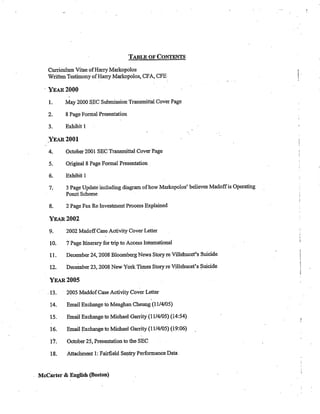

Harry Markopolos Testimony To Congress

•

2 likes•1,545 views

The document discusses the benefits of meditation for reducing stress and anxiety. Regular meditation practice can help calm the mind and body by lowering heart rate and blood pressure. Studies have shown that meditating for just 10-20 minutes per day can have significant positive impacts on both mental and physical health over time.

Report

Share

Report

Share

Download to read offline