Choice of Entity Overview

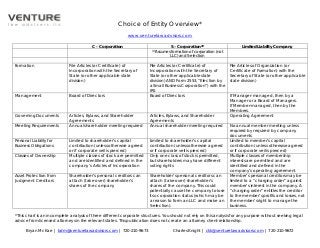

- 1. Choice of Entity Overview* www.venturelawadvisors.com C - Corporation S – Corporation** Limited Liability Company **Assumes formation of corporation (not LLC) and S-election Formation File Articles (or Certificate) of File Articles (or Certificate) of File Articles of Organization (or Incorporation with the Secretary of Incorporation with the Secretary of Certificate of Formation) with the State (or other applicable state State (or other applicable state Secretary of State (or other applicable division) division) AND Form 2553, “Election by state division) a Small Business Corporation”) with the IRS Management Board of Directors Board of Directors If Manager-managed, then by a Manager or a Board of Managers. If Member-managed, then by the Members. Governing Documents Articles, Bylaws, and Shareholder Articles, Bylaws, and Shareholder Operating Agreement Agreements Agreements Meeting Requirements Annual shareholder meeting required Annual shareholder meeting required No annual member meeting unless required by required by company documents Personal Liability for Limited to shareholder’s capital Limited to shareholder’s capital Limited to member’s capital Business Obligations contribution (unless otherwise agreed contribution (unless otherwise agreed contribution (unless otherwise agreed or if corporate veil is pierced) or if corporate veil is pierced) or if corporate veil is pierced) Classes of Ownership Multiple classes of stock are permitted Only one class of stock is permitted, Multiple classes of membership and are identified and defined in the but shareholders may have different interests are permitted and are company’s Articles of Incorporation voting rights identified and defined in the company’s operating agreement Asset Protection from Shareholder’s personal creditors can Shareholder’s personal creditors can Member’s personal creditors may be Judgment Creditors attach (take over) shareholder’s attach (take over) shareholder’s limited to a “charging order” against shares of the company shares of the company. This could member’s interest in the company. A potentially cause the company to lose “charging order” entitles the creditor its s-corporation status (which may be to the member’s profits and losses, not a reason to form an LLC and make an the member’s right to manage the S-election). business. * This chart is an incomplete analysis of three different corporate structures. You should not rely on this analysis for any purpose without seeking legal advice from licensed attorneys in the relevant states. This publication does not create an attorney client-relationship. Bryan McKae | bdm@venturelawadvisors.com | 720-210-9673 Charles Knight | ckk@venturelawadvisors.com | 720-210-9672

- 2. C - Corporation S – Corporation** Limited Liability Company Pros • Low cost of formation • Low cost of formation • Highly flexible ownership and • Flexible ownership and capital • Pass-through taxation capital structure structure • Owners might be able to take losses • Allows for preferential distributions • Allows for preferential distributions in early years and voting and differing voting rights • Some favorable tax treatment for • Pass-through taxation • Favorable tax treatment for employee incentives • Limited corporate formalities employee incentives • Opportunities to reduce self- • Ability to issue profits interests to employment tax obligations employees Cons • Two layers of tax (which can be • No more than one class of stock • Cost of formation can be high minimized in many cases) • Corporate entities and partnerships • Equity incentives can be difficult to • Corporate formalities (e.g. typically cannot be shareholders understand for employees shareholder meetings) can be • Shareholders must be US citizens or • VC funds typically cannot invest in burdensome residents LLCs • Less flexible governance and • Favorable pricing on employee • Operating agreements are ownership structure than LLC stock limited by inability to have complicated more than one class of stock • Investors less inclined to invest in LLC When you might elect If you: If you: If you: this form of entity: • Anticipate raising investor capital in • Do not anticipate raising investor • Do not anticipate raising investor near term capital in near term capital in near term • Will issue equity to employees • Can minimize payroll tax obligations • Require flexible and low • Will pay out most of earnings in with S-Corp structure maintenance ownership structure salaries • Only need 1 class of stock • Anticipate generating near term • Anticipate generating near term cash flow or can take losses cash flow or can take losses • Need to make special allocations of profits and losses When you might avoid If you: If you: If you: this form of entity: • Anticipate generating and have • Intend to raise investor capital in • Intend to raise investor capital in the ability to deduct substantial near term near term near term losses • Need more than one class of stock • Intend to issue equity to • Anticipate generating substantial • Will own appreciating property (inc. unsophisticated employees net profits real estate) • Need to reinvest net profits into • Will own appreciating property or • Will have more than 100 company growth assets shareholders (inc. employees) • Need to reinvest net profits into company growth * This chart is an incomplete analysis of three different corporate structures. You should not rely on this analysis for any purpose without seeking legal advice from licensed attorneys in the relevant states. This publication does not create an attorney client-relationship. Bryan McKae | bdm@venturelawadvisors.com | 720-210-9673 Charles Knight | ckk@venturelawadvisors.com | 720-210-9672