rich from owning real estate and trading stocks. We’ve all heard the story of the little old lady who lived modestly and worked as a school teach- er for 40 years. She never earned more than $35,000 per year, owned a modest home, and shared her life with two cats. Once she died, her rela- tives discovered a $150,000 life insurance policy and $1.5 million in stocks that she left to the elementary school’s scholarship fund. The national media loves to air these stories. It seems there are several old ladies who fit this seemly unique profile year after year. How could that be? Investing in stocks is not the world’s most challenging task. In fact, at its core, it’s very simple. The truth is that the stock market creates millionaires every year. Investing in stocks, with wealth in mind, is easier than you think. Invest In What You Know Wanna be a good stock market in- vestor? Keep it simple and start with companies and products with which you are familiar. If you’ve ever opened a can of Coca Cola on a hot summer day and felt refreshed and invigorated, why not own the stock? It’s a product you know with a story you understand. When I say “a story you understand,” I mean to say that you understand how the Coca Cola Corporation makes money, or to ex- press it in Wall Street terms, you understand how the company earns revenue. The more bottles and cans of Coke that Coca Cola sells around the world each day, the larger the com- pany’s profit. Over the past ten years Coke stock (symbol KO) has risen from around $40 per share to a high of $71 — $1000 in- vested in Coca Cola stock ten years ago would be worth $4,100 today; $10,000 invested in Coca Cola stock would be worth $41,000 today. If you spend more than $100 per year eating fast food, why not own the stock? Over the past ten years McDonalds stock (symbol MCD) has risen from a low of $15 per share to a high of $95 per share. By Doug Carver Organizer Pasadena and Burbank Cashflow Meetup Groups I can remember my first time play- ing Robert Kiyosaki’s Cashflow board game about eight years ago and how it started a chain of events that continues to this day. What stuck with me most was not the “how to” of playing the game but the people that I met at the event. These were not like the normal people in my life that would tell me I was crazy for trying to start my own real estate business or that financial freedom was impossible without a steady well-paying job. The people I met were excited about learn- ing and expanding their knowledge on how to achieve financial freedom. They were active investors in real estate and the stock market. They were small busi- ness owners with a passion and vision for creating more financial success in their lives. Overall, they had a mindset for prosperity that I like to call a “Cash- flow” mindset. A lot of people complain that Kiyosaki does not provide the specific details on how people should implement his strat- egies to create financial freedom in his books and programs. Truth is he never spells out a step-by-step “how to” for building long-term financial freedom. What he does teach is far more impor- tant, and that is how to create a “Cash- flow” mindset. Kiyosaki describes it in his book Cashflow Quadrant moving your mindset from the E (employee) and S (self-employed) side of his Cashflow quadrant to the B (business owner) and I (investor) side of the quadrant. In lay- man’s terms, it’s the mental shift from someone who seeks financial security at all costs to someone who can confidently and knowledgeably take measured risks. This is a simplistic definition but a very important one to understand. Without the correct mindset, it really doesn’t matter how much you learn the “how to” of real estate investing, trading stocks, building a strong MLM business, etc. You will not succeed. It’s like trying to grow corn in a field of sand. The seeds will not germi- nate and you’ll end up with next to noth- ing to harvest in the fall. How, you ask, does this relate to the Cashflow game? Well, after playing the game a bunch of times, I learned the “how to” of getting out of the rat race, but I still was not able to take what I learned from the game and apply it to my real- life financial situ- ation. However, I realized that the time I was spending with my new Cashflow friends was changing the way I thought about money and my financial future. I no longer viewed the stock market as a giant rigged system for losing money. I began to see the tremen- dous opportunities in the sinking real es- tate market even as many people I knew were losing money on deals that had gone bad. Overall, I saw for the first time op- portunities all around me to create wealth even as the newspapers talked constantly of the “Great Recession.” Today as a result of my ongoing in- volvement playing and organizing local Cashflow events in Southern California, I have a thriving real estate investing business. It was after speaking with one of my Cashflow friends who was a real estate investor that I was encouraged to start wholesaling distressed properties. It turned out to be a great decision. More recently, I’ve begun to learn how to suc- cessfully trade in the stock market using options. As a self-proclaimed real estate “zealot”, I never would have dreamed of investing in the equity markets. Howev- er, after playing Cashflow 202 with my Cashflow friend ,who is an active trader, and learning about his trading system, I was able to see the opportunity before me. I now fully expect that investing in the markets will be a huge part of my fu- ture financial success in addition to my Learn How to Create Stock Market Wealth Today Investors Manifest a “Cashflow” Mindset FREENo. 1 / Vol. 1 2012 Personal Finance News from the Publishers of Realty411 Magazine - www.Realty411Guide.com Continued on pg. 2 Continued on pg. 12 By Tyrone Jackson TheWealthyInvestor.net Doug Carver (left) and Chris Hanson dis- play the Cashflow game to group members. Published by Realty411 Magazine CashFlow Express is published in Santa Barbara County by Realty411. © Copyright 2015. All Rights Reserved. Reproduction without permission is strictly prohibited. The opinions expressed by writers and columnists are not endorsed by the publishers and/or editorial staff. Before investing in real estate, stocks, bonds, mutual funds, gold, or securities, seek the advisement of a trusted financial advisor, attorney or tax consultant. Investing in any asset and market sector is risky business and may result in the loss of capital. Please invest responsibly. PRINTED IN THE USA ~ GOD BLESS AMERICA DISCLOSURE AND INFORMATION - ATTENTION ALL: The publications, events, expos and mixers produced and promoted by Realty411guide.com, reWEALTHmag.com and/or their owners, em- ployees, agents and affiliates (collectively “411”) are for informational and entertainment purposes ONLY. The information and presentations provided herein do not constitute an offer or solicitation to buy or sell securities or real estate. Please be aware that real estate investing is VERY RISKY. 411 is not responsible for any of the information provided and/or statistical data presented, and 411 does not represent that any information or opinions expressed and data provided reflect the opin- ions, advice and research of the publishers, editors, columnists, ven- dors, speakers, sponsors, guests who are in attendance at the events, and do not reflect the opinions, advice or research of 411. By attending 411 events you acknowledge that the investment strategies mentioned may not be suitable for you, that any real estate investment is inher- ently risky, that all investments are subject to risks, which could result in the entire loss of your investment, and that 411 is not responsible for any losses or outcome of any investment made by you from or after 411 events, or as a result of contacts made at these events as well as after reading 411 publications. You personally are 100% responsible for your due diligence, for all investment information and for all decisions with respect to any potential investment or transaction. 411 does not endorse, and has not performed due diligence on any of the colum- nists, advertisers, vendors, speakers, sponsors, companies and guests who appear at our events or in our publications. The information pre- sented at any 411 event related to any potential real estate investment is general in nature and does not constitute legal, tax or investment ad- vice. 411 strongly recommends that you seek the advice of your trusted attorney, broker, CPA and/or financial adviser before taking action as an investor. To contact us, please call (805) 693-1497. Real estate, and all investing, is risky and may result in the entire loss of your principal investment. Please invest responsibly. track to wealth, which can often times lead to utter disaster. Recently, I ran into an ac- quaintance at an event; she is a very active investor in Southern California. She disclosed that she had a bad experience at one of the local real estate investor clubs, one which is no longer in operation. If you take away anything from this publication, please take my advice: Spend time researching people and companies before you jump into a business relationship. Be sure to ask for references and actually call them. Check on- line to see if there are any negative reports. And, if your investment is quite substantial, I would even recommend doing a professional background check as well. You cannot be too careful with your hard-earned money. It may have taken decades to accumulate that nest egg, don’t get excited and rush into something with- out having all the facts! I always recommend seeing an investment first-hand. I’ve invested in some properties out of state and have seen each one prior to making a purchase - sometimes I visit twice! Also make sure to invest in what you understand. I like to keep it simple with buy-and-hold rent- als, the caveat is to purchase them in emerging markets. Some people like to invest in tax liens, notes or even assisted living facilities. Whichever path you choose, make sure you fully comprehend your investment choice. It’s important to remember that the higher the financial rewards, generally, the greater the risk will be. Be cautious, ask questions and, as always, if we can help you please don’t hesitate to contact our office: 805.639.1497. Thank you, I hope to see you in person soon! Be Social and Receive Updates from Linda Pliagas on Facebook, Twitter, LinkedIn, Pinterest, Ning, and Google+ FOUNDER Linda Pliagas pliagas@msn.com EDITORIAL STAFF Hannah Ash Lori Peebles Stephanie Mojica COPY EDITOR Lori Peebles PHOTOGRAPHER John DeCindis PRODUCTION Lori Peebles Augusto Meneses PUBLISHED BY Realty411 ADVERTISING 805.693.1497 EVENTS & EXPOS Teri Burke Suzanne Lilly Lawrence Ruano WEBSITE Maria Victoria TO REACH US, CALL: 310.499.9545 We provide complimentary copies for your CashFlow group or REIA Passive Income for Today & Tomorrow Ca$hFlow EXPRESS Yes!You can be rich from owning real estate and trading stocks. We’ve all heard the story of the little old lady who lived modestly and worked as a school teach- er for 40 years. She never earned more than $35,000 per year, owned a modest home, and shared her life with two cats. Once she died, her rela- tives discovered a $150,000 life insurance policy and $1.5 million in stocks that she left to the elementary school’s scholarship fund. The national media loves to air these stories. It seems there are several old ladies who fit this seemly unique profile year after year. How could that be? Investing in stocks is not the world’s most challenging task. In fact, at its core, it’s very simple. The truth is that the stock market creates millionaires every year. Investing in stocks, with wealth in mind, is easier than you think. Invest In What You Know Wanna be a good stock market in- vestor? Keep it simple and start with companies and products with which you are familiar. If you’ve ever opened a can of Coca Cola on a hot summer day and felt refreshed and invigorated, why not own the stock? It’s a product you know with a story you understand. When I say “a story you understand,” I mean to say that you understand how the Coca Cola Corporation makes money, or to ex- press it in Wall Street terms, you understand how the company earns revenue. The more bottles and cans of Coke that Coca Cola sells around the world each day, the larger the com- pany’s profit. Over the past ten years Coke stock (symbol KO) has risen from around $40 per share to a high of $71 — $1000 in- vested in Coca Cola stock ten years ago would be worth $4,100 today; $10,000 invested in Coca Cola stock would be worth $41,000 today. If you spend more than $100 per year eating fast food, why not own the stock? Over the past ten years McDonalds stock (symbol MCD) has risen from a low of $15 per share to a high of $95 per share. By Doug Carver Organizer Pasadena and Burbank Cashflow Meetup Groups I can remember my first time play- ing Robert Kiyosaki’s Cashflow board game about eight years ago and how it started a chain of events that continues to this day. What stuck with me most was not the “how to” of playing the game but the people that I met at the event. These were not like the normal people in my life that would tell me I was crazy for trying to start my own real estate business or that financial freedom was impossible without a steady well-paying job. The people I met were excited about learn- ing and expanding their knowledge on how to achieve financial freedom. They were active investors in real estate and the stock market. They were small busi- ness owners with a passion and vision for creating more financial success in their lives. Overall, they had a mindset for prosperity that I like to call a “Cash- flow” mindset. A lot of people complain that Kiyosaki does not provide the specific details on how people should implement his strat- egies to create financial freedom in his books and programs. Truth is he never spells out a step-by-step “how to” for building long-term financial freedom. What he does teach is far more impor- tant, and that is how to create a “Cash- flow” mindset. Kiyosaki describes it in his book Cashflow Quadrant moving your mindset from the E (employee) and S (self-employed) side of his Cashflow quadrant to the B (business owner) and I (investor) side of the quadrant. In lay- man’s terms, it’s the mental shift from someone who seeks financial security at all costs to someone who can confidently and knowledgeably take measured risks. This is a simplistic definition but a very important one to understand. Without the correct mindset, it really doesn’t matter how much you learn the “how to” of real estate investing, trading stocks, building a strong MLM business, etc. You will not succeed. It’s like trying to grow corn in a field of sand. The seeds will not germi- nate and you’ll end up with next to noth- ing to harvest in the fall. How, you ask, does this relate to the Cashflow game? Well, after playing the game a bunch of times, I learned the “how to” of getting out of the rat race, but I still was not able to take what I learned from the game and apply it to my real- life financial situ- ation. However, I realized that the time I was spending with my new Cashflow friends was changing the way I thought about money and my financial future. I no longer viewed the stock market as a giant rigged system for losing money. I began to see the tremen- dous opportunities in the sinking real es- tate market even as many people I knew were losing money on deals that had gone bad. Overall, I saw for the first time op- portunities all around me to create wealth even as the newspapers talked constantly of the “Great Recession.” Today as a result of my ongoing in- volvement playing and organizing local Cashflow events in Southern California, I have a thriving real estate investing business. It was after speaking with one of my Cashflow friends who was a real estate investor that I was encouraged to start wholesaling distressed properties. It turned out to be a great decision. More recently, I’ve begun to learn how to suc- cessfully trade in the stock market using options. As a self-proclaimed real estate “zealot”, I never would have dreamed of investing in the equity markets. Howev- er, after playing Cashflow 202 with my Cashflow friend ,who is an active trader, and learning about his trading system, I was able to see the opportunity before me. I now fully expect that investing in the markets will be a huge part of my fu- ture financial success in addition to my Learn How to Create Stock Market Wealth Today Investors Manifest a “Cashflow” Mindset FREENo. 1 / Vol. 1 2012 Personal Finance News from the Publishers of Realty411 Magazine - www.Realty411Guide.com Continued on pg. 2 Continued on pg. 12 By Tyrone Jackson TheWealthyInvestor.net Doug Carver (left) and Chris Hanson dis- play the Cashflow game to group members. Contents - 2014 1 FirstKey Lending Offers Options 4 Publisher’s Welcome Note 5 The Millionaire Maker Returns 6 Management Tips by Pam Texas 7 Out-of-State Investment Advice 9 Rehab with Andrew Cordle 10 Q-n-A with Zinc Financial 12 & 18 Attract Private Lenders 13 Investing in Texas Land 15 The Investment Lab is Open 16 Incorporate a Business 21 & 23 CashFlow Resources 24 Scenes from Our Expos 26 How to Avoid Capital Gains From the Publishers of Realty411 Magazine 1604 Grant Ave., Novato, CA 94945 California Department of Real Estate Brokers #1897444 PRIVATE MONEY LOANS Beach, Seattle, Atlanta and even New York City just this year alone! It’s a dream come true, and we plan on hosting many more expos and mixers around the nation, including upcoming events in Florida, Missouri, Ohio, and Texas. Our largest expo has attracted up to 300 people and our smaller events regularly unite an exclusive group of veteran real estate leaders. We plan on expanding our events even further. My goals are lofty: I envision some day hosting international real estate conferences — this is precisely how much I enjoy and believe in the power of networking. It is a pleasure and privilege to meet the readers of our numerous publica- tions. We produce our quarterly glossy Realty411 magazine, with Real Estate Wealth as an alternate cover. We have separate distribution and websites for each. The 100-page glossy is available at no charge at selected grocery stores, and will soon be available in bookstores across the country. Next, we have our REI Wealth Monthly, a digital and interactive issue spe- cifically designed for online enjoyment. It was created for the Apple News- stand by Noland Araracap, a San Diego-based technology enthusiast. Next, of course, is our newspaper CashFlow Express, which is directly distributed at our live expos and mixers, and at selected real estate events that we support and sponsor around the country. For the rest of the year, in addition to expanding our calendar of live ex- pos, we will continue to expand our media and marketing company with spe- cial print supplements and new online websites. We just completed our first Private Money 411 Special Supplement and are starting the second! It is our mission to be an all-encompassing resource of information for investors. In closing, I’d like to add that if we can assist you in any way, or if you have any feedback on our publications or events, please let me know. Your suggestions and comments are always welcomed. LindaPliagas Contact us: 310.499.9545 or info@realty411guide.com Be Social and Receive Regular Updates from Me on: Facebook, Twitter, LinkedIn, Pinterest, Google+ DISCLOSURE AND INFORMATION FOR READERS AND EXPO GUESTS The publications, events, expos and mixers promoted by Realty411guide.com and/ or their owners, employees agents and affiliates (collectively “411”) are for informa- tional and entertainment purposes ONLY. The information and presentations provided therein do not constitute an offer or solicitation to buy or sell securities or real estate. Please be aware that real estate investing is VERY RISKY. 411 is not responsible for any of the information provided and/or statistical data presented, and do not reflect the opinions, advice or research of 411. You personally are 100% responsible for your due diligence, for all investment information and for all decisions with respect to any potential investment or transaction. 411 strongly recommends that you seek the advice of your trusted attorney, broker, CPA and/or financial adviser before investing. CashFlow Express • Page 4 CashFlow Express is published in Santa Barbara County by Realty411. © Copyright 2013. All Rights Reserved. Reproduction without permission is strictly prohibited. The opinions expressed by writers and columnists are not endorsed by the publishers and/or editorial staff. Before investing in real estate, stocks, bonds, mutual funds, gold, or securities, seek the advisement of a trusted financial advisor, attorney or tax consultant. Investing in any asset and market sector is risky business and may result in the loss of capital. Please invest responsibly. PRINTED IN THE USA ~ GOD BLESS AMERICA Connect to our virtual network ~ Search for us here: Welcome to Cashflow Express T hanks for joining us for a new edition of Cashflow Express. I developed this newspaper a couple of years after the onset of our glossy magazine, Realty411, and our alternate cov- er Real Estate Wealth, because of my love for newspapers. The plain newsprint paper was what lured me into pursuing a degree in journalism. I’ve always loved the way newspapers look and feel so thought it would be creative to develop one as a spe- cial gift for our guests who attend our expos around the country. That’s really how it all devel- oped; and we’ve been producing Cashflow Express for a number of years now. It’s wonderful to see ideas and aspirations turn into reality. I feel very fortunate to be able to provide valuable information to others who are interested in learning about real estate. I’m very involved in the production of each issue, includ- ing the design. It’s a wonderful creative outlet for me. While being at the forefront of the investment industry has been a positive experience, for the most part, my position has also led me to experience stress and anxiety. Particularly, when I hear about negative experiences that occur in our industry. I cannot stress how important it is for all investors to take the time to do the most thorough due diligence they possibly can BEFORE investing with anyone, whether you meet them at a real estate club, a national expo like ours, or the many other places these people may be lurking. Be skeptical and do your homework. The allure for quick profit in this industry unfortunately at- tracts people who may not have the best interest at heart for oth- ers. We have to put our profes- sion in perspective: The entry to the real estate industry is easy compared to other high-income fields, which require advanced degrees that can take years to complete. Again, the industry seems to have the illusion of being a fast PRESIDENT Nikolaos K. Pliagas PRODUCTION Lori Peebles Augusto Meneses PUBLISHED BY Realty411 Magazine EVENTS & EXPOS Colby Sorrenson WEBSITE Maria Victoria CONTENTS - FALL 2015 GROW YOUR BUSINESS WITH US! FOR ADVERTISING INFORMATION: 805.693.1497 We provide FREE Copies for your Meetup Group or REIA LindaPliagas

- 5. Get Started Today! Call 888-484-6537 Visit RealtyMogul.com/realty411 Rates from 9% High LTVs Stated Income* Loans from $150K to $3MM+ 12 Month Interest Only with Extension Option Up to 90% of Rehab Budget Financed *4506T form or first 2 pages of tax returns requested for proof of IRS filing ©2015 Realty Mogul, Co. Licensed in California under BRE license #01926613 and CFL license 60DBO 35802. This is not an offer to lend. Any financing will be subject to a credit evaluation, approval of the subject property collateral, and other restrictions. Terms and conditions are subject to change. Realty Mogul currently lends in the following states: AZ, CA, CO, CT, DC, DE, FL, GA, HI, IL, IN, MB, MA, NC, NH, NJ, NM, NY, OH, OK, PA, TX, VA, WA. Goodbye, Hard Money Hello, RealtyMogul.com we deliver the leverage and speed you need for your rehab projects, without the complications. Up to 90% Leverage 10 second Letter of Intent Simple, no hassle application Get your funds in 10 days

- 6. T hroughout the years, I have met many phenomenal people at our live events throughout the country. One of the perks about this business is that after a while you begin to know some on a personal level and begin to follow their progress as an investor. When I met Stacee Nelson years ago, she was busy rehabbing a single family residence in Santa Barbara. The project was a major rehab and the property was stripped down to the bare bones. Nelson is not one to shy away from complicated deals, she takes on projects with certainty and confidence. It’s been interesting to follow Nel- son through her progression from rehabbing single-family homes to her risk-taking efforts in purchasing water-front properties, REO tapes, and now even a hotel. LINDA: How long have you been investing in real estate? STACEE: I purchased my first condo when I was 22 and then didn’t invest in anything for a long time. When I was living in Ger- many I started going to real estate auctions at the courthouse. My friend was buying properties to renovate and hold. I tagged along. In 2011, living in Santa Barbara, I began my formal education in real estate investing and purchased my first flip house in 2012. LINDA: I even saw one of your projects in Santa Barbara a couple of years ago. What attracted you to the hotel niche? STACEE: The idea of renovating an empty building into a small boutique hotel was initially the idea of my business partner. At the time we were looking for alternative passive income opportunities REHAB From Rehabbing Homes to Renovating a Hotel as well as ways to create a positive impact on communities. An opportu- nity presented itself in the form of an empty 15,000 square foot building directly on the town square in Gonzales, Texas. The town was keen to redevelop their downtown, which made for a win-win opportunity. Continued on pg. 8 Interview By Linda Pliagas CashFlow Express • Page 6

- 7. Direct Your Future™ Instant Access To Your IRA Funds Real estate transactions just got easier TheEntrustGroup.com Cards are issued by Citibank, N.A. pursuant to a license from Visa U.S.A. Inc. and managed by Citi Prepaid Services. This card can be used everywhere Visa debit cards are accepted. Full disclosures, terms and conditions apply. The Entrust Group is an administrator for self-directed retirement plans. We specialize in providing administrative services to help investors diversify their retirement portfolios with alternative investments of their choice. © 2014. The Entrust Group, Inc. All Rights Reserved. The Entrust Group myDirection Visa® Prepaid Card Make faster real estate investments, pay property costs, and maintain your assets, all with the swipe of a card. Affordable, convenient, and easy to use, The Entrust Group myDirection Visa® Prepaid Card gives you the freedom to invest in what you want, when you want.

- 8. Continued on pg. 28 LINDA: Was it easier to take on the challenge and expense of a hotel rehab after doing many single-family home deals? STACEE: Initially we thought it would be a comparable project, just larger in scope. What we learned was that renovating an empty build- ing into a hotel with individual plumbing, HVAC, cable, etc. was far more complicated and costly than anticipated. Certainly having a background in single-family home renovations was crucial in the planning and budgeting, but we were sur- prised by the sheer volume of issues that arose during the construction phase. The next one will go much more smoothly as a result of the num- ber of lessons we learned. LINDA: Tell us about the hotel. Where and how did you find it? STACEE: My business partner has a long-time family friend living and investing in the town. He made the initial introductions to the town’s economic development council who were very interested in supporting business growth in the area. Their support was a critical factor in the decision to purchase in Gonzales, Texas. We toured numerous vacant buildings in the area until we found one large enough and with a perfect location directly on the town square. LINDA: How long did the rehab take? Did the entire property have to be worked on or only a section? STACEE: The rehab took over a year to com- plete. There were a number of delays in the project especially when our initial contractor was removed from the project. One of our important lessons from this project, was to have a project manager on-site during the construction phase. The volume of issues was simply magnified by one hundred versus a single family renovation. Our hands-on project manager made the differ- ence in our ultimate success and project comple- tion. To provide an idea of the complexity of a project like this: the smoke and fire alarm sys- tems had to be coordinated with the installation of electricity and plumbing (water sprinklers), the HVAC system required coordination in tim- ing with the electrician, drywall installer (ceil- ing vents) and the roofer (where the systems are housed), the water coming into the building had to be separated between the hotel and the restaurant located on the ground floor, and the elevator turned into a complicated project all by itself. LINDA: What was the biggest lesson you’ve learned from this transaction? STACEE: Rather than give one, I’m going to pro- vide a few lessons we learned from this project: For large projects, invest in a project manager who is on-site and regularly reporting on prog- ress. Have the contractor regularly send pictures and review before progress payments are made. It’s a necessity to have a detailed project plan and budget agreed on, in writing, by the contrac- tor. We thought we had sufficient detail in our initial project summary based on our housing rehab experience. What we learned is you can’t be to detailed oriented in the budget and plan- ning phase. The more detailed the budget and contractor commitments are, the better. Include a split between labor and materi- als so it is very clear for both sides, especially when you choose materials. Have the contrac- tor sign the agreements. Budget sufficiently for contingencies. The larger and more complex the project is, the greater the likelihood for additional unplanned expenses. Have an agreed process for change orders that includes approving changes and costs be- fore the work is completed. LINDA: How is the hotel performing now? What are your goals with the property? STACEE: The hotel looks fantastic. The reviews of the guests who have stayed there are over- whelmingly positive. While we positioned the boutique hotel to provide executive-style accom- modations for the local oil industry, the major- ity of our guests thus far are visiting Gonzales, Texas, for the regional rodeo events, the hot rod show, the summer concert series, and many his- torical events. Gonzales, Texas is known as the place where the first shot of the Texas Revolu- tion was fired. LINDA: Wow, that really sounds exciting! Now, In addition to hotels and single-family homes, your company also invests in Marina and resort properties around the world, is that correct? STACEE: Yes. We looked at a variety of differ- ent passive income and commercial real estate opportunities and decided that marina and resort properties were ideal: It is a relatively untapped From Rehabbing Homes to Renovating a Hotel, pg. 6 CashFlow Express • Page 8

- 9. a program designed just for real estate investors! Program Highlights: • No Primary Residence • No Pre-Payment Penalties! • Loan amounts up to $800,000 • Short Term Bridge Financing* • Rates starting out at 10.0% • Up to 85% of Purchase • Points vary. Please see website for pricing information 1 Up to 85% of acquisition, LTV with minimum of 5 or more profitable transactions with ZINC in the last 12 months. *Please go to www.zincfinancial.net for complete details Telephone 559.326.2509 Fax 866.602.8892 zincfinancial.net Equity Based Lending Wholesale Division • California • Arizona Hard Money Wholesale Lender Funding at High Speed! This information is for use by mortgage professionals only and should not be distributed to the general public. All loans are made in compliance with Federal, State and Local Laws. This is not a commitment to lend. Loans made or arranged pursuant to a California Lender’s License. Loans made or arranged in Arizona must be represented and originated by a mortgage broker qualified to do business in that state. We lend on distressed Real Estate Investments! F I N A N C I A L , L L C

- 10. CashFlow Express • Page 10 By Tim Houghten, staff writer elf-directed individual retirement ac- counts or IRAs are rapidly growing in popularity, but experts warn that it is important to only get into such an in- vestment with proper education and professional guidance. Kaaren Hall, owner of uDirect IRA Services in Orange County, California, says even after more than two decades in the financial industry and six years of running her company, she too must continually stay on top of her investment educa- tion, particularly regarding Internal Revenue Service guidelines for retirement accounts. Self-directed IRAs allow people to invest their retirement funds into a variety of options outside of the traditional stock market, including real estate, land, and private notes. “Financial literacy is not taught in schools, but our future depends on understanding it,” Hall says. “Only about 4 percent of U.S. investors have a self-directed IRA. Why?” Because most investors and many advisors simply aren’t aware of it. It’s Time to Self Direct Your Future We understand the details and challenges involved with property development and can work with you through the phases of development to help you build your company. ■ Flexible 6 – 24 months ■ No prepayment penalties ■ Interest reserve or pay-current available ■ Rates starting at 9% ■ We fund loans from $500,000 up to $5 million ■ Primarily in the southwestern states But even those who are aware of the potential financial power of self- directed IRAs often do not fully comprehend the IRS guidelines of “prohibited transactions,” ac- cording to Hall. “You’re not allowed to have any personal benefit from your IRA prior to retirement,” Hall says. A common misconception among investors is that they can use the self-directed IRA funds to purchase real estate or other property from themselves or close relatives such as a spouse, a child, a grandchild, a parent, a grandparent and any spouses of such relatives. These transac- tions are not permitted under self-directed IRAs, according to Hall. However, an investor could purchase property from a more distant relative such as a sibling, a cousin, a niece, or an uncle. “Make sure you know what you’re doing,” Hall says. “We’re here to help people so they under- stand the twists and turns as much as possible. I’ve educated tens of thou- sands of people about the use of self-directed IRAs and uDirect IRA Services is set up to serve and educate self-directed IRA inves- tors.” The term self-directed in itself misleads some people because it is the IRA doing the investing, Hall adds. “So that’s confusing because they get into trouble by maybe sign- ing a purchase contract (in their own name),” she says. “Your IRA can’t buy an asset that you own.” Consequently, people should wait until they actually open an account with a quali- fied custodian before funding it and making transactions, Hall says. Gener- ally, a custodian rather than the actual investor should sign purchase contracts relevant to self- directed IRAs. While representatives of companies such as uDirect IRA do not give actual investment ad- vice due to potential legal liability, they can help people follow ever-changing IRS guidelines. Hall, a former mortgage broker whose work history includes Bank of American and Indymac Bank, has educated tens of thousands of inves- tors into deciding whether self-directed IRAs are right for them. She and her associates have directly worked with thousands of clients. To learn more about self-directed IRAs, call 866-447-6598 or visit: www.uDirectIRA.com Financial literacy is not taught in schools, but our future depends on understanding it,” Hall says. “Only about 4 percent of U.S. investors have a self-directed IRA. Why? “ ”

- 11. REALTY411 EVENTSREALTY411 EVENTS LOS ANGELES - CA$HFLOW Expo West Coast Network with investors from around the nation! September 19th - 9 am, Complimentary Book LAS VEGAS, NV - 2nd Viva Las Vegas Expo Event hosted with Real Estate Insider’s Club October 24th - 9 am, Play & Learn in Vegas SEATTLE, WA - Network in the Northwest With Real Estate Association of the Puget Sound August 15th - 9 am in Bellevue, Washington NAPA VALLEY, CA - CRUSH It Expo 2015 Hosted by BAWB, Bay Area Wealth Builders October 3rd - 8 am, It’s Harvest Time in Napa NEW YORK CITY, NY - CA$HFLOW Expo East Hosted with REIA NYC - Meet Us in Manhattan November 7th - 9 am, Focus on Finance DALLAS, TX - Giving Thanks / Giving Back Lone Star State Expo with Dennis Henson, AREA November 21st - 9 am to 5 pm, Charity Expo! Our expos recently received exposure here:

- 12. D o you think that you might have missed the boat to invest in single- family rental homes? The answer is a resounding NO! We all remember 2005-2007, when it seemed that inves- tors couldn’t make a mistake in the resi- dential fix and flip market. Investors with little experience were able to outbid the competition, slap some minor paint and carpet improve- ments, and then sell their properties for incredible returns. But then the bubble burst, and many investors were left with homes that couldn’t be sold or in some cases, even given away. They had two choices: Give up the properties through foreclosure or become a landlord. RENTAL DEMAND OUTPACES EXPECTATIONS Statistics show that nearly 35% of Americans now rent instead of own. Drill further into the statistics and you’ll find that 35% of renters choose single- family homes and 19% choose duplexes, triplexes or fourplexes. With these two categories encompassing 54% of all rental choices, it makes perfect sense that investors are looking to 1-4 unit properties instead of owning larger multi- family apartment-style buildings. 1-4 unit properties have a lower price point, the ownership risk is spread out among mul- tiple structures, and the overall expense ratio is lower. Renters in single family housing tend to pay their own utilities, maintain the landscaping themselves and have access to municipal water/ sewer/garbage at a much lower rate than through private service. Rental demand is projected to change significantly over the next ten years, primarily driven by the changing nature of the household. Baby boom- ers are moving in with their children or into senior housing, and millennials are favoring renting over owning because of its flexibility and lower commitment level. Being well versed in the changing market is the key to having a profitable portfolio. Also noteworthy is that there are an estimated 14 million rental homes owned by non-institutional investors in the United States – most of which are owned free and clear. Quick math: Using 14 million rental homes at an average value of $100,000 each, that’s potentially $1.4 trillion in new loans that can be originated and re-invested into the market. Colony American Finance has multiple financing options available so you can ac- cess your portfolio’s equity and quickly put it to work to buy additional properties, invest in your children’s education, or simply replenish your cash position. KNOWLEDGE IS POWER The savviest investor will do three things: Research, research and more research. Mortgage brokers and real estate brokers have invaluable information, such as market trends and vacancy rates, as well as access to properties that might not be listed for sale. But it’s significantly more critical for investors to have access to capital: Both liquid cash and innovative financing. No longer is the SFR rental market mo- nopolized by private money loans with steep interest rates and fees or the more traditional Fannie/Freddie product that caps out at 5-10 properties. Colony American Finance provides non-recourse term loans for stabilized portfo- lios and fix and flip lines of credit for acquisi- tion funding. FIX/FLIP LINES OF CREDIT If you want to grow your portfolio or per- haps don’t yet own a rental portfolio, a line of credit is definitely the right choice. Colony American Finance offers two different line of credit options, depending on investor experi- ence and short-term/long-term goals. Our Entrepreneurial Line of Credit is a non-revolving, declining line designed for the investor who does less than 20 fix/flip projects per year and only within the 1-4 unit residen- tial arena. Line amounts start at $500,000 and go upwards of $5,000,000. Borrowers have 12 months to utilize the proceeds and 12 months to pay back each draw. This loan has no prepayment penalties. For the more active investor, our Institu- tional Line of Credit offers additional flexibility as it allows for both residential 1-4 unit prop- erties and commercial properties up to 20 units. The Institutional Line of Credit is also a revolving line, meaning you can access the funds multiple times. Line amounts start at Colony American Finance Wants to Jumpstart Your SFR Portfolio Rental demand is projected to change significant- ly over the next ten years, primarily driven by the changing nature of the household. CashFlow Express • Page 12 By Jennifer Goralski, Vice President

- 13. NewDirectionIRA.com (877)742-1270 Real Estate IRAsResidential, commercial, notes, fix and hold, fix and flip, and more. CashFlow Express • Page 13 $3,000,000 and can go as high as $50,000,000. Borrowers have 12 months to access the pro- ceeds and typically nine months to repay each draw. This is a non-recourse loan and has no prepayment penalties. Also important to note is that you can utilize either the Entrepreneurial or Institutional Line of Credit to build your own personal rental portfolio. Once you have completed the renovations on your fix/flip properties, you can look to refinance your holdings into one of Colony American Fi- nance’s term loans. NON-RECOURSE TERM LOAN OPTIONS If your SFR rental portfolio has five or more properties, Colony American Finance is your op- tion for attractive financing options. Our loans are underwritten like a commercial loan, which means no more debt-to-income ratios hurting you when qualifying. Rather, your portfolio is under- written on the assets and the cash flow generated from those assets. Plus, because we lend across the U.S., a single-term loan can be made on port- folios with holdings in multiple states. Our rates are competitive with traditional FNMA loans, are amortized over 30 years and can be fixed for five or ten years. Our loan amounts start at $500,000 and can go up to $100 million – and almost all term loans are available on a non-recourse basis. Important too, is that borrowers can have multiple tranches of loans to facilitate estate planning or property management issues. REGIONAL STRATEGIES Auction.com recently released data that showed investors are favoring buy-and-hold strategies over fix/flip on a nationwide basis, but that investor intent varies between online/offline investors, regions, and property prices. Mid- westerners and Southerners are more likely to buy and hold whereas those in the Northeast are more likely to fix/flip. Investors in the western states are evenly split between fix/flip and buy/ hold strategies. Whatever your investment style, we have the capital for either strategy. It’s an exciting time to be an investor; trends indicate that the rental market will continue to improve over the next decade. Colony American Finance is ready to provide meaningful and cost-effective financing options for your portfolio. -Jennifer Goralski has been a lender since 1993 and has an in-depth knowledge of single fam- ily home portfolio lending. She is available to be reached at 310.752.5287 or at Jennifer.goralski@ colonyamericanfinance.com R ealtyMogul.com, the online marketplace for real es- tate investing, announced that Michael Sanchez and Charles H. Kim, CFA will join the com- pany’s Commercial Lending Division. RealtyMogul.com recently secured $250 million in capital commitments from institutional investors for bridge and permanent lending in commercial real estate, and Sanchez and Kim will further facilitate the company’s ex- plosive growth and expansion in the commercial real estate debt markets. Sanchez and Kim, who helped launch Colony Mortgage Capital in 2013 and have originated and ex- ecuted nearly $1 billion of senior and mezzanine loans since its inception, will be responsible for generating sub- stantial new commercial business for RealtyMogul.com. They will lend their considerable experience to provide strategic coun- sel on the real estate capital markets. “High caliber talent such as Mi- chael and Charles are rare. It’s a tes- tament of RealtyMogul.com’s market position and platform that these two industry leaders would choose to join our team from Colony Capital,” said Jilliene Helman, CEO of RealtyMogul. com. “We are thrilled they are com- ing aboard our platform, as they will help us further build Realty- Mogul.com into a world-class commercial real estate capital markets player.” Sanchez has over 25 years of commercial real estate experience, with an emphasis on structured finance and portfolio man- agement. Sanchez earned a B.S. degree in real estate finance from California State Polytechnic University. Kim brings an equally impressive track record in real estate finance, with more than 15 years of experience in origination, underwriting and execution of financing transactions across various asset types. He holds a B.S. in management sci- ence from University of California, San Di- ego, and has an MBA from USC’s Marshall School of Business. He also holds the Chartered Financial Analyst designation. RealtyMogul.com Adds Two Top Commercial Real Estate Producers New Hires Speak Volumes in the Company’s Aggressive Expansion of Experienced Talent Kim Sanchez

- 14. Everything is explained and everything is revealed. Anthony often repeats himself just to ensure that ev- eryone understands it. Patrick realizes that many of his students are embarking into unknown territory, and as he states, “doesn’t want you to make the same mis- takes that I made when I learned the business.” Every few months, Patrick disembarks with a bus load of eager students from throughout California and around the nation. Investors of all ages are anxious to learn how to rehabilitate distressed properties and make a handsome profit doing so. Patrick’s American Dream was realized through real estate. He began as a handyman, then graduated to a real estate inspector. Today, he has flipped hundreds of houses and has also shared the stage with influ- ential leaders of wealth, such as Donald Trump, Suze Orman and Ron LeGrand. Although he prides himself as being a “self-made man,” Patrick acknowledges that he’s had a lot of help to get where he is today. “My beautiful wife, Mindy, is my right hand. And I have a phenomenal team of brokers, real estate agents, rehabbers, contractors and investors who have been instrumental to my success.” Patrick describes himself as a man of faith: “God has guided my way throughout this journey,” he con- fides. Before we conclude the interview, we asked Patrick if he had any last-minute suggestions for our read- ers. He replied: “Don’t wait to invest, start now. Many people don’t believe they have the money to start investing, but did you know that you could use some of your home’s equity or your 401(k) retirement plan from work? You can even use money from your IRA account to get started.” Patrick believes almost anyone can succeed in real estate with the proper mentor, education, motiva- tion, and passion. Sign up for one of Anthony’s weekend seminars. They are held in Rancho Cucamonga, Calif. The team’s mission is to transform the lives of others and improve their quality of life. Call Anthony Patrick at New Har- vest Ventures, LLC and ask how you can sign up to learn the art of successful real estate investing. For information, call (909) 694-2221. Anthony Patrick holds the future in his hand. As an entrepreneur and real estate investor, Anthony Patrick likes to be in control of his future and says real estate has fulfilled his “American Dream”. Anthony Patrick credits his success to his team of experts. They make work not only profitable but also fun. Anthony says he surrounds himself with people he cares about and his team includes his wife, Mindy Booker (red shirt), and his sister, Elvie Gil-Jund (white shirt), and long-time friend Richard Endrosolin (green shirt). His broker, Scott Ch- eramie (red tie), is also an important part of New Harvest Ventures, LLC, as well as team members Robert McGrauth (ivory shirt) and Joe Lopez (black shirt). CashFlow Express • Page 14 Anthony Patrick was a guest speaker at a MORSynergy event produced by MOR Financial. Living the American Dream: Anthony Patrick’s Testimonial, pg. 1 Anthony Patrick has rehabbed hundreds of homes in the Inland Empire.

- 15. T his article will discuss the ins and outs of borrowing money when property is held in a Land Trust AND how to lend money to a Land Trust using the property in the trust for col- lateral. First, it is important to understand that if you are buying property and financing it through a conventional loan that must be qualified using secondary market guidelines, you will generally NOT be able to close directly into your Land Trust. The only exception to this rule (that I am aware of as of this writing) is Bank of America. If you are buying property in Illinois AND using an Illinois Land Trust Agreement, BOA will let you close directly into a Land Trust. This leaves 99% of the rest of us out in the cold. However, BOA (and many other conventional lenders) will only allow you to obtain four secondary market loans and then they cut you off! So, if you are very active in the real estate game you will be forced to obtain your loans via a Portfolio Lender (where the loan is NOT qualified in the secondary market) or Private Lenders. Most Portfolio Lenders WILL let you close directly into your Land Trust (with your Trustee signing the mortgage on the property held in trust as collateral for your loan). Closing directly into a Land Trust is the smartest way to obtain title be- cause your personal name is NEVER in the chain of title. It is much easier to use a Private Lender when borrow- ing money using a Land Trust. And you can be much more creative using a Land Trust (especially when there are multiple Private Lenders in- volved) than if you held title in your own name. Case in point. Bob needed $50,000 to fund his next real estate deal, but he did not want to go to a bank to borrow the money. Not only do banks charge high interest rates but they want full collateral no matter how much money you want to borrow. Bob had $100,000 of equity in one of his properties, but only needed $50,000. If Bob borrowed from a bank they would require Bob’s entire equity to be used as collateral for a $50,000 loan (50% Loan-to-Value). Since Bob’s property was held in a Land Trust he could assign varying percentages of the Beneficial Interest to multiple Private Lenders. For ex- ample, he could borrow $10,000 from five different Private Lenders and give them each an Assignment of Ben- eficial Interest equal to the percentage of ownership in the Trust (equity = $100,000 / 10,000 = 10% ownership per Private Lender). Some of the other advantages of borrowing this way are; no credit check, no public knowledge of the transaction, no reporting to the credit agencies and the remaining equity is still available for additional borrow- ing, if needed. Let’s turn the tables on this scenario and look at this from the lender’s viewpoint. If I were the lender I would want to have the title checked to make sure the property being borrowed against was in fact in the Land Trust that I was lending to. I would also want to make sure there were no other loans against the property (other than what might have been represented by the borrower). Furthermore, I would demand the filing of a UUC-1 form that would secure my position against the Beneficial Interest (which is personal property NOT real estate). I would also want a statement from the Trustee of the Land Trust confirm- ing her knowledge of my loan and security interest given. In Ferraro V. Parker 229 So2d 621 (1969) the court ruled that a collateral assignment of a beneficial interest in a Land Trust would not be treated as a mortgage, nor require foreclosure nor entitle any party to any redemp- tive rights. However, Illinois case law indicates that, where a trust is created simultaneously with a financ- ing arrangement, it might be deemed a mortgage. The bottom line to all of this legal talk is that if the Trust Agreement is created PRIOR to a financing arrangement, the Beneficial Interest can be secured by a UUC- 1 and repossessed without going to court. This process works really well when selling to long-term tenants that you want to convert to buyers of the property they live in. This article has discussed the methods of borrowing and lending on property that is held in a Land Trust. We learned that using a Land Trust to hold title to investment real estate provides many ways to creatively finance property. We also learned that borrowing money on property held in a Land Trust gives the borrower many more options than conventional lenders provide. Additionally, we learned that selling property held in Trust to cur- rent tenants is more secure and less risky than conventional contract sales. Randy Hughes aka, Mr. Land Trust™ P.P.S. If you want to jumpstart your Land Trust education, go to my online FREE training right now for more on how to create your own Land Trusts immediately. Here is the link: www.landtrustwebinar.com. If you have a Land Trust question pick up the phone and call me! I actually an- swer my own phone. 866-696-7347 or email: randy@mrlandtrust.net CashFlow Express • Page 15 Borrowing and Lending Money with LAND TRUSTS By Randy Hughes, “Mr. Land Trust”

- 16. www.REIROADMAP.com FOR ANTHONY PATRICK’S LIFE-CHANGING MENTORING PROGRAM THAT WILL TEACH YOU THE MONEY-MAKING ART OF FLIPPING HOUSES JUMP ON THE BUS! HANDS ON! JoinOurUpcomingBusTour CALLTODAY909-694-2221 Contact us today for more info email: Anthony@NewHarvestVenturesLLC.com • www.NewHarvestVenturesLLC.com

- 17. Take Your Life Back! IN 3 INTENSIVE DAYS, MENTOR ANTHONY PATRICK WILL TEACH YOU: • How to find great investment properties • How to manage contractors • How to estimate repair and building upgrades • How to never overpay for repairs again • Which upgrades will provide the best return • How to inspect properties with confidence • How to develop a real estate investment team • How to analyze a rehab project to prevent over-spending • How to determine if a property will qualify for FHA financing • How to avoid pitfalls & more... Learn It! Live it! Do it! FOR AN INCREDIBLE LEARNING EXPERIENCE! 909-694-2221 Anthony@NewHarvestVenturesLLC.com www.NewHarvestVenturesLLC.com “This is a true ‘Hands On and Step-by-Step” experi- ence. There’s not better way to learn than having Anthony Patrick and the power team there to hold your hand.” Edwin and Anita Mizunaga Rancho Cucamonga LEARN TO BUILD WEALTH AND FINANCIAL FREEDOM THROUGH REAL ESTATE

- 18. R eal estate is the invest- ment for intelligent inves- tors today. But where do you find the time and great returns without sacrificing every- thing else you love doing? The Status Quo & Investment Strategies that Fit There appears to be nothing safer to invest in than real estate today. The returns are pretty attractive too. But when sophisticated investors and busy professionals look at how most others are investing, it can start to ap- pear challenging. If you are a doctor, lawyer, professor, or even successful artist – you don’t want to ditch a great career you are passionate about to start from scratch learning about being a landlord. Now hands-on fixing and flipping houses and managing your own rental properties can be great for those who don’t really love their jobs, or need a new source of income. But it’s a different story if you are already putting in 40 hours a week in something you like. Or Real Estate Investing: How to Make 3 Times More Returns Than Your Friends if you are already financially independent and don’t want to cramp your free lifestyle. If this is you, your friends might be invested in REITs, real estate company stocks or even turnkey rental property programs. These can be great ways to diversify a portfolio. But stocks and REITs are really too volatile. Turnkey rentals are great. They provide automatic passive income and all the perks of direct investment in property. But is that the best you can do in returns and getting ahead? You Can’t Afford Not to Demand More The problem is that the vast majority of indi- viduals and couples are way behind on retire- ment savings and wealth building. The aver- age 401(k) balance is only around $100,000. Recent data from the Federal Reserve shows that retirement savings and investment bal- ances drop to almost half by the time individu- als are in retirement. That means retirees are burning through half of their retirement funds within a year or two of exiting the workforce. Data 360 reports the average life expectancy in the United States is now just shy of 80 years old, and rising. The bottom line is that whether you have Turnkey rentals are great. They provide au- tomatic passive income and all the perks of direct investment in property. But is that the best you can do in returns and getting ahead? double the average savings or even eight times your salary saved today – it just isn’t go- ing to be enough. Not by a long shot. So how do you get ahead? Continued on pg. 28 Private Mortgage Fund, LLC provides one to three year bridge and interim financing for non-owner occupied residential and commercial properties in California. Contact us to learn how we can help you make close more transactions. We Make the Deal Happen PRIVATE MORTGAGE FUND, LLC • 23586 CALABASAS RD. SUITE 100 • CALABASAS, CA 91302 • (818) 702-2551 Contact Elliott Kimmel: ekimmel@pmfundllc.com ext 7 or Gordon Van Dueck: Gordon@pmfundllc.com ext 9 CashFlow Express • Page 18

- 19. Have you ever done business with this guy? Pitbull’s 38th National Hard Money Conference Tuesday Oct 13, 2015 Caesars Atlantic City New Jersey See why industry experts say this is the No. 1 hard money conference in the country! A one day event delivering powerful information on: Learn how to avoid the most common mistakes made by brokers and investors. Meet and network with both the established and new players in the market. Ask questions of our panel of experts. Find new funding sources. Continental breakfast in the morning and cocktail reception in the evening. Register Today! Register online at www.pitbullconference.com Questions? Just give us a call at 858.736.7788 Yeah, he’s the lender who promises low rates and terms, but never closes your deal. He’s also the guy who asks for upfront money just to "look" at a deal, but doesn't return a phone call. You know, the guy who promises everything, but never delivers. Avoid having to deal with “this guy” by establishing relationships with reputable lenders, industry service providers and experienced brokers. A solid network is key to finding success in our in- dustry. You have to know who to call—and for which deal. Make these powerful connections by joining us at Pitbull’s 38th National Hard Money Conference and maybe, just maybe you will never have to do business with “this guy” again.

- 20. DANGERSDANGERS By Kathy Fettke, Real Wealth Network LANDLORD appeared to have a quite an impressive system in place, so I decided to pay a visit. What I found was the owners were very young – in their 20s and had only a couple years experience in real estate. When they showed me their available properties, I thought we were walking through their newly acquired homes just out of foreclosure and in pre-renovation phase. You can imagine my horror when they proud- ly told me these were their turn-key homes. It appeared that no renovation had been done at all. In fact, there was not even a handle on the very old, rusty oven. I told them their properties did not meet our strict criteria, and they quickly replied, “That’s OK. We’ve already sold these to out-of-state investors. We have a wait list.” I asked if the buyers ever came to see what they were buying. They said, “Never.” These kids were expert internet marketers. They were not turn-key rental operators. I was amazed at how trusting their buyers must have been to unknowingly purchase such garbage. The 10 Most Common Signs of Dangerous Turn- Key Rental Operators Real estate investing is really not hard to get right – IF you use the protective measures avail- able to you like property inspections, appraisals and rent verifications. When it comes to working with a turn-key property company, here are just a few of the things we look for at the outset when vetting teams. 1. Inexperienced Operators If they don’t have a solid track record, they will be practicing and learning with YOUR money. 2. Not Walking the Talk If they don’t own a portfolio of rental property, they won’t really know first-hand what it takes to succeed. 3. Lone Rangers If they don’t have a team to sup- port them, you won’t be supported either – especially if anything hap- pens to them. does the buying, renovating, leasing and manage- ment of your rental property, and all you have to do is deposit rent checks. Unfortunately, most of these misinformed investors end up writing checks and making few deposits. The problem is that most people trust what other people tell them. They believe the market- ing message. For example, have you ever bought Fiji water? The marketing is beautiful and makes you feel like you’re drinking right out of a waterfall on a tropical island. But the Cleveland Water Department ran tests comparing Fiji Water to Cleveland tap water and found arsenic, human feces and other contaminants in the Fiji Water. False advertising is often used to market “turn- key properties.” At Real Wealth Network, we are constantly bombarded with companies who want to come speak at our events. Before they can do so, they must be thoroughly vetted to determine if their version of “turn-key” is the same as ours. I noticed one company was especially savvy at internet marketing. From the looks of their marketing, they More and more sellers are throwing out the term “turn-key rental property” in hopes they can attract out-of-state buyers. But what do they really mean by ‘turn-key’? I heard a fellow podcaster state recently that all you have to do to pro- vide turn-key property is buy a home, get it rented, put it under management and voila! You can flip “turn-key” property at retail pric- ing to eager out-of-state investors! This is certainly not our definition of turn-key. Unfortunately, turn-key means ab- solutely nothing anymore. Uneducated buyers assume turn-key means that you don’t have to do a thing. The belief (or false hope) is that someone else M Continued on pg. 26

- 21. CashFlow Express • Page 21 FREE PROBATE HOME SYSTEM REPORT: Access @ www.dfprobatesystem.com One of my mentors always used to say “there are riches in niches” and that couldn’t be more true in the world of real estate investing. I nvesting is not a “one size fits all” venture - some people love the challenge of turning trashy houses into beautiful homes, while others love to become passive lenders or landlords such that they can ac- count for a more predictable payment stream. We all need to find our own niche that works best for our available time, financial resources and personality types. Once an investor finds that “one thing,” the key is to really stick with it long enough to implement efficient systems and push through the challenges that inevitably occur. Growing up in a household with two stay-at-home par- ents; one focused on retirement hobbies and the other an active community volunteer, I was inspired to seek a fi- nancial path that would allow my time, talent and income to support my philanthropic goals and family-focused life- style. It was the combination of my “WHY” mixed with my enthusiastic curiosity of investment properties that be- gan my quest for financial freedom via real estate. I was specifically focused on finding an investment strategy that required minimal time with maximum returns over a long term view, and after 13 years of actively doing what felt like the Goldilocks approach to leveraging different strat- egies, my Investors in Action business partner Terri and I stumbled into a niche that was “Just Right” - and that was self storage. Prior to meeting Terri in 2009, we had both independent- ly tried our hands at flipping and renting residential prop- erties. Upon closing my first “fixer” in 2002, my friend gave me a financial calculator and bottle of Pepto-Bismol as if to say “buckle up for a crazy ride.” Little did I realize that I would eventually tear half that first house down and become my own general contractor rebuilding it from the ground up. If you casually knew me, you would not likely envision me jack-hammering concrete slabs or tearing up the roof with a Sawzall... but I took every DIY opportunity to get my hands on the power tools and make the best of it. Demolition Days included “Weapons of Mass Destruc- tion” where friends would grab a hard hat and sledgehammer to take a whack at the wall, date nights consisted of a dump run followed by a trip to Home Depot with the trailer. Taco Tuesdays with the crew were a regular affair. It was exhaust- ing yet exhilarating, and pro- vided many memorable learn- ing experiences that I would reflect upon fondly. That said, I quickly realized that my sharp-shooting nail gun skills would not be my fastest path to financial freedom, nor was there anything “passive” about rehabbing. After hanging up the prover- bial hard hat, my next “Goldi- locks” adventure would con- sist of becoming a landlord. My first rental experience started out with the rosiest of outlooks, my team took all the right steps that the gurus teach you to do: LLC - check; market growth and neighborhood evaluation - check; reputable property manager - check. We found a ten- ant willing to pay us one year in advance. No worries with rent collections or evictions you’d think right!? Little did we know later that this nice young lady was running some sort of establishment “ill suited” for this cute little Tennessee neighborhood. When it came time to renew the lease, she was gone and our manager whom was embarrassed by the property condition buried his head in the sand like an ostrich. Left behind in the house were things that investor nightmares and scary campfire stories are made of. My point of sharing this is not to scare any readers from owning residential rentals (We’ve owned other rentals with great tenants, managers and solid returns). I just prefer lessening my landlording headaches by renting space to people’s “stuff” vs. where they actually live. By 2010, Terri and I had established our company, Investors in Action, and focused attention towards private lend- ing and notes. “Being the Bank” as we like to call it, has been a very success- ful strategy for us - especially in the up- CashFlow without Tenants or Toilets NICHE Continued on pg. 26 By Alia Ott, Co-Founder of Investors in Action

- 22. CashFlow Express • Page 22 T he real estate industry is changing. With more and more competition in the marketplace, challenges in getting a loan and cautious homeowners staying put, it can be nearly impossible to find property that you might be interested in purchasing for your real estate portfolio. Is there a solution? Is there a way to combat the real estate lead shortage that has per- meated virtually the entire industry and has stalled your efforts at investing? What new and experienced real estate investors are seeing in the market is a fundamental change that may last for the foreseeable future. Overall, the nation is experiencing a shortage in the amount of properties that are being put on the market, leading to a lack of leads. This is creating increased pricing on homes that are for sale and issues in trying to build and acquire a real estate portfolio. WHY A SHORTAGE IN REAL ESTATE? The shortage in real estate leads that is occurring in most areas of the United States is due to issues in the lending industry that started several years ago and that continue today. With it becoming more and more difficult to qualify for a mortgage, homeown- ers are holding onto their homes instead of buying and moving because they have no other option. Homeowners that want to expand their homes are simply adding on or remodeling to avoid the issues with lenders and the hassles in moving. This is leading to a painful shortage in the real estate market. The Philadelphia Inquirer agrees: “Some ob- servers believe they are seeing the emerg- ing signs of a housing shortage. . . Predict- ing how much housing is needed involves a complex calculus that weighs hard statistics (new-home starts, sales of previously owned homes) against a certain amount of demo- graphic tea-leaf reading (household-forma- tion forecasts). Thus, there isn’t complete consensus on what will be enough.” As mentioned, while the overall interest rate is the lowest it has been in years, there are few people with good enough credit to purchase a home. When someone does de- cide to sell their home it is usually because they have to move for a job relocation or for another pressing matter, such as medical treatment or because they need to down- size – or they are in the enviable position of having good enough credit that they were able to secure a pre-approval on a new loan to purchase a bigger home. How does this create a shortage? Since lending is tight, fewer people can afford to put their homes on the market. That means that the availability of homes has decreased. To add to the shortfall, the slow economy has led to a construction slowdown, which means that fewer homes are being built to accommodate new communities and homes that are being torn down. Overall, this has led to a painful real estate shortage for much of the nation. The Sacra- mento Business Journal reported that, “One analysis of the region’s housing market thinks there’s just not enough for sale. Again. A shortage of inventory is driving everything in the residential market from pricing to rental affordability, according to Zillow. One reason for that is a lingering hangover for the build- ing industry from the housing bust of the last decade, said Svenja Gudell, senior director of research with Zillow. Though the economy began to recover three years ago, housing con- struction is still lagging, she said. In 2012 and 2013, only 159 new home permits were issued for every 1,000 new residents, according to Zil- low.” The overall lack of new homes available and the persistent challenge in getting a loan is creating issues for investors as they try to navigate few options and high prices. HOUSING SHORTAGE EQUALS INFLATED PRICES Most economists will tell you that the biggest drivers in the market are supply and demand. As you can imagine, decreased supply in the housing market means that pricing has skyrocketed, something that real estate investors simply cannot afford when they are looking for business opportunities. The Sacramento Business Journal reported that, “For both renters and homeowners, Sacramento is now defined by Zillow as one of the 10 least affordable metro areas in the country. Mortgage payments here take up 26 percent of income, compared to 15.3 percent nationally. Though the percentage is lower than Sacramento’s historic mortgage pay- ment percentage of 29.5 percent, Zillow noted buyers at the moment also tend to have lower When You Can’t Find Real Estate Leads, LOOK TO PROBATE! TOOLS Continued on pg. 30 By Leon McKenzie US Probate Leads

- 24. TRIPLE YOUR EARNINGS Register| Exhibit | Sponsor The American Association of Private Lenders’ 6th Annual Conference & Exhibition offers you the ultimate in networking and learning - the opportunity to exchange information, ideas, and perspectives with your colleagues, person-to-person, face-to-face. Register early to receive the best rates! 2015 AAPL ANNUAL CONFERENCE & EXPO NOVEMBER 8-10, 2015 | CAESARS PALACE | LAS VEGAS, NEVADA AAPLCONFERENCE.COM | 913-888-1250 |#AAPLANNUAL